WEDNESDAY: 15 December 2021. Time Allowed: 3 hours.

This paper has two sections. SECTION I has twenty (20) short response/computational questions. SECTION II has three (3) computational questions. All questions are compulsory. Marks allocated to each question are shown at the end of the question. Any assumptions made must be clearly and concisely stated.

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2020.

Assume that the following rates of tax applied throughout the year of income 2020:

Monthly taxable pay Annual taxable pay Rate of tax

(Sh.) (Sh.) % in each Sh.

1 – 24,000 1 – 288,000 10%

24,001 – 40,667 288,001 – 488,000 15%

40,668 – 57,334 488,001 – 688,000 20%

Excess over – 57,334 Excess over – 688,000 25%

Personal relief Sh.2,400 per month (Sh.28,800 per annum).

SECTION I – 40 MARKS

- Explain the meaning of “pay as you earn (PAYE)”. (2 marks)

- State the tax position on value of meals provided by the employer. (2 marks)

- Individual income tax returns should be filed on or before 30th June of the following year. Highlight the applicable penalty for late filing. (2 marks)

- Identify the applicable advance tax rates for vans, pick-ups, trucks, prime movers and lorries. (2 marks)

- Explain the term “residential rental income” as used in taxation. (2 marks)

- In relation to Capital Gain Tax (CGT), indicate the applicable rate of tax and comment whether it is a final tax. (2 marks)

- Explain the term “equality” as a principle of taxation. (2 marks)

- Identify the term used when the producer transfers the tax burden to the final consumer. (2 marks)

- Explain the term “stamp duty” as used in taxation. (2 marks)

- Patrick Maloba works as an assistant accountant for Beta Ltd. He was provided with a saloon car of 2000cc by the company on 1 July 2020. The car had been purchased for Sh.1,800,000 in year 2019.

Required:

The taxable benefit (if any) during the year of income 2020 in relation to the saloon car provided by the employer. (2 marks)

- James Mwatela an employee of Mamboleo Ltd. purchased a residential house through a mortgage loan advanced

by XYZ Bank. The monthly interest payable on the loan was Sh.42,000.

Required:

Advice James Mwatela, on the applicable monthly mortgage relief, in computation of his pay as you earn (PAYE). (2 marks)

- Mercy Cherono’s rental income for the month of November 2021 was Sh.246,000.

Required:

Determine Mercy Cherono’s residential rental income tax payable, indicating the due date for tax payment.

(2 marks)

- Indicate when and by what percentage should the taxpayers in the agricultural sector pay instalment tax. (2 marks)

- Highlight the two applicable rates for value added tax (VAT) purposes. (2 marks)

- Propose two conditions for a company to be considered as a resident in Kenya for tax purposes. (2 marks)

- The accountant of Luckystar Ltd. listed the following expenses in relation to bad debt:

- General provision for bad debts Sh.172,000

- Bad debt written off Sh.84,000

- Specific provision for bad debts Sh.93,000

Required:

Identify the bad debt expense listed above (if any) that should be allowed for tax purposes. (2 marks)

- Apart from pay as you earn (PAYE), state two other statutory deductions. (2 marks)

- Kenland Enterprises generates Sh.400,000 per month on average in sales revenue. Advise the management of Kenland Enterprises whether they are supposed to register for value added tax (VAT) purposes. (2 marks)

- After a tax presentation, Justus Mwania did not understand clearly what is meant by withholding tax.

Required:

Explain to him the meaning of “withholding tax” (2 marks)

- Erick Mwololo a dealer in electronic goods made a profit of Sh.3,240,600 in the year 2020. However, in the year 2019 he had made a loss of Sh.1,243,800 from the same business. Determine the taxable amount for the year (2 marks)

SECTION II

QUESTION 21

Citing four reasons, justify why accounting profit is different from taxable profit. (8 marks)

Deborah Sitati is employed by Talak Ltd. as a manager. She has provided the following information in relation to her employment income for the year ended 31 December 2020.

- Basic salary of Sh.87,500 per month (PAYE 35,900) per month.

- She was provided with a monthly commuter allowance of Sh.21,000.

- She received leave allowance equivalent to one month’s basic pay.

- She was provided with a saloon car of 2000cc. The car had been purchased at a cost of Sh.2,100,000.

- The company paid Sh.157,500 for her husband’s medical bills. The company’s medical scheme covered all employees.

- The company provided her with a fully furnished house. The cost of furniture was Sh.420,000.

- She was provided with a security guard and a cook whom the company paid monthly salaries of Sh.15,750 and Sh.21,000 respectively.

- She was given free goods worth Sh.60,000 by the company during the year.

- She is a member of a registered pension scheme where she contributed Sh.49,000 per month towards the scheme.

- The company paid Sh.315,000 for her son’s school fees. This amount was deducted as an expense in the books of Talak Ltd.

- She worked for 5 days out of her duty station during the year for which she was paid Sh.8,750 per day. ‘

Required:

Taxable income for Deborah Sitati for the year ended 31 December 2020. (10 marks)

Taxable payable (if any) from the income computed in (b) (i) above. (2 marks)

(Total: 20 marks)

QUESTION 22

The following transactions were extracted from the books of Zadec Electronics Ltd, a value added tax (VAT) registered company for the month of October 2021.

1 October 2021: Purchased 8 phones at Sh.10,000 each.

4 October 2021: Purchased flash disks at Sh.25,000.

4 October 2021: Sold 4 cameras at Sh.15,0000 each.

5 October 2021: Purchased 10 television sets at Sh.20,000 each.

6 October 2021: Sold 2 projectors for a total of Sh.250,000.

8 October 2021: Purchased flash bulbs at Sh.120,000.

9 October 2021: Sold 2 television sets at Sh.30,000 each.

12 October 2021: Sold 10 phones on credit to Zawadi Enterprises at a total of Sh.175,000.

15 October 2021: Purchased 50 wrist watches at Sh.2,500 each.

18 October 2021: Exported 3 television sets to Uganda at Sh.40,000 each.

22 October 2021: Bought energy saving bulbs at Sh.140,000.

25 October 2021: Sold 6 flash disks at Sh.1,000 each.

28 October 2021: Paid electricity bills of Sh.4,500.

The above transactions are stated exclusive of VAT at the rate of 16%, where applicable.

Required:

The VAT payable by or refundable to Zadec Electronics Ltd. for the month of October 2021. (12 m

Excel Cement Manufacturing Ltd. commenced operations on 2 May 2020 after incurring the following expenditure:

Sh.

Factory building 84,000,000

Packaging machine 6,000,000

Crashing machine 12,000,000

Conveyor belts 18,400,000

3-Tractors (each at Sh.3,200,000) 9,600,000

8-Lorries (each at Sh.3,000,000) 24,000,000

3-Saloon cars (each at Sh.3,000,000) 9,000,000

2-Delivery vans (each at Sh.2,400,000) 4,800,000

Computers 600,000

Furniture 540,000

Additional information:

- Factory building cost is inclusive of the cost of land amounting to Sh.30,000,000.

- The following assets were disposed of on 31 October 2020:

Sh.

1-Tractor 2,800,000

2-Lorries (each at Sh.2,400,000) 4,800,000

Required:

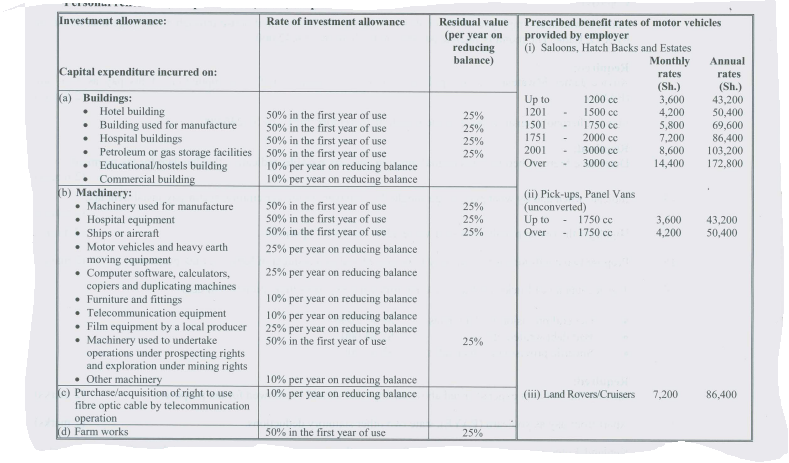

Investment allowances due to the company for the year ended 31 December 2020. (8 marks)

(Total: 20 marks)

QUESTION 23

1. Explain the following types of tax assessment:

Default assessment. (2 marks)

Self assessment. (2 marks)

2. Outline four transactions that require personal identification number (PIN). (4 marks)

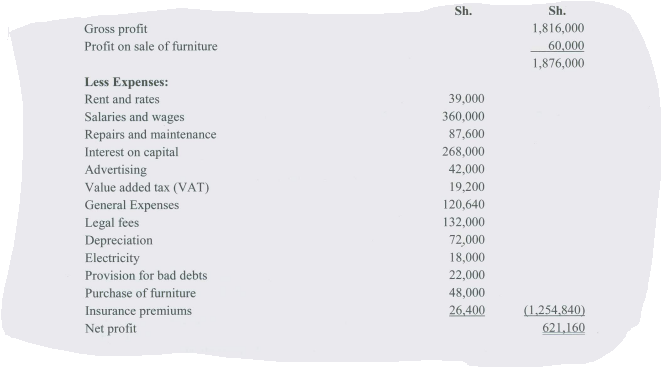

3. Haraka and Makali are partners trading as Hali Traders and sharing profits and losses equally. The statement of profit or loss for the partnership for the year ended 31December 2020 was as follows:

Additional information:

- Insurance premiums expense included Sh.13,500 paid to insure Makali’s private car.

- Interest on capital relates to the partners on their capital contribution with each partner receiving Sh.134,000.

- Legal fees include Sh.42.000 paid for appeal on a tax assessment and Sh.27,800 paid as stamp duty.

- Salaries and wages include Sh.124,000 and Sh.90,000 paid to Haraka and Makali respectively during the year.

- General expenses include Sh.88.000 embezzled by the cashiers.

- Investment allowances for the year were agreed with the tax authorities at Sh.236,000.

Required:

The adjusted partnership profit or loss for the year ended 31 December 2020. (10 marks)

Allocation of the profits or losses in (b) (i) above to the partners. (2 marks)

(Total: 20 marks)