MONDAY: 4 April 2022, Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions, Marks allocated to each question are shown at the end of the question. Show ALL your Workings. Do NOT write anything on this paper.

QUESTION ONE

1. Summarise six factors that a finance manager could consider when selecting the source of finance. (6 marks)

2. Discuss four methods of issuing ordinary shares. (4 marks)

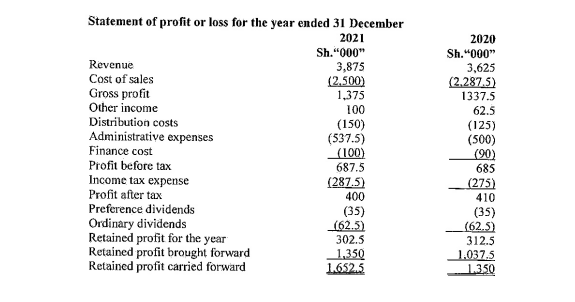

3. Enzyl Ltd. has provided the following statements of profit or loss for the year ended 31 December 2020 and 31 December 2021 for your review:

Required:

Horizontal analysis of the statement of profit or loss for the year ended 31 December 2020 and 31 December 2021. (10 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain four factors that influence a firm’s cost of capital. (4 marks)

2. NimeaI Ltd. produces and sells a single product N20.

The following information relates to the company:

Budgeted sales (units) 10,000

Sales price (Sh.) 1,206

Variable cost per unit (Sh.) 400

Fixed costs per annum (Sh.) 5,600,000

Required:

The break-even point in units arid in shillings. (4 marks)

The number of units to be sold in order to achieve a profit of Sh.2,000,000. (2 ,marks)

The margin of safety in percentage. (2 marks)

Discuss four limitations of budgeting in a firm. (8 marks)

(Total: 20 marks)

QUESTION THREE

1. Distinguish between the terms “compounding” and “discounting” in relation to time value of money. (2 marks)

2. Firms strive to achieve goals which at times compliment and conflict with each other. With reference to the above statement, explain four ways in which goals of a firm may conflict with each other. (8 marks)

3. Sanitize’. Ltd. currently owns 100,000 outstanding ordinary shares with a market price of Sh.10 per share. The firm has Sh.1,000,000 earnings after tax and intends to invest Sh.2,000,000 during the year 2022_ The firm is also considering declaring a dividend of Sh.5 per share at the end of the year The firm’s cost.of capital is 10%.

Required:

The price of the share at the end of the year 2022 if dividend is not declared. (2 marks)

The price of the share at the end of the year 2022 if dividend is declared. (2 marks)

The number of new shares to be issued in (c) (i) and (c) (ii) above. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain the the following securities valuation models:

Book value_ (2 marks)

Intrinsic value. (2 marks)

2. Buyrite Ltd. has recently issued Sh.1,000, 10% convertible bond. The bond can be converted into 30 ordinary

shares at the end of five years.

The current market, price of the shares of Buyrite Ltd. is Sh.25 per share. The-price is expected to grow at a rate of 10% per annum:

The. investors required- rate of return is 12%.

Required:

The current value of the bond. (6 marks)

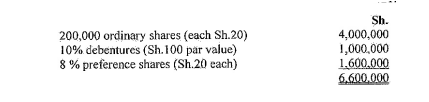

3. The following is the capital structure of Maendeleo Limited as at 31 December 2021:

Additional information:

- The current market value of ordinary shares is Sh_40 while the preference shares are: trading.* Sh.50 per share.

- The ordinary shareholders have been paid a dividend of Sh.2 per shares for the year 2021. The dividends are expected to grow at an annual growth rate of 10% for the foreseeable future.

- The debentures have a market. value of Sh.120.

- Corporation tax rate is 30%.

Required:

Maendeleo limited’s weighted average cost of capital (WACC). (10 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the following types of capital rationing:

Hard capital rationing. (2 marks)

Soft capital rationing. (2 marks)

2. Discuss three factors that influence the formulations of the working capital policy of a firm. (6 marks)

3. Fridel Ltd. finance director has provided the following details for their upcoming investrnent project.

The company has a policy of recouping its investments within four years. The industry required rate of return is 10% and the current commercial interest rate is 12%. The estimated cost of the project is Sh.24,000,000. It is expected to generate 5 years annual cash flows as follows:

Year 1 2 3 4 5

Cash flow (SE) 7,800,000 6,000,000 4,200,000 7,400,000 9,200,000

Required:

The Net Present Value (NPV) of the project. (5 marks)

The Internal Rate of Return (IRR). (5 marks)

(Total: 20 marks)