WEDNESDAY: 7 December 2022. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Explain TWO limitations of industry life cycle models in relation to fundamental analysis. (4 marks)

2. Highlight FIVE reasons for increased use of enterprise value multiples in equity valuation. (5 marks)

3. The following information relates to Ukunda Ltd.:

1. Earnings per share (EPS) in the year 2021 was Sh.4.

2. The retention ratio is 70%.

3. The company expected to earn a return on equity of 16% on its investments.

4. The required rate of return is 12%.

5. The dividends are paid at the end of the year.

Required:

Using Gordon’s constant growth model:

Determine the company’s sustainable growth rate. (2 marks)

Estimate the value of the company’s share at the beginning of the year 2022. (3 marks)

Calculate the present value of growth opportunities assuming no growth. (3 marks)

4. Outline THREE methods used to estimate the required rate of return to the private company equity. (3 marks)

(Total: 20 marks)

QUESTION TWO

1. Highlight FOUR methods that may be used to invest in foreign equities. (4 marks)

2. In relation to industry and company analysis, assess THREE generic competitive strategies. (6 marks)

3. Jeremy Owuor is preparing a valuation report of Maximum Exports Ltd. He has decided to use a three stage free cash flow to equity (FCFE) valuation model and he has made the following estimates:

1. The FCFE per share for the current year is Sh.1.00.

2. The FCFE is expected to grow at 10% for next year then at 26% annually for the following three years and then at 8% in year 5 and thereafter.

3. Maximum Exports Ltd. estimated beta is 2.00 and the current market conditions favours a 5% risk free rate of return and a 5% equity risk premium.

Required:

Estimate the value of a share of maximum Export Ltd. (7 marks)

4. A stock has a dividend payout ratio of 40%, return on equity (ROE) of 8.3, an earnings per share of Sh.4.25, sales per share of Sh.218.75 and an expected growth rate in dividends and earnings of 5%. Shareholders require a return of 10% on their investment.

Required:

Calculate the justified price-to-sales (P/S) multiple based on these fundamentals. (3 marks)

(Total: 20 marks)

QUESTION THREE

1. George Nyamu has concluded that two stage dividend discount model (DDM) is the most appropriate for valuing Blue Energy Ltd. The current dividend paid by the company is Sh.5.00. The analyst wants to value the company’s shares using the following approaches separately:

1. The dividend growth rate will be 12% throughout the first stage of four years. The dividend growth rate thereafter will be 6%.

2. Instead of using the estimated stable growth rate of 6% in the second stage, George wants to use his estimate that four years later Blue Energy stock will be worth 15 times its earnings per share. He expects that the earnings retention ratio at that time will be 0.60.

3. In contrast to the above approach in which growth rate declines abruptly from 12% in the fourth year to 6% in the fifth, the growth rate would decline linearly from 12% in first year to 6% in the fifth year. The current share price is Sh.100.

The required return is 14%.

Required:

Estimate the present value of the terminal value of the share. (6 marks)

Advise whether the investor should purchase the company’s shares using the H-model. (4 marks)

2. Chris Sifuna of XYZ pension plan has historically invested in the shares of only Kenya-domiciled companies.

Recently he has decided to add international exposure to the plan portfolio.

Required:

In relation to the above statement, explain THREE challenges that Chris Sifuna of XZY pension plan may encounter while investing in foreign equity securities. (6 marks)

3. An investor gathers the following data estimates for a company from the energy sector. It includes projected earnings and dividends over a three year period. The required rate of return of the project is 10%. Average dividend payouts rate for mature companies in the market is 0.45. The industry average return on equity is 0.13. The earnings per share in year 3 is Sh.4.00. The industry average price earnings ratio is 24.0.

Required:

Estimate the terminal value of the share using the Gordon Growth Model. (4 marks)

(Total: 20 marks)

QUESTION FOUR

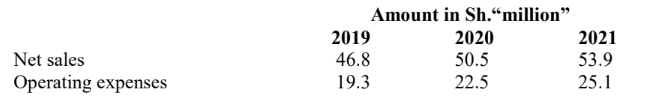

1. The following selected information is gathered from financial records of Oanda Ltd.:

An analyst estimates that sales for 2022 will grow at an average annual growth rate in net sales over 2019 – 2021 period and the year 2022 operating expenses/net sales ratio will be the same as the average ratio over the year 2019 and 2021 time period.

Required:

Estimate the year 2022 operating expenses. (6 marks)

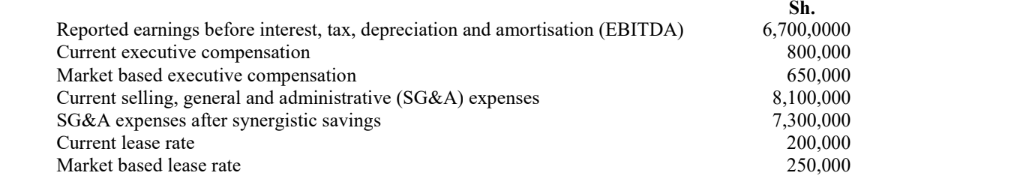

2. Jamal Hassan has gathered the following data for XXT Ltd. for the year ended 30 September 2022:

Required:

Compute the normalised EBITDA for:

Financial buyer. (3 marks)

Strategic buyer. (4 marks)

3. Describe TWO drawbacks to using enterprise value to earnings before interest, taxes, depreciation and amortisation (EV/EBITDA). (4 marks)

4. Explain the term “Tobins q”. (3 marks)

(Total: 20 marks)

QUESTION FIVE

1. In private company valuation, describe instances when the following valuations are applied:

Discount for lack of marketability. (2 marks)

Discount for lack of control. (2 marks)

Control premium. (2 marks)

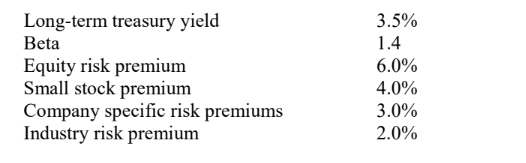

2. An equity analyst gathers the following information:

Required:

Calculate the required rate of equity using the expanded capital asset pricing model (CAPM). (2 marks)

3. Highlight FOUR applications of equation valuation models. (4 marks)

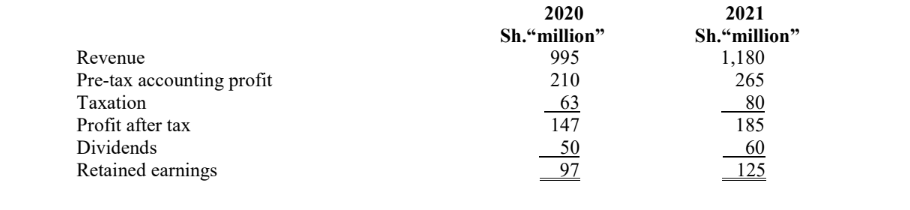

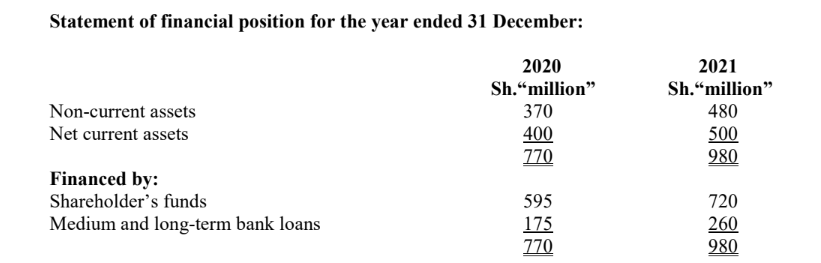

4. The following financial information relates to Beth PVT Ltd. for the year ended 31 December 2020 and 31 December 2021:

Pre-tax accounting profit is taken after deducting the economic depreciation of the company’s non-current assets (also the depreciation used for tax purposes).

Additional information:

1. Economic deprecation was Sh.95 million in 2020 and Sh.105 million in 2021.

2. Interest expenses were Sh.13 million in 2020 and Sh.18 million in 2021.

3. Other non-cash expenses were Sh.32 million in 2020 and Sh.36 million in 2021.

4. The rate of tax was 30% in both years.

5. Beth PVT Ltd. had non-capitalised leases valued at Sh.35 million in each year 2019 – 2021.

6. The company’s pre-tax cost of debt was estimated as 7% in 2020 and 8% in 2021.

7. The company’s cost of equity was estimated as 14% in 2020 and 16% in 2021.

8. The target capital structure is 75% equity, 25% debt.

9. Capital employed at the end of 2019 was Sh.695 million. There were no loans at that date.

Required:

Net operating profit after taxes (NOPAT) for financial year’s ending 31 December 2020 and 31 December 2021. (2 marks)

Capital employed by Beth PVT Ltd. for each of the years 2020 and 2021. (2 marks)

Weighted average cost of capital (WACC) of Beth PVT Ltd. for both years 2020 and 2021. (2 marks)

Economic value added (EVA) of Beth PVT Ltd. for each of the years 2020 and 2021. (2 marks)

(Total: 20 marks)