WEDNESDAY: 19 May 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Explain four categories of capital investment projects. (4 marks)

2. Nyakati Limited intends to invest in a four-year mini project whose initial outlay is Sh.32,000,000. The project is expected to generate the following cash flows at the end of each year:

Year 1 2 3 4

Cash flows (Sh. “000”) 12,000 15,000 9,000 6,000

The cost of capital is 12%.

Ignore taxation.

Required:

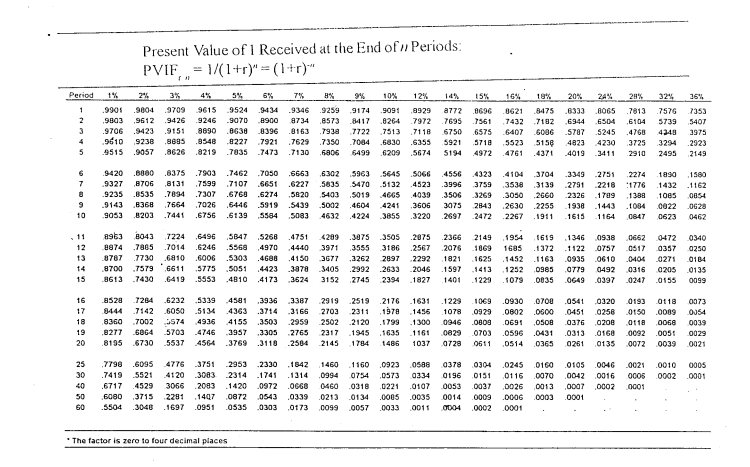

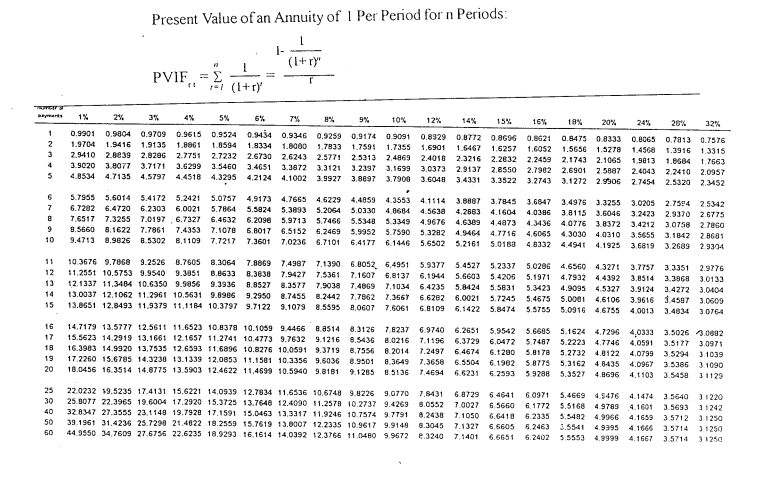

Advise the management on whether to undertake the project using the internal rate of return (IRR) method. (4 marks)

3. Describe four reasons for valuing financial assets. (4 marks)

Hazi Limited expects to pay a dividend of Sh.5.40 per share in one year’s time.

Additional information:

- The company’s dividend payout ratio is 60%.

- The shareholders’ required rate of return on equity is 15%.

- Dividends have been growing at a constant rate in perpetuity.

- The company’s shares are currently trading at Sh.64.50 per share at the Securities Exchange.

Required:

Advise an investor who holds shares in Hazi Limited whether to buy more shares or to sell the shares.

(4 marks)

4. Propose four factors to consider when choosing between long term loan capital and ordinary share capital as a source of finance. (4 marks)

(Total: 20 marks)

QUESTION TWO

1. The role of a finance manager in a modern organisation is pervasive in all the activities of any business firm. In light of the above statement, highlight four roles of a finance manager in an organisation. (4 marks)

2. Describe four factors that could affect a company’s dividend policy. (4 marks)

3. Examine five roles of the Capital Markets Authority (CMA) or a similar institution in your country. (5 marks)

4. Etiud Mwaniki is considering investing in Security A and Security B in equal proportions. The following forecasts have been provided:

State Probability Returns (%)

Security A Security B

Recession 0.30 12 6

Stable 0.40 15 7.5

Expansion 0.30 10 5

Required:

Expected return for the portfolio. (4 marks)

Standard deviation for security A. (3 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the following concepts in the context of Islamic Finance:

Takaful. (2 marks)

Riba. (2 marks)

Mudarabah financing. (2 marks)

Murabahah financing. (2 marks)

2. The following are extracts from Riziki Ltd.’s statement of financial position as at 30 March 2021:

Book values Sh. “Million”

Ordinary shares (Sh.50 par value) 9,600

6% preference shares (Sh.100 par value) 7,900

4.8% debenture (Sh.100 par value) 6,400

23,900

Additional information:

- The ordinary shares of Riziki Ltd. are currently quoted at Sh.72 per share (cum dividend).

- The most recently declared dividend was Sh.2 per share and will be paid in a years’ time. The dividend growth rate is 5%.

- The dividend will continue to grow at the rate of 5% into the foreseeable future.

- The preference shares currently trade at Sh. 80 per share. There is no preference dividend owing at this point in time.

- The debentures are irredeemable and currently trade at 120% of their nominal value.

- The corporation tax rate is 30%.

Required:

The cost of capital for each source of finance for Riziki Ltd. (4 marks)

The weighted average cost of capital (WACC) for Riziki Ltd. (4 marks)

3. ABC Limited’s current annual sales are Sh.1.8 million with a cost of sales of 80% and bad debts average 1% of total sales.

The current debt collection period is one month and the management considers that if credit terms were eased (Option A), the effects would be as follows:

Present Policy Option A

Additional sales (%) 25%

Average collection period 1 month 2 months

Bad debts (% of sales) 1% 3%

Additional information:

- The company requires a 20% return on its investments.

- The cost of sales are 75% variable and 25% fixed.

Required:

Advise the management on whether or not to ease the credit terms. (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. Outline four factors that could hinder the success of a rights issue. (4 marks)

2. Alpha Ltd. intends to introduce a new product, branded “Q” into the market. This will require an initial investment in machinery costing Sh.4,800,000. The machinery will be installed at a cost of Sh.200,000 and is estimated to have a useful life of four years and a salvage value of Sh.800,000.

Additional information:

- Capital allowance will be provided on the machinery on a reducing balance basis.

- Annual profits from the sale of Product “Q” will amount to Sh.1,920,000 before deducting depreciation on machinery.

- An investment in working capital amounting to Sh.340,000 will be required on commencement of the project.

- The firm pays corporation tax at the rate of 30%.

- Cost of capital is 15% per annum.

Required:

The annual depreciation rate. (3 marks)

The total initial cash outlay. (2 marks)

The total terminal cash flows. (2 marks)

The annual net operating cash flows. (5 marks)

Using the net present value approach, advise the management of this company on the suitability or otherwise of the project. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Discuss four factors that a firm should consider in formulating a working capital policy on the management of trade receivables. (4 marks)

2. Phoenix Ltd. is considering amendments to its current inventory management policy.

The following information relates to the proposed ordering policy:

- The current policy is to order 200,000 units when the inventory level falls to 70,000 units.

- Forecast demand to meet production requirements during the next year is 1,250,000 units.

- The cost of placing and processing an order is Sh.500, while the cost of holding a unit is Sh.1 per unit per year. Both costs are expected to be constant during the next year.

- Orders are received two weeks after being placed with the supplier.

- Assume one year has 50 weeks.

Required:

The cost of the current ordering policy. (3 marks)

Determine the savings that could be made by using the economic order quantity (EOQ) model. (3 marks)

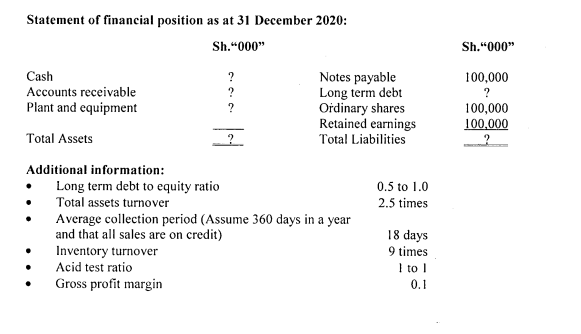

3. The following data was extracted from the financial statements of Mbuni Ltd. for the year ended 31 December 2020:

Required:

Determine the following:

Long term debt. (1 mark)

Total liabilities and shareholders‘ equity. (1 mark)

Cost of sales. (1 mark)

Inventory. (1 mark)

Accounts receivable. (1 mark)

Cash. (I mark)

Complete the statement of financial position of Mbuni Ltd. for the year ended 31 December 2020 using the figures obtained in 3 (i) to 3 (vi) above. (2 marks)

4. Ork Limited has an outstanding Sh.2 million face value bond with a 14% coupon rate and 3 years remaining until maturity.

Interest payments are made semi-annually.

Required:

The value of this bond assuming the nominal annual required rate of return is 12%. (2 marks)

(Total: 20 marks)