SECTION A (40 marks)

Answer ALL the questions in this section.

1. State the meaning of each of the following terms as used in accounting:

(i) Asset;

(ii) Liability.

(2 marks)

2. List two classifications of ledgers. (2 marks)

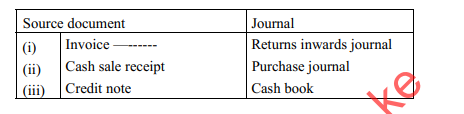

3. Match each of the following source documents with the appropriate journal.

4. State the book of original entry used for recording goods returned to a supplier. (1 mark)

5. On 1 June 2016, a firm’s debtor called Paul had an outstanding balance of Ksh 17,000. On 4 June 2016, the firm sold goods amounting to Ksh 48,000 on credit to Paul. On 30 June 2016 Paul paid the firm Ksh 53,000 by cheque. .

Prepare Paul’s ledger account in the books of the firm. (2 marks)

6. On 1 August 2016, a petty cashier had a cash float of Ksh 9,000. The petty cashier made payments amounting to Ksh 7,650 during the first week of August 2016. Determine the cash held by the petty cashier at the end of the week. (1 mark)

7. Highlight the meaning of each of the following terms as used in bank reconciliation:

(i) Dishonoured cheque;

(ii) Standing order payment. (2 marks)

8. The following information relates to Stalet Traders for the month of March 2016: Ksh

Credit purchases 600,400

Returns outwards 13 300

Cheques paid to suppliers 490,100

Prepare a purchases ledger control account. (2 marks)

9. Pola Enterprises uses straight line method of depreciation on its furniture each year. State the accounting concept applied. (1 mark)

10. Differentiate between capital expenditure and revenue expenditure. (2 marks)

11. Tamu Traders had the following information relating to electricity expenses: Ksh

Electricity owing: 1 May 2016 4,900

31 May 2016 6 800

Electricity paid during the month 25300

Determine the electricity expense for the month of May 2016. (2 marks)

12. Highlight the meaning of the term ‘subscriptions’, as used in non-profit making organisations. (1 mark)

13. Manga Traders does not keep a proper set of books of account. On 1 January 2016, the

business had shop premises worth Ksh 1,700,000, cash at bank Ksh 320,000 and a bank loan of

Ksh 2,000,000.

(i) Determine the capital as at 1 January 2016

(ii) Comment on the capital position of the business. (3 marks)

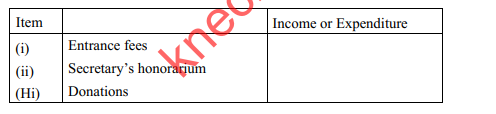

14. Classify each of the following items as income or expenditure, of a social club:

15. Malipo Limited, bought furniture for Ksh 260,000 on credit from Hightech Dealers on 1 February 2016. Record the transaction above in the general journal. (3 marks)

16. Molo Enterprises had a gross profit of Ksh 150,000 and expenses of Ksh 101,200 for the year ended 31 October 2016:

(i) Determine the net profit for the year;

(ii) The proprietor has set a target net profit equal to one-third of the gross profit, for the new year.

Advise the proprietor on the action to take, based on the performance in (i) above. (3 marks)

17. State the meaning of the term, ‘error of original entry’. (1 mark)

18. Highlight the meaning of the term, ‘cash discount’. (1 mark)

19. On 1 January 2014, Safi Limited bought a motor vehicle for Ksh 2,000,000. The firm

depreciates its motor vehicles at 20% per annum on cost.

Determine the book value of the motor vehicle as at 31 December 2015. (3 marks)

20. Natali Traders had a net profit of Ksh. 295,000 (qr^the year ended 31 December 2015. During the year, the proprietor withdrew Ksh 315,000. “Advise the proprietor on the effect of the withdrawal on the capital of the business. (2 marks)

SECTION B (60 marks)

Answer any FOUR of the questions in this section.

21. (a) Baridi Traders had the following expenditure for the year ended 31 December 2015:

Purchase of computers Ksh

150,000

Salaries 850,000

Installation of CCTV camera 100,000

Repainting of the office building 105,000

Purchases of goods 470,000

Extension of warehouse 340,000

Painting firm’s logo on a motor vehicle 120,000

Fuel for motor vehicles 298,000

Determine the:

(i) total capital expenditure;

(ii) total revenue expenditure. (6 marks)

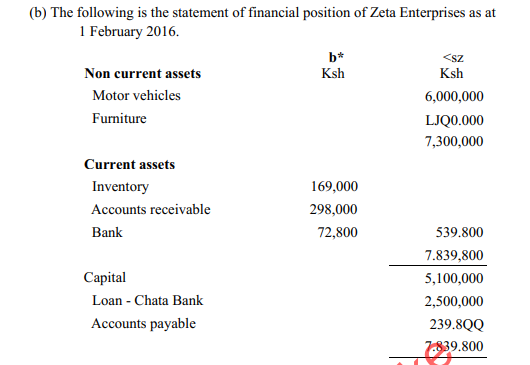

During the week ended 6 February 2016, the following transactions took place:

The proprietor brought in additional amount of Ksh 1,000,000 and deposited it in the business bank account.

Bought a motor van of Ksh 750,000 by cheque.

Bought goods for Ksh 180,000 on credit.

Repaid Ksh 200,000 of the bank loan.

Received a cheque of Ksh 65,000 from a debtor.

Sold excess furniture for Ksh 40,000 and the buyer paid by cheque.

Prepare a statement of financial position as at 6 February 2016

(a)

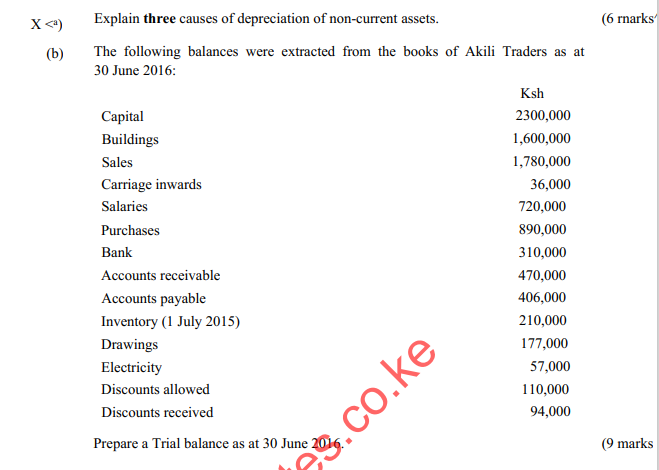

Explain three causes of depreciation of non-current assets.

The following balances were extracted from the books of Akili Traders as at 30 June 2016:

Capital

2300,000

Buildings 1,600,000

Sales 1,780,000

Carriage inwards 36,000

Salaries 720,000

Purchases 890,000

Bank 310,000

Accounts receivable 470,000

Accounts payable 406,000

Inventory (1 July 2015) 210,000

Drawings 177,000

Electricity 57,000

Discounts allowed 110,000

Discounts received 94,000

Prepare a Trial balance as at 30 June 2016. (9 marks

On 1 May 2016, Belinda Enterprises had the following balances:

Ksh

Cash in hand 19,500

Cash at bank 173,400

The following transactions took place during the month of May: 2016

May 2 Purchased goods for Ksh 11,600 in cash.

3 Sold goods for Ksh 64,000 and received cash.

4 Bought stationery for Ksh 3,100 and paid in cash.

10 Received a cheque of Ksh 22,500 from Fatuma.

16 Paid Juma Ksh 46,000 by cheque.

17 Received rent of Ksh 24,000 in form of a cheque.

18 Paid electricity of Ksh 2,000 by cheque.

28 Withdrew Ksh 50,000 from the bank for office use.

30 Paid wages amounting to Ksh 85,400 in cash.

31 The proprietor took Ksh 20,000 from the cash till for personal use.

Prepare a two-column cash book for the month of May 2016

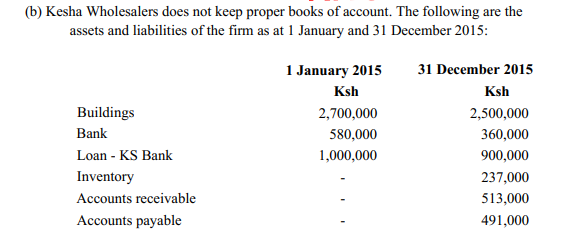

• The net profit for the year ended 31 December 2015 was Ksh 311,000.

• The proprietor withdrew Ksh 31,000 each month for personal use.

(i) Prepare:

(I) statement of affairs as at 1 January 2015.

(II) statement of affairs as at 31 December 2015.

(ii) Advise the proprietor on the capital position of the firm based on the results in (i) above. (7 marks)

^24^ (a) The following transactions relate to Peto Enterprises for the month of June 2016:

2016

June 1 Purchased goods on credit from Dolly Traders worth Ksh 47,000.

7 Purchased goods on credit from Elite Manufacturers worth Ksh 106,000.

13 Purchased goods on credit from Frank Wholesalers worth Ksh 68,000.

14 Returned goods to Dolly Traders valued at Ksh 3,000.

18 Purchased goods from Gedi Limited on credit worth Ksh 37,000.

19 Returned goods to Frank Wholesalers valued at Ksh 6,000.

29 Purchased goods on credit from Hassan Traders worth Ksh 59,000.

30 Purchased goods on credit from Ida Retailers worth Ksh 10,000.

(i) Prepare:

(I) purchases journal;

(II) returns outwards journal.

(ii) Post the totals from the journals in (i) above to purchases account and returns outwards account. (6 marks)

(b) The following balances were extracted from the books of account of Tawala

Wholesalers as at 31 December 2015:

Sales Ksh

970,000

Salaries and wages 430,000

Discounts received 21,600

Inventory (1 January 2015) 142,000

Office expenses 132,000

Returns inwards 15,000

Returns outwards 22,000

Purchases 560,000

Carriage outwards 96,400

Discounts allowed 32,500

Furniture at cost 340,000

Additional information:

On 31 December 2015

• Inventory was valued at Ksh 292,000.

• Salaries outstanding amounted to Ksh 20,800.

• Furniture is to be depreciated at 10% per annum on cost.

(i) Prepare an income statement for the year ended 31 December 2015.

(ii) Advise the proprietor on the action to take based on the performance in (i) above.

(a) Explain the treatment of each of the following items in the final accounts:

(i) Accrued expenses

(ii) Prepaid expenses

(iii) Outstanding income.

(6 marks)

(b) On 30 June 2016, the cash book (bank column) of Daraja Traders showed a debit balance of Ksh 106,000 while the bank statement balance on the same date had a balance of Ksh 114,100.

On investigation, the following discrepancies were revealed:

Bank charges amounting to Ksh 1,900 were reflected on the statement only.

Cheques totalling Ksh 59,800 were issued to the suppliers but not yet been presented to the bank for payment.

A customer made a direct deposit of Ksh 37,400 into the business bank account.

A cheque received from Tamu Restaurant of Ksh 41,200, had not yet been credited into the bank statement.

The firm had placed a standing order for rent of Ksh 46,000 which was reflected on the bank statement only.

Prepare:

(i) an updated cash book;

(ii) a bank reconciliation statement. (9 marks)

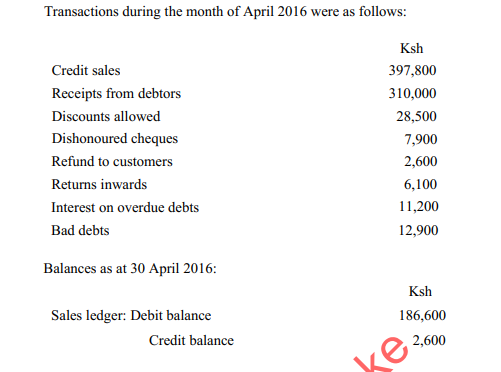

26. (a) The following are the balances of Timo Retailers as at 1 April 2016:

Ksh

Sales ledger: Debit balance 120,000

Credit balance 36,000

(i) Prepare a sales ledger control account.

(ii) Advise the proprietor on the action to take based on the results obtained in (i) above. (8 marks)

(b) The trial balance of Kilimo Traders failed to agree. The difference of Ksh 11,600 was placed on the debit side of the suspense account. Later, the following errors were revealed.

• The purchases journal was undercast by Ksh 6,000.

• A cash sale of Ksh 1,700 was completely omitted from the books.

• A credit sale of Ksh 23,000 to James was recorded in John’s account.

• The sales account was overcast by Ksh 3,200.

• Electricity of Ksh 2,400 paid by cheque was recorded in the bank account only.

Prepare:

(i) Journal entries to correct the errors above.

(ii) The suspense account duly balanced.