December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your

workings.

QUESTION ONE

1. Outline four characteristics of a well-functioning securities market. (4 marks)

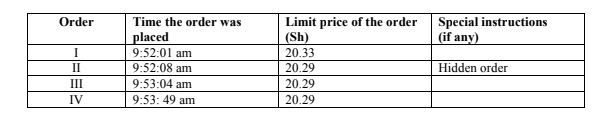

2. Consider an order driven system that allows hidden orders. The following four sell orders on Huduma Ltd. shares are currently in the automated trading systems (ATS) limit order section:

Required:

Based on the order precedence hierarchy, illustrate the precedence in which the four orders were executed. (6 marks)

3. Explain the five steps involved in equity valuation process. (5 marks)

4. Explain the term “convertible preference”. (1 mark)

Outline five advantages of convertible preference share an investor. (4 marks)

(Total: 20 marks)

QUESTION TWO

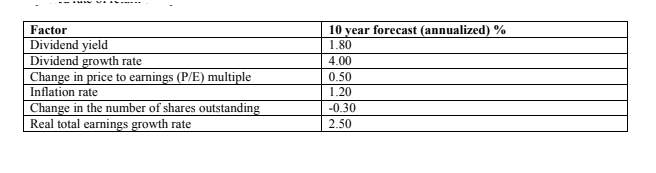

1. Julias Koech is an investment analyst at an asset management firm. Each year he provides his firm with a report that includes a series of market forecasts. As part of his report, he uses the Grinold-Kroner model to forecast the expected rate of return on equities for the next 10 years. He uses the data below to prepare his forecast:

Required:

Calculate the following sources of return for equities:

Expected nominal earnings growth return. (2 marks)

Expected repricing return. (2 marks)

Expected income return. (2 marks)

2. In each case, explain two tests used to examine the following:

Weak form of efficient market hypothesis. (4 marks)

Semi- strong form of efficient market hypothesis. (4 marks)

3. Explain three principles of technical analysis. (6 marks)

(Total: 20 marks)

QUESTION THREE

1. Distinguish between the following terms as used in industry analysis:

Growth company and growth stock. (2 marks)

Defensive company and defensive stock. (2 marks)

Cyclical company and cyclical stock. (2 marks)

Speculative company and speculative stock. (2 marks)

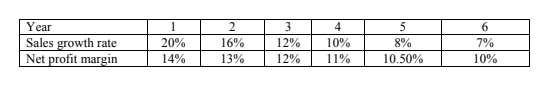

2. Medina Ltd has a competitive advantage that will probably deteriorate over time. Flavor Tobiko expects this deterioration to be reflected in declining sales growth rates as well as declining profit margins. To value the company, Tobiko has accumulated the following information:

- Current sales are Sh.600 million. Over the next six years, the annual sales growth rate and the net profit margin are projected to be as follows:

- Beginning in Year 6, the 7% sales growth rate and 10% net profit margin should persist indefinitely.

- Capital expenditures (net of depreciation) in the amount of 60% of the sales increase will be required each year.

- Investments in working capital equal to 25% of the sales increase will also be required each year.

- Debt financing will be used to fund 40% of the investments in net capital items and working capital.

- The beta for company is 1.10. The risk-free rate of return is 6% and the equity risk premium is 4.5%.

- There are 70 million outstanding shares.

Required:

The estimated total market value of equity. (10 marks)

The value of Medina Ltd.’s share. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. An analyst is examining a private firm under consideration as an acquisition and determines the following:

- The current capital structure is non-optimal because the owner avoids the use of debt.

- A small stock premium and company-specific risk premium are determined because the private firm is much smaller and much less diversified than the public firms that beta is estimated from.

- The industry risk premium reflects the additional risk in this industry compared to the broad market.

The relevant figures are listed below:

- Risk-free rate 3.6%

- Equity risk premium 6.0%

- Beta 1.3

- Small stock premium 3.0%

- Company-specific risk premium 2.0%

- Industry risk-premium 1 .0%

- Pretax cost of debt 9.0%

- Debt/total cap for public firms in industry 30%

- Optimal debt/total cap 12%

- Current debt/total 3%

- Tax rate 30%.

Required:

The required return on equity using the capital asset pricing model (CAPM), the expanded CAPM and the build-up method. (6 marks)

The weighted average cost of capital (WACC) using the current capital structure and the optimal capital structure, assuming a cost of equity of 16%. (4 marks)

Comment on the appropriate capital structure weights. (2 marks)

2. An analyst gathered the following data for Equifax Ltd.:

- Recent share price Ksh.22.50

- Shares outstanding 40 million

- Market value of debt Ksh.137 million

- Cash and marketable securities Ksh.62.3 million

- Investments Ksh.327 million

- Net income Ksh.137.5 million

- Interest expense Ksh.6.9 million

- Depreciation and amortization Ksh.10.4 million

- Taxes Ksh.95.9 million

Required:

The enterprise value to earnings before interest, tax, depreciation and amortisation (EV/EBITDA) ratio for Equifax Ltd. (4 marks)

3. Examine two favourable arguments for and against enterprise value to earnings before interest tax depreciation and amortisation (EV/EBITDA). (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Kawaida Ltd is expecting return on equity (ROE) of 15% over each of the next five years. Its current book value is Ksh.5.00 per share, it pays no dividends, and all earnings are reinvested. The required return on equity is 10%. Forecasted earnings in years 1 to 5 are equal to ROE times beginning book value.

Required:

The intrinsic value of the company using a residual income model, assuming that after five years, continuing residual income falls to zero. (3 marks)

The intrinsic values of the company using residual income, assuming that after five years to assuming that the residual income remains constant at Sh.0.44 forever. (3 marks)

Assuming that after Year 5, Kawaida’s residual income will decay over time to zero with a persistence factor of 0.4. Determine the new intrinsic value of Kawaida. (3 marks)

Suppose that at the end of Year 5 Kawaida’s ROE falls to a long-run average level and the price-to-book ratio falls to 1.2. What will be the intrinsic value? (3 marks)

2. Amlex Ltd is a large manufacturer and distributor of packaged consumer food products. James, a buy-side analyst covering Amlex Ltd, has studied the historical growth rates in sales, earnings, and dividends for the company, and also has made projections of future growth rates. James expects the current dividend of Sh.1.10 to grow at 11% for the next five years, and that the growth rate will decline to 8% and remain at that level thereafter. James feels that his estimate of the company’s beta is unreliable, so he is using the bond yield plus risk premium method to estimate the required rate of return on the stock. The yield to maturity of Amlex’s Ltd long-term bond (6.27% of 2021) is 6.67%. Adding a 4.0% risk premium to the yield-to-maturity gives a required return of 10.67%, which

James rounds to 10.7%.

Required:

Determine the stock value using the Two-Stage Dividend Discount Model. (8 marks)

(Total: 20 marks)