ENTRY/BOOKS OF FIRST ENTRY

In order to extract a trial balance, an Statement of Comprehensive Income and Statement of Financial Position, the information must be posted to the accounting books. These accounting books are known by a number of names – the books of original entry, the books of prime entry or the books of first entry. The books of original entry comprise the following books:

- Sales Book

- Sales Return Book

- Cash Receipts Book

- Debtors (Trade Receivables)Ledger

- Purchases Book

- Purchases Return Book

- Cheque Payment Book

- Creditors (Trade Payables) Ledger

- Petty Cash Book

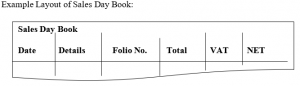

SALES BOOK: Written from Sales Invoice

Each sales invoice should be entered in the sales book as follows:

- Date of invoice

- Customers name

- Invoice number – all sales invoices should be sequentially numbered at the printers

- Total amount of invoice

- Trade Receivables ledger account

- Cash sale amount – if not a credit sale

- Analysis columns appropriate to the various different types of sales including VAT analysis columns – showing net goods and VAT for the respective rates and then the analysis excluding VAT. Analysis columns can be specifically tailored to the nature of the entity’s business and transactions type. Analysis headings should only be set up for items, which are expected to recur regularly. All other items should be analysed under a sundry column with a brief narrative as to their nature beside that item.

The sales book should be totalled and ruled off monthly. The total should agree with the cross tot of the analysis columns. Each month should be commenced on a new page.

A separate section should be opened in the sales book for all sales credit notes issued and these should be dealt with in the same fashion as above in relation to recording sales invoices. This can be a separate book, if required, known as the sales returns book.

A sales summary may be prepared at the back of the sales book by entering the totals of both invoices and credit notes for each month.

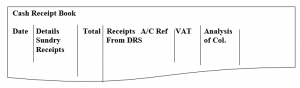

CASH RECEIPTS BOOK

This book should record all monies received and lodged to the bank accounts. Each receipt will be entered into the cash receipt book as follows: (a) Date received

- Details of receipt i.e. from whom received

- The amount of the receipt

- Analysis of receipts i.e. debtors receipt, cash sales receipt and miscellaneous receipts. Miscellaneous receipts should have a written narrative beside such receipts for identification purposes e.g. VAT refunds etc. These miscellaneous receipts will have no corresponding entry in the debtors’ ledger. Cash sales will be analysed in the sales book both for the type of transaction and VAT analysis

- Lodgement column – This should be the last column and should record all lodgements made to the bank

The total of all the analysis columns at the end of each month should be equal to the total column – excluding the lodgement column. The total column ought to agree with the total of the lodgement column, provided daily lodgements are being made. The cash receipts book should be totalled and ruled off monthly and each month should be commenced on a new page.

Bank stamped lodgement slips should be retained and kept on a special file.

Example Layout of Cash Receipt Book:

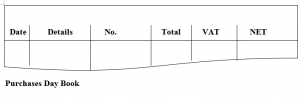

PURCHASES BOOK

On receipt of a purchase invoice, the invoice should be assigned an internal sequential number. This number has no relevance to the supplier but it is a method of filing and retrieving it, if required. All calculations, additions and extensions on the purchase invoice should be checked. It is also a means to check that all invoices are entered into the “books”. I.e. numbers should be sequential and it is easier to check if any are missing from the relevant books and analysis sheets.

Each invoice should be entered in the purchase book detailing the following:

- Date of invoice – i.e. date received and entered

- Supplier’s name

- Internal sequential number of invoice

- Total amount

- Creditor’s ledger amount – if applicable

- Analysis columns for purchase of materials by category e.g. capital expenditure, subcontract work, travel, entertainment, sundry, etc. including VAT analysis columns. The analysis columns should show net goods and VAT at the respective rates and the analysis excluding VAT. The VAT analysis columns will be split between items for resale and non-re-sale items and any further analysis required for the annual VAT returns. Analysis columns will be specifically tailored to the nature of the entity’s business and the transactions type. Analysis headings should only be set up for items which are expected to recur regularly. All other items should be analysed under a sundry column and a brief narrative as to their nature beside that item.

The purchase book should be totalled and ruled off monthly. The total column must agree with the cross total of the analysis columns plus the VAT column. Each month should be commenced on a new page.A separate section should be opened in the purchases book for all purchases credit notes received and these should be dealt with in the same fashion as noted above related to recording purchase invoices. This can be kept as a separate book, if necessary and called the purchase returns book.

A purchase summary should be prepared at the back of the purchases book by entering the total of the invoices and credit notes for each month.

Example Layout of Purchases Day Book:

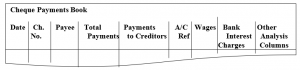

CHEQUE PAYMENTS BOOK

This records all payments made through the bank accounts. Each payment amount will be entered into the cheque payments book as follows:

- Date of cheque

- Details of payment i.e. to whom payable and for what

- Cheque number

- Cheque total

- Analysis of payment i.e. creditors payments, salaries, wages, motor expenses, etc. Apart from payment to creditors, other payments will be made directly by cheque i.e. no corresponding entry will exist in the purchase book or creditors ledger. The exact analysis of items other than payments processed through the payments relating to purchases book and the creditors’ ledger will be dependent on the nature of the company’s business and transactions. Analysis headings should only be set up for items, which are expected to recur regularly. All other times should be analysed under a sundry column with a brief narrative as to their nature beside that item.

It is essential that when cheques are being presented for signature that they must be accompanied by the supporting documentation i.e. invoice, goods received note and/or supplier’s statement. On payment, the supporting documentation should be stamped “Paid” and initialled by the cheque signatory in order to prevent re-payment. All cheques should be crossed “Account Payee only – non-negotiable”. Suppliers’ statements should be agreed with invoices to hand and if applicable, the creditors’ ledger balances.

The total of all the analysis columns at the end of the month should be equal to the total column. The cheque payments should be totalled and ruled off monthly and each month should be commenced on a new page.

Example Layout of Cheque Payments Book:

DEBTORS (Trade Receivables) LEDGER/SALES LEDGER

A debtors’ (trade receivables) ledger is used to keep a record of all amounts due to the company in respect of sales made. A loose-leaf type ledger would be the appropriate form to operate. An account should be maintained for each debtor (trade receivables) – including debtors (trade receivables) in foreign currencies, if any. An index at the front of the ledger can record the debtors’ name.

All sales to customers should be posted from the sales book to the DEBIT side of the individual accounts involved. Each entry should show the date, the description i.e. goods or services, the invoice number, the sales book reference and the amount – including VAT.

All returns from customers should be posted from the sales return book on the CREDIT side of the individual accounts involved. Each entry should show the date, the description, the credit note number, the sales returns book reference and the amount, including VAT.

Any receipts from debtors (trade receivables) should be posted from the debtors’ (trade receivables) columns in the cash receipts book on the CREDIT side of the individual accounts involved. Each entry should show the date received, description i.e. cash or cheque, the cash receipts book reference and the amount received.

A list of balances should be maintained periodically and this list should show the amount due by debtors (trade receivables) to the company at that date.

A control account should be maintained at the front of the ledger to which the total sales, total credits and total receipts for each month should be posted. The balance on this control account at the end of every month should agree with the total of the debtors’(trade receivables) balances at that date.

CREDITORS (Trade Payables) LEDGER/PURCHASES LEDGER

A creditors’ (trade payables) ledger is used to keep a record of all amounts due by the company in respect of purchases made. Initially, a creditor’s ledger account should only be opened where the amounts involved are relatively large or for a supplier where transactions are expected to recur on a regular basis. At a later date, when the overall volume of transactions increases, to maintain a control, all purchases may be processed through the creditors’ (trade payables) ledger whether for cash/cheque or credit. A Creditor’s Ledger is useful to analyse from whom purchase are made, how often and how much

A loose-leaf type ledger would be the appropriate form to operate. An account should be maintained for each creditor – including foreign currency creditors. An index at the front of the ledger can record the creditors’ (trade payables) name.

All purchases from suppliers should be posted from the purchase book to the CREDIT side of the individual account involved. Each entry should show the date of the purchase, the description i.e. goods or services, the internal reference number, the purchase book reference and the amount, including VAT.

All returns to customers should be posted from the purchases returns book on the DEBIT side of the individual accounts involved. Each entry should show the date, the description, the credit note number, the purchases returns book reference and the amount, including VAT.

Any payments to creditors (trade payables) should be posted from the creditor columns in the cheque payments book on the DEBIT side of the individual accounts involved. Each entry should show the date paid, description i.e. cash or cheque, the cheque number, the cheque payments book reference and the amount paid.

A list of balances should be maintained periodically and this list should show the amount due to creditors by the company at that date.

A control account should be maintained at the front of the ledger to which the total purchases, total credits and total payments for each month should be posted. The balance on this control account at the end of every month should agree with the total of the creditors (trade payables) balance at that date.

PETTY CASH BOOK or PETTY CASH ACCOUNT

This should record all cheques drawn to fund petty cash. These should be recorded as receipts in the petty cash book. Furthermore, a full record should be kept, with supporting documentation, of all disbursements made out of petty cash. These disbursements should be analysed under appropriate columns as follows:

- Date

- Narrative

- Petty cash docket reference number

- Total amount

- VAT analysis split between items for re-sale and non-re-sale items recording the net goods and VAT amount for each rate of VAT

- The analysis of the nature of the disbursements will be the amount exclusive of VAT and all probably cover headings such as postage, entertainment, travel, publications, office requisitions, etc. and a sundry column. The sundry column is for items, which are not expected to recur regularly and each entry in this column should have a brief narrative as to the nature of transaction.

It is preferable that an imprest petty cash system be operated whereby a pre-set amount of cash be introduced into petty cash, i.e. RWF100,000 and this would be topped up to the preset amount at the end of each week, or when required. The exact amount to be put into petty cash will be determined by the volume of transaction processed through petty cash and the amount of the individual transactions. It would be preferable to establish a maximum amount that may be processed for any transaction through petty cash i.e. RWF10,000. Thereafter, any amounts in excess of that amount are paid by cheque.

NOMINAL LEDGER

The information to prepare an Statement of Comprehensive Income and Statement of Financial Position is extracted from the NOMINAL LEDGER.

The NOMINAL LEDGER is a book/record containing what are referred to as LEDGER ACCOUNTS.

An individual LEDGER ACCOUNT shows details of transactions in relation to the various ASSETS, LIABILITIES, EXPENSES and REVENUE.

Each account is given a separate page. The page is divided into two halves. The left-hand side of the page is called the debit side while the right hand side of the page is called the credit side. The title of the account is shown across the top of the account at the centre

THE ACCOUNTING EQUATION

The resources of a firm are known as ASSETS. Someone must have supplied these resources. The total amount supplied by the owner of the business is known as CAPITAL.

Therefore, if all the resources of the business are supplied by the owner, the following must be true:

ASSETS = CAPITAL

However, some of the assets normally have been provided by some other person than the owner. This indebtedness of a firm is referred to as LIABILITIES. Therefore, the equation is now referred to as

ASSETS = CAPITAL + LIABILITIES

or

ASSETS – LIABILITIES = CAPITAL

This equality of assets with the total of capital and liabilities will always hold true.

ASSETS are made up of items such as PREMISES, PLANT and MACHINERY, MOTOR VEHICLES, FIXTURES and FITTINGS, etc.

LIABILITIES are made up of money owing for goods purchased, for expenses incurred and loans received by the firm, etc.

CAPITAL refers to the owners’ EQUITY or NET WORTH.

THE STATEMENT OF COMPREHENSIVE INCOME

The Statement of Comprehensive Income shows details how the PROFIT or LOSS of a period has been made.

THERE ARE TWO COMPONENTS PARTS:

- THE TRADING ACCOUNT:

This shows the GROSS PROFIT for the account period.

The GROSS PROFIT is the difference between:

SALES and COST OF GOODS SOLD

- THE PROFIT AND LOSS ACCOUNT:

This shows the NET PROFIT for the period.

NET PROFIT = GROSS PROFIT plus INCOME FROM OTHER SOURCES less

EXPENSES

THE STATEMENT OF FINANCIAL POSITION

This is simply a list of all the ASSETS CONTROLLED and all LIABILITIES OWED by the business at a particular date. It is a snapshot of the financial position of the business at a given moment in time. In the Statement of Financial Position, assets and liabilities are subdivided into:

Non-current Assets

An asset with a LONG LIFE acquired FOR USE IN THE BUSINESS and NOT

PURCHASED FOR RESALE

- INTANGIBLE g. Goodwill

- TANGIBLE g. Plant and machinery

- FINANCIAL g. Investments

Current Assets

An asset owned by the business with the INTENTION OF CONVERSION INTO CASH within ONE YEAR. These are shown in order of LIQUIDITY – Inventory (stock, finished and unfinished goods), Trade Receivables, Prepaid Expenses, Bank and Cash (the more liquid, the lower down the list).

Current Liabilities

Amounts PAYABLE WITHIN ONE YEAR – Examples: Trade Payables, Accrued Expenses

Long-Term Liabilities

Amounts PAYABLE AFTER MORE THAN ONE YEAR – Examples: Debentures, Loans Capital

This is a special type of LIABILITY, representing what is owed by THE BUSINESS to ITS OWNERS i.e. the proprietors claim against the business. In non-commercial entities, this is often referred to as an accumulated fund.

THE EFFECT OF TRANSACTIONS ON A STATEMENT OF FINANCIAL POSITION

Any transaction completed by the owner/employees of the business will affect the business Statement of Financial Position. The reason for this is because at all times, the golden rule is being applied i.e. every DEBIT has a CREDIT or more precisely, the value of the DEBITS is equal to the value of the CREDITS. For example, if the owner buys an asset with cash, the cash balance decreases (Credit) while the non-current assets increase (Debit).

The Statement of Financial Position may be presented in one of two ways:

CAPITAL EXPENDITURE AND REVENUE EXPENDITURE

| CAPITAL EXPENDITURE is expenditure, which results in the ACQUISITION OF NON-

CURRENT ASSETS or an IMPROVEMENT in their EARNINGS CAPACITY ⇒ NOT CHARGED AS AN EXPENSE in the PROFIT AND LOSS ACCOUNT ⇒ APPEARS UNDER “NON-CURRENT ASSETS” in the STATEMENT OF FINANCIAL POSITION REVENUE EXPENDITURE is expenditure for the purpose of either: ⇒ TRADE OR BUSINESS e.g. administration, distribution ⇒ MAINTAINING the EXISTING EARNINGS CAPACITY OF NON-CURRENT ASSETS e.g. repairs

|

⇒ CHARGED to the STATEMENT OF COMPREHENSIVE INCOME IN THE PERIOD TO WHICH IT RELATES