MASOMO MSINGI PUBLISHERS APP – Click to download and access all our materials in soft copies

PAPER NO.8 FINANCE FOR DECISION MAKING

UNIT DESCRIPTION

This paper is intended to equip the candidate with knowledge, skills and attitudes that will enable him/her to effectively manage, control and optimize on institutional finances.

8.0 LEARNING OUTCOMES

A candidate who passes this paper should be able to:

- Describe the roles of the statement of financial position, statement of comprehensive income, statement of changes in equity, and statement of cash flows in evaluating a company’s performance and financial position

- Identify various sources of finance

- Make basic capital budgeting decisions under environment of certainty

- Prepare budgets for organisations and explain budgetary controls

- Make basic capital structure decisions

- Make appropriate dividend decisions

CONTENT

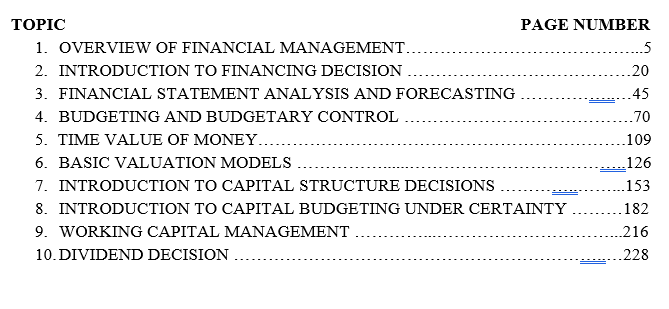

1 Overview of financial management

- Nature and scope of finance

- Finance functions – Managerial, Routine and other emerging functions

- Goals of a firm; financial and non-financial objectives, overlaps and conflicts among the objectives

- Agency theory, stakeholder’s theory and corporate governance

- Ethical issues in financial management

2 Introduction to financing decision

- Nature and objectives of the financing decision

- Factors to consider when making financing decisions

- Sources of finances for organisations; internally generated funds and the externally generated funds, long term sources, medium term and short term sources of finance

- Sources of finance for small and medium sized enterprises (SMEs)

- Methods of issuing ordinary shares

3 Financial Statement Analysis and Forecasting

- Definition of financial statements analysis

- The roles of financial reporting and financial statements analysis

- Users of financial statements and their information needs

- Importance of financial statement analysis

- Cost of disclosing financial information; direct costs, indirect costs

- Analysing financial statements

- Income statement: Components and format of the income statement

- Statement of financial position; components and format of statement of financial position

- Statement of changes in equity; components of equity, equity valuation ratios

- Cash flow statements; component and format of the cash flow statement

- Ratio analysis; Meaning and uses of financial ratios – Calculation and interpretation of profitability ratios, Liquidity ratios, efficiency ratios, capital structure ratios, coverage ratios and equity ratios, and limitation of financial ratios

- Common size statements – Vertical and horizontal analysis

- Red flags and accounting warning signs that may indicate financial statements are of poor quality

4 Budgeting and budgetary control

- Nature and purposes of budgets

- Limitations of budgeting

- Preparation of budgets; master budgets, functional budgets, department budgets, cash budgets.

- Purpose of budgetary control; operation of a budgetary control system, organisation and coordination of the budgeting function

- Distinction between budgeting and budgetary control in the private and public sectors

- Cost-Volume-Profit (CVP) Analysis

5 Time value of money

- Concept of time value of money

- Time value of money versus time preference of money

- Relevance of the concept of time value of money

- Compounding technique

- Discounting techniques

- The loan amortisation schedule

6 Basic valuation models

- Concept of value

- Relevance of valuation of securities/firms

- Valuation of debentures, preference shares and ordinary shares

7 Introduction to capital structure decisions

- Firms capital structure and factors influencing capital structure decisions

- The meaning and relevance of cost of capital

- Factors influencing firms cost of capital

- Component costs of capital

- The firm’s overall cost of capital – Weighted average cost of capital (WACC) and

- Weighted marginal cost of capital (WMCC)

8 Introduction to capital budgeting under certainty

- The nature and importance of capital investment decisions

- Capital investment’s cash flows – initial cash outlay, terminal cash flows and annual net operating cash flows, incremental approach to cash flow estimation

- Capital investment appraisal techniques; Features of an ideal capital budgeting technique, Non-discounted cash flow methods – payback period and accounting rate of return and discounted cash flow methods – net-present value, internal rate of return, profitability index and discounted payback period, Strengths and weaknesses of the investment appraisal techniques

- Incorporating capital rationing in capital budgeting – The meaning and types of capital rationing

- Challenges encountered when making capital investment decisions in reality

9 Working capital management

- Introduction and concepts of working capital

- Working capital versus working capital management

- Factors influencing working capital requirements of a firm

- Importance and objectives of working capital management

- Working capital financing policies

10 Dividend decision

- Forms of dividend payments

- When to pay dividends – Interim and final dividend

- Factors influencing dividend payments

- The firm’s dividend policy – The residual policy, stable predictable policy, constant payout ratio policy and regular plus extra policy

- Why pay dividends/Dividend theories – Dividend relevance theories; Bird in hand theory, Clientele effect theory, Information signaling theory, Walter’s theory, Tax differential theory, Modigliani and Miller’s dividend irrelevance theory

- Impact of a dividend decision on share price

SAMPLE WORK

Complete copy of FINANCE FOR DECISION MAKING STUDY TEXT (NOTES) is available in SOFT copy (Reading using our MASOMO MSINGI PUBLISHERS APP) and in HARD copy

Phone: 0728 776 317

Email: info@masomomsingi.com

MASOMO MSINGI PUBLISHERS APP – Click to download

TOPIC ONE

OVERVIEW OF FINANCE

INTRODUCTION

Finance is called “The science of money”. It studies the principles and the methods of obtaining control of money from those who have saved it, and of administering it by those into whose control it passes.

Involves the task of raising funds required by the firm at the most favorable terms.

It’s the study of how best to raise funds needed by the business and allocation of the utilized and the distribution of returns generated.

The above definition will therefore cover the four financial management functions namely;

- Financing function

- Investing function

- Dividend function

- Liquidity function

Financing function

The finance management is responsible for making projections of the firms’ future financial needs. He has to determine the companies fixed capital needs in the short, medium and long-term as well as the working capital needs.

He has to ensure that the finance is provided in the most appropriate form and for the purpose for which it is required at the lowest possible cost to the company.

He needs to be well equipped with the requirement of financial markets.

Investing function

The finance manager has to ensure that the funds raised are allocated to the most efficient and most productive uses so as to fulfill the company’s objective of maximizing shareholders wealth.

Liquidity function

The finance manager has additional responsibility of advising on the quantity and timing of funds since cash receipts and distribution don’t always consider.

He should ensure that the firms’ financial resources are well managed by;

- Ensure that there is proper management of working capital.

- Maintain optimal level of investments in each of the working capital items investments (stocks), debtors, opportunity costs in order to efficiently with deal cash shortage or surplus.

Dividend function

Involves allocation of profits available for distribution

Appropriate of earnings attributable to shareholders i.e. profit after interest and tax and preference dividend is paid out as cash dividend and the other proportion is to be retained for re-investment.

Goals of a form

This can be divided into 2:

- Financial goals

- Non-financial goals

Profit maximization goals

The main aim of economic activity is earning profits

A business concern also function mainly for the purpose of earning profit

Profit maximization however, is a traditional and narrow approach which aims at maximizing the profits of the business concern.

Favorable arguments for profit maximization (advantages)

The following points are important in the profit objective of the entity.

- Main aim is to make profit

- Profit is the economic measure of efficient business operation

- Profit is the main source of finance

- Profit reduces risk of business concern

- Profitability meets the social needs.

Unfavorable arguments for profit maximization (disadvantages)

- Leads to exploitation of workers and consumers

- Creates immoral practices such as corrupt practice and unfair trade

- Leads to inequality among shareholders

- Profit maximization is vague in the sense that it doesn’t specify the profit at the expense of his profitability.

Wealth Maximization:

Wealth Maximization is considered as the appropriate objective of an enterprise. When the firms maximizes the stock holder’s wealth, the individual stockholder can use this wealth to maximize his individual utility. Wealth maximization is the single substitute for a stock holder’s utility.

A Stock holder’s wealth is shown by:

Stock holder’s wealth = No. of shares owned x Current stock price per share. The higher the stock price per share, the greater will be the stock holder’s wealth.

Arguments in favour of Wealth Maximization:

- Due to wealth maximization, the short term money lenders get their payments in time.

- The long time lenders too get a fixed rate of interest on their investments.

- The employees share in the wealth gets increased.

- The various resources are put to economical and efficient use.

MASOMO MSINGI PUBLISHERS APP – Click to download and access all our materials in soft copies

Argument against Wealth Maximization:

- It is socially undesirable.

- It is not a descriptive idea.

- Only stock holders wealth maximization does not lead to firm’s wealth maximization.

- The objective of wealth maximization is endangered when ownership and management are separated.

In spite of the arguments against wealth maximization, it is the most appropriative objective of a firm.

Non- financial goals

Are also known as corporate social responsibility (CSR) goals.

CSR goals can be defined as making a positive effort to help the society i.e. is the managerial responsibility to take actions that protect and promotes the welfare of the various stakeholders of the firm and not just shareholders.

Is organization’s responsibility to improve the overall welfare of society by avoiding harmful practices. This has a long term advantage to the firm and therefore in the long run the stakeholders’ wealth will be maximized.

Area of social responsibility

Social responsibility may extend from the stakeholders towards;

Employees

- Paying fair salaries and wage

- Providing conducive working environment

- Offer opportunities for growth and development g. training

- Involve them in decision making

Customers

- Charging fair prices

- Providing relevant information pertaining commodity

- Offer good quality products and services

- Offer opportunities for growth and development e.g. training

- Be honest with weight measurements

- Regular supply of goods and services

Suppliers/creditors

- Prompt payment

- Give accurate financial statements

- Negotiations should be done

Government

- Pay taxes promptly

- Refrain from engaging in unlawful practices

- Provide accurate information when applying for permits

Community

- Taking care of the environment

- Employing people within the community

- Giving bursaries to needy students

- Contributing to construction of schools and hospitals for less privileged

Ethical issues in financial management

Related to the issue of social responsibility is the question of business ethics. Ethics are defined as the “standards of conduct or moral behaviour”. It can be though of as the company’s attitude toward its stakeholders, that is, its employees, customers, suppliers, community in general, creditors, and shareholders. High standards of ethical behaviour demand that a firm treat each of these constituents in a fair and honest manner. A firm’s commitment to business ethics can be measured by the tendency of the firm and its employees to adhere to laws and regulations relating to:

- Product safety and quality

- Fair employment practices

- Fair marketing and selling practices

- The use of confidential information for personal gain

- Illegal political involvement

- Bribery or illegal payments to obtain business

AGENCY THEORY CONCEPT, CONFLICT AND RESOLUTION IN A FIRM

Agency is a relationship that occurs between a principal and an agent. It arises when the principal hires an agent to perform some tasks on behalf of him.

In financial theory, the agency concept arises due to separation between the ownership of the business and management of business.

The ownership is rested in the hands of shareholders while the management of the business is left in the hands of the managers.

Shareholders, as owners can’t manage the business because of;

- Geographical distances hence lack of time

- Lack of relevant technical skills to manage the firm

- May be too many to manage a simple firm

An agency conflict arises due to the divergence of interest of principal (shareholders) and agent (manager).

Types of agency relationship

Shareholder (principal) versus management (agents)

In modern time, there is a significant separation between ownership and management of the firm. The owners provide funds and other resources and expect the management to put this to the best use. The management undertakes the day to day operations of the firm since they have the technical skills and expertise.

An agency problem presents itself whenever there is divergence of interest between the shareholder and management.

The following are some of the decisions by management which would result in conflict with shareholders;

Sources of conflict between management and shareholders

- Managements may use corporate resources for personal use

- Managements may take holidays and spend huge sum of company money.

- Creative accounting – involves manipulation of finances

- Empire building – managers may organize for mergers beneficial to themselves and not shareholders.

- Failure to declare dividend for no good reason.

Resolution of conflicts

- Performance based remuneration

This involves remunerating managements for actions they take that maximizes shareholders wealth. Managements could be given bonuses, commission for superior performance in certain periods.

- Incurring agency cost

Agency costs are those incurred by shareholders in trying to cut management behaviour and action and therefore minimize agency conflicts.

Types of agency costs

- Monitoring cost- arise as a result of mechanism put in place to ensure interest of shareholders are met. These include; cost of hiring auditors.

- Boding assurance – insurance taken for managers who engage in harmful practice.

- Opportunity cost- costs incurred either because of the benefit foregone for not investing in a riskier but more profitable investment or due to the delay when procedures have to be followed.

- Restructuring cost – Are costs incurred in changing an organization structure so as to prevent undesirable management activities.

- Direct intervention by shareholders

These may be done in the following ways;

- Making recommendations to the management on how the firm should be run

- Threat of firing

- Use of corporate governance principles which specify the manner in which organizations are acted and managed. The duties and rights of all stakeholders are outlined.

- Threat of hostile takeover (sell the business)

This may be arranged by shareholders to lock out managements who aren’t responsible

Creditors/suppliers/lenders (principals) versus shareholders/management (agents)

In this relationship the shareholders (agents) are expected to manage the credit funds provided by the creditors. The shareholders manage these funds through management

The following actions by shareholders through management could lead to conflict between them and creditors.

- Shareholders could invest in very risky projects

- Dividend payment to shareholders could be very high

- Default on interest payment

- Shareholders could organize mergers which aren’t beneficial to creditors

- Shareholders could acquire additional debt that increases the financial risk of the firm.

- Manipulation of financial statements so as to mislead creditors

- Shareholders could dispose of assets which are security for credit given

Reduction of above conflicts

Restrictive covenants: these are covenants/agreements entered into between the firm and creditors to protect the creditor’s interest.

Types of restrictive covenants

- Asset based covenants: states that the minimum asset base to be maintained by the firm.

- Liability based covenants: this limits the firm’s ability to incur more debts

- Cash flow based covenants: this states the minimum working capital to be held by the firm

- It may also restrict amount of dividends to be paid in future.

- Control based covenants: these limits management ability to make various decisions e.g. providers of debt capital may require to be represented in the board meetings.

- Callability provision – this provision will provide that the borrower will have to pay the debt before the expiry of the maturity period if there is breach of terms and conditions of the bond covenant..

- The lenders may sue the company

- Incurring agency costs such as hiring external auditors

- Use of corporate governance principles so as to minimize the conflict

Shareholders (principals) versus external auditors (agents)

Auditors are appointed by shareholders to monitor the performance of management

They are expected to give an opinion as to the true and fair view of the company’s financial position and performance as reflected in the finances that managers prepare.

Causes of conflict/problem

- When auditors collude with management in the performance of duty whereby the independence is compromised.

- Demanding very high audit fees which reduces the firms profit even when the company has a strong internal control system existing.

- Issuing unqualified reports which might be misleading to shareholders thus exposing them to investment loss.

- Failure to apply to professional care and due diligence in performance of audit work.

Resolution to conflicts

- Disciplinary actions by ICPAK such as;-

- Suspension of an auditor from practice

- Cancellation and withdrawal of practicing certificate

- Fines and penalties

- Shareholders can sue the auditors

- Shareholders can remove auditors from office at the time of AGM

- Shareholders can appoint audit committees to avoid collusion between management and audit department.

- Shareholders can appoint persons of integrity to fill the vacant position

- Fair remuneration of auditors can also minimize chances of conflict.

Shareholders versus government

The shareholders operate in environment using the license given by the government.

The government expects the shareholders to conduct their business in a manner which is beneficial to the government and society at large.

The government in this relationship is the principal and the company is the agent.

Causes of conflicts

Shareholders may take some actions which may conflict the interest of the government as the principal. E.g.

- Company may involve itself in illegal business activities

- Shareholders may not create a clear picture of the earnings or profit it generates in order to evade taxes.

- The business may not respond to CSR activities initiated by government

- Company may fail to ensure the safety of employees.

- Shareholder may avoid certain types of investments that the government proposes.

Resolutions to conflicts

- Government should give guidelines on minimum disclosure requirements for shareholder in order to eliminate tax evasion.

- Government may issue incentives inform of capital allowances in some given areas and locations.

- The government may encourage the spirit of CSR on the activities of the company

- Government may seek for directorship in some companies.

Head office and subsidiary/branch

Companies have diverse operations set up in different geographical locations. The headquarter acts as the principal and the subsidiary as an agent thus creating an agency relationship.

The subsidiary management may pursue its own goals at the expense of overall corporate goals. This will lead to sub-optimisation and conflict of interest with the headquarter.

This conflict can be resolved in the following ways:

- Frequent transfer of managers

- Adopt global strategic planning to ensure commonality of vision

- Having a voluntary code of ethical practices to guide the branch managers

- An elaborate performance reporting system providing a 2-way feedback mechanism.

- Performance contracts with managers with commensurate compensation package for the same.

SAMPLE WORK

Complete copy of FINANCE FOR DECISION MAKING STUDY TEXT is available in SOFT copy (Reading using our MASOMO MSINGI PUBLISHERS APP) and in HARD copy

Phone: 0728 776 317

Email: info@masomomsingi.com