SECTION A (40 marks)

Answer ALL the questions in this section.

1. State two uses of accounting information. (2 marks) ,

2. Classify each of the following expenditures as either capital or revenue:

(i) Repairs of motor vehicles used in the business.

(ii) Purchase of goods for sale.

(iii) Drilling a borehole. (3 marks)

3. List two methods of depreciating non-current assets. (2 marks)

4. State the source document used in each of the following transactions: (

(i) Goods purchased on credit

(ii) Goods returned by a customer. (2 marks)

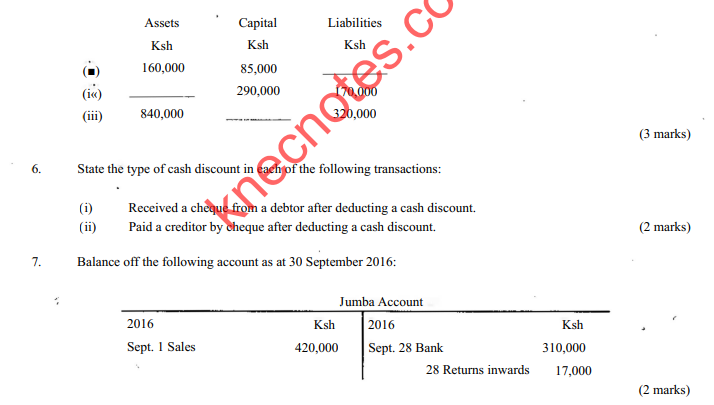

5. Fill in the missing amounts in the spaces provided.

8. State the type of error in each of the following:

(i) A cash sale was debited to sales account and credited to cash account.

(ii) A payment by cheque of Ksh 2,100 for electricity was recorded in the books as Ksh 1,200. (2 marks)

9. The total debits of a trial balance exceeded the total credits. State the side in which the difference will be placed in a suspense account. (1 mark)

10. The total payments made by a petty cashier during the month of April 2016 was Ksh. 48,900.

The balance at the end of the month was Ksh 3,100. Determine the cash float at the beginning of the month. (1 mark)

11. State the control account(s) in which each of the following items are recorded:

(i) Bad debts –

(ii) Inter ledger transfer – (2 marks)

12. Unused stationery worth Ksh 5,000 issued to clerks of a firm was not recorded in the books as stock of stationery at the end of the financial year. State the accounting concept applicable.

• (1 mark)

13. ‘Fhe following information relates to rent payable by a firm: Ksh

Rent paid during the year 2016 272,000

Rent prepaid – 1 January 2016 16,000

Rent prepaid – 31 December 2016 28,000

Determine the rent expense for the year 2016. (3 marks)

14. State the appropriate ledger for each of the following accounts:

(i) Equipment;

(ii) A creditor. (2 marks)

15. Pota does not keep a proper set of books of account. On 1 January 2016, the business had inventory of Ksh 208,000, accounts receivable Ksh 372,800, accounts payable Ksh 297,800 and cash at bank Ksh 37,000.

(i) Determine the capital as at 1 January 2016.

(ii) Advise Pota on the capital position of the business if the initial capital was Ksh 400,000. (2 marks)

State two types of books of original entry. (2 marks)

17. The following information relates to Bida Traders for the year 2016: Ksh

Sales 638,000

Cost of sales 297,000

Expenses 365,000

(i) Determine the net profit or loss for the year 2016.

(ii) Advise the proprietor on the action to take based on the results in (i) above.

18. List two items found in the bank statement but not in the cash book for the same period.

(2 marks)

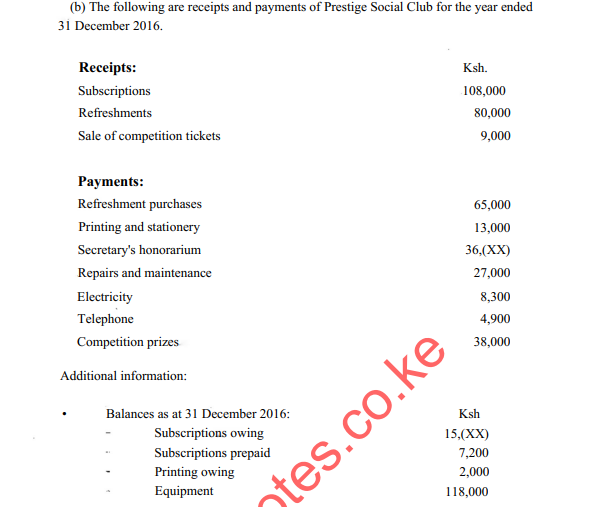

19. State the term used to describe the excess of income over expenditure in a non-profit making organisation. (1 mark)

20. On 31 March 2016, the updated cash book balance of a firm was Ksh 136,200. The unpresented cheques amounted to Ksh 79,800, Determine the balance as per the bank

statement. (2 marks)

SECTION B (60 marks)

Answer any FOUR questions from this section.

21. (a) Raha Traders had the following balances as at 11 June 2016: Ksh.

Purchase ledger: Credit 239,800

Debit 14,600 ‘fransactions during the month of June were as follows:

Credit purchases 487,200

Cheque payments to creditors 309,700

Discounts 61,(MX)

Returns outwards 47,1 (MJ

Cash payments to creditors 152,500

Refund to the firm by creditors 18,000

Balance as at 30 June 2016:

Purchases ledger: Credit

Debit

Ksh 182,300

Ksh 22,500

Prepare a purchases ledger control account for the month of June 2016. (6 marks)

(b) On 1 May 2016, Wawili Enterprises had the following balances: Ksh

Cash in hand 32,500

Cash at bank 106,900

During the month, the following transactions took place: 2016

May 1 1 Sold goods for Ksh 28,000 in cash.

3 Bought stationery for Ksh 6,400 in cash.

i 7 Benta Limited settled their account of Ksh 84,000 by cheque, after deducting a cash discount of 5%.

Settled Fit Wholesaler’s account of Ksh 70,000 by cheque, after deducting a cash discount of 5%.

Received a cheque of Ksh 45,000 from KT Traders, after deducting a cash discount of Ksh 5000.

Paid Jami Enterprises Ksh 9000 by cheque after deducting a cash dscount of Ksh 1,000.

Deposited Ksh 40,000 of the cash in hand into the bank account.

Prepare a three column cash book for the month of May 2016. (9 marks)

22. (a) Explain three types of errors that do not affect the agreement of a trial balance. (6 marks)

(b) Sela Retailers operates a petty cash book on an imprest system. On 1 May 2016, the petty cashier was given Ksh 9,000 by the main cashier.

The petty cashier made the following payments during the week:

2016 Ksh

1 Bus fare 200

1 Mobile phone airtime 1,200

2 Tea leaves 600

3 Taxi charges 330

3 Sugar 250

4 Telephone 2,300

4 Painting papers 6(X)

5 Cakes 500

6 Pens 280

7 Writing pads 800

(i) Prepare a petty cash book with the following analysis columns:

Travelling –

Stationery

Refreshments

Communication

(ii) At the end of the week, the petty cashier had Ksh 1,800 cash in hand.

State the possible cause of the difference between the cash in hand and the balance in the petty cash book.

23. (a) Explain the use of each of the following documents:

(i) Invoice;

(ii) Credit note;

(iii) Statement of account. (6 marks)

(b) Sarah started a business with Ksh. 4(X),0(X) which was deposited in a business bank account on I July 2016.

The following transactions look place during the month:

2016

July 1 Paid for shop repairs of Ksh 20,000 by cheque.

3 Purchased goods for Ksh 50,000 and paid by cheque.

4 Sold goods for Ksh 37,500 in cash.

9 Purchased goods of Ksh 170,000 on credit from Kote manufacturers.

13 Withdrew Ksh 100,000 from the bank for office use.

25 Paid wages amounting to Ksh 60,000 by cheque.

29 Paid general expenses amounting to Ksh 11,700 in cash.

31 Took Ksh 7,000 from the cash till for personal use.

Prepare ledger accounts to record the transactions above. (9 marks)

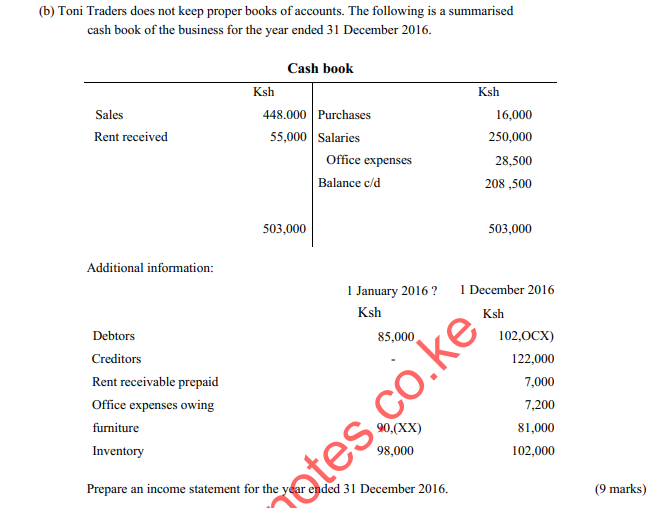

24.

(a) The following transactions relate to Kwala Enterprises lor the month of June 2016:

2016

June 1 Sold goods for Ksh 27,500 on credit to Jomba Manufacturers.

17 Sold goods for Ksh 19,200 on credit to Karen Restaurant.

20 Sold excess machinery for Ksh 45,000 on credit to Zawadi Traders.

24 Karen Restaurant returned goods worth Ksh 2,200.

30 Sold goods to Mina Enterprises for Ksh 60,000 on credit and

allowed a trade discount of 5%.

Prepare:

(i) sales journal

(ii) returned inwards journal

(iii) general journal

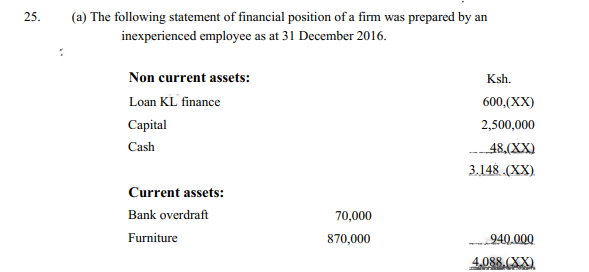

Prepare a corrected statement of financial position as at 3.1 December 2016. (7 marks)

(b) The following information relates to the motor vehicles bought by Race Limited:

The firm depreciates its motor vehicles at the rate of 20% per annum on cost.

For each of the years: 2014, 2015 and 2016, prepare:

(i) motor vehicles account.

(ii) provision for depreciation on motor vehicles account. (8 marks) 26.’ (a) Explain each of the following accounting concepts:

(i) Going concern;

(ii) Business entity;

(iii) Dual aspect.