FRIDAY: 3 September 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. In relation to pooled investment products:

Explain the meaning of the term “mutual funds”. (2 marks)

Summarise six advantages of investing in mutual funds. (6 marks)

2. The following information relates to the value of a unit fund held by an investor as at 31 December 2020:

- The account was valued at Sh.50 million at the month of January 2020 and Sh.57 million as at 31 December 2020.

- During the next four quarters of the year 2020, the cash flows were as follows:

Date Cash flows (Sh.”000″) Valuation (Sh.”000″)

31 March 2020 (2,580) 53,000

30 June 2020 (1,970) 54,000

30 September 2020 (1,125) 55,000

31 December 2020 900 57,000

Required:

The time weighted rate of return (TWRR) for the fund as at 31 December 2020. (4 marks)

3. Hydrax Ltd. is an all equity financed company with a cost of capital of 17.75%. The company is evaluating five annual capital investment projects with the following expected returns and risks:

Project Initial outlay Annual cash flow Beta

Sh. “million” Sh “million”

13 150 165 0.3

150 170 0.5

X 200 240 1.0

Y 250 295 1.5

250 300 2.0

Additional information:

- The risk free rate of return is 7.5%.

- The market rate of return is 16%.

Required:

The beta factor of the company. (1 mark)

Using suitable computations, advise the management of Hydrax Ltd. on the project to undertake. (5 marks)

Compute the beta factor of the accepted project(s) based on your results in (ii) above. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Evaluate four ethical responsibilities of a portfolio manager. (4 marks)

2. As the new investment analyst of Matrix Capital Ltd., you have been provided with the following information relating to a fund manager’s return for the past four years:

Year Fund manager returns Market index returns

(%) (%)

2020 9.385 9.676

2019 11.715 12.505

2018 14.211 13.125

2017 12.501 11.918

Required:

The fund manager’s tracking error. (4 marks)

Highlight three causes of tracking error in ( (i) above. (3 marks)

3. The following data describes a three-stock financial market that satisfies the single-index model:

Stock Capitalisation Beta Mean excess return Standard deviation

Sh “million” (%) (%)

A 3,000 1.0 10 40

B 1,940 0.2 2 30

C 1,360 1.7 17 50

The standard deviation of the market-index portfolio is 25%.

Required:

The mean excess return of the index portfolio. (2 marks)

The covariance between stock A and stock B. (2 marks)

The covariance between stock B and the index. (2 marks)

4. As a Certified Investment and Financial Analyst trainee, you recently landed a job in an investment firm and were posted in the private wealth management department. One of your clients, Mr. Richmond Mapesa, is a high net worth investor (HNI) with an estimated net worth of Sh.500 million. He would like to invest some of his money in tax efficient, low risk and high returns products. Further analysis into his investment profile indicates that he is risk averse and has low liquidity needs. He is also open to offshore investing.

Required:

Recommend three investment products available to Richmond Mapesa based on the information provided above. (3 marks)

(Total: 20 marks)

QUESTION THREE

1. Describe two consequences faced by financial market participants suffering from each of the following behavioural biases:

Mental accounting. (2 marks)

Loss aversion bias. (2 marks)

Overconfidence bias. (2 marks)

Endowment bias. (2 marks)

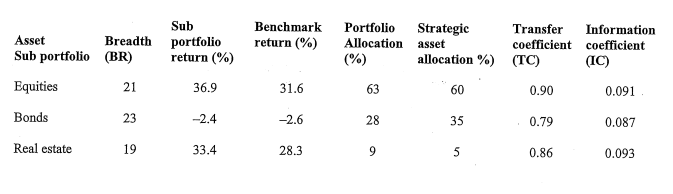

2. Teresia Nyaboke is assessing the performance of the actively managed diversified asset portfolio. The diversified asset portfolio is invested in equities, bonds and real estate and allocations to these asset classes and to the holdings within them are unconstrained. Selected return, financial, risk and statistical data are presented below:

Required:

Calculate the following:

The value added (VA) to the diversified asset portfolio attributable to security selection decision. (3 marks)

The value added to the diversified asset portfolio attributable to asset allocation decision. (3 marks)

The information ratio of each sub portfolio. (3 marks)

3. Susan Atieno has compiled the following data for three active managers:

Manager Residual return (%) Residual risk (%) Level of risk aversion

1 5.0 5.5 0.12

2 4.0 5.0 0.10

3 5.0 7.5 0.08

Required

Determine the manager that has the highest optimal level of residual risk. (3 marks)

(Total: 20 marks)

QUESTION FOUR

1. Propose five applications of fintech in portfolio management. (5 marks)

2. Differentiate between “core capital” and “excess capital” in relation to private wealth management. (4 marks)

Fredrick Onyango and Assumpta Akinyi are 74 and 71 years old respectively. They would like to maintain annual spending of Sh.500,000 on an inflation adjusted basis. Inflation is expected to be 3% and the nominal risk free rate is 5%. Their survival probabilities based on their current age are provided below:

Fredrick Assumpta Probability survival Probability survival

Year Onyango Akinyi (Fredrick Onyango) (Assumpta Akinyi)

1 74 71 0.9355 0.9831

2 75 72 0.8702 0.9649

3 76 73 0.8038 0.9457

Required:

Calculate the couple’s capitalised value of their core capital spending needs over the next three years. (4 marks)

3. An analyst has estimated that the returns for an asset, conditional on the performance of the overall economy, are as follows:

Return Probability Economic growth

5% 20% Poor

10% 40% Average

14% 40% Good

The conditional expected returns on the market portfolio are:

Return Probability Economic growth

2% 20% Poor

10% 40% Average

15% 40% Good

The risk free rate is 5% and the risky asset has a beta of 1.1 with respect to the market portfolio.

Required:

Using the capital asset pricing model (CAPM), determine whether the asset is correctly priced. (4 marks)

Examine three limitations of the capital asset pricing model (CAPM). (3 marks)

(Total: 20 marks)

QUESTION FIVE

1. William Munyi, aged 69, has had bad luck with his investments in recent years and decides to consult you for advice. Munyi’s portfolio is composed of 90% stocks and 10% bonds with a total value of Sh.2.6 million Classifying himself as conservative, Munyi blamed the aggressive allocation on a previous money manager, and says he wants to substantially increase the fixed income weighting of his portfolio.

From his portfolio, Munyi hopes to fund his retirement at the rate of Sh.7,000 per month adjusted for inflation. He has also promised a local charity at least Sh.2 million upon his death. Munyi is in good health and most of the men in his family have lived into their late 80s.

Required:

Based solely on the information presented above, analyse the risk tolerance of the investor. (4 marks)

2. A portfolio has the following returns:

Month Returns (%)

1 0.99

2 0.22

3 —0.30

4 1.10

5 —0.04

6 1.50

7 2.50

8 1.50

9 —0.50

10 1.20

11 1.09

12 —1.20

The minimum acceptable return is 0.50% for each month.

Required:

The Sortino ratio of the portfolio. (6 marks)

3. Consider a portfolio consisting of two securities as shown below:

Stock Weighting (Wo) Standard deviation

AB 0.40 4%

XY 0.60 7%

Additional information:

- The portfolio value is Sh.50 million.

- The correlation between the two stocks is 25% and the Z-score is —1.645.

Required:

The value at risk (VaR) over 1 day period with a 95% confidence level. (4 marks)

Examine three applications of value at risk (VaR). (3 marks)

Highlight three weaknesses of VaR. (3 marks)

(Total: 20 marks)