1 Introduction

Types of employee benefit

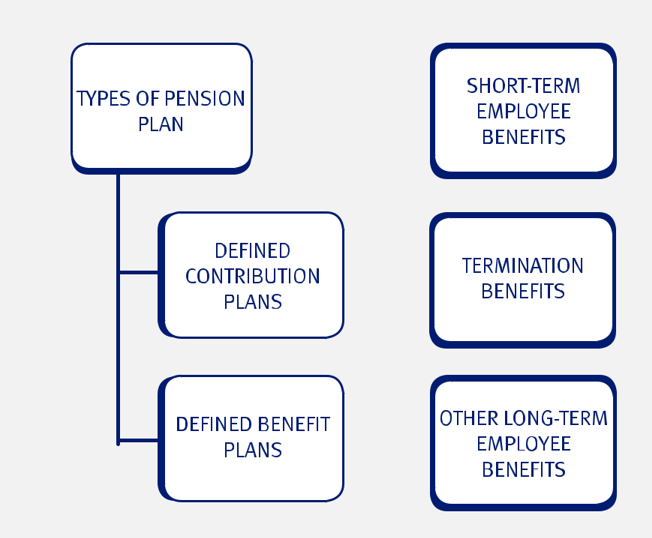

IAS 19 identifies four types of employee benefit as follows:

- Post-employment benefits. This normally relates to retirement

- Short-term . This includes wages and salaries, bonuses and other benefits.

- Termination benefits. Termination benefits arise when benefits become payable upon employment being terminated, either by the employer or by the employee accepting terms to have employment terminated.

- Other long-term . This comprises other items not within the above classifications and will include long-service leave or awards, long-term disability benefits and other long-service benefits.

Each will be considered within this chapter, with particular emphasis upon post-employment defined benefit plans.

2 Post-employment benefit plans

A pension plan (sometimes called a post-employment benefit plan or scheme) consists of a pool of assets, together with a liability for pensions owed. Pension plan assets normally consist of investments, cash and (sometimes) properties. The return earned on the assets is used to pay pensions.

There are two main types of pension plan:

- defined contribution plans

- defined benefit plans.

This distinction is important because the accounting treatment of the two types of pension plan is very different.

Defined contribution plans are benefit plans where the entity ‘pays fixed contributions into a separate entity and will have no legal or constructive obligation to pay further contributions if the fund does not hold sufficient assets to pay all relating to their service’ (IAS 19, para 8).

Defined benefit plans are post-employment plans that are not defined contribution plans.

A defined contribution plan

An entity pays fixed contributions of 5% of employee salaries into a pension plan each month. The entity has no obligation outside of its fixed contributions.

The lack of any obligation to contribute further assets into the fund means that this is a defined contribution plan.

A defined benefit plan

An entity guarantees a particular level of pension benefit to its employees upon retirement. The annual pension income that employees will receive is based on the following formula:

Salary at retirement × (no. of years worked/60 years)

The entity has an obligation to pay extra funds into the pension plan to meet this promised level of pension benefits. This is therefore a defined benefit plan.

Test you understanding 1 – Deller

Deller has a defined contribution pension scheme. However, during the year, it introduced a new post-employment plan (the Fund) for its employees as a way of enhancing the benefits they will receive when they retire. Deller makes monthly contributions into the Fund that are equal to a set percentage of the salary cost.

Upon retirement, employees will receive annual payments from the Fund based on their number of years of service and their final salary.

The Fund is voluntary and Deller can cancel it at any point.

Deller has a history of paying employees benefits that are substantially above the national average, with annual increases in excess of inflation. Deller has won many accolades as a ‘top employer’ and received positive coverage from the national press when the Fund was announced. The leadership team are well trusted by the employees.

Required:

Advise Deller on whether the Fund is a defined benefit plan or a defined contribution plan.

3 Accounting for defined contribution plans

The entity should charge the agreed pension contribution to profit or loss as an employment expense in each period.

The expense of providing pensions in the period is often the same as the amount of contributions paid. However, an accrual or prepayment arises if the cash paid does not equal the value of contributions due for the period.

Test your understanding 2 – Defined contribution scheme

An entity makes contributions to the pension fund of employees at a rate of 5% of gross salaries. For convenience, the entity pays $10,000 per month into the pension scheme with any balance being paid in the first month of the following accounting year. The wages and salaries for 20X6 are $2.7 million.

Required:

Calculate the pension expense for 20X6, and the accrual/ prepayment at the end of the year.

4 Accounting for defined benefit plans

The statement of financial position

Under a defined benefit plan, an entity has an obligation to its employees. The entity therefore has a long-term liability that must be measured at present value.

The entity will also be making regular contributions into the pension plan. These contributions will be invested and the investments will generate returns. This means that the entity has assets held within the pension plan, which IAS 19 states must be measured at fair value.

On the statement of financial position, an entity offsets its pension obligation and its plan assets and reports the net position:

- If the obligation exceeds the assets, there is a plan deficit (the usual situation) and a liability is reported in the statement of financial position.

- If the assets exceed the obligation, there is a surplus and an asset is reported in the statement of financial position.

It is difficult to calculate the size of the defined benefit pension obligation and plan assets. It is therefore recommended that entities use an expert known as an actuary.

Measuring the plan assets and liabilities

In practice, an actuary measures the plan assets and liabilities by applying carefully developed estimates and assumptions relevant to the defined benefit pension plan.

- The plan liability is measured at the present value of the defined benefit obligation, using the Projected Unit Credit Method. This is an actuarial valuation method.

- Discounting is necessary because the liability will be settled many years in the future and, therefore, the effect of the time value of money is material. The discount rate used should be determined by market yields on high quality corporate bonds at the start of the reporting period, and applied to the net liability or asset at the start of the reporting period.

- Plan assets are measured at fair value. IFRS 13 Fair Value Measurement provides a framework for determining how fair value should be established.

- IAS 19 does not prescribe a maximum time interval between valuations. However, valuations should be carried out with sufficient regularity to ensure that the amounts recognised in the financial statements do not differ materially from actual fair values at the reporting date.

- Where there are unpaid contributions at the reporting date, these are not included in the plan assets. Unpaid contributions are treated as a liability owed by the entity/employer to the plan.

The year-on-year movement

An entity must account for the year-on-year movement in its defined benefit pension scheme deficit (or surplus).

The following proforma shows the movement on the defined benefit deficit (surplus) over a reporting period:

| $000 | |

| Net deficit/(asset) brought forward | X/(X) |

| (Obligation bfd – assets bfd) | |

| Net interest component | X/(X) |

| Service cost component | X |

| Contributions into plan | (X) |

| Benefits paid | – |

| –––––– | |

| X/(X) | |

| Remeasurement component (bal. fig) | X/(X) |

| –––––– | |

| Net deficit/(asset) carried forward | X/(X) |

| (Obligation cfd – assets cfd) | –––––– |

The net interest component: this is charged (or credited) to profit or loss and represents the change in the net pension liability (or asset) due to the passage in time. It is computed by applying the discount rate at the start of the year to the net defined benefit liability (or asset).

The service cost component: this is charged to profit or loss and is comprised of three elements:

- ‘Current service cost, which is the increase in the present value of the obligation arising from employee service in the current period. period.

- Past service cost, which is the change in the present value of the obligation for employee service in prior periods, resulting from a plan amendment or curtailment

- Any gain or loss on settlement’ (IAS 19, para 8).

Contributions into the plan: these are the cash payments paid into the plan during the reporting period by the employer. This has no impact on the statement of profit or loss and other comprehensive income.

Benefits paid: these are the amounts paid out of the plan assets to retired employees during the period. These payments reduce both the plan obligation and the plan assets. Therefore, this has no overall impact on the net pension deficit (or asset).

After accounting for the above, the net pension deficit will differ from the amount calculated by the actuary as at the current year end. This is for a number of reasons, that include the following:

- The actuary’s calculation of the value of the plan obligation and assets is based on assumptions, such as life expectancy and final salaries, and these will have changed year-on-year.

- The actual return on plan assets is different from the amount taken to profit or loss as part of the net interest component.

An adjustment, known as the remeasurement component, must therefore be posted. This is charged or credited to other comprehensive income for the year and identified as an item that will not be reclassified to profit or loss in future periods.

Explanation of terms

A past service cost is the ‘change in the present value of the defined benefit obligation for employee service in prior periods, resulting from a plan amendment or a curtailment’ (IAS 19, para 8).

- Past service costs could arise when there has been an improvement in the benefits to be provided under the plan. This will apply whether or not the benefits have vested (i.e. whether or not employees are immediately entitled to those enhanced benefits), or whether they are obliged to provide additional work and service to become eligible for those enhanced benefits.

- Past service costs are included within the service cost component for the year.

- Past service costs are recognised at the earlier of:

– ‘when the plan amendment or curtailment occurs

– when the entity recognises related restructuring costs or termination benefit’ (IAS 19, para 103).

A curtailment is a significant reduction in the number of employees covered by a pension plan. This may be a consequence of an individual event such as plant closure or discontinuance of an operation, which will typically result in employees being made redundant.

A settlement occurs when an entity enters into a transaction to eliminate the obligation for part or all of the benefits under a plan. For example, an employee may leave the entity for a new job elsewhere, and a payment is made from that pension plan to the pension plan operated by the new employer.

- The gain or loss on settlement comprises the difference between the fair value of the plan assets paid out and the reduction in the present value of the defined benefit obligation and is included as part of the service cost component.

- The gain or loss on settlement is recognised on the date when the entity eliminates the obligation for all or part of the benefits provided under the defined benefit plan.

Separate disclosure of the plan assets and obligation

For the purposes of the P2 exam it will be quicker to account for the net pension obligation, as outlined in the section above.

However, in a set of published financial statements that are prepared in accordance with IFRS Standards, an entity should disclose separate reconciliations for the defined benefit obligation and the plan assets, showing the movement between the opening and closing balances. These would appear as follows:

| Obligation | Assets | |

| $000 | $000 | |

| Brought forward | X | X |

| Interest on obligation | X | |

| Interest on plan assets | X | |

| Service cost component | X | |

| Contributions into plan | X | |

| Benefits paid | (X) | (X) |

| –––––– | –––––– | |

| X | X | |

| Remeasurement component (bal. fig) | X/(X) | X/(X) |

| –––––– | –––––– | |

| Carried forward | X | X |

| –––––– | –––––– |

Summary of the amounts recognised in the financial statements

Illustration 1 – Defined benefit plan – Celine

The following information is provided in relation to a defined benefit plan operated by Celine. At 1 January 20X4, the present value of the obligation was $140 million and the fair value of the plan assets amounted to $80 million.

| 20X4 | 20X5 | |

| Discount rate at start of year | 4% | 3% |

| Current and past service cost ($m) | 30 | 32 |

| Benefits paid ($m) | 20 | 22 |

| Contributions into plan ($m) | 25 | 30 |

| Present value of obligation at 31 December ($m) | 200 | 230 |

| Fair value of plan assets at 31 December ($m) | 120 | 140 |

Required:

Determine the net plan obligation or asset at 31 December 20X4 and 20X5 and the amounts to be taken to profit or loss and other comprehensive income for both financial years.

Solution

The statement of financial position

| 20X4 | 20X5 | |

| $m | $m | |

| PV of plan obligation | 200.0 | 230.0 |

| FV of plan assets | (120.0) | (140.0) |

| ––––– | ––––– | |

| Closing net liability | 80.0 | 90.0 |

| ––––– | ––––– |

The statement of profit or loss and other comprehensive income

Both the service cost component and the net interest component are charged to profit or loss for the year. The remeasurement component, which comprises actuarial gains and losses, together with returns on plan assets to the extent that they are not included within the net interest component, is taken to other comprehensive income.

| Profit or loss | 20X4 | 20X5 | |

| $m | $m | ||

| Service cost component | 30.0 | 32.0 | |

| Net interest component | 2.4 | 2.4 | |

| ––––– | ––––– | ||

| Other comprehensive income | 32.4 | 34.4 | |

| Remeasurement component | 12.6 | 5.6 | |

| ––––– | ––––– | ||

| Total comprehensive income charge for year | 45.0 | 40.0 | |

| ––––– | ––––– |

Reconciliation of the net obligation for 20X4 and 20X5

| 20X4 | 20X5 | |

| $m | $m | |

| Obligation bal b/fwd 1 January | 140.0 | 200.0 |

| Asset bal b/fwd at 1 January | (80.0) | (120.0) |

| ––––– | ––––– | |

| Net obligation b/fwd at 1 January | 60.0 | 80.0 |

| Service cost component | 30.0 | 32.0 |

| Net interest component | ||

| 4% × $60m | 2.4 | |

| 3% × $80m | 2.4 | |

| Contributions into plan | (25.0) | (30.0) |

| Benefits paid | – | – |

| Remeasurement component (bal. fig.) | 12.6 | 5.6 |

| ––––– | ––––– | |

| Net obligation c/fwd at 31 December | 80.0 | 90.0 |

| ––––– | ––––– | |

Illustration – Accounting for past service costs

An entity operates a pension plan that provides a pension of 2% of final salary for each year of service. On 1 January 20X5, the entity improves the pension to 2.5% of final salary for each year of service, including service before this date. Employees must have worked for the entity for at least five years in order to obtain this increased benefit. At the date of the improvement, the present value of the additional benefits for service from 1 January 20X1 to 1 January 20X5, is as follows:

| $000 | |

| Employees with more than five years’ service at 1.1.X5 | 150 |

| Employees with less than five years’ service at 1.1.X5 | |

| (average length of service: two years) | 120 |

–––––

270

–––––

Required:

Explain how the additional benefits are accounted for in the financial statements of the entity.

Solution

The entity recognises all $270,000 immediately as an increase in the defined benefit obligation following the amendment to the plan on 1 January 20X5. This will form part of the service cost component. Whether or not the benefits have vested by the reporting date is not relevant to their recognition as an expense in the financial statements.

Illustration – Curtailments

AB decides to close a business segment. The segment’s employees will be made redundant and will earn no further pension benefits after being made redundant. Their plan assets will remain in the scheme so that the employees will be paid a pension when they reach retirement age (i.e. this is a curtailment without settlement).

Before the curtailment, the scheme assets had a fair value of $500,000, and the defined benefit obligation had a present value of $600,000. It is estimated that the curtailment will reduce the present value of the future obligation by 10%, which reflects the fact that employees will not benefit from future salary increases and therefore will be entitled to a smaller pension than previously estimated.

Required:

What is net gain or loss on curtailment and how will this be treated in the financial statements?

Solution

The obligation is to be reduced by 10% × $600,000 = $60,000, with no change in the fair value of the assets as they remain in the plan. The reduction in the obligation represents a gain on curtailment which should be included as part of the service cost component and taken to profit or loss for the year. The net position of the plan following curtailment will be:

| Before | On | After | |

| curtailment | |||

| $000 | $000 | $000 | |

| Present value of obligation | 600 | (60) | 540 |

| Fair value of plan assets | (500) | – | (500) |

| ––––– | ––––– | ––––– | |

| Net obligation in SOFP | 100 | (60) | 40 |

| ––––– | ––––– | ––––– | |

The gain on curtailment is $60,000 and this will be included as part of the service cost component in profit or loss for the year.

Test your understanding 3 – Fraser

The following information relates to a defined benefit plan operated by Fraser. At 1 January 20X1, the present value of the obligation was $1,000,000 and the fair value of the plan assets amounted to $900,000.

| 20X1 | 20X2 | 20X3 | |

| Discount rate at start of year | 10% | 9% | 8% |

| Current and past service cost ($000) | 125 | 130 | 138 |

| Benefits paid ($000) | 150 | 155 | 165 |

| Contributions paid into plan ($000) | 90 | 95 | 105 |

| PV of obligation at 31 December ($000) | 1,350 | 1,340 | 1,450 |

| FV of plan assets at 31 December ($000) | 1,200 | 1,150 | 1,300 |

Required:

Show how the defined benefit plan would be shown in the financial statements for each of the years ended 31 December 20X1, 20X2 and 20X3 respectively.

Test your understanding 4 – TC

TC has a defined benefit pension plan and prepares financial statements to 31 March each year. The following information is relevant for the year ended 31 March 20X3:

- The net pension obligation at 31 March 20X3 was $55 million. At 31 March 20X2, the net obligation was $48 million, comprising the present value of the plan obligation stated at $100 million, together with plan assets stated at fair value of $52 million.

- The discount rate relevant to the net obligation was 6.25% and the actual return on plan assets for the year was $4 million.

- The current service cost was $12 million.

- At 31 March 20X3, TC granted additional benefits to those currently receiving benefits that are due to vest over the next four years and which have a present value of $4 million at that date. They were not allowed for in the original actuarial assumptions.

- During the year, TC made pension contributions of $8 million into the scheme and the scheme paid pension benefits in the year amounting to $3 million.

Required:

Explain the accounting treatment of the TC pension scheme for the year to 31 March 20X3, together with supporting calculations.

Test your understanding 5 – Mickleover

On 1 July 20X3 Mickleover started a defined benefit pension scheme for its employees and immediately contributed $4m cash into the scheme. The actuary has stated that the net obligation was $0.4m as at 30 June 20X4. The interest rate for good quality corporate bonds was 10% at 1 July 20X3 but 12% by 30 June 20X4. The actual return on the plan assets was 11%. The increased cost from the employee’s service in the year was $4.2m which can be assumed to accrue at the year end.

On 30 June 20X4 Mickleover paid $0.3m in settlement of a defined benefit obligation with a present value of $0.2m. This related to staff that were to be made redundant although, as at 30 June 20X4, they still had an average remaining employment term of one month. The redundancies were not foreseen at the start of the year.

Required:

Discuss the correct accounting treatment of the above transaction in the financial statements of Mickleover for the year ended 30 June 20X4.

5 The asset ceiling

Most defined benefit pension plans are in deficit (i.e. the obligation exceeds the plan assets). However, some defined benefit pension plans do show a surplus.

If a defined benefit plan is in surplus, IAS 19 states that the surplus must be measured at the lower of:

- the amount calculated as normal (per earlier examples and illustrations)

- the total of the present value of any economic benefits available in the form of refunds from the plan or reductions in future contributions to the plan.

This is known as applying the ‘asset ceiling’. It means that a surplus can only be recognised to the extent that it will be recoverable in the form of refunds or reduced contributions in the future. In other words, it ensures that the surplus recognised in the financial statements meets the definition of an ‘asset’ (a resource controlled by the entity that will lead to a probable inflow of economic benefits).

Illustration 2 – The asset ceiling

| The following information relates to a defined benefit plan: | $000 |

| Fair value of plan assets | 950 |

| Present value of pension liability | 800 |

| Present value of future refunds and reductions in future | 70 |

| contributions | |

Required:

What is the value of the asset that recognised in the financial statements?

Solution

| The amount that can be recognised is the lower of: | $000 | |

| Present value of plan obligation | 800 | |

| Fair value of plan assets | (950) | |

| ––––– | ||

| (150) | ||

| ––––– | ||

| $000 | ||

| PV of future refunds and/or reductions in future contributions | (70) | |

| –––– |

Therefore the asset that can be recognised is restricted to $70,000.

Test your understanding 6 – Arc

The following information relates to the defined benefit plan operated by

Arc for the year ended 30 June 20X4:

| $m | |

| FV of plan assets b/fwd at 30 June 20X3 | 2,600 |

| PV of obligation b/fwd at 30 June 20X3 | 2,000 |

| Current service cost for the year | 100 |

| Benefits paid in the year | 80 |

| Contributions into plan | 90 |

| FV of plan assets at 30 June 20X4 | 3,100 |

| PV of plan obligation at 30 June 20X4 | 2,400 |

Discount rate for the defined benefit obligation – 10%

Arc has identified that the asset ceiling at 30 June 20X3 and 30 June 20X4, based upon the present value of future refunds from the plan and/or reductions in future contributions amounts to $200m at 30 June 20X3 and 30 June 20X4.

Required:

Explain, with supporting calculations, the accounting treatment of the pension scheme for the year ended 30 June 20X4.

6 Other issues

Disclosure requirements

IAS 19 has extensive disclosure requirements. An entity should disclose the following information about defined benefit plans:

- explanation of the regulatory framework within which the plan operates, together with explanation of the nature of benefits provided by the plan

- explanation of the nature of the risks the entity is exposed to as a consequence of operating the plan, together with explanation of any plan amendments, settlements or curtailments in the year

- the entity’s accounting policy for recognising actuarial gains and losses, together with disclosure of the significant actuarial assumptions used to determine the net defined benefit obligation or assets. Although there is no longer a choice of accounting policy for actuarial gains and losses, it may still be helpful to users to explain how they have been accounted for within the financial statements.

- a general description of the type of plan operated

- a reconciliation of the assets and liabilities recognised in the statement of financial position

- a reconciliation showing the movements during the period in the net liability (or asset) recognised in the statement of financial position

- the charge to total comprehensive income for the year, separated into the appropriate components

- analysis of the remeasurement component to identify returns on plan assets, together with actuarial gains and losses arising on the net plan obligation

- sensitivity analysis and narrative description of how the defined benefit plan may affect the nature, timing and uncertainty of the entity’s future cash flows.

Other

IAS 19 covers a number of other issues in addition to post-employment benefits as follows:

Short-term – This includes a number of issues including:

- Wages and salaries and bonuses and other benefits. The general principle is that wages and salaries costs are expenses as they are incurred on a normal accruals basis, unless capitalisation is permitted in accordance with another reporting standard, such as IAS 16 or IAS 38. Bonuses and other short-term payments are recognised using normal criteria of establishing an obligation based upon past events which can be reliably measured.

- Compensated absences. This covers issues such as holiday pay, sick leave, maternity leave, jury service, study leave and military service. The key issue is whether the absences are regarded as being accumulating or non-accumulating:

– accumulating benefits are earned over time and are capable of being carried forward. In this situation, the expense for future compensated absences is recognised over the period services are provided by the employee. This will typically result in the recognition of a liability at the reporting date for the expected cost of the accumulated benefit earned but not yet claimed by an employee. An example of this would be a holiday pay accrual at the reporting date where unused holiday entitlement can be carried forward and claimed in a future period.

– for non-accumulating benefits, an expense should only be recognised when the absence occurs. This may arise, for example, where an employee continues to receive their normal remuneration whilst being absent due to illness or other permitted reason. A charge to profit or loss would be made only when the authorised absence occurs; if there is no such absence, there will be no charge to profit or loss.

- Benefits in kind. Recognition of cost should be based on the same principles as benefits payable in cash; it should be measured based upon the cost to the employer of providing the benefit and recognised as it is earned.

Termination benefits

Termination benefits may be defined as benefits payable as a result of employment being terminated, either by the employer, or by the employee accepting voluntary redundancy. Such payments are normally in the form of a lump sum; entitlement to such payments is not accrued over time, and only become available in a relatively short period prior to any such payment being agreed and paid to the employee.

The obligation to pay such benefits is recognised either when the employer can no longer withdraw the offer of such benefits (i.e. they are committed to paying them), or when it recognises related restructuring costs (normally in accordance with IAS 37). Payments which are due to be paid more than twelve months after the reporting date should be discounted to their present value.

Other long-term

This comprises other items not within the above classifications and will include long-service leave, long-term disability benefits and other long-service benefits. These are accounted for in a similar manner to accounting for post-employment benefits, typically using the projected unit credit method, as benefits are payable more than twelve months after the period in which services are provided by an employee.

Criticisms of IAS 19

Retirement benefit accounting continues to be a controversial area. Commentators have perceived the following problems with the IAS 19 approach:

- The fair values of plan assets may be volatile or difficult to measure reliably. This could lead to significant fluctuations in the statement of financial position.

- IAS 19 requires plan assets to be valued at fair value. Fair values of plan assets are not relevant to the economic reality of most pension schemes. Under the requirements of IAS 19, assets are valued at short-term amounts, but most pension scheme assets and liabilities are held for the long term. The actuarial basis of valuing plan assets would better reflect the long-term costs of funding a pension scheme. However, such a move would be a departure from IFRS 13 Fair Value Measurement which seeks to standardise the application of fair value measurement when it is required by a particular reporting standard.

- The treatment of pension costs in the statement of profit or loss and other comprehensive income is complex and may not be easily understood by users of the financial statements. It has been argued that all the components of the pension cost are so interrelated that it does not make sense to present them separately.

Test you understanding 1 – Deller

It is possible that there will be insufficient assets in the Fund to pay the benefits due to retired employees, particularly if final salaries or life expectancy rise substantially. Deller therefore bears actuarial and investment risk because, if it continues with the Fund, it would need to make up for any shortfall.

Although the Fund is voluntary and can be cancelled, Deller has a history of remunerating its employees above the national average as well as a strong reputation as a good and honest employer. Deller therefore has a constructive obligation to continue with the Fund and to ensure that its level of assets is sufficient.

As a result of the above, the Fund should be accounted for as a defined benefit plan.

Test your understanding 2 – Defined contribution scheme

This appears to be a defined contribution scheme.

The charge to profit or loss should be:

$2.7m × 5% = $135,000

The statement of financial position will therefore show an accrual of $15,000, being the difference between the $135,000 expense and the $120,000 ($10,000 × 12 months) cash paid in the year.

Test your understanding 3 – Fraser

| Statement of financial position | |||

| 20X1 | 20X2 | 20X3 | |

| $000 | $000 | $000 | |

| Net pension (asset)/liability | 150 | 190 | 150 |

Profit or loss and other comprehensive income for the year

| 20X1 | 20X2 | 20X3 | |||

| Profit or loss | $000 | $000 | $000 | ||

| Service cost component | 125 | 130 | 138 | ||

| Net interest component | 10 | 14 | 15 | ||

| ––––– | ––––– | ––––– | |||

| Charge to profit or loss | 135 | 144 | 153 | ||

| Other comprehensive income: | |||||

| Remeasurement component | 5 | (9) | (88) | ||

| Total charge to comprehensive income | ––––– | ––––– | ––––– | ||

| 140 | 135 | 65 | |||

| ––––– | ––––– | ––––– | |||

| The remeasurement component on the net obligation | |||||

| 20X1 | 20X2 20X3 | ||||

| $000 | $000 | $000 | |||

| Net obligation at start of the year | 100 | 150 | 190 | ||

| Net interest component (10% X1/9% X2/8% X3) | 10 | 14 | 15 | ||

| Service cost component | 125 | 130 | 138 | ||

| Contributions into plan | (90) | (95) | (105) | ||

| Remeasurement (gain)/loss (bal. fig) | 5 | (9) | (88) | ||

| ––––– ––––– ––––– | |||||

| Net obligation at end of the year | 150 | 190 | 150 | ||

| ––––– ––––– ––––– | |||||

Test your understanding 4 – TC

| $m | |

| Net obligation brought forward | 48 |

| Net interest component (6.25% × 48) | 3 |

| Service cost component: | |

| Current service cost | 12 |

| Past service cost | 4 |

| –––– | |

| 16 | |

| Contributions into the plan | (8) |

| Benefits paid | – |

| Remeasurement component (bal fig) | (4) |

| –––– | |

| Net obligation carried forward | 55 |

| –––– | |

Explanation:

- The discount rate is applied to the net obligation brought forward. The net interest component is $3m and this is charged to profit or loss.

- The current year service cost, together with the past service cost forms the service cost component. Past service cost is charged in full, usually when the scheme is amended, rather than when the additional benefits vest. The total service cost component is $16m and this is charged to profit or loss.

- To the extent that there has been a return on assets in excess of the amount identified by application of the discount rate to the fair value of plan assets, this is part of the remeasurement component (i.e. $4m – $3.25m ($52m × 6.25%) = $0.75m).

- Contributions paid into the plan during the year of $8m reduce the net obligation.

- Benefits paid of $3 million will reduce both the scheme assets and the scheme obligation, so have no impact on the net obligation.

- The statement of financial position as at 31 March 20X3 will show a net deficit (a liability) of $55m.

Test your understanding 5 – Mickleover

The accounting treatment of a defined benefit plan is as follows:

- the amount recognised in the statement of financial position is the present value of the defined benefit obligation less the fair value of the plan assets as at the reporting date.

- The opening net position should be unwound using a discount rate that applies to good quality corporate bonds. This should be charged/credited to profit or loss.

- The increased cost from the employees’ service during the past year is known as a current service cost. This should be expensed against profits as part of the service cost component and credited to the pension scheme obligation.

- Curtailments should be recognised at the earlier of when the curtailment occurs or when the related termination benefits are recognised.

- The remeasurement component should be included in other comprehensive income and identified as an item which will not be reclassified to profit and loss in future periods.

In relation to Mickleover:

- The net liability on the statement of financial position as at 30 June 20X4 is $0.4m.

- Although this is the first year of the scheme cash of $4m was introduced at the start of the year and so this should be unwound at 10%.

- The net interest component credited to profit and loss will therefore be $0.4m (10% × $4m). The service cost arises at the year end and so is not unwound.

- Although the employees have not yet been made redundant, the costs related to the redundancy will have been recognised during the current reporting period. Therefore, a loss on curtailment of $0.1m ($0.3m – $0.2m) should also be recognised in the current year. As the curtailment was not foreseen and would not have been included within the actuarial assumptions, the $0.1m should be charged against profits within the service cost component.

- The remeasurement loss, which includes the difference between the actual returns on plan assets and the amount taken to profit or loss as part of the net interest component, is $0.5m (W1).

| (W1) Remeasurement component | |||

| $m | |||

| Net obligation brought forward | 0 | ||

| Contributions | (4) | ||

| Net interest component (10% × $4m) | (0.4) | ||

| Service cost component: | |||

| Current service cost | 4.2 | ||

| Loss on curtailment | 0.1 | ||

| –––– | |||

| 4.3 | |||

| Benefits paid | – | ||

| Remeasurement component (bal fig) | 0.5 | ||

| –––– | |||

| Net obligation carried forward | 0.4 | ||

| –––– | |||

Test your understanding 6 – Arc

| Net plan | Ceiling adj* | Net plan | Note | ||

| asset before | asset after | ||||

| ceiling adj | |||||

| ceiling adj | |||||

| $m | $m | $m | |||

| Balance b/fwd | (600) | 400 | (200) | 1 | |

| Net interest | (60) | 40 | (20) | 2 | |

| component (10%) | 100 | – | 100 | ||

| Service cost | 3 | ||||

| component | – | ||||

| Benefits paid | – | – | 4 | ||

| Contributions in | (90) | – | (90) | 5 | |

| ––––– | ––––– | ––––– | |||

| Sub-total: | (650) | 440 | (210) | ||

| Remeasurement | (50) | 60 | 10 | 6 | |

| component: | ––––– | ––––– | ––––– | ||

| Balance c/fwd | |||||

| (700) | 500 | (200) | |||

| ––––– | ––––– | ––––– | |||

* note that this is effectively a balancing figure.

Explanation:

- The asset ceiling adjustment at the previous reporting date of 30 June 20X3 measures the net defined benefit asset at the amount recoverable by refunds and/or reduced future contributions, stated at $200m. In effect, the value of the asset was reduced for reporting purposes at 30 June 20X3.

- Interest charged on the obligation or earned on the plan assets is based upon the discount rate for the obligation, stated at 10%. This will then require adjustment to agree with the net return on the net plan asset at the beginning of the year. Net interest earned is taken to profit or loss for the year.

- The current year service cost increases the plan obligation, which therefore reduces the net plan asset. The current year service cost is taken to profit or loss for the year.

- Benefits paid in the year reduce both the plan obligation and the plan assets by the same amount.

- Contributions into the plan increase the fair value of plan assets, and also the net plan asset during the year.

- The remeasurement component, including actuarial gains and losses for the year, is identified to arrive at the present value of the plan obligation and the fair value of the plan assets at 30 June 20X4. As there is a net asset of $700m ($3,100m – $2,400m) for the defined benefit pension plan, the asset ceiling test is applied to restrict the reported asset to the expected future benefits in the form of refunds and/or reduced future contributions. This is stated in the question to be $200m. To the extent that an adjustment is required to the net asset at the reporting date, this is part of the net remeasurement component.

| Statement of financial position | $000 | |||

| Net pension asset | 200 | |||

| ––––– | ||||

| Profit or loss and other comprehensive income for the year | ||||

| Profit or loss | $000 | |||

| Service cost component | 100 | |||

| Net interest component | (20) | |||

| ––––– | ||||

| Charge to profit or loss | 80 | |||

| Other comprehensive income: | ||||

| Remeasurement component | 10 | |||

| Total charge to comprehensive income | ––––– | |||

| 90 | ||||

| ––––– |

One thought on “Employee benefits”