WEDNESDAY: 1 September 2021. Time Allowed: 3 hours.

Answer any FIVE questions. ALL questions carry equal marks. Show ALL your workings.

QUESTION ONE

1. Explain the term “financial innovation”. (2 marks)

Describe three categories of financial innovation. (6 marks)

2. Anne Mena, an investor at the securities exchange, buys XYZ Ltd.’s shares on margin and holds the position for exactly one year, during which time the company pays a dividend. Interest rate on the loan and the dividend are both paid at the end of the year. The following additional information is provided:

- Purchase price per share Sh.20

- Sale price per share Sh.18

- Number of shares purchased 1,000

- Leverage ratio 3.5

- Interest rate per annum 10%

- Dividend per share Sh.0.10

- Commission per share Sh.0.01

Required:

The total return on Anne Mena’s investment. (4 marks)

3. Discuss four characteristics of a well-functioning financial market. (8 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the following terms as used in financial markets:

Index-arbitrage trading. (2 marks)

Credit derivatives. (2 marks)

Reinsurance. (2 marks)

Financial crisis. (2 marks)

Securitisation. (2 marks)

2. Analyse five pricing strategies for financial services. (10 marks)

(Total: 20 marks)

QUESTION THREE

1. Describe three market execution mechanisms for trading shares. (6 marks)

2. Discuss four challenges that might be faced by investors in developing a vibrant mortgage market. (8 marks)

3. Distinguish between the following sets of terms as used in financial markets:

“Continuous market” and “call market”. (4 marks)

“Long position” and “short position”. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain five objectives of the anti-money laundering regulations in your country. (5 marks)

2. Highlight seven functions of the Institute of Certified Investment and Financial Analysts (ICIFA). (7 marks)

3. Discuss four functions of financial intermediaries in an emerging economy. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. Outline five factors that one could consider when pricing financial services. (5 marks)

2. Highlight five types of incentives which might be provided by the Capital Markets Authority (CMA) to encourage potential and existing investors in the securities market. (5 marks)

3. Evaluate five methods that banks might use to manage credit risk. (10 marks)

(Total: 20 marks)

QUESTION SIX

1. Describe three factors that might contribute to the degree of efficiency in a financial market. (6 marks)

2. Analyse three ways in which moral hazard might lead to adverse selection. (6 marks)

3. Summarise four types of derivatives traded in the derivatives security market. (8 marks)

(Total: 20 marks)

QUESTION SEVEN

1. Explain five uses of securities market indexes. (5 marks)

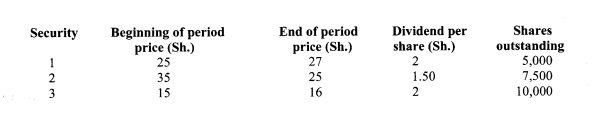

2. An analyst gathers the following information for a market capitalisation weighted index comprising securities 1, 2 and 3:

Required:

The total return of the index. (3 marks)

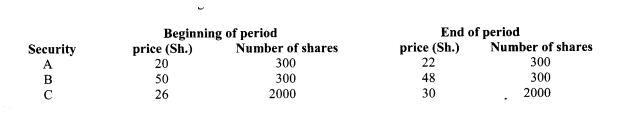

3. An analyst gathers the following information for an equally weighted index:

Required:

Assuming Sh.1,000 is invested in each of the shares, calculate the return of the index over the period. (2 marks)

4. Analyse five benefits of informal loans. (10 marks)

(Total: 20 marks)