6.0 Introduction

One of the key components of capital budgeting decision is the cost of capital. Capital is the term for fund that firm uses. Capital can be raised from creditors and owners. To properly evaluate potential investment firms must know how much their capital cost. The cost of capital is the compensation investor’s demand from the firm that uses their fund. It refers to the minimum rate of return required by the firm’s investors. It is the weighted average of the minimum rate of return required by investors in common equity capital, preference share capital and long term debt. It is a combined cost.

6.1 The component cost of capital

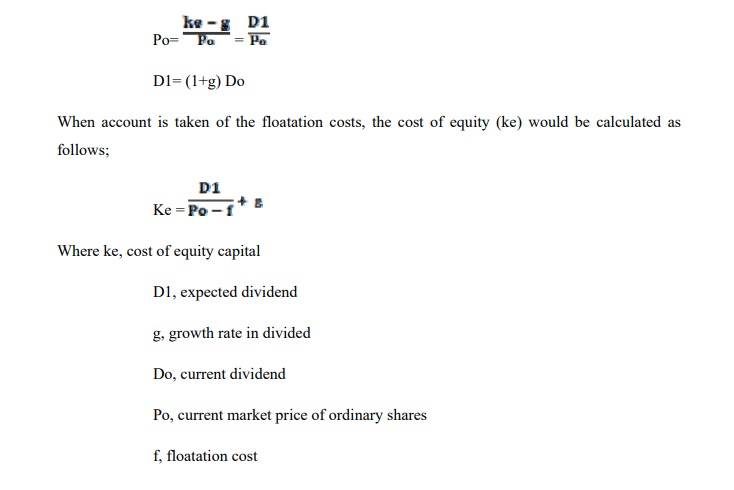

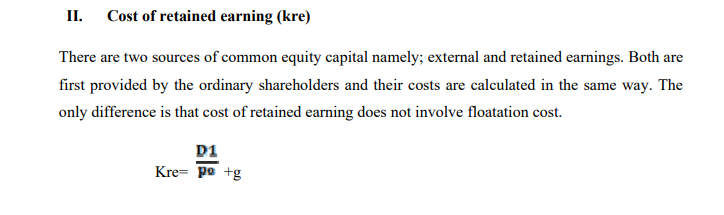

1.The cost of equity capital

This is the minimum rate of return required by investors in common equity capital. It is the minimum rate of return required on all projects financed by common equity capital so as to maintain the market value of the shares at the current level. It is the discount rate that equates the present value of the expected divided to the current price of the shares.

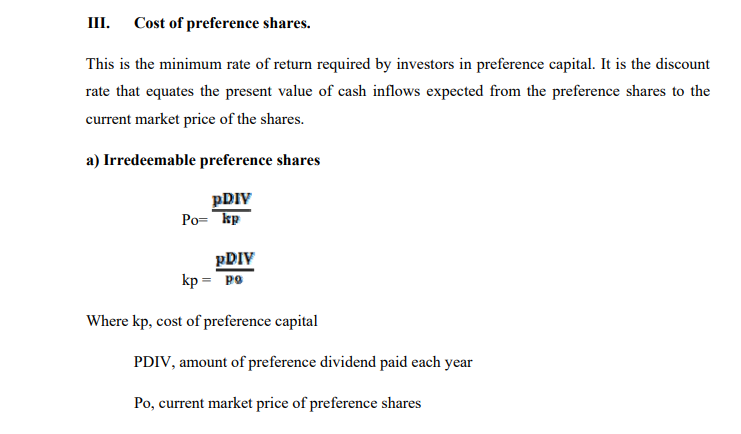

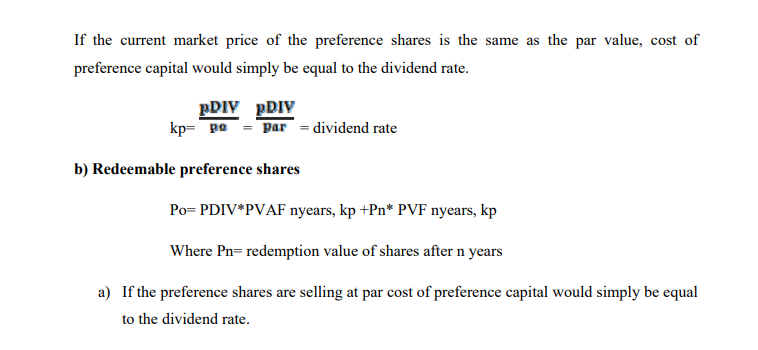

If the preference shares are selling at a discount or premium, the shot cut method used in calculating the before tax cost of debt issued at a discount of premium can be applied to calculate the cost of preference capital.

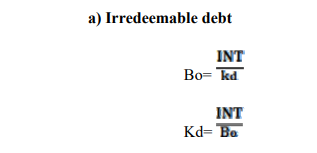

4. Cost of debt

This is the minimum rate of return required by the providers of debt finance. It is the discount rate that equates the present value of cash inflows expected from the debt instrument to the current market price of the debt security.

If the bonds are selling at par, the before tax cost of debt (kd) would simply be equal to the coupon rate.

Redeemable Bond/ Debt

BO=INT*PVAFnyrs, kd+ Bn*PVFnyrs, kd

Where BO, present value of the bonds

INT, amount of interest paid each year

N, number of years to maturity of the bonds

Bn, redemption value of the bond after n years

kd, cost of debt

- If the bonds are selling at par, the before tax cost would simply be equal to the coupon rate.

- If the bonds are selling at a discount or premium, the before tax cost (kd) would be determined through trial and error method.

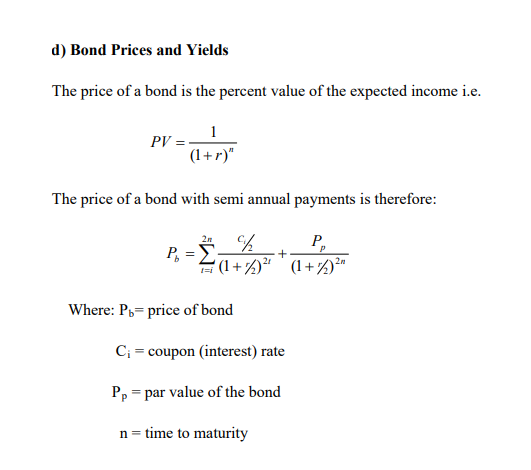

Bond Valuation and Yield on a Bond

What is a bond?

A bond is an “I owe you” (IOU). It is a promise by a borrower to a lender to pay a stated rate of interest for a defined period and then repay the principle at the specific maturity date. Bonds are referred to as senior debts because they take procedure over junior debts due to their legal obligations. Junior debts include general creditors.

General Features of Bonds

Bond interest: – usually paid semi-annually but for some it may be annual. It is also referred to as coupon rate

Coupon rate: – interest paid on the face value of the bond. Zero coupon bonds don’t pay serialized interest.

Yield: – the rate of return on the bond which largely depends on risk.

Market value: – the prevailing price of a bond which could be equal higher or lower than the face value. If selling lower it is said to be selling at discount and if higher it is said to be selling at a premium.

An indenture: – the agreement between the bond holder and the issuer.

Call provision: – a provision on the indenture for the issuer to redeem the bond at a specified amount before the maturity date.

Yield on a Bond

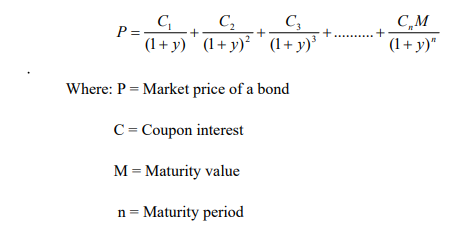

The yield on a bond should reflect the coupon interest that will be earned plus any plus any capital gain or loss realized from holding the bond to maturity. The yield to maturity (YTM) is therefore the formally accepted measure of return/yield on a bond. It is the interest rate that equates the present value of cash flow from a bond to the bonds market price. Alternatively it’s the bond’s interest rate of return (bond’s IRR). It is found by solving for ‘y’ m the following mathematical expression

The IRR (YTM) of a bond is calculated using a trial and error process whose steps are as follows:

- Select an arbitrary interest rate and use it to calculate the present value of the cash flow from the bond.

- If the present value of the cash flow equals the price of the bond, the arbitrary interest selected in step 1 is the bond’s YTM.

- If the present value is higher than the price of the value select a higher interest rate and if the present value is less than the price, select a lower interest rate. Continue this process until the present value equals the bonds price.

- Use linear interpolation to get an exact rate of interest.

6.2 Weighted Average Cost of Capital (WACC)

This is the weighted average of the cost of equity capital, cost of preference capital and cost of debt. It is the cost of funds already raised by the firm to finance its existing projects. It is therefore a historical cost.

Procedure for calculation of the WACC

Compute the components cost or the costs of the specific sources of funds

- Determine the proportion or weight of each capital component in the capital structure. This is done by dividing the amounts of funds raised from each source by the total of the long term funds.

- Multiply the weight of each capital component by its cost. This gives a weighted component cost.

- All the weighted component costs are added together. Their total is the firms weighted average cost of capital.

6.3 Marginal Cost of Capital (MCC)

This is the cost of raising additional or incremental new funds to finance new projects. It is therefore a future cost. It is the weighted average of the additional capital. Marginal weights are used to calculate the marginal cost of capital. Marginal weights are the proportions of the capital components in the optimal capital structure. The optimal capital structure is that long term capital mix that the firm intends to maintain in the long run. It is the long term capital mix that minimizes the firm’s cost of capital and maximizes the value of the firm.