TUESDAY: 2 August 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Do NOT write anything on this paper.

QUESTION ONE

1. Highlight four costs of issuing shares in the securities exchange in your country. (4 marks)

2. Dima Ltd. has developed a new product and is considering whether to put it into production. The following information is available:

1. Development costs will be Sh.4.8 million.

2. Production will require purchase of new machinery at a cost of Sh.2.4 million payable immediately. The machinery has a production life of four years and a production capacity of 30,000 units per annum.

3. Production costs per unit: Sh.

• Variable material cost 8.00

• Variable labour cost 12.00

• Variable overheads 12.00

Fixed production costs including straight line depreciation on plant and machinery will amount to Sh.200,000 per annum.

4. Selling price is Sh.80.00 per unit. Demand is projected at 25,000 units per annum.

5. The retail price index is expected to increase at a rate of 5% per annum over the period and selling price will increase at the same rate. Annual inflation rates on production costs are as follows:

(%)

Variable material cost 4

Variable labour cost 10

Variable overheads 4

Fixed costs 5

6. The weighted average cost of capital (WACC) in nominal terms is 15%.

Required:

Advise the firm whether to undertake the production using the net present value (NPV) approach. (8 marks)

3. The following information relates to the capital structure of Tamu Caterers Limited for the year ended 31 December 2021:

Capital source Current market value

Sh.“000”

Corporate bond 11,927

Ordinary shares 26,170

Preference shares 7,203

Additional information:

1. The corporate bond has a Sh.1,000 face value, pays interest at a rate of 11% annually and will mature in 10 years time. The bond is currently trading at Sh.1,125 at the securities market and its yield-to-maturity is 9.05%.

2. The ordinary shares paid a dividend of Sh.1.80 last year and each share is selling at Sh.27.50 at the securities market. The firm’s dividend on ordinary shares is expected to grow at a rate of 7% per annum to perpetuity.

3. The firm’s preference shares pays a 9% dividend on a Sh.100 par value.

4. The corporation tax rate is 30%.

Required:

The weighted average cost of capital (WACC) for the firm. (6 marks)

Explain two factors that will determine the cost of capital for Tamu Caterers Limited. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Joshua Makau is approaching retirement next year and is expecting a lumpsum pension payment amounting to Sh.20 million.

Required:

Recommend four investment products available in the financial market that he should consider to enable him achieve financial freedom. (4 marks)

2. Distinguish between the following terms as used in finance:

“Agency cost” and “agency problem”. (2 marks)

“Intrinsic value” and “market value”. (2 marks)

“Liberal credit policy” and “conservative credit policy”. (2 marks)

3. Horizon Construction Limited wishes to increase the number of its branches in the country.

The board of directors of the company has decided to finance the expansion programme by raising funds from the existing shareholders through a one for four rights issue.

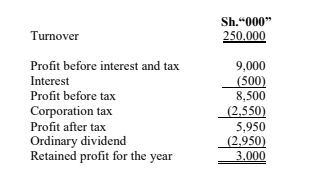

The published income statement of the company for the year ended 31 December 2021 had the following information:

The share capital of the company comprises of 10 million ordinary shares which have a par-value of Sh.10 per share. The shares of the company are currently being traded on the securities exchange with a price-earnings (P/E) ratio of 20 times.

The firm’s board of directors have decided to issue the new shares at a 25% discount on the current market price.

Required:

1. The theoretical ex-right price of an ordinary share of the company. (2 marks)

2. The theoretical value of each right. (1 mark)

Assuming an investor held 5,000 ordinary shares of the company before the rights issue announcement and Sh.15,000 in his savings account. Calculate the following options and identify the best option to the investor if he:

3. Exercises all his rights. (3 marks)

4. Sells all his rights. (2 marks)

5. Ignores the rights issue. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Examine four shortcomings of the percentage of sales method of forecasting. (4 marks)

2. Discuss three causes of conflict between shareholders and managers in relation to agency theory. (6 marks)

3. Explain four sources of finance as used in Islamic Financing. (4 marks)

4. Explain the following dividend theories:

Bird-in-hand theory. (2 marks)

Clientele effect theory. (2 marks)

Information signaling theory. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Cryptocurrency is a digital asset designed to work as a medium of exchange that uses strong cryptograph to secure financial transactions, control the creation of additional units and verity the transfer of assets.

Required:

In light of the above statement, examine four limitations of cryptocurrency. (8 marks)

2. The following information relates to inventory relationship of QZ Ltd.:

1. Annual purchases of Sh.2,160,000.

2. Purchase price per unit is Sh.60.

3. Carrying cost is 15% of the purchase price per unit.

4. Cost per order placed is Sh.240.

5. Desired stock levels is 300 units. This stock level was in hand initially.

6. Lead time is 7 days.

Assume a 365-day year.

Required:

The economic order quantity (EOQ) for the company. (3 marks)

The optimal number of orders to be placed in a year. (1 mark)

The re-order level. (2 marks)

Assuming that for any orders of at least 2,000 units, the firm will get 5% discount on the purchase price. Analyse whether the company should take advantage of the discount or not. (4 marks)

3. Digital Ltd. has some computer industrial plant which it intends to replace four years from today. The company’s director estimates that the cost of the plant to the company at that time will be Sh.30 million. To finance the operations, the Finance Director has decided to set up a fund with Golden Bank Ltd. Golden Bank Ltd. has assured the Finance Director that if he opts for this option, the rate of interest will be fixed at 8% per annum. The Finance Director intends to set aside a constant amount from his annual budgets to finance the plant. The rate of interest will be compounded semi-annually.

Required:

The amount that the Finance Director should deposit with Golden Bank Ltd. every year to achieve his objective. (2 marks)

(Total: 20 marks)

QUESTION FIVE

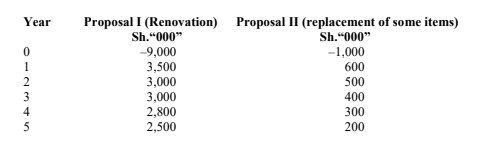

1. Hamsa Manufacturing Ltd. is considering two alternative investment proposals. The first proposal requires a major renovation of the company’s manufacturing facility. The second proposal involves replacing a few obsolete items of equipment in the manufacturing facility. The company is only able to select one of the two proposals.

The cash flows associated with each proposal are shown below:

The firm discounts cash flows at the rate of 15%.

Required:

Rank the two investment proposals using the net present value (NPV) approach. (4 marks)

Rank the two investment proposals using the internal rate of return (IRR) approach. (4 marks)

Compare the rankings under the NPV and IRR approaches and comment on any differences. (3 marks)

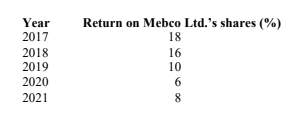

2. A financial expert has provided you with the following data regarding returns on Mebco Ltd.’s shares for the years 2017 – 2021:

Required:

The risk in Mebco Ltd.’s shares return as measured by the standard deviation. (4 marks)

3. Koki Ltd. recently paid a dividend of Sh.2.50 per share. The dividend is expected to grow at a rate of 15% per annum for the first three years, then at a rate of 10% per annum for the next 2 years after which the dividend will grow at a rate of 5% per annum to perpetuity. The required rate of return for the ordinary share is 12%.

Required:

The intrinsic value of the ordinary share of Koki Ltd. (5 marks)

(Total: 20 marks)