MONDAY: 30 August 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Explain the following types of accounting errors:

Compensating errors. (2 marks)

Complete reversal of entry. (2 marks)

Error of commission. (2 marks)

2. Discuss three functions of the International Accounting Standards Board (IASB). (6 marks)

3. The following information was extracted from the books of Dada Traders for the month of May 2021:

Balance on purchases ledger as at 1 May 2021:

Sh.

- Debit balance 980,000

- Credit balance 2,990,000

Transactions during the month of May 2021:

Sh.”000″

Purchases on credit 39,245

Purchases returns 895

Cheques paid to trade payables 23,370

Cash paid to trade payables 6,515

Discounts received from trade creditors 1,155

Credit sales offset against credit purchases 1,780

Credit purchase of a motor vehicle posted in the purchases ledger 2,990

Balance as at 31 May 2021 (Debit) 885

Required:

Purchases ledger control account for the month ended 31 May 2021. (8 marks)

(Total: 20 marks)

QUESTION TWO

Alpha Omega operates a retail business. He has not employed a qualified accountant, and therefore has not maintained proper accounting records.

The following information was extracted from his books for the year ended 31 March 2020:

Sh.”000″

Accounts receivable 2,000

Bank overdraft 240

Accounts payable 1,520

Electricity expenses accrued 60

10% bank loan 2,400

Allowance for doubtful debts 100

Freehold property (cost) 2,400

Motor vehicles (Net book value) 3,000

Furniture and fixtures (Net book value) 960

Inventory 1,560

The following transactions took place during the year ended 31 March 2021:

- Sales and purchases on credit amounted to Sh.8,320,000 and Sh.7,600,000 respectively.

- The following transactions were carried out through the bank account:

Sh.”000″

Electricity expenses 260

General expenses 140

Interest on loan 120

Drawings 240

Loan repayment on 30 September 2020 400

Collections from accounts receivable 7,560

Proceeds from sale of motor vehicle 480

Salaries and wages 640

Purchases of furniture 800

Payments to accounts payable 7,760

Sales — Cash 2,880

Purchases — Cash 960

- The business operates at a gross profit margin of 25%.

- Accrued electricity as at 31 March 2021 amounted to Sh.76,000.

- Bad debts of Sh.80,000 were written off during the year ended 31 March 2021. The allowance for doubtful debts is to be maintained at 5% of the outstanding accounts receivable at the end of year.

- During the year ended 31 march 2021, the business received discounts of Sh.160,000 and allowed discounts of Sh.280,000.

- Loan interest paid was for half a year up to 30 September 2020.

- The business depreciates motor vehicles at 20% per annum on a reducing balance basis. A full years’ depreciation is provided on a motor vehicle acquired in the course of the year and no depreciation is provided on a motor vehicle disposed of in the course of the year.

- The motor vehicle disposed during the year ended 31 March 2021, had been purchased at Sh.1,000,000 and had an accumulated depreciation of Sh.488,000 at the time of disposal.

- Furniture is depreciated at a rate of 10% per annum on cost and is pro-rated to the period used in the year. The additional furniture was purchased on 1 October 2020, while the cost of furniture held on 31 March 2020 was Sh.1,600,000.

Required:

1. Statement of profit or loss for the year ended 31 March 2021. (12 marks)

2. Statement of financial position as at 31 March 2021. (8 marks)

(Total: 20 marks)

QUESTION THREE

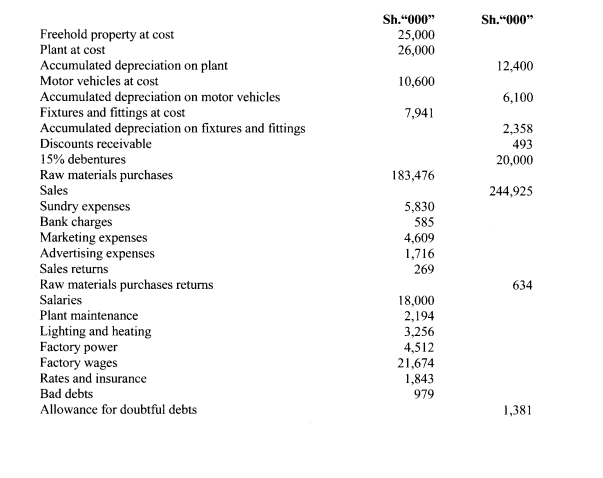

The following trial balance was extracted from the books of Alfajiri Manufacturers Ltd. as at 30 June 2021:

Additional information:

- Freehold property includes land at a cost of Sh.15,000,000. The other amount is the cost of buildings.

- Buildings are to be depreciated using the straight line method over a fifty-year life commencing 1 July 2020. This expense is considered to be a factory overhead.

- Depreciation is to be provided on a reducing balance basis as follows:

Asset Rate per annum

Plant 15%

Motor vehicles 25%

Fixtures and fittings 10%

Only plant depreciation is charged to the factory. The other depreciation charges are considered administrative expenses.

- Allowance for doubtful debts is to be adjusted to 8% of the accounts receivable.

- The following expenses are to be apportioned in the ratio 4:1 between factory and administrative overheads:

- Lighting and heating

- Risks and insurance

- Sundry expenses

- An amount of Sh.6,000,000 included in the factory wages account is the factory manager’s salary.

- The directors wish to provide for a final dividend which will bring the dividend for the year up to Sh.5 per share.

- Debenture interest for the current year has not yet been paid.

- Some finished goods which cost Sh.541,000 have been sold to a customer at an additional profit margin of Sh.57,000 but the customer has indicated that he intends to return them since they are not what he ordered. This sale was a credit sale and has been included in the accounts receivable.

- As at 30 June 2021:

- Light and heat accrued was Sh.154,000

- Insurance prepaid was Sh.48,000

- Rates prepaid were Sh.150,000

- Inventories as at 30 June 2021 were valued at:

Sh.”000″

- Raw materials 27,851

- Work-in-progress 16,490

- Finished goods 24,627

Required:

1. Manufacturing account for the year ended 30 June 2021. (10 marks)

2. Statement of profit or loss for the year ended 30 June 2021. (10 marks)

(Total: 20 marks)

QUESTION FOUR

The following balances were extracted from the books of Afya Youth Club for the year ended 30 June 2020:

Sh. “000”

Land at cost 90,000

Equipment (Cost — Sh.25,000,000) 20,000

Furniture and fittings (Cost Sh.80,000,000) 46,000

Bar inventory 18,400

Subscriptions in arrears 5,000

Bank balance 4,500

Long-term bank deposits 12,000

Long-term loan 96,000

Bar creditors 16,800

Subscription in advance 1,600

Accrued bar wages 2,300

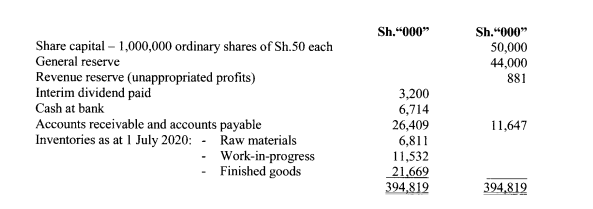

The club’s receipts and payment account for the year ended 30 June 2021 was as follows:

Additional information:

- The following information relates to the club as at 30 June 2021:

Sh.”000″

Subscription in arrears 4,000

Bar creditors 16,000

Bar inventory 19,800

Subscription in advance 2,400

Bar wages due 3,200

- Interest receivable on long-term deposits amounted Sh.2,200,000.

- The long-term loan is repaid in annual instalments of Sh.30,000,000 excluding interest. The interest for the year ended 30 June 2021 was Sh.9,200,000.

- Depreciation is provided as follows:

Asset Rate per annum Method

Equipment 10% Straight line

Furniture and fittings 15% Reducing balance

It is the policy of the club to charge a full year’s depreciation on assets in the year of purchase and no depreciation in the year of disposal.

Required:

1. Bar statement of profit or loss for the year ended 30 June 2021. (4 marks)

2. Statement of income and expenditure for the year ended 30 June 2021. (8 marks)

3. Statement of financial position as at 30 June 2021. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain three roles played by accounting officers in public sector accounting. (6 marks)

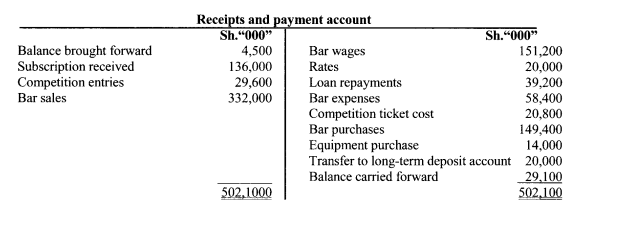

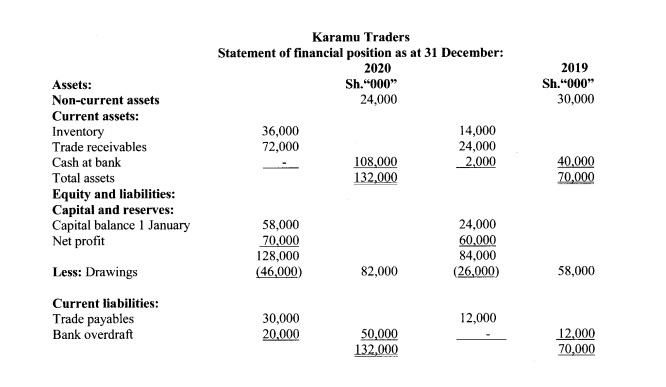

2. The following are the financial statement extracts from the books of Karamu Traders:

Additional information:

- There were no purchases or disposals of non-current assets during the years ended 31 December 2019 and 31 December 2020.

- During the year ended 31 December 2020, Karamu Traders reduced their selling prices in order to stimulate sales.

- Assume price levels were stable.

- Assume a 365-day year.

Required:

For the year ended 31 December 2019 and 31 December 2020, compute the following ratios:

Gross profit mark-up. (2 marks)

Gross profit margin. (2 marks)

Net profit margin. (2 marks)

Return on capital employed (ROCE). (2 marks)

Current ratio. (2 marks)

Acid test ratio. (2 marks)

Accounts receivable collection period. (2 marks)

(Total: 20 marks)