INTRODUCTION

Once the basic concept of consolidating accounts has been understood, the more complicated adjustments can be introduced.

The adjustments involve a number of different scenarios, but a theme common to most of them is that they involve amounts that have been paid or remain payable between companies in the group.

DETERMINING THE FAIR VALUE OF NET ASSETS

When the parent company acquires the subsidiary company, the identifiable assets and liabilities acquired must be accounted for at their fair values on preparation of the subsequent consolidated financial statements (IFRS 3). This is to ensure that an accurate figure is calculated for goodwill (as well as to ensure the purchase price paid is accurate).

IFRS 3 defines the fair value of an asset (and a liability) as being the amount for which an asset could be exchanged, or a liability settled, between knowledgeable willing parties in an arm’s length transaction.

The standard goes on to outline how the fair values of various assets and liabilities can be determined and is summarised in the following table:

| Category of Asset / Liability | Fair Value |

| Land and Buildings | Market Value |

| Plant & Equipment | Market value.

If no evidence of market value exists, then: Depreciated Replacement Cost |

| Intangibles | Estimated value |

| Securities traded on active market | Current Market Value |

| Non-marketable securities | Estimated Value |

| Receivables | Present Value of amounts to be received. (do not discount if short term) |

| Payables | Present Value of amounts to be paid (do not discount if short term) |

| Raw Materials | Current Replacement Cost |

| Work-In-Progress | Selling Price of finished goods minus the total of: • Costs to complete • Disposal costs • Reasonable profit allowance |

| Finished Goods | Selling Price minus the total of:

• Disposal costs • Reasonable profit allowance |

| Contingent liabilities | Should be included in net assets acquired, if their fair value can be measured reliably, even if they would not normally be recognised |

In general, only assets and liabilities that existed at the date of acquisition can be included in the calculation of goodwill.

Acquired intangible assets must always be recognised and measured. Unlike the previous IFRS 3, there is no exception where reliable measurement cannot be obtained.

If further evidence regarding the fair values of acquired assets and liabilities only becomes available after acquisition (i.e. some asset or liability values were only estimated at acquisition), the consolidated financial statements should be adjusted to reflect this additional evidence. But, this adjustment can only be made if the new evidence becomes available within twelve months after the acquisition.

If this is the case, the assets or liabilities should be adjusted to the new values, as if these new values had been used from the date of acquisition.

If an asset is to be revalued upwards at the date of acquisition, from its carrying amount to its fair value, then the following adjustment is made when preparing the consolidated accounts:

Debit Asset Account

Credit Revaluation Reserve (Fair Value adjustment) of Subsidiary at date of acquisition and at the SFP date With the amount of the increase. (If it is a decrease, reverse the above journal entry)

INTER-COMPANY INVENTORY PROFIT

Companies in a group often trade with each other. If one company in the group sells goods to another company in the group, at a profit, then a problem arises if the buyer has some or all of those goods in stock at the Statement of Financial Position date.

The goods, shown in inventory, will contain an element of profit which from a group perspective, has not been realised. Bearing in mind that the group accounts seek to present the members of the group as if they were one single entity, this profit must be eliminated.

Thus the action necessary is:

- Calculate the profit on inter-company inventory

- Eliminate the profit. This can be done by:

Dr Reserves of seller

Cr Inventory

With the profit on inventory

INTER-COMPANY PROFIT ON SALE OF A NON-CURRENT ASSET

This is similar to the previous situation. One company in the group sells a non-current asset to another company in the group, at a profit. For the same reasons as above, this profit must be eliminated (and thus the asset shown at its original cost to the group).

- Calculate the profit.

- Eliminate the profit. This can be done by:

Dr Reserves of seller

Cr Asset Account

With the profit

INTER-COMPANY DEBTS

As the entities in the group are being presented as if they are just one single economic entity, amounts owing between group companies must be eliminated for consolidation purposes.

The holding company and subsidiary are likely to trade with each other, which could lead to inter-company debtors and creditors arising at the year end. Inter-company indebtedness should be cancelled out when preparing the consolidated Statement of Financial Position

PREFERENCE SHARES IN A SUBSIDIARY COMPANY

When establishing whether a parent-subsidiary situation exists, preference shares are generally ignored as they usually do not carry voting rights. Therefore, the holders of these shares do not participate in deciding the financial and operating policies of the company. (There are rare exceptions to this rule).

However, the holders of preference shares are entitled to participate in the profits of a company upon its winding up.

The parent, as well as purchasing ordinary (equity) shares, may also purchase preference shares, though the relevant percentage holdings may be different. For example, P might own 75% of the equity shares of S, but only 30% of the preference shares.

In calculating the goodwill figure, the cost of preference shares is compared to their nominal value. This will be done in the cost of control account.

The nominal value of the preference shares held by outside interests will be reflected in the Non-Controlling Interest account.

LOAN NOTES IN A SUBSIDIARY COMPANY

Loan notes/debentures/loan stock etc. do not affect the parent-subsidiary relationship either.

If the parent buys these loan notes, like preference shares, the difference between their cost and nominal value will be included in the cost of control account in arriving at the overall goodwill figure.

The balance of the loan notes not held by the parent, though held by outside interests, is not included in the NonControlling Interest figure. Rather, it is shown separately as non-current liabilities in the consolidated Statement of Financial Position.

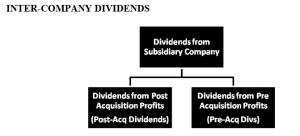

The treatment of inter-group dividends can be confusing. This is mainly because there are a number of different possible situations.

IAS 10 Events After the Reporting Date allows dividends to be included as a liability in the balance only if those dividends had been declared before the year-end. Declared means that the dividends have been appropriately authorised and are no longer at the discretion of the entity.

So, in treating dividends payable in the question, make sure that they can be recognised in the first place.

There are two classes of dividends to be aware of when preparing consolidated accounts:

- Dividends out of post-acquisition profits.

These are dividends paid or payable out of profits that have been earned since the date of acquisition.

- Dividends out of pre-acquisition profits.

These are dividends paid or payable out of profits earned before the acquisition date.

It is an important distinction to make, as the accounting treatment of each is very different.

Dividends Out of Post Acquisition Profits

There are a number of possible situations in regard to such dividends:

- Dividends paid by the Subsidiary to the Parent

If the dividend has already been paid to the parent, then no further adjustment is required when preparing the consolidated Statement of Financial Position.

- Dividends proposed by the Subsidiary and the Parent has taken account of this in its books Here, because the parent has taken credit for its share, it is rather similar to the treatment of intercompany debts. One company in the group owes money to another company in the group, in this case a dividend.

Inter-company amounts must be cancelled for group purposes. To do this:

Dr Dividends Payable

Cr Dividends Receivable

With the inter-group amount

Dividends proposed by the subsidiary and the parent has not taken account of this in its books

In this case, the parent has not reflected the dividend due to it in its own books. The easiest treatment is to bring the dividend receivable into the books of the Parent Company and then cancel the inter company amount.

The procedure would be as follows:

Dr Dividends Receivable

Cr Reserves of Parent

With the amount of the inter-group dividend Then:

Dr Dividends Payable

Cr Dividends Receivable

With the amount of the inter-group dividend

- Establish Group Structure

Which company is the acquirer and to what extent do they control the acquiree? When was the subsidiary acquired?

Group structure is established by reference to the number of ordinary shares held by the parent company (usually in questions, anyway. See alternative ways of establishing control at the beginning of this area).

- Determine the adjustments to be made and the journal entries to effect these adjustments.

- Calculate Goodwill arising on acquisition

Watch for the method of measuring NCI and the impact that this may have on the goodwill figure too

The goodwill calculation, at its most basic, measures what was paid for the investment and what was acquired in return.

What was paid is found in P’s Statement of Financial Position in its investment in subsidiary (subject to any adjustments e.g. pre-acquisition dividends, deferred consideration, contingent consideration). What was received is its share of the capital and reserves (i.e.net assets) that existed at the date of acquisition.

The difference between these amounts will be either positive or negative goodwill.

Examine the question to see if goodwill has become impaired. If it has, reduce goodwill and set it against consolidated reserves.

Calculate Non-Controlling Interest

Give the Non-Controlling Interest their share of all capital and all reserves that exist at the Statement of Financial Position date.

This figure will appear in the consolidated Statement of Financial Position