WEDNESDAY: 3 August 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Do NOT write anything on this paper.

QUESTION ONE

1. Discuss three features of derivatives. (6 marks)

2. Cite four reasons why exotic derivative products have become popular in the recent past. (4 marks)

3. Describe two reasons for hedging an equity portfolio. (4 marks)

4. Good Life Investment Consultants are managing bond investments portfolio for their clients worth Sh.100 million with a duration of 1.5 years. They are considering increasing the duration of their bond portfolio to 3.5 years through the use of a swap. They estimate that the duration of a fixed-rate bond is 75% of its maturity.

Required:

Advise Good Life Investments Consultants on whether to enter into a swap paying fixed and receiving floating or paying floating and receiving fixed. Justify your answer. (2 marks)

Using suitable computations, advise whether Good Life Investments Consultants on whether it should choose a four year swap with quarterly payments or a three-year swap with semi-annual payments.(2 marks)

Determine the most appropriate notional principal of the swap to be employed. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the following terms as used in futures exchanges:

Floor trader. (1 mark)

Scalper. (1 mark)

Day trader. (1 mark)

Position trader. (1 mark)

2. Daniel Kioko is analysing a recently purchased call option on Nebo Ltd.’s share with an exercise price of Sh.35 and a premium of Sh.3.20.

Required:

The payoffs and profits for the call option at expiration assuming the prices of Nebo Ltd.’s share are estimated at Sh.30, Sh.35 and Sh.40 respectively. (2 marks)

The break-even price assuming that there are no transaction costs. (2 marks)

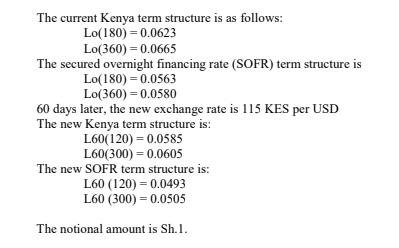

3. An investor is considering a one year currency swap with semiannual payments. The two currencies are the Kenya Shilling (KES) and the United States Dollar (USD). The current exchange rate is 110 KES per USD.

Required:

The annualised fixed rates for shilling and dollar. (4 marks)

The market value (in shillings) of pay shilling fixed and receive dollar fixed swap. (2 marks)

The market value (in shillings) of pay floating and receive dollar fixed swap. (2 marks)

The market value (in shillings) of pay floating and receive dollar floating swap. (2 marks)

The market value (in shillings) of pay fixed and receive dollar floating swap. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. With reference to risk management using forward contracts and futures contracts, examine three instances where a short hedge and a long hedge are appropriate. (3 marks)

2. Pepino Limited is a company incorporated in Kenya and has a South African subsidiary that generates 10 million South African Rands (ZAR) a year. Pepino Limited would like to lock in the rate at which it converts ZAR to Kenya Shillings using a currency swap. The fixed rate on a currency swap in South Africa Rands is 4% and the fixed rate on a currency swap in Kenya Shillings is 5%.

The current exchange rate is 1 KES = 0.825 ZAR.

Required:

The notional principal in South Africa Rands and Kenya Shilling for a swap with annual payments that will achieve Pepino Limited’s objective. (2 marks)

The overall periodic cash flow from the subsidiary operations and the swap. (3 marks)

3. An asset manager enters into an equity swap in which he receives the return of MSE share index in return for paying the return on BJIA index. At the start of the swap, the MSE share index is at 4781.9 and the BJIA is at 9867.33.

Required:

The market value of the swap three months later when the MSE share index is at 5242.9 and BJIA is at 10016.

Assume that notional principal of the swap is Sh.15 million. (3 marks)

4. Raki Limited is a Kenyan Company that occasionally undertakes short-term loans denominated in US dollars. Raki Limited uses forward rate agreement (FRA) to lock in the rate of such loans as soon as it determines that it will need the money. The underlying being the 180-day London interbank offered rate (LIBOR) at a FRA rate of 5.25%.

On 15 April 2022, Raki Limited determines that it will borrow Sh.40 million on 20 August 2022. The loan is to be repaid 180 days later (16 February 2023) and the rate will be at LIBOR plus 200 basis points. Raki Limited decides to go long on FRA thereby enabling it to receive the difference between LIBOR on 20 August 2022 and the FRA rate quoted by the dealer on 15 April 2022 of 5.25%.

Raki Limited locks in a 7.25% rate that is 5.25% plus 200 basis points. At contract expiration, that is, 20 August 2022, 180 day LIBOR is at 6%.

Required:

Describe how the FRA will be executed. (1 mark)

Compute the FRA payoff. (2 marks)

5. In 60 days, a bank plans to lend Sh.10 million for 180 days. The lending rate is secured overnight financing rate (SOFR) plus 200 basis points. The current SOFR is 4.5%. The bank buys an interest rate put that matures in 60 days with a notional principal of Sh.10 million and a strike rate of 4.3%. The put premium is Sh.4,000.

At expiration, SOFR is at 4.1%.

Required:

Calculate the effective annual rate of the loan. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Kennedy Mwangi owns a dividend paying stock currently worth Sh.150. He plans to sell the stock in 250 days. In order to hedge against a possible price decline, he takes a short positon in a forward contract that expired in 250 days.

The risk free rate is 5.25%. Over the next 250 days, the stock will pay dividends according to the following schedule:

Additional information:

1. 100 days after the forward contract is entered, the stock price declines to Sh.115.

2. At expiration, the stock price is at Sh.130.

There are 365 days in a year.

Required:

The forward price of a contract established today and expiring in 250 days. (3 marks)

The value of a forward contract after 100 days of entering the forward contract. (3 marks)

The value of the forward contract at its expiration. (2 marks)

2. A futures contract on a Treasury bill expires in 50 days. The treasury bill matures in 140 days. The discount rates on treasury bills are as follows:

50 day Treasury bill 5.0%

140 day Treasury bill 4.6%

Required:

Determine the appropriate futures price by using the prices of the 50 and 140 day Treasury bill. (3 marks)

Find the futures price in terms of the underlying spot price compounded at the appropriate risk free rate. (3 marks)

Convert the futures price to the implied discount rate on the futures. (2 marks)

3. An investor holds a futures contract whose underlying is the MSE share index. Assume the following:

• The maturity of the futures contract is close to the maturity hedge.

• Ignore the daily settlement of futures contract.

Additional information:

1. The value of the MSE share index is 2000 and the portfolio value is Sh.5,000,000.

2. The risk free rate is 10% per annum and dividend yield is 4% per annum.

3. The Beta of the portfolio is 1.5.

4. A futures contract on the MSE share index with four months to maturity is used to hedge the portfolio value over the next three months where one futures contract is for delivery of 250 times the index.

Required:

The current futures price. (2 marks)

The number of futures contracts needed to be shorted to hedge the portfolio. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. With reference to credit derivatives:

Explain three applications of index credit default swap (CDS) deals. (3 marks)

Highlight four terms and conditions that a protection buyer and seller need to agree in a Credit Default Swap (CDS). (4 marks)

2. Discuss the following concepts of option moneyness:

In-the-money options. (2 marks)

At-the-money options. (2 marks)

Out-of-the-money options. (2 marks)

3. Wembe Ltd.’s shares are currently trading at Sh.6.10 per share. The dividend paid was Sh.0.50 per share. Assume that dividends are only paid annually. A European option exists on shares with an exercise price of Sh.5 with one year to maturity. The risk-free rate is 8% and the variance of the rate of return on the share is 12%.

Required:

The value of the call option using the Black-Scholes option pricing model. (7 marks)

(Total: 20 marks)