THURSDAY: 2 September 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. In relation to industry and company analysis, discuss three generic competitive strategies that a company might employ in order to compete and generate profits. (6 marks)

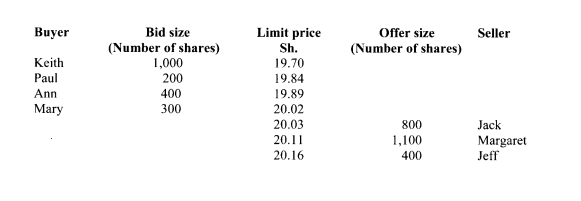

2. A market has the following limit on its book for a particular stock:

Ian submits a day order to sell 1,000 shares limit Sh.19.83.

Required:

Assuming that no more buy orders are submitted on that day after Ian submits his order, determine Ian’s average trade price. (2 marks)

Explain how the market will go about executing Ian’s order in (i) above. (4 marks)

3. Blue Line Ltd. is expected to pay a Sh.2 I dividend next year. The dividend will decline ,by 10% annually for the following three years. In year 5, the firm will sell off an asset worth Sh.100 per share. The year 5 dividend, which includes a distribution of some of the proceeds of the asset sale is expected to be Sh.60. In year 6, the dividend is expected to decrease to Sh.40 and this will be maintained for one additional year. The dividend is then expected to grow by 5% annually thereafter.

The required rate of return is 12%.

Required:

Calculate the value per share of the firm. (4 marks)

4. Summarise four challenges that market regulation seeks to address in financial markets. (4 marks)

(Total:20 marks)

QUESTION TWO

1. Differentiate between “free cash flow to firm (FCFF)” and “free cash flow to equity (FCFE)”. (2 marks)

Outline two cases where free cash flow to firm (FCFF) is preferred over free cash flow to equity (FCFE) forbvaluation purposes. (2 marks)

Ndovu Ltd. has revenues amounting to Sh.20 million this year. Its future performance will be tracked to sales as follows:

- Sales growth and the net profit margin are projected yearly as shown in the following table:

Year 1 2 3 4 5 6

Sales growth (%) 30 25 20 15 10 5

Net profit margin (%) 8 7.5 7.0 6 5.5 5

- Fixed capital investment net of depreciation is projected to be 30% of the sales increase each year.

- Working capital requirements are 7.0% of the projected shilling increase in sales each year.

- Debt will finance 40% of the investments in net capital and working capital.

- The company has a 12% required return on equity.

- The firm has 1 million ordinary shares outstanding.

Required:

Using the two stage, free cash flow to equity (FCFE) approach, estimate the value of equity of Ndovu Ltd.

(Assume long term growth rate is 5%) (10 marks)

2. Jaraz Metals Ltd. is expecting a return on equity (ROE) of 15% over each of the next five years. Its current book value is Sh.5.00 per share. The company pays no dividend and all earnings are reinvested. The required rate of return on equity is 10%. Forecasted earnings in years 1 through year 5 are equal to ROE times beginning book value.

Required:

The intrinsic value of the company using the residual income model.

(Assume that after five years, continuing residual income falls to zero) (6 marks)

(Total: 20 marks)

QUESTION THREE

1. Analyse five elements that an equity analyst should consider while conducting a thorough company analysis. (5 marks)

2. Mwendwa Kilonzo, an investor at the Securities Exchange, bought Sh.25 million worth of Talino Ltd.’s shares. Her contribution was 40% with the remainder being borrowed from her stock broker.

Required:

The leveraged position ratio. (1 mark)

The return on the equity investment based on the leveraged position in (i) above assuming the share price rises by 10%. (1 mark)

The return on equity investment on leveraged position assuming the share price falls by 10%. (1 mark)

3. Suppose an equity analyst estimates a 2.1% dividend yield, long-term inflation of 3.1%, earnings growth rate of 4%, a repurchase yield of 0.5% and price to earnings (P/E) ratio of 3%.

Required:

Using the information above, formulate the Grinold-Kroner Model. (2 marks)

Compute the expected return on the share using the Grinold-Kroner Model in (i) above. (2 marks)

Highlight four advantages of the Grinold-Kroner Model. (4 marks)

4. The following data was obtained from the financial statements of Watamu Limited for the year ended 31 December 2019 and 31 December 2020:

2020 2019

Total shareholders equity (Sh.”million”) 18,503 17,143

Net income available to ordinary shareholders (Sh.”million”) 3,526 3,056

Price per share (Sh.) 16.80 15.30

Number of shares outstanding (million) 3,710 2,790

Required:

For each year, compute:

Book value per share (BVPS). (2 marks)

Market to book ratio at end of 2019. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Rafiki Ltd.’s share is currently selling for Sh.16.00. The current earnings of the company are Sh.3.00 per share and current dividend is Sh.1.50 per share. Dividends are expected to grow at a rate of 3.5% per year indefinitely. The risk free rate is 4%, the market equity risk premium is 6% and the company’s beta is estimated to be 1.1.

Required:

Justified leading and trailing price to earnings (P/E) ratios for the company. (4 marks)

2. Panda Ltd. has recently paid a dividend of Sh.0.75, which has been growing at a rate of 10% per annum. This growth rate is expected to decline to 5% over the next five years and then remain at 5% indefinitely. The current market price per share is Sh.30.

Required:

Expected return of Panda Ltd. using H-model. (4 marks)

3. An analyst has gathered the following information for Alpha Ltd.:

- Expected earnings per share (EPS) is Sh.5.70

- Expected dividends per share (DPS) is Sh.2.70.

- Dividends are expected to grow at a rate of 2.75% per year indefinitely.

- The required rate of return is 8.5%.

Required:

The price/earnings (P/E) multiple for the company. (2 marks)

4. A financial analyst has gathered the following information about similar companies in the banking sector:

First Bank Prince Bank Pioneer Trust

Price to book (P/B) ratio 1.10 0.60 0.60

Price to earnings (P/E) ratio 8.40 11.10 8.30

Required:

Determine the company(s) that is most likely to be undervalued. (2 marks)

5. Two equity analysts at an investment bank are provided with the following financial information relating to Jasper Limited:

The analysts are required to forecast the year 2021 income statement and outline the key assumptions used in their analysis.

For year 2021, they are required to assume nominal Growth Domestic Product (GDP) growth rate of 3.6% based on expectations of real GDP growth of 1.6% and inflation rate of 2.0%.

The summary of key assumptions are:

Required:

Calculate equity analyst 2’s forecast for cost of sales in the year 2021. (4 marks)

Calculate equity analyst 1 ‘s forecast for selling, general and administrative expenses in the year 2021. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Samson Mwagire is interested in trading shares at the Securities Exchange. He approached John Babu, an accomplished equity analyst at Bambito Financial Services, who advised him to use technical analysis to predict share prices.

Required:

In relation to the above statement:

Highlight three assumptions of technical analysis. (3 marks)

Summarise four limitations of using technical analysis in predicting share prices. (4 marks)