NOMINAL, EFFECTIVE AND REAL EXCHANGE RATES

An exchange rate is simply the price of one currency in terms of another. For example, suppose that, however unlikely it might be, RWF1 = $1.50 or RWF1 = Euro 2.50, etc. These are examples of the nominal exchange rate (NER) and clearly there are as many NERs as there are currencies. The NERs of significance for the economy are those with the country’s important trading partners.

It is possible that one currency is gaining value against some currencies but losing value against others. The effective exchange rate (EER) is an index which attempts to measure the overall change in the value of one currency against a range of other currencies.

DETERMINATION OF THE NOMINAL EXCHANGE RATE

The NER is a price and, like any price, the value will be determined by buyers and sellers in a market, in this case the foreign exchange markets. These are highly competitive markets, resembling perfectly competitive ones in some respects. For example, homogeneous products; a large number of financial institutions dealing; well-informed dealers using advanced communications systems.

Only money is being traded and, therefore, the seller of one currency is of necessity the buyer of another. By focusing on just two currencies, a particular NER can be isolated and the analysis simplified. If we take just the Franc (RWF) and the Dollar (USD) then sellers of RWF by definition are buyers of USD and vice versa. Anything causing increased demand for USD (i.e. increased sales of RWF) will cause the RWF to depreciate against the USD (i.e. the USD to appreciate against the RWF). For example, if the exchange rate changes from RWF1 = USD2.50 to RWF1 = USD2.60, the RWF has appreciated while the USD has depreciated.

By isolating the motives for buying a foreign currency, we can better understand the forces of supply and demand at work. Americans wish to buy RWF for a number of reasons including the following:

- To finance the purchase of Rwandan goods and services (Cassiterite, coffee, tourism, etc.);

- To invest in Rwanda: (a) in real assets (FDI) and (b) in financial assets (portfolio investments);

- The American Central Bank may wish to influence the RWF/USD exchange rate.

The first above represents a current account transaction while the other two are capital account transactions (Section 13A). The willingness of foreigners to buy a country’s exports will depend on how competitive they are in terms of price and quality. All else being equal, a successful trading nation can expect to have a strong currency. Inward investment in real assets will depend on the long-term prospects for the economy to generate an acceptable rate of return to prospective foreign investors. Investments in financial assets on the other hand will be influenced by relative interest rates and the shorter term prospect of capital gains or losses. If interest rates rise in Rwanda relative to America, all else being equal, this will attract funds into the Rwandan financial system and vice versa. If the franc is expected to lose value in the future this will result in increased selling (note the self-fulfilling expectation) and vice versa.

Portfolio investments are highly liquid and can have a destabilising effect on money markets. Sudden or short-term fluctuations in the value of a currency are not caused by current account transactions or by long term capital flows (FDI). Sudden (and sometimes dramatic) changes are caused by changes in interest rates or changing confidence in the future value of the currency..

The traditional analysis of exchange rate determination focuses initially on current account transactions, in particular the supply and demand for currencies to finance international trade.

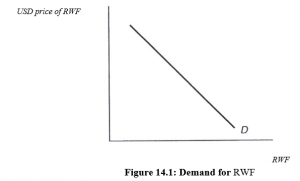

When the RWF is strong relative to the USD, Rwandan goods will be more expensive in America for any given Rwandan price level. By implication the Americans will want fewer RWF to buy Rwandan exports when the RWF has a high rate against the USD. This can be illustrated (Figure 14.1) by a downward-sloping demand curve for RWF. At higher exchange rates fewer RWF are bought by Americans with a view to buying Rwandan goods and services.

The demand curve in Figure 14.1 will shift if there are changes in such things as the popularity of Rwandan goods, Rwandan interest rates relative to foreign rates, expectations regarding the future exchange rate, the Rwandan price level, etc.

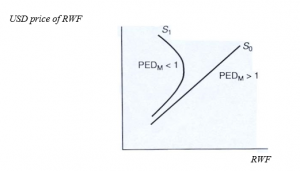

The supply of RWF, for current account transactions is equivalent to the demand for USD to import American goods and services into Rwanda. As the exchange rate of the RWF rises, American goods are cheaper in Rwanda for any given price level in America. So, more American goods will be bought in Rwanda if RWF has a high exchange rate. However it does not follow that more RWF are necessarily being spent on these extra imports which require fewer RWF to buy them. Only if the price-elasticity of demand for American imports (PEDm) is elastic will more RWF be actually spent buying the extra American goods.

Figure 14.2: Supply of RWF

Assuming this is the case (PEDm > 1), we can represent the supply of RWF to buy American goods with an upward-sloping supply curve. If demand were price-inelastic there would be a backward-bending supply curve as illustrated in Figure 14.2.

If the demand for American imports remains price elastic in Rwanda the supply curve of RWF will remain upward sloping (So), if demand becomes price-inelastic the supply curve bends backwards (S I).

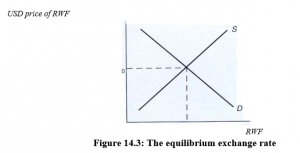

By bringing the supply and the demand curves together the analysis of the determination of the NER can be based on straight forward supply and demand analysis. Figure 14.3 illustrates this (assuming PEDm > I).

Figure 14.3: The equilibrium exchange rate

The equilibrium RWF/OM exchange rate (eo) is determined at the intersection of the supply and demand for RWF. RWF0 represents the equilibrium quantity of RWF traded for the given period.

If the demand curve in Figure 14.3 shifts outward (rising Rwandan interest rates attracting an inflow of funds for example) the equilibrium value of RWF will rise and vice versa. If the supply curve shifts outward (rising American interest rates causing an outflow of funds for example) the equilibrium exchange rate falls and vice versa as illustrated in Figure 14.4.

An increase in the demand for RWF shifts the demand curve from Do to Dl. The value of the RWF increases from, say, USD2.50 to USD2.60. A fall in demand (Do ~ D2) causes the exchange rate to fall from USD2.50 to, for example, USD2.40.

PURCHASING POWER PARITY

Purchasing power parity (PPP) is a theory of the long-run determination of the exchange rate. According to PPP changes in relative prices between countries will be the most important influence on the NER in the long run. PPP predicts that countries with relatively high inflation rates will experience a decline in the exchange rate of their currency.

Using the example of the Rwandan and Kenyan beers (Section 14A), assume 100% inflation in Rwanda leads to a doubling of the price of Rwandan Beer i.e. from RWF10 to RWF20. At the original NER (1RWF1 = RWF1) the Rwandan Beer loses competitiveness and beer drinkers in both Rwanda and Kenya switch to Kenyan beer.

The switch to Kenyan beer will mean an increased demand for KES in Rwanda, and (assuming demand in Kenya for the Rwandan product is price-elastic) a fall in demand for RWF from importers of Rwandan Beer. Figure 14.5 illustrates these effects.

A switch in purchases from Rwandan to Kenyan products implies an increased supply of RWF to the foreign exchange market to buy more KES (So ~ S I). Assuming demand for Rwandan goods in Kenya is price-elastic there is less demand for RWF as a result of Rwandan inflation (Do–+ DI). The equilibrium value of the RWF falls from e0 to e1.

RWF price of RWF

PPP predicts that the value of the RWF will fall by an amount necessary to restore the competitiveness of Rwandan products (i.e. a new NER of RWF1 = RWF0.50 in our simple example). If we generalise, the prediction is that the NER’s will adjust so that, in the longer term, the RER remains constant. What this means is that similar products should cost the same in different currencies. According to PPP, it is current account transactions that determine the exchange rate in the long run even if capital account transactions lead to shortterm fluctuations.

. FIXED AND FLOATING EXCHANGE RATES

In pursuit of their macro-economic objectives (Section 11A) governments must decide on an appropriate policy for the exchange rate. Three alternative policies (or exchange rate regimes) are typically available:

- free floating

- fixed

- managed float

A free floating system is where the government allows the exchange rate to be determined by free market forces. The currency may appreciate or depreciate depending on the relative strength of supply and demand in the foreign exchange market.

The level of the exchange rate has an important bearing on the ability of a country to trade. Fluctuations in the exchange rate can be damaging for the economy. Because of this, governments may intervene to influence the exchange rate through a variety of fixed exchange rate systems.

Strictly speaking, a fixed exchange rate would require currencies to be locked together at a particular rate.

However governments may enter into fixed exchange rate agreements whereby upper and lower limits to the exchange rate are fixed, rather than a particular rate. The post-war Bretton Woods agreement and the Exchange Rate Mechanism in the EU are examples. Three rates need to be determined, a central rate plus upper and lower limits which determine the band within which the actual market rate is permitted to fluctuate (Figure 14.6).

Provided the free market exchange rate remains within the upper (e1) and lower (e2) limits there is no need for central banks to intervene. The objective is to limit the extent of variation allowable rather than fix the rates at a particular level. The tighter the bands the greater the degree of certainty for those involved in international trade but the greater the likelihood the central bank will need to intervene.

Figure 14.7: Intervention in a fixed exchange rate system

If the equilibrium rate moves outside the band the Central Bank must intervene (Figure 14.7). The shift of the demand curve from D0 to D1 will result in an exchange rate of e4 which is below the permissible lower limit of e2. The Central Bank is obliged to intervene before the lower limit is breached. The Bank will be required to use its foreign reserves to buy its own currency. The distance ab indicates the excess supply of the currency at the lower limit e2 and is the minimum quantity of RWF that needs to be purchased- An alternative (or complementary) policy is for the Bank to raise domestic interest rates with a view to shifting the demand curve for the currency upward so that the point of intersection is once again within the permitted band- Were the demand curve to shift outward from Do to D2 the free market rate rises to e3 which is above the upper limit of el- To prevent this the Bank must increase the supply of its own currency to the market by an amount at least equal to cd, the extent of the excess demand at e1 – The Bank’s official reserves will be rising as it purchases foreign currency – Alternatively (or as a complement) the Bank could reduce domestic interest rates with a view to shifting the supply and demand curves downwards so that the point of intersection is within the permitted band-

Operating a fixed exchange rate system imposes certain constraints on a Central Bank:

- An adequate stock of foreign currency reserves must be maintained for intervention purposes.

- Monetary policy (Section 12D) must be subordinated to the exchange rate regime. Interest rates may need to be adjusted to strengthen (or weaken) the currency as circumstances require.

Problems arise when long-term trends – trade patterns, inflation rates etc. – create the need to realign currencies. In Figure 14.8, for example, if the shift from D0 to D1 reflects a longer term trend rather than a temporary shift a devaluation of the currency will be necessary.

If e3 represents the long-run equilibrium rate then the currency has become overvalued with respect to the original band. The shift from D0 to D1, if permanent, is causing a continuous fall in the Bank’s foreign currency reserves (ab per period) as it intervenes to prevent the rate falling below e2. Furthermore, a policy of high domestic interest rates will be the appropriate monetary policy to adopt.

Figure 14.8: Devaluation as an option

As foreign reserves are finite and high interest rates will undermine domestic economic activity, the government will be forced to devalue the currency. Devaluation means choosing a lower central rate and, therefore, a new lower band which will remove the pressure on the Bank’s foreign reserves and domestic interest rates.

If one country is undertaking devaluation, then it follows that at least one other country must be pursuing ‘revaluation’. This requires choosing a higher band because the currency has become undervalued with respect to the original band. The ultimate freedom to devalue down or revalue up has given rise to the term ‘adjustable peg’ to describe these systems. Effectively, they are designed to remove short-term fluctuations rather than prevent longer term adjustments in exchange rates.

Managed Float

A managed float (sometimes referred to as a ‘dirty float’) is a policy whereby a Central Bank unilaterally intervenes in the money markets to influence the exchange rate. It is not part of an international agreement requiring it to do so as in the case of fixed exchange rate systems. The government typically sets the target for the exchange rate which the Bank pursues.

Arguments in Favour of Fixed Exchange Rate Regimes

- By creating a degree of certainty regarding the exchange rate, they reduce the costs and risks associated with international trade, and therefore can be expected to promote international trade.

- Participating countries will be required to pursue prudent macroeconomic policies that keep inflation low or face the need for frequent devaluations.

- A degree of order is achieved, particularly if the alternative is countries unilaterally seeking competitive advantage through artificially low exchange rates.

Arguments against Fixed Exchange Rate Regimes

- The need for stocks of foreign currency reserves can be wasteful of scarce resources.

- Periodic realignments when currencies need to be devalued can cause currency crises. Ø Speculators have a one way bet. If the evidence points to the need to devalue a currency, speculators can borrow that currency simply with a view to selling it on the foreign exchange markets. This increases the pressure on the authorities to devalue after which the speculators can switch back into the (now devalued) currency to repay liabilities while leaving a profit.

Arguments in Favour of Free Floating Rates

- The exchange rate continuously adjusts to bring the balance of payments into equilibrium. This follows from the fact that the Central Bank simply refuses to use reserves to intervene.

- Savings on official reserves.

- Greater freedom to pursue other macroeconomic objectives. For example, interest rates can be set to meet the internal needs of the economy rather than support the (perhaps overvalued) exchange rate.

- A flexible exchange rate can operate as a shock-absorber for an economy. For example, it is much easier for an economy to restore its international competitiveness by allowing the NER to fall than by reducing its internal price level (See Section 14E).

Arguments Against Free Floating Rates

- Free floating rates can be extremely volatile. This increases the risks and therefore costs (in terms of hedging) involved in international trade.

- Because the costs involved rise, firms will be less likely to engage in international trade.

EXCHANGE RATES AND THE BALANCE OF PAYMENTS

We have seen (Section 13A) that balance of payments disequilibrium typically means a loss of official reserves resulting from a deficit elsewhere in the accounts. This deficit may be due to private outflows on the capital account. However, a ‘fundamental disequilibrium’ can be interpreted as a large and persistent deficit on the current account. The country is ‘not paying its way in the world’ resulting in falling reserves, perhaps official borrowing and very likely high interest rates in an attempt to attract capital inflows.

With flexible exchange rates, this fundamental disequilibrium cannot occur. Quite simply, if the Central Bank is not intervening, reserves cannot be falling. The exchange rate will adjust to equate the supply and demand for the currency for current account and capital account transactions. A fundamental disequilibrium occurs when the Central Bank refuses to allow the necessary adjustment in the exchange rate.

A current account deficit is removed by reducing the value of imports relative to exports. In the absence of devaluation, the following policies might be adopted:

- Deflate the economy; Ø Import controls;

- Buy domestic campaigns.

The first implies the use of monetary and/or fiscal policy to cut the overall level of aggregate demand in the economy. While this will lead to falling demand for imports, the demand for goods in general will fall with a likely increase in unemployment.

The second strategy, while it may be effective, invites retaliation. It is also likely to contravene international commitments such as the World Trade Organisation (formerly GAAT) agreements.

Even the third strategy may contravene international commitments given to the EAC.

By devaluing the currency, the government makes imported goods more expensive while exports become less expensive. The impact on the current account will depend on how domestic demand for imports and foreign demand for exports respond. This in turn depends on the price elasticity of demand for imports and exports.

The Marshall Lerner condition

This states that if the sum of the price elasticities of demand for imports and exports is greater than one (PEDm + PEDx > 1) in absolute terms then devaluation will improve the balance of trade.

There is some evidence that the Marshall Lerner condition is likely to hold in the longer term but perhaps not in the shorter term. International trade flows may be the result of contracts that cannot be quickly changed. Furthermore, it may take time for consumers in one country to adapt to changes in another country’s prices. If so the demand for imports and exports may be relatively inelastic in the short term.

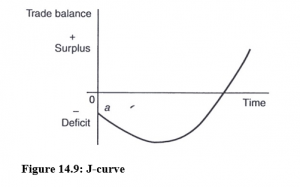

If the sum of the elasticities is less than one in the short term but greater than one in the longer term, devaluation will initially have a worsening effect on the balance of payments followed by an improvement. This is the j-curve effect illustrated in Figure 14.9.

Starting at point a with a trade deficit the government devalues the currency. The short-term effect is for the trade balance to worsen by going further into deficit but to improve over time.

Figure 14.9: J-curve

MONETARY AND FISCAL POLICY WITH FIXED AND FLOATING EXCHANGE RATES

Fixed exchange rate systems have a cost in terms of monetary independence. We have seen that the level of domestic interest rates will have to complement the exchange rate policy. Furthermore the domestic money supply will respond to surpluses and deficits on the balance of payments whereas with flexible exchange rates domestic money supply is internally controlled.

Assume fixed exchange rates and a balance of payments surplus reflected in rising official reserves. The surplus is the result of the Central Bank selling the domestic currency (i.e. buying foreign currency) to prevent the exchange rate rising. However, the increase in foreign reserves at the Central Bank will be matched by an increase in the liquidity of the banking system as the Bank is supplying domestic currency to the foreign exchange market. A balance of payments deficit would cause the domestic money supply to contract as the Bank would be buying domestic currency with foreign currency reserves.

It is possible for the Bank to counteract this balance of payments effect on the domestic money supply. Open market operations (Section 12D) can be used as a means of sterilisation. When there is a balance of payments surplus which would otherwise cause the money supply to expand, the Bank could sell government bonds which would reverse the expansionary effect of the surplus. With a balance of payments deficit, the appropriate sterilisation would be to purchase government bonds.

Monetary policy designed to influence the domestic economy becomes ineffective with fixed exchange rates when there is free capital mobility. Assume the government attempts to stimulate the domestic economy via an expansionary monetary policy. The domestic money supply expands causing domestic interest rates to fall. However, with free capital mobility the fall in interest rates will cause an outflow on the capital account as investors seek higher returns abroad. This outflow will cause the exchange rate to fall. To prevent the exchange rate falling, the Central Bank must buy its own currency and/or raise domestic interest rates, i.e. put the monetary policy into reverse.

Fiscal policy will be more effective under fixed exchange rates. Assume an expansionary fiscal policy whereby the level of taxation is cut. Increased spending leads to an expansion of the economy. As incomes rise, there will be rising demand for money balances (Section 12E) causing domestic interest rates to rise. This in turn will lead to an inflow of capital which will cause the exchange rate to rise. However, the Central Bank must now intervene to prevent the exchange rate rising. It does so by selling the domestic currency and/or lowering domestic interest rates either of which implies an increase in the domestic money supply. This expansionary monetary policy reinforces the initial fiscal policy.

The above analysis implicitly assumes that output rather than the price level increases with fiscal expansion. If the domestic price level were to rise then exports would fall and imports rise, in which case the previous analysis would require some modification.

With flexible exchange rates, the effectiveness of policy is reversed; monetary policy is effective whereas fiscal policy is not. We have seen that fiscal expansion exerts upward pressure on interest rates whereas monetary expansion implies lower interest rates. With free capital mobility and rising interest rates, capital inflows will cause the exchange rate to rise with the result that exports fall while imports rise. These effects of the rising exchange rate will reverse any expansionary effect of the fiscal policy. However, the lower interest rates following monetary expansion result in a lower exchange rate due to capital outflows. This stimulates exports and curtails imports, both of which reinforce the effects of monetary expansion.