WEDNESDAY: 3 August 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Explain three types of market structures based on execution mechanisms. (6 marks)

2. Stephen Mwaweza buys stock on margin and holds the position for exactly one year, during which time the stock pays a dividend. Assume that the interest on the loan and the dividend are both paid at the end of the year.

Required:

The total return on this investment. (4 marks)

3. Tim Limited’s competitive advantage is expected to deteriorate over time. Evans Karani, an equity analyst for the company expects this deterioration to be reflected in declining sales growth rates as well as declining profit margins. To value the company, Evans has accumulated the following information:

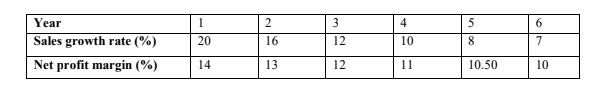

1. Current sales are Sh.600 million. Over the next six years, the annual sales growth rate and the net profit margin are projected to be as follows:

Beginning in year 6, the 7% sales growth rate and 10% net profit margin should persist indefinitely.

2. Capital expenditures (net of depreciation) equal to 60% of the sales increase will be required each year.

3. Investment in working capital equal to 25% of the sales increase will be required each year.

4. Debt financing will be used to fund 40% of the investment in net capital expenditure items and working capital.

5. The beta for Tim Limited is 1.10. The Treasury bond rate of return is 6% and equity risk premium is 4.5%.

6. There are 70 million shares outstanding.

Required:

Cost of equity. (1 mark)

Free cash flow to equity (FCFE). (6 marks)

The value of the firm. (3 marks)

(Total: 20 marks)

QUESTION TWO

1. In relation to industry analysis, develop a five step approach to be followed while constructing a preliminary list of peer companies. (5 marks)

2. John Weru is valuing the ordinary shares of Diamond Ltd. as at 31 December 2021, when the book value per share is Sh.10.62. He has made the following assumptions:

1. Earnings per share (EPS) will be 20% of the beginning book value per share for each of the next three years.

2. Diamond Ltd. will pay cash dividend equal to 40% of EPS.

3. At the end of three years, Diamond Ltd. ordinary shares will trade at four times its book value.

4. The beta for Diamond Ltd. is 0.7, the risk free rate is 4.5% and the equity risk premium is 5.0%.

Required

The value per share of the firm using residual income model. (9 marks)

3. Describe two challenges encountered in the implementation of appraisal standards used in valuing private companies. (2 marks)

4. A financial analyst has gathered the following information for a private firm:

Working capital Sh.600,000

Non-current assets Sh.2,300,000

Normalised earnings Sh.340,000

Required return for working capital 5%

Required return for non-current assets 13%

Growth rate of residual income 4%

Discount rate for intangible assets 18%

Required:

The value of the firms using the excess earnings method (EEM). (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Describe three applications of equity valuation. (6 marks)

2. Explain the following terms as used in equity valuation:

Liquidation value. (2 marks)

Investment value. (2 marks)

3. Bee Ltd. had an earning per share (EPS) of Sh.2 in the year 2021. The earnings in the year 2022 without the additional planned investments are expected to remain at Sh.2. The retention ratio is 0.70. The company is expected to earn a return on equity of 15% on its investments and the required return is 12%. Dividends are paid at the end of the year.

Required:

The present value of growth opportunities (PVGO). (6 marks)

4. Damco Ltd. has just paid a dividend of Sh.2.57 per share. Dividends are expected to grow by 12% for the next two years and by 8% the year after that. From the fourth year, the dividends are expected to grow at a rate of 6.2% indefinitely. The required rate of return is 7.2%.

Required:

The current value of the company’s share using Gordon Growth Model. (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. Evaluate the following technical analysis indicators:

Price-based indicators. (2 marks)

Momentum indicators (2 marks)

Sentiment indicators. (2 marks)

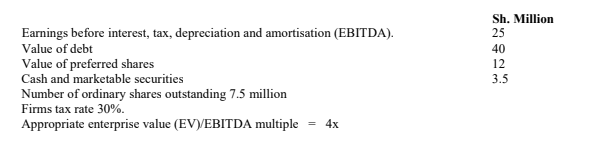

(2. An investor considering the enterprise value approach to valuation gathers the following data:

Required:

The value per share of the company’s ordinary shares using the enterprise value approach. (4 marks)

Highlight two limitations of using enterprise value to earnings before interest, tax, depreciation and amortisation (EV/EBITDA). (2 marks)

3. Pendo Ltd. has existing assets which have a book value of Sh.2,431,000 and a gross cash flow of Sh.390,000. The expected salvage value is Sh.607,800 and a life of 10 years. The real cost of capital is 8%.

Required:

The cash flow return on investment (CFROI) of the firm. (4 marks)

4. A minority shareholder holds 10% of a private firm’s equity, with the Chief Executive Officer (CEO) holding the other 90%. Using normalised earnings, the value of the firm’s equity is estimated at Sh.20 million. The CEO refuses to sell the firm and the minority shareholder cannot sell their interest easily. A discount for lack of marketability (DLOM) of 15% will be applied. A discount for lack of control (DLOC) is 0%.

Using reported earnings instead of normalised earnings provides an estimated firm equity value of Sh.19 million.

Required:

The value of the minority shareholder’s equity interest. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Outline four assumptions of efficient capital market hypothesis. (4 marks)

2. Explain two sets of tests used to examine each of the following:

Weak form of efficient market hypothesis. (2 marks)

Semi-strong form of efficient market hypothesis. (2 marks)

3. As an equity analyst, explain four elements of a company analysis. (4 marks)

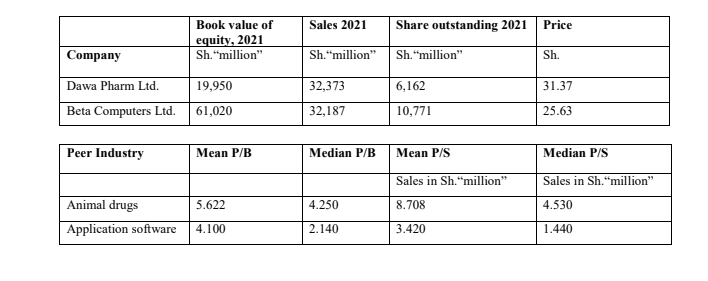

4. Dawa Pharm Ltd. belongs to the Animal drugs industry and Beta Computers Ltd. belongs to the applications software industry. The following additional information has been provided:

Where P/B – Price-to-book ratio

P/S – Price-to- sales ratio

Required:

Calculate:

Price-to-book ratio for Dawa Pharm Ltd. and Beta Computers Ltd. (4 marks)

Price-to-sales ratio for Dawa Pharm Ltd. and Beta Computers Ltd. (4 marks)

(Total: 20 marks)