December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Stanley Oloo observes the strong demand for online cashless transactions being offered by Fahari Ltd. and wants to invest in the company’s shares. Unfortunately, Stanley Oloo doesn’t know the return he should expect from his investment. He has been given a risk-free rate of 3%, a market return of 10%, and company’s beta of 1.5.

Required:

The expected return of the company. (5 marks)

An analyst looking at the same information decides that the past performance of Fahari Ltd. is not representative of its future performance. He decides that, given the increase in Fahari Ltd’s. Market capitalization, Fahari Ltd. acts much more like the market than before and thinks Fahari Ltd.’s beta should be closer to 1.1. What is the analyst’s expected return for Fahari Ltd.’s shares? (5 marks)

2. Describe three considerations that a well-conceived investment policy statement should specify. (5 marks)

3. Discuss the relationship between stock prices and investors’ beliefs about the business cycle. (5 marks)

(Total: 20 marks)

QUESTION TWO

1. What are some of the important prerequisites to investing? (5 marks)

2. Describe the major differences between individual and institutional investors. (5 marks)

3. Africa Natural Resources (ANR), a Kenyan listed mining company, buys a large but privately held mining company in Rwanda. As a result of the cross-border acquisition of a private company, ANR’s standard deviation of returns is reduced from 50% to 30% and its correlation with the market falls from 0.95 to 0.75. Assume that the standard deviation and return of the market remain unchanged at 25% and 10%, respectively, and that the risk-free rate is 3%.

Required:

Calculate the beta of ANR stock and its expected return before the acquisition. (5 marks)

Calculate the expected return after the acquisition. (5 marks)

(Total: 20 marks)

QUESTION THREE

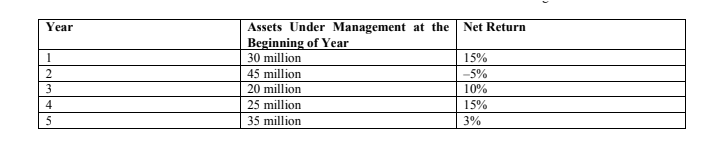

Kamau and his wife, Awino, are planning for retirement and want to compare the past performance of a few mutual funds they are considering for investment. They believe that a comparison over a five-year period would be appropriate. They are given the following information about the Nairobi Valley Superior Fund that they are considering.

The Kamau’s are interested in aggregating this information for ease of comparison with other funds.

Compute the holding period return for the five-year period. (5 marks)

Compute the arithmetic mean annual return. (5 marks)

Compute the geometric mean annual return. How does it compare with the arithmetic mean annual return? (5 marks)

The Kamau’s want to earn a minimum annual return of 5%. Is the money weighted annual return greater than 5%? (5 marks)

(Total: 20 marks)

QUESTION FOUR

1. Fixed weightings, flexible weightings, and tactical asset allocation are three approaches to asset allocation. Compare and contrast these three different approaches. (5 marks)

2. Explain the concept of bond immunization and the benefits derived from using this technique. (5 marks)

3. Explain the basic concept of bond duration and why this measure is meaningful to investors. (5 marks)

4. Discuss at least three differences between investing in stocks and investing in bonds. (5 marks)

(Total: 20 marks)

QUESTION FIVE

1. Briefly explain the holding period return (HPR) and give several characteristics of this measure. (5 marks)

2. Which type of risks cannot be avoided by carefully researching a company’s business prospects and financial statements? (5 marks)

3. Explain the relationship between risk, the expected rate of return and the actual rate of return. (5 marks)

4. Explain the relationship between correlation, diversification, and risk reduction. (5 marks)

(Total: 20 marks)