WEDNESDAY: 7 December 2022. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Explain THREE ways in which goals of a firm may overlap. (6 marks)

2. Summarise FOUR hindrances to international standardisation of Islamic Finance. (4 marks)

3. Hekima Ltd. has a capital structure consisting of Sh.250 million in 12% debentures and Sh.150 million in ordinary

shares of Sh.10 par value. The company distributes all its net earnings as dividends. The financial analyst of Hekima Ltd. intends to raise an additional Sh.50 million to finance an expansion programme and is considering three financing options.

Option I: Issue an 11% debenture stock.

Option II: Issue 13% cumulative preference shares.

Option III: Issue additional ordinary shares of Sh.10 par value.

The corporation tax rate is 30%.

Required:

Calculate the earnings before interest and tax (EBIT) and the earnings per share (EPS) at the point of indifference

between the following financing options:

Option I and option III. (5 marks)

Option II and option III. (5 marks)

(Total: 20 marks)

QUESTION TWO

1. “Provision for depreciation is an internally generated source of finance to a firm”.

By giving TWO reasons, justify the above statement. (4 marks)

2. Explain THREE challenges facing green finance in your country. (6 marks)

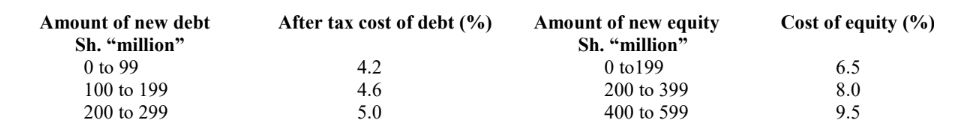

3. Adopt Ltd. has a target capital structure of 60% equity and 40% debt. The schedule of financing costs for the firm is shown below:

Required:

Determine the breakpoints for both equity and debt component. (2 marks)

Calculate the marginal cost of capital (MCC) at each break points computed in (c) (i) above. (4 marks)

Marginal cost of capital schedule for (c) (ii) above. (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the differences between the following approaches to post merger integration:

Absorption approach. (2 marks)

Preservation approach. (2 marks)

Symbiosis approach. (2 marks)

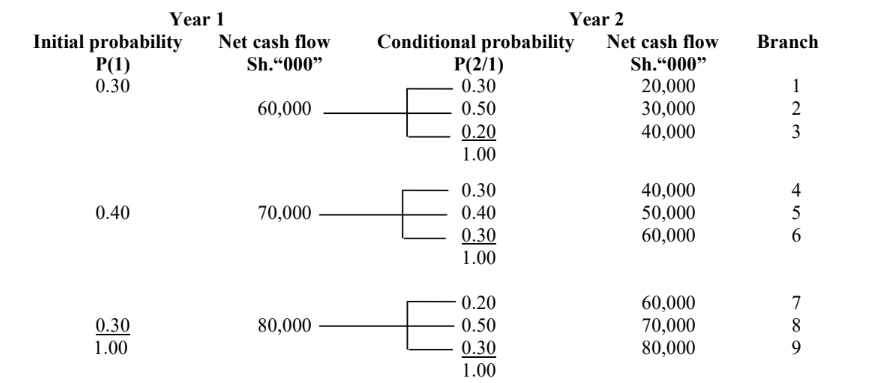

2. Daycare enterprises is considering undertaking a special project requiring an initial outlay of Sh.90,000,000. The project would have a two year life after which there will be no expected salvage or terminal value. The possible incremental after tax cash flows and associated probabilities of occurrence are as follows:

The company’s required rate of return for this investment is 8%.

Required:

Calculate the expected net present value (ENPV) for the project. (8 marks)

Suppose that the possibility of abandonment exist and that the abandonment value of the project at the end of the first year is Sh.45,000,000 after taxes.

Advise the management of Daycare Enterprises whether abandonment is the right choice. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Highlight FOUR objectives of an effective inventory management system. (4 marks)

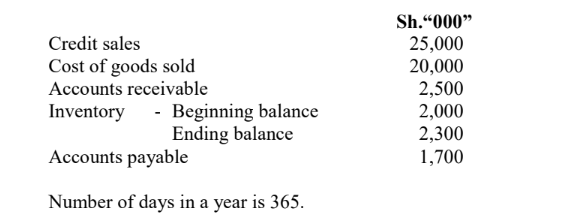

2. The following financial statement data relates to Fastline Ltd.:

Required:

The net operating cycle of Fastline Ltd. (6 marks)

3. Upendo Ltd. is considering acquiring Maridadi Ltd., a firm operating in the same industry so as to consolidate its

market share.

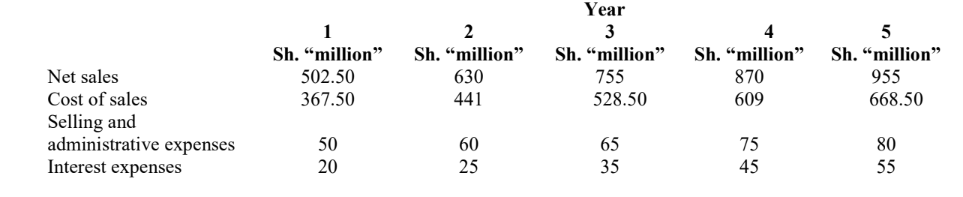

Given below are financial information relating to Maridadi Ltd. for the next five years:

Additional information:

1. Maridadi Ltd. will retain Sh.20 million for internal expansion each year.

2. The cost of equity capital is 24%.

3. After the fifth year, the cash flows available to Upendo Ltd. from Maridadi Ltd. are expected to grow by 8% per annum to perpetuity.

4. Corporation tax rate applicable is 30%.

5. The number of ordinary share in issue at Maridadi Ltd. is 10 million shares.

Required:

The dividend per share (DPS) payable by Maridadi Ltd. in each year if the firm adopts a residual dividend policy. (6 marks)

The maximum price payable by Upendo Ltd. to acquire a share of Maridadi Ltd. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Cite FOUR reasons why firms find it difficult to achieve expected synergy as a result of mergers and acquisitions.

(4 marks)

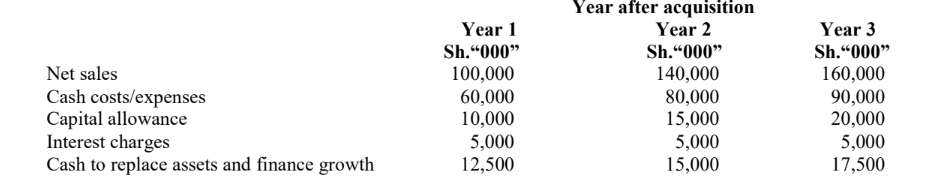

2. Orange Ltd. and Rainbow Ltd. are companies operating in the same line of business. In the past few years, Orange Ltd. has experienced stiff competition from Rainbow Ltd. to an extent that Orange Limited is now contemplating acquiring Rainbow Ltd. to consolidate its market share. If Orange Ltd. acquires Rainbow Ltd., the expected results of Rainbow Ltd. for the next three years will be as follows:

Additional information:

1. From year 4 onwards, it is expected that the annual cash flows from Rainbow Ltd. will increase by 6% each year into perpetuity.

2. Tax is payable at the rate of 30% and this tax is paid in the same year the profits to which it relates are earned.

3. If Orange Ltd. acquires Rainbow Ltd., its overall cost of capital (WACC) will be 12.4%.

Required:

The offer price that Orange Ltd. should offer to Rainbow Ltd. using discounted cash flow method. (6 marks)

3. Zedo Ltd.’s existing debt to equity ratio is 0.5 and its asset beta (unlevered equity beta) is 0.4. The firm decides to undergo a financial reconstruction during which it would repurchase its outstanding shares using borrowed debt. This will effectively increase the firm’s debt to equity ratio to 0.8.

Additional information:

1. The risk free rate of return is 10%.

2. The return of market portfolio is 14%.

3. The corporation tax rate applicable is 30%.

4. The current earnings per share (EPS) is Sh.4 and the company adopts 50% payout ratio as its dividend policy.

Required:

The firm’s equity beta before and after the financial reconstruction. (3 marks)

The firm’s cost of equity before and after financial reconstruction using capital asset pricing model (CAPM). (3 marks)

The share price of the firm before and after financial reconstruction. (3 marks)

Advise the management of the company on whether they should carry out financial reconstruction based on your answer in (iii) above. (1 mark)

(Total: 20 marks)