MONDAY: 17 May 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. You have been appointed as the accounts assistant of Newa Enterprises. The business does not maintain complete records.

The following information is availed to you by the owner:

- Current ratio = 2.6 : 1

- Quick ratio = 1.4 : 1

- Working capital = Sh.1,100.000

Required:

Current assets. (2 marks)

Current liabilities. (2 marks)

Liquid assets. (2 marks)

Inventory. (2 marks)

2. In the books of Rhyme Enterprises, the balance at bank as at 30 October 2020 according to the cash book, was Sh.894,680. Subsequently, the following discoveries were made:

- Cheque No.176276 dated 3 October 2020 for Sh.310.840 in favour of Love Ltd. had been incorrectly recorded in the cash book payments as Sh.301. 840.

- Bank commission charged of Sh.169,560 and bank interest charged of Sh.109.100 had been entered in the bank statement on 23 October 2020, but not included in the cash book.

- The bank statement showed a cheque of Sh.29,310 received from Andrew Oloo and credited in the bank statement on 9 October 2020 was dishonoured on 26 October 2020. No entry had been made in the cash book with regard to the dishonoured cheque.

- Cheque No.177145 for Sh.15.100 had been recorded twice as a credit in the cash book.

- Cash received in the last few days of October 2020 amounting to Sh.1,895,000 was deposited in the bank on 31 October 2020. This amount was recorded in the cash book, but was updated in the bank statement on 2 November 2020.

- Some customers paid directly into the bank account amounts totalling to Sh.210.100 on 25 October 2020. These amounts had not been recorded in the cash book.

- Cheques paid by Rhyme Enterprises during October 2020 amounting to Sh.395,800 were not presented to the bank for payment until November 2020.

- A standing order payment of Sh.15.000 on 17 October 2020, had not been recorded in the cash book.

Required:

Updated cash book as at 30 October 2020. (8 marks)

Bank reconciliation statement as at 30 October 2020. (4 marks)

(Total: 20 marks)

QUESTION TWO

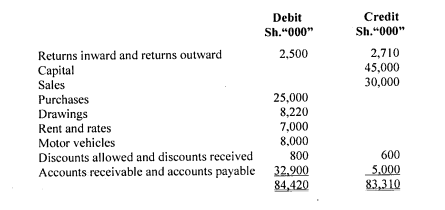

1. Alice Kibibi’s accountant has prepared her trial balance, which did not balance, as follows:

Additional information:

- A credit note for Sh.2.850,000 was entered in the account of customer P. Toro, but no entry was made in the returns account.

- The sales account was overcast by Sh.4,800,000. ‘

- Sh.2,970,000 of goods withdrawn for Alice Kibibi’s personal use was entered into the drawings account. but no other entries were made.

- A discount allowed of Sh.2,520,000 was credited in error to the discounts received account.

- Cash sales of Sh.19,780,000 had not been entered in the sales account.

- A bad debt of Sh.6,300,000 had been entered in the customer’s account, but not in any other account.

- The purchases account had been undercast by Sh.2,650,000.

Required:

Journal entries to correct the above errors. (Narrations not required). (7 marks)

Suspense account duly balanced. (3 marks)

2. The following details relate to the machines owned by Ujenzi Contractors:

Machine Cost Date of Purchase

Sh.”000″

A 26,000 2 January 2011

B 15,000 17 November 2013

C 47,500 30 June 2014

D 18,000 10 May 2017

E 110,000 9 October 2018

Ujenzi Contractor’s depreciation policy is as follows:

- Machines A and B are depreciated on a straight line basis with no scrap value, over 10 years.

- Machine C is depreciated on a reducing balance basis at 20% per annum, with a scrap value of Sh.5,000,000.

- Machines D and E are depreciated on a straight line basis over 5 years with a scrap value equal to 10% of the original cost.

- A full year’s depreciation for each machine is provided in the year of purchase.

Required:

A property, plant and equipment schedule from I January 2011 to 31 December 2020 with the following details:

- Date of purchase.

- Cost.

- Annual depreciation.

- Accumulated depreciation.

- Net book value.

(10 marks)

(Total: 20 marks)

QUESTION THREE

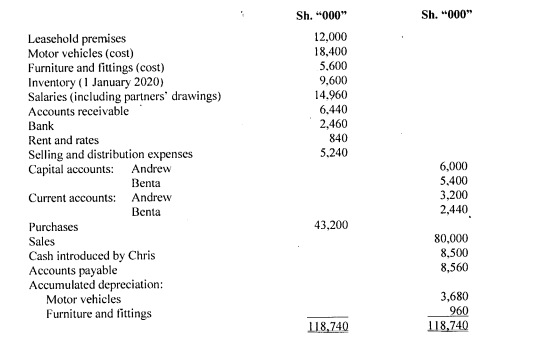

Andrew and Benta have been partners in a business sharing profits and losses in the ratio of 2:1 after interest on capital is charged at the rate of 10% per annum. Their financial year ends on 31 December each year.

Additional information:

- On 1 July 2020, Chris was admitted as a partner. From that date, Andrew, Benta and Chris were to share profits and losses in the ratio 2:2:1 respectively after charging interest on capital at 10% per annum.

- For the purpose of admission of the new partner, the value of the goodwill of the business was agreed at Sh.9,000,000, but was to be written off immediately.

- On 1 July 2020, Chris paid Sh.8,500,000 into the business. It was agreed that Sh.5,000,000 be his fixed capital and the balance be credited to his current account. No adjusting entries had been made yet to record his admission into the partnership.

- The following trial balance was extracted from the books of the partnership as at 31 December 2020:

- Sales during the second half of the year 2020 were 60% of the total sales.

- Selling and distribution expenses were in proportion to the sales for each period. All other expenses were incurred evenly throughout the year.

- Depreciation is to be charged on cost per annum as follows:

Asset Rate

Motor vehicles 20%

Furniture and fittings 10%

- Drawings by the partners were as follows:

Sh. “000”

Andrew 2,540

Benta 2,020

Chris 660

- Allowance for doubtful debts is apportioned as follows:

1 January 2020 — 30 June 2020 — Sh.129,000

1 July 2020 — 31 December 2020 — Sh.80,000

- The leasehold premises was acquired on 1 January 2020 and is being amortised over a period of 25 years.

- Inventory as at 31 December 2020 was valued at Sh.10,800,000.

Required:

1. Statement of profit or loss and appropriation account in columnar form for the two periods ended 30 June 2020 and 31 December 2020. (10 marks)

2. Partners’ current accounts. (4 marks)

3. Statement of financial position as at 31 December 2020. (6 marks)

(Total: 20 marks)

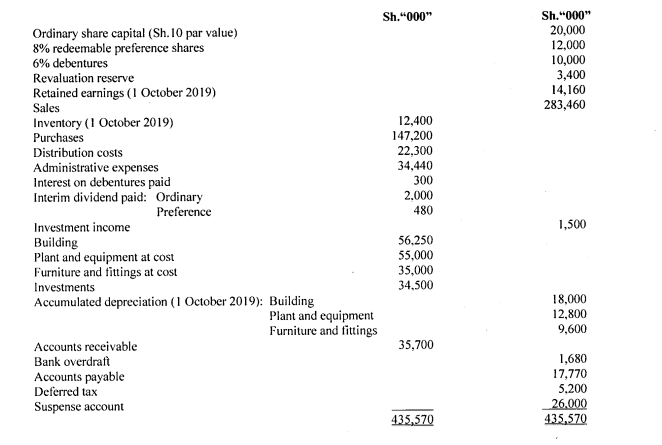

QUESTION FOUR

The following trial balance was extracted from the books of account of Almond Ltd. as at 30 September 2020:

Additional information:

- The amount in the suspense account was discoveted to be as a result of 2,000,000 ordinary shares issued at Sh.13 per share.

- The annual stock-take took place on 6 October 2020. It gave an inventory value of Sh.14.500,000. During the period

from 1 October 2020 to 6 October 2020, the following transactions took place:

Sh.”000″

Sales 1,600

Purchases 470

Sales returns 200

Purchases returns 80

Almond Ltd. makes a uniform rate of gross profit of 5% on selling price.

- As at 30 September 2020, no entry had been made in the books for the following unpresented cheques:

- Stationery Sh.160,000

- Payment in advance for goods worth Sh.300,000 to be delivered in October 2020.

- The company received a demand notice for rates of Sh.240,000 for the year ended 30 September 2020.

- The company’s policy in relation to the annual depreciation on its non-current assets is as follows:

- Building – 4% on a straight line basis.

- Plant and equipment – 15% on a straight line basis.

- Furniture and fittings – 10% on a reducing balance basis.

Plant and equipment have a residue value of Sh.5,000,000.

- As at 30 September 2020, an allowance of 4% of accounts receivable is to be made as well as a provision for corporation tax of Sh.18,500,000.

- As at 30 September 2020, the investment portfolio was as follows:

Sh.”000″

Short-term investment 22,500

Long-term investment 12,000

- The directors proposed to pay a final ordinary dividend of 10%.

Required:

1. Statement of profit or loss for the year ended 30 September 2020. (10 marks)

2. Statement of financial position as at 30 September 2020. (10 marks)

(Total: 20 marks)

QUESTION FIVE

1. Highlight four uses of the general journal. (4 marks)

2. Distinguish between the terms “prime cost” and “factory overheads” as applied in manufacturing accounts. (4 marks)

3. In the context of public sector accounting, explain the following terms:

Social benefits. (2 marks)

Contingent asset. (2 marks)

Contingent liability. (2 marks)

4. Explain the following terms as used in not-for-profit organisations:

Crowdfunding. (2 marks)

Life membership. (2 marks)

Grants. (2 marks)

(Total: 20 marks)