Acquisition of a subsidiary

There are two acquisition scenarios that need to be considered in more detail:

- mid-year acquisitions

- step acquisitions.

Mid-year acquisitions

A parent entity consolidates a subsidiary from the date that it achieves control. If this happens partway through the reporting period then it will be necessary to pro-rate the results of the subsidiary so that only the post-acquisition incomes and expenses are consolidated into the group statement of profit or loss.

Illustration 1 – Tudor – mid-year acquisition of a subsidiary

On 1 July 20X4 Tudor purchased 1,600,000 of the 2,000,000 $1 equity shares of Windsor for $10,280,000. On the same date it also acquired 1,000,000 of Windsor’s $1 10% loan notes. At the date of acquisition the retained earnings of Windsor were $6,150,000.

The statements of profit or loss for each entity for the year ended 31 March 20X5 were as follows.

| Tudor | Windsor | ||

| $000 | $000 | ||

| Revenue | 60,000 | 24,000 | |

| Cost of sales | (42,000) | (20,000) | |

| ––––––– | ––––––– | ||

| Gross profit | 18,000 | 4,000 | |

| Distribution costs | (2,500) | (50) | |

| Administrative expenses | (3,500) | (150) | |

| ––––––– | ––––––– | ||

| Profit from operations | 12,000 | 3,800 | |

| Investment income | 75 | – | |

| Finance costs | – | (200) | |

| ––––––– | ––––––– | ||

| Profit before tax | 12,075 | 3,600 | |

| Tax | (3,000) | (600) | |

| ––––––– | ––––––– | ||

| Profit for the year | 9,075 | 3,000 | |

| Retained earnings bfd | ––––––– | ––––––– | |

| 16,525 | 5,400 |

There were no items of other comprehensive income in the year.

The following information is relevant:

- The fair values of Windsor’s net assets at the date of acquisition were equal to their carrying values with the exception of plant and equipment, which had a carrying value of $2,000,000 but a fair value of $5,200,000. The remaining useful life of this plant and equipment was four years at the date of acquisition. Depreciation is charged to cost of sales and is time apportioned on a monthly basis.

- During the post-acquisition period Tudor sold goods to Windsor for $12 million. The goods had originally cost $9 million. During the remaining months of the year Windsor sold $10 million (at cost to Windsor) of these goods to third parties for $13 million.

- Incomes and expenses accrued evenly throughout the year.

- Tudor has a policy of valuing non-controlling interests using the full goodwill method. The fair value of non-controlling interest at the date of acquisition was $2,520,000.

- The recoverable amount of the net assets of Windsor at the reporting date was $14,150,000. Any goodwill impairment should be charged to administrative expenses.

Required:

Prepare a consolidated statement of profit or loss for Tudor group for the year ended 31 March 20X5.

Solution

Tudor group statement of profit or loss for the year ended 31 March 20X5

| $000 | ||

| Revenue ($60,000 + (9/12 × $24,000) – $12,000) | 66,000 | |

| Cost of sales | (46,100) | |

| ($42,000 + (9/12 × $20,000) – $12,000 + $600 (W6) + $500 | ||

| (W5)) | –––––– | |

| Gross profit | 19.900 | |

| Distribution costs ($2,500 + (9/12 × $50)) | (2,538) | |

| Administrative expenses | (3,912) | |

| ($3,500 + (9/12 × $150) + $300 (W3)) | –––––– | |

| Profit from operations | 13,450 | |

| Investment income ($75 – $75) | – | |

| Finance costs ((9/12 × $200) – $75) | (75) | |

| –––––– | ||

| Profit before tax | 13,375 | |

| Tax ($3,000 + (9/12 × $600)) | (3,450) | |

| –––––– | ||

| Profit after tax for the year | 9,925 | |

| Profit attributable to: | –––––– | |

| Owners of the parent (bal. fig) | 9,655 | |

| Non-controlling interest (W7) | 270 | |

| –––––– |

9,925

––––––

There were no items of other comprehensive income in the year.

(W1) Group structure – Tudor owns 80% of Windsor

– the acquisition took place three months into the year

– nine months is post-acquisition

| (W2) Goodwill impairment | |

| $000 | |

| Net assets of the subsidiary (W3) | 13,000 |

| Goodwill (W4) | 1,450 |

| –––––– | |

| 14,450 | |

| Recoverable amount | (14,150) |

| –––––– | |

| Impairment | 300 |

| –––––– |

The impairment will be allocated against goodwill and charged to the statement of profit or loss.

Goodwill has been calculated using the fair value method so the impairment needs to be factored in when calculating the profit attributable to the NCI (W7).

| (W3) Net assets | Acq’n | Rep. | |

| date | date | ||

| $000 | $000 | ||

| Equity capital | 2,000 | 2,000 | |

| Retained earnings | 6,150 | 8,400 | |

| (Rep date = $5,400 bfd + $3,000) | 3,200 | ||

| Fair value adjustment – PPE ($5.2m – | 3,200 | ||

| $2.0m) | |||

| Depreciation on FVA (W6) | – | (600) | |

| –––––– | –––––– | ||

| 11,350 | 13,000 | ||

| –––––– | –––––– |

| (W4) Goodwill | |

| $000 | |

| Consideration | 10,280 |

| FV of NCI at acquisition | 2,520 |

| ––––––– | |

| 12,800 | |

| FV of net assets at acquisition (W3) | (11,350) |

| ––––––– | |

| Goodwill pre-impairment review (W2) | 1,450 |

| ––––––– |

(W5) PURP

$2 million ($12m – $10m) of the $12 million intra-group sale remains in inventory.

The profit that remains in inventory is $500,000 (($12m – $9m) × 2/12).

(W6) Excess depreciation

Per W3, there has been a fair value uplift in respect of PPE of $3,200,000.

This uplift will be depreciated over the four year remaining life.

The depreciation charge in respect of this uplift in the current year statement of profit or loss is $600,000 (($3,200,000/4 years) × 9/12).

| (W7) Profit attributable to the NCI | |||

| $000 | $000 | ||

| Profit of Windsor (9/12 × $3,000) | 2,250 | ||

| Excess depreciation (W6) | (600) | ||

| Goodwill impairment (W2) | (300) | ||

| ––––– | |||

| × 20% | 1,350 | ––––– | |

| Profit attributable to the NCI | 270 | ||

| ––––– | |||

Step acquisitions

A step acquisition occurs when the parent company acquires control over the subsidiary in stages. This is achieved by buying blocks of shares at different times. Acquisition accounting is only applied at the date when control is achieved.

- Any pre-existing equity interest in an entity is accounted for according to:

– IFRS 9 in the case of simple investments

– IAS 28 in the case of associates and joint ventures

– IFRS 11 in the case of joint arrangements other than joint ventures

- At the date when the equity interest is increased and control is achieved:

(1) re-measure the previously held equity interest to fair value

(2) recognise any resulting gain or loss in profit or loss for the year

(3) calculate goodwill and the non-controlling interest on either a partial or full basis.

For the purposes of the goodwill calculation, the consideration will be the fair value of the previously held equity interest plus the fair value of the consideration transferred for the most recent purchase of shares at the acquisition date. You may wish to use the following proforma:

| $ | |

| Fair value of previously held interest | X |

| Fair value of consideration for additional interest | X |

| NCI at acquisition | X |

| ––– | |

| X | |

| Less: FV of net assets at acquisition | (X) |

| ––– | |

| Goodwill at acquisition | X |

| ––– |

- If there has been re-measurement of any previously held equity interest that was recognised in other comprehensive income, any changes in value recognised in earlier years are now reclassified to retained earnings.

- Purchasing further shares in a subsidiary after control has been acquired (for example taking the group interest from 60% to 75%) is regarded as a transaction between equity holders. Goodwill is not recalculated. This situation is dealt with separately within this chapter.

Illustration 2 – Ayre, Fleur and Byrne

Ayre has owned 90% of the ordinary shares of Fleur for many years. Ayre also has a 10% investment in the shares of Byrne, which was held in the consolidated statement of financial position as at 31 December 20X6 at $24,000 in accordance with IFRS 9. On 30 June 20X7, Ayre acquired a further 50% of Byrne’s equity shares at a cost of $160,000.

The draft statements of profit or loss for the three companies for the year ended 31 December 20X7 are presented below:

Statements of profit or loss for the year ended 31 December 20X7

| Ayre | Fleur | Byrne | |

| $000 | $000 | $000 | |

| Revenue | 500 | 300 | 200 |

| Cost of sales | (300) | (70) | (120) |

| ––––– | ––––– | ––––– | |

| Gross profit | 200 | 230 | 80 |

| Operating costs | (60) | (80) | (60) |

| ––––– | ––––– | ––––– | |

| Profit from operations | 140 | 150 | 20 |

| Income tax | (28) | (30) | (4) |

| ––––– | ––––– | ––––– | |

| Profit for the period | 112 | 120 | 16 |

| ––––– | ––––– | ––––– |

The non-controlling interest is calculated using the fair value method. On 30 June 20X7, fair values were as follows:

- Byrne’s identifiable net assets – $200,000

- The non-controlling interest in Byrne – $100,000

- The original 10% investment in Byrne – $26,000

Required:

Prepare the consolidated statement of profit or loss for the Ayre Group for the year ended 31 December 20X7 and calculate the goodwill arising on the acquisition of Byrne.

Solution

Group statement of profit or loss for the year ended 31 December 20X7

| $000 | |

| Revenue ($500 + $300 + (6/12 × $200)) | 900 |

| Cost of sales ($300 + $70 + (6/12 × $120)) | (430) |

| ––––– | |

| Gross profit | 470 |

| Operating costs ($60 + $80 + (6/12 × $60)) | (170) |

| ––––– | |

| Profit from operations | 300 |

| Profit on derecognition of equity investment (W1) | 2 |

| ––––– | |

| 302 | |

| Income tax ($28 + $30 + (6/12 × $4)) | (60) |

| ––––– | |

| Profit for the period | 242 |

| ––––– | |

| Profit attributable to: | |

| Equity holders of the parent (bal. fig) | 226.8 |

| Non-controlling interest (W2) | 15.2 |

| ––––– | |

| Profit for the period | 242 |

| ––––– | |

| Goodwill calculation | |

| $000 | |

| FV of previously held interest | 26 |

| FV of consideration for additional interest | 160 |

| NCI at acquisition date | 100 |

| ––––– | |

| 286 | |

| FV of net assets at acquisition | (200) |

| ––––– | |

| Goodwill | 86 |

| ––––– |

(W1) Group Structure

This is a step acquisition. The previous investment in shares must be revalued to fair value with the gain on revaluation recorded in the statement of profit or loss.

| Dr Investment ($26,000 – $24,000) | 2,000 |

| Cr Profit or loss | 2,000 |

The investment, now held at $26,000, is included in the calculation of goodwill.

Ayre had control over Byrne for 6/12 of the current year. Therefore 6/12 of the incomes and expenses of Byrne are consolidated in full.

| (W2) Profit attributable to the NCI | |||

| $000 | $000 | ||

| Profit of Fleur in consolidated profit or loss | 120 | ||

| × 10% | –––– | 12 | |

| Profit of Byrne in consolidated profit or loss | 8 | ||

| (6/12 × $16) | –––– | ||

| × 40% | 3.2 | ||

| –––– | |||

| Profit attributable to NCI | 15.2 | ||

| –––– | |||

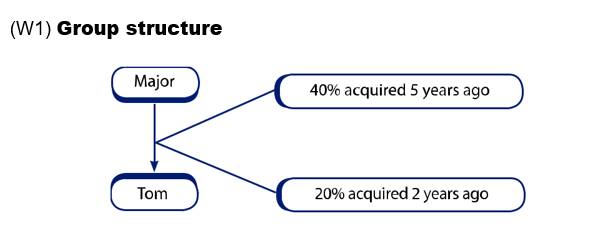

Test your understanding 1 – Major and Tom

The statements of financial position of two entities, Major and Tom, as at 31 December 20X6 are as follows:

| Major | Tom | |

| $000 | $000 | |

| Investment | 160 | |

| Sundry assets | 350 | 250 |

| ––––– | ––––– | |

| 510 | 250 | |

| ––––– | ––––– | |

| Equity share capital | 200 | 100 |

| Retained earnings | 250 | 122 |

| Liabilities | 60 | 28 |

| ––––– | ––––– | |

| 510 | 250 | |

| ––––– | ––––– |

Major acquired 40% of Tom on 31 December 20X1 for $90,000. At this time, the retained earnings of Tom stood at $76,000. A further 20% of shares in Tom was acquired by Major three years later for $70,000. On this date, the fair value of the existing holding in Tom was $105,000. Tom’s retained earnings were $100,000 on the second acquisition date. The NCI should be valued using the proportion of net assets method.

Required:

Prepare the consolidated statement of financial position for the Major group as at 31 December 20X6.

2 Disposal scenarios

During the year, one entity may sell some or all of its shares in another entity causing a loss of control.

Possible situations include:

- the disposal of all the shares held in the subsidiary

- the disposal of part of the shareholding, leaving a residual holding after the sale, which is regarded as an associate

- the disposal of part of the shareholding, leaving a residual holding after the sale, which is regarded as a trade investment.

The accounting treatment of all of these situations is very similar.

Disposals in the individual financial statements

In all of the above scenarios, the profit on disposal in the investing entity’s individual financial statements is calculated as follows:

| $ | |

| Sales proceeds | X |

| Carrying amount (usually cost) of shares sold | (X) |

| ––– | |

| Profit/(loss) on disposal | X/(X) |

| ––– |

The profit or loss may need to be reported as an exceptional item. If so, it must be disclosed separately on the face of the parent’s statement of profit or loss for the year.

There may be tax to pay on this gain, depending on the tax laws in place in the parent’s jurisdiction. This would result in an increase to the parent company’s tax expense in the statement of profit or loss.

Disposals in the consolidated financial statements

If the sale of shares causes control over a subsidiary to be lost, then the treatment in the consolidated financial statements is as follows:

- Consolidate the incomes and expenses of the subsidiary up until the disposal date

- On disposal of the subsidiary, derecognise its assets, liabilities, goodwill and non-controlling interest and calculate a profit or loss on disposal

- Recognise any remaining investment in the shares of the former subsidiary at fair value and subsequently account for this under the relevant accounting standard

– A holding of 20–50% of the shares would probably mean that the remaining investment is an associate, which should be accounted for using the equity method

– A holding of less than 20% of the shares would probably mean that the remaining investment should be accounted for under IFRS 9 Financial Instruments.

Where control of a subsidiary has been lost, the following template should be used for the calculation of the profit or loss on disposal:

| $ | $ | ||

| Disposal proceeds | X | ||

| Fair value of retained interest | X | ||

| ––– | |||

| Less interest in subsidiary disposed of: | X | ||

| Net assets of subsidiary at disposal date | X | ||

| Goodwill at disposal date | X | ||

| Less: Carrying amount of NCI at disposal date | (X) | ||

| ––– | (X) | ||

| ––– | |||

| Profit/(loss) to the group | X/(X) | ||

| ––– |

Illustration 3 – Rock

Rock has held a 70% investment in Dog for two years. Goodwill has been calculated using the full goodwill method. There have been no goodwill impairments to date.

Rock disposes of all of its shares in Dog. The following information has been provided:

| $ | |

| Cost of investment | 2,000 |

| Dog – Fair value of net assets at acquisition | 1,900 |

| Dog – Fair value of the non-controlling interest at acquisition | 800 |

| Sales proceeds | 3,000 |

| Dog – Net assets at disposal | 2,400 |

Required:

Calculate the profit or loss on disposal in:

- Rock’s individual financial statements

- the consolidated financial statements.

Solution

- Rock’s individual financial statements

| $ | |||

| Sales proceeds | 3,000 | ||

| Cost of shares sold | (2,000) | ||

| –––––– | |||

| Profit on disposal | 1,000 | ||

| –––––– | |||

| (b) Consolidated financial statements | |||

| $ | $ | ||

| Sales proceeds | 3,000 | ||

| Interest in subsidiary disposed of: | |||

| Net assets at disposal | 2,400 | ||

| Goodwill at disposal (W1) | 900 | ||

| Carrying amount of NCI at disposal (W2) | (950) | ||

| ––––– | (2,350) | ||

| ––––– | |||

| Profit on disposal | 650 | ||

| ––––– | |||

| (W1) Goodwill | |||

| $ | |||

| Consideration | 2,000 | ||

| FV of NCI at acquisition | 800 | ||

| –––––– | |||

| 2,800 | |||

| FV of net assets at acquisition | (1,900) | ||

| –––––– | |||

| Goodwill | 900 | ||

| –––––– | |||

| (W2) NCI at disposal date | |||

| $ | |||

| NCI at acquisition | 800 | ||

| NCI % of post acquisition net assets | 150 | ||

| (30% × ($2,400 – $1,900)) | ––––– | ||

950

–––––

Illustration 4 – Thomas and Percy

Thomas disposed of a 25% holding in Percy on 30 June 20X6 for $125,000. A 70% holding in Percy had been acquired five years prior to this. Thomas uses the full goodwill method. Goodwill was impaired and written off in full prior to the year of disposal.

| Details of Percy are as follows: | $ | |

| Net assets at disposal date | 340,000 | |

| Fair value of a 45% holding at 30 June 20X6 | 245,000 |

The carrying value of the NCI is $80,000 at the disposal date.

Required:

What is the profit or loss on disposal for inclusion in the consolidated statement of profit or loss for the year ended 31 December 20X6?

Solution

The group’s holding in Percy has reduced from 70% to 45%. Control over Percy has been lost and a profit or loss on disposal must be calculated.

The profit on disposal to be included in the consolidated statement of profit or loss is calculated as follows:

| $ | $ | ||

| Proceeds | 125,000 | ||

| FV of retained interest | 245,000 | ||

| ––––––– | |||

| Net assets recognised at disposal | 340,000 | 370,000 | |

| Goodwill at disposal | – | ||

| Less: NCI at disposal date | (80,000) | ||

| ––––––– | (260,000) | ||

| ––––––– | |||

| Profit on disposal | 110,000 | ||

| ––––––– |

On 30 June 20X6, the remaining investment in Percy will be recognised at its fair value of $245,000. From that date, it will be accounted for using the equity method in the consolidated financial statements.

Test your understanding 2 – Padstow

Padstow purchased 80% of the shares in St Merryn four years ago for $100,000. On 30 June it sold all of these shares for $250,000. The net assets of St Merryn at the acquisition date were $69,000 and at the disposal date were $88,000. Fifty per cent of the goodwill arising on acquisition had been written off in an earlier year. The fair value of the non-controlling interest in St Merryn at the date of acquisition was $15,000. It is group policy to account for goodwill using the full goodwill method.

Tax is charged at 30%.

Required:

- Calculate the profit or loss arising to the parent entity on the disposal of the shares.

- Calculate the profit or loss arising to the group on the disposal of the shares.

Test your understanding 3 – Hague

Hague has held a 60% investment in Maude for several years, using the full goodwill method to value the non-controlling interest. Half of the goodwill has been impaired prior to the date of disposal of shares by Hague. Details are as follows:

| $000 | |

| Cost of investment | 6,000 |

| Maude – Fair value of net assets at acquisition | 2,000 |

| Maude – Fair value of a 40% investment at acquisition date | 1,000 |

| Maude – Net assets at disposal | 3,000 |

| Maude – Fair value of a 25% investment at disposal date | 3,500 |

Required:

- Assuming a full disposal of the holding and proceeds of $10 million, calculate the profit or loss arising:

- in Hague’s individual financial statements

- in the consolidated financial statements.

Tax is 25%.

- Assuming a disposal of a 35% holding and proceeds of $5 million:

- calculate the profit or loss arising in the consolidated financial statements

- explain how the residual shareholding will be accounted for.

Ignore tax.

Presentation of disposed subsidiary in the consolidated financial statements

There are two ways of presenting the results of the disposed subsidiary:

- Time-apportionment line-by-line

In the consolidated statement of profit or loss, the income and expenses of the subsidiary are consolidated up to the date of disposal. The traditional way is to time apportion each line of the disposed subsidiary’s results.

The profit or loss on disposal of the subsidiary would be presented as an exceptional item.

- Discontinued operation

If the subsidiary qualifies as a discontinued operation in accordance with IFRS 5 then its results are aggregated into a single line on the face of the consolidated statement of profit or loss. This is presented immediately after profit for the period from continuing operations.

This single figure comprises:

– the profit or loss of the subsidiary up to the disposal date

– the profit or loss on the disposal of the subsidiary.

Test your understanding 4 – Kathmandu

The statements of profit or loss and extracts from the statements of changes in equity for the year ended 31 December 20X9 are as follows:

Statements of profit or loss for the year ended 31 December 20X9

| Kathmandu | Nepal | |

| group | ||

| $ | $ | |

| Revenue | 553,000 | 450,000 |

| Operating costs | (450,000) | (400,000) |

| ––––––– | ––––––– | |

| Operating profits | 103,000 | 50,000 |

| Investment income | 8,000 | – |

| ––––––– | ––––––– | |

| Profit before tax | 111,000 | 50,000 |

| Tax | (40,000) | (14,000) |

| ––––––– | ––––––– | |

| Profit for the period | 71,000 | 36,000 |

| ––––––– | ––––––– | |

| Extracts from SOCIE for year ended 31 December 20X9 | ||

| Kathmandu | Nepal | |

| group | ||

| $ | $ | |

| Retained earnings b/f | 100,000 | 80,000 |

| Profit for the period | 71,000 | 36,000 |

| Dividend paid | (25,000) | (10,000) |

| –––––– | –––––– | |

| Retained earnings c/f | 146,000 | 106,000 |

| –––––– | –––––– | |

There were no items of other comprehensive income during the year.

Additional information

- The accounts of the Kathmandu group do not include the results of Nepal.

- On 1 January 20X5 Kathmandu acquired 70% of the shares of Nepal for $100,000 when the fair value of Nepal’s net assets was $110,000. Nepal has equity capital of $50,000. At that date, the fair value of the non-controlling interest was $40,000. It is group policy to measure the NCI at fair value at the date of acquisition.

- Nepal paid its 20X9 dividend in cash on 31 March 20X9.

- Goodwill has not been impaired.

Required:

- Prepare the group statement of profit or loss for the year ended 31 December 20X9 for the Kathmandu group on the basis that Kathmandu plc sold its holding in Nepal on 1 July 20X9 for $200,000. This disposal is not yet recognised in any way in Kathmandu group’s statement of profit or loss. Assume that Nepal does not represent a discontinued operation per IFRS 5.

- Explain and illustrate how the presentation of the group statement of profit or loss would differ from part (a) if Nepal represented a discontinued activity per IFRS 5.

- Prepare the group statement of profit or loss for the year ended 31 December 20X9 for the Kathmandu group on the basis that Kathmandu sold half of its holding in Nepal on 1 July 20X9 for $100,000 This disposal is not yet recognised in any way in Kathmandu group’s statement of profit or loss. The residual holding of 35% has a fair value of $100,000 and leaves the Kathmandu group with significant influence over Nepal.

3 Control to control scenarios

In this chapter, we have looked at:

- share purchases that have led to control over another company being obtained

- share sales that have led to control over another company being lost.

However, some share purchases will simply increase an entity’s holding in an already existing subsidiary (e.g. increasing a holding from 80% to 85%). Similarly, some share sales will not cause an entity to lose control over a subsidiary (e.g. decreasing a holding from 80% to 75%).

These ‘control to control’ scenarios will now be considered in more detail.

Increasing a shareholding in a subsidiary (e.g. 80% to 85%)

When a parent company increases its shareholding in a subsidiary, this is not treated as an acquisition in the group financial statements. For example, if the parent holds 80% of the shares in a subsidiary and buys 5% more then the relationship remains one of a parent and subsidiary. However, the NCI holding has decreased from 20% to 15%.

The accounting treatment of the above situation is as follows:

- The NCI within equity decreases

- The difference between the consideration paid for the extra shares and the decrease in the NCI is accounted for within equity (normally, in ‘other components of equity’).

Note that no profit or loss arises on the purchase of the additional shares.

Goodwill is not recalculated.

The following proforma will help to calculate the adjustments required to NCI and other components of equity:

$

Cash paid X Cr

Decrease in NCI (X) Dr

––––

Decrease/(increase) to other components of equity X/(X) Dr/Cr (bal. entry)

––––

The decrease in NCI will represent the proportionate reduction in the carrying amount of the NCI at the date of the group’s additional purchase of shares

- For example, if the NCI shareholding reduces from 30% to 20%, then the carrying amount of the NCI must be reduced by one-third.

Test your understanding 5 – Gordon and Mandy

Gordon has owned 80% of Mandy for many years.

Gordon is considering acquiring more shares in Mandy. The NCI of Mandy currently has a carrying amount of $20,000, with the net assets and goodwill having a carrying amount of $125,000 and $25,000 respectively.

Gordon is considering the following two scenarios:

- Gordon could buy 20% of the Mandy shares leaving no NCI for $25,000, or

- Gordon could buy 5% of the Mandy shares for $4,000 leaving a 15% NCI.

Required:

Calculate the adjustments required to NCI and other components of equity.

Sale of shares without losing control (e.g. 80% to 75%)

From the perspective of the group accounts, a sale of shares which results in the parent retaining control over the subsidiary is simply a transaction between shareholders. If the parent company holds 80% of the shares of a subsidiary but then sells a 5% holding, a relationship of control still exists. As such, the subsidiary will still be consolidated in the group financial statements. However, the NCI has risen from 20% to 25%.

The accounting treatment of the above situation is as follows:

- The NCI within equity is increased

- The difference between the proceeds received and the increase in the non-controlling interest is accounted within equity (normally, in ‘other components of equity’).

Note that no profit or loss arises on the sale of the shares. Goodwill is not recalculated.

The following proforma will help to calculate the adjustments required to NCI and other components of equity:

| $ | ||

| Cash proceeds received | X | Dr |

| Increase in NCI | (X) | Cr |

| ––– | ||

| Increase/(Decrease) to other components of | X/ | Cr/Dr (bal. |

| equity | (X) | entry) |

| ––– |

The increase in the NCI will be the share of the net assets (always) and goodwill (fair value method only) of the subsidiary at the date of disposal which the parent has effectively sold to the NCI.

- For example, if the NCI shareholding increases from 20% to 30%, then the carrying amount of the NCI must be increased by 10% of the subsidiary’s net assets and, if using the fair value method, goodwill.

Illustration 5 – No loss of control – Juno

Until 30 September 20X7, Juno held 90% of Hera. On that date it sold a 10% interest in the equity capital for $15,000. At the date of the share disposal, the carrying amount of net assets and goodwill of Juno were $100,000 and $20,000 respectively. At acquisition, the NCI was valued at fair value.

Required:

How should the sale of shares be accounted for in the Juno Group’s financial statements?

Solution

| $ | ||

| Cash proceeds | 15,000 | Dr |

| Increase in NCI: 10% × ($100,000 + $20,000) | (12,000) | Cr |

| –––––– | ||

| Increase in other components of equity (bal. fig) | 3,000 | Cr |

| –––––– | ||

There is no gain or loss to the group as there has been no loss of control. Note that, depending upon the terms of the share disposal, there could be either an increase or decrease in equity.

Test your understanding 6 – David and Goliath

David has owned 90% of Goliath for many years and is considering selling part of its holding, whilst retaining control of Goliath.

At the date of considering disposal of part of the shareholding in Goliath, the NCI has a carrying amount of $7,200 and the net assets and goodwill have a carrying amount of $70,000 and $20,000 respectively. The NCI was valued at fair value at the acquisition date.

- David could sell 5% of the Goliath shares for $5,000 leaving it holding 85% and increasing the NCI to 15%, or

- David could sell 25% of the Goliath shares for $20,000 leaving it holding 65% and increasing the NCI to 35%.

Required:

How would these share sales be accounted for in the consolidated financial statements of the David group?

Test your understanding 7 – Pepsi

Statements of financial position for three entities at the reporting date are as follows:

| Pepsi | Sprite | Tango | ||

| $000 | $000 | $000 | ||

| Assets | 1,000 | 800 | 500 | |

| Investment in Sprite | 326 | – | – | |

| Investment in Tango | 165 | – | – | |

| ––––– | ––––– | ––––– | ||

| Total assets | 1,491 | 800 | 500 | |

| Equity | ––––– | ––––– | ––––– | |

| Ordinary share capital ($1) | 500 | 200 | 100 | |

| Retained earnings | 391 | 100 | 200 | |

| ––––– | ––––– | ––––– | ||

| 891 | 300 | 300 | ||

| Liabilities | 600 | 500 | 200 | |

| ––––– | ––––– | ––––– | ||

| Total equity and liabilities | 1,491 | 800 | 500 | |

| ––––– | ––––– | ––––– | ||

Pepsi acquired 80% of Sprite when Sprite’s retained earnings were $25,000, paying cash consideration of $300,000. It is group policy to measure NCI at fair value at the date of acquisition. The fair value of the NCI holding in Sprite at acquisition was $65,000.

At the reporting date, Pepsi purchased an additional 8% of Sprite’s equity shares for cash consideration of $26,000. This amount has been debited to Pepsi’s investment in Sprite.

Pepsi acquired 75% of Tango when Tango’s retained earnings were $60,000, paying cash consideration of $200,000. The fair value of the NCI holding in Tango at the date of acquisition was $50,000.

At the reporting date, Pepsi sold 10% of the equity shares of Tango for $35,000. The cash proceeds have been credited to Pepsi’s investment in Tango.

Required:

Prepare the consolidated statement of financial position of the Pepsi group.

4 Subsidiaries acquired exclusively with a view to resale

Subsidiaries acquired exclusively with a view to subsequent

A subsidiary acquired exclusively with a view to resale is not exempt from consolidation. However, if it meets the ‘held for sale’ criteria in IFRS 5 Non-current Assets Held for Sale and Discontinued Operations:

- it is presented in the financial statements as a disposal group classified as held for sale. This is achieved by amalgamating all its assets into one line item and all its liabilities into another

- it is measured, both on acquisition and at subsequent reporting dates, at fair value less costs to sell. (IFRS 5 sets down a special rule for such subsidiaries, requiring the deduction of costs to sell. Normally, it requires acquired assets and liabilities to be measured at fair value).

The ‘held for sale’ criteria in IFRS 5 include the requirements that:

- the subsidiary is available for immediate sale

- the sale is highly probable

- it is likely to be disposed of within one year of the date of its acquisition.

A newly acquired subsidiary which meets these held for sale criteria automatically meets the criteria for being presented as a discontinued operation.

Illustration: IFRS 5

David acquires Rose on 1 March 20X7. Rose is a holding entity with two wholly-owned subsidiaries, Mickey and Jackie. Jackie is acquired exclusively with a view to resale and meets the criteria for classification as held for sale. David’s year-end is 30 September.

On 1 March 20X7 the following information is relevant:

- the identifiable liabilities of Jackie have a fair value of $40m

- the acquired assets of Jackie have a fair value of $180m

- the expected costs of selling Jackie are $5m.

On 30 September 20X7, the assets of Jackie have a fair value of $170m.

The liabilities have a fair value of $35m and the selling costs remain at $5m.

Discuss how Jackie will be treated in the David Group financial statements on acquisition and at 30 September 20X7.

Solution

On acquisition the assets and liabilities of Jackie are measured at fair value less costs to sell in accordance with IFRS 5:

| $m | |

| Assets | 180 |

| Less selling costs | (5) |

| –––– | |

| 175 | |

| Liabilities | (40) |

| –––– | |

| Fair value less costs to sell | 135 |

| –––– |

At the reporting date, the assets and liabilities of Jackie are remeasured to update the fair value less costs to sell.

| $m | |

| Assets | 170 |

| Less selling costs | (5) |

| –––– | |

| 165 | |

| Liabilities | (35) |

| –––– | |

| Fair value less costs to sell | 130 |

| –––– |

The fair value less costs to sell has decreased from $135m on 1 March to $130m on 30 September. This $5m reduction in fair value must be presented in the consolidated statement of profit or loss as part of the single line item entitled ‘discontinued operations’. Also included in this line is the post-tax profit or loss earned/incurred by Jackie in the March – September 20X7 period.

The assets and liabilities of Jackie must be disclosed separately on the face of the statement of financial position. Jackie’s assets will appear below the subtotal for the David group’s current assets:

$m

Non-current assets classified as held for sale 165

Jackie’s liabilities will appear below the subtotal for the David group’s current liabilities:

| $m | |

| Liabilities directly associated with non-current assets | 35 |

| classified as held for sale | |

| No other disclosure is required. |

Test your understanding 1 – Major and Tom

Consolidated statement of financial position for Major as at 31 December 20X6

| $ | |

| Goodwill (W3) | 55,000 |

| Sundry assets ($350,000 + $250,000) | 600,000 |

| ––––––– | |

| 655,000 | |

| ––––––– | |

| Equity and liabilities | $ |

| Equity share capital | 200,000 |

| Retained earnings (W5) | 278,200 |

| Non-controlling interest (W4) | 88,800 |

| Liabilities ($60,000 + $28,000) | 88,000 |

| ––––––– | |

| 655,000 | |

| ––––––– |

Tom becomes a subsidiary of Major from December 20X4.

The previously held investment must be revalued to fair value with the gain or loss recorded in the statement of profit or loss.

| Dr Investment | |

| ($105,000 – $90,000) | 15,000 |

| Cr Profit or loss | 15,000 |

| (W2) Net assets | |||||

| At Acquisition | At Reporting | ||||

| 20X4 | date | ||||

| $ | $ | ||||

| Share capital | 100,000 | 100,000 | |||

| Retained earnings | 100,000 | 122,000 | |||

| ––––––– | ––––––– | ||||

| 200,000 | 222,000 | ||||

| ––––––– | ––––––– | ||||

| (W3) Goodwill | |||||

| $ | |||||

| Fair value of previously held interest | 105,000 | ||||

| Fair value of consideration for additional interest | 70,000 | ||||

| ––––––– | |||||

| 175,000 | |||||

| NCI at acquisition (40% × $200,000) | 80,000 | ||||

| Less: FV of net assets at acquisition (W2) | (200,000) | ||||

| ––––––– | |||||

| 55,000 | |||||

| ––––––– | |||||

| (W4) Non-controlling interest | |||||

| $ | |||||

| NCI at acquisition date | 80,000 | ||||

| NCI % of post-acquisition net assets | 8,800 | ||||

| (40% × $22,000 (W2)) | ––––––– | ||||

| 88,800 | |||||

| ––––––– | |||||

| (W5) Group Retained earnings | |||||

| $ | |||||

| Major | 250,000 | ||||

| Gain on revaluation of investment (W1) | 15,000 | ||||

| Tom (60% × $22,000 (W2)) | 13,200 | ||||

| ––––––– | |||||

| 278,200 | |||||

| ––––––– | |||||

Test your understanding 2 – Padstow

| (a) Profit to Padstow | |

| $000 | |

| Sales proceeds | 250 |

| Cost of shares sold | (100) |

| ––––– | |

| Profit on disposal | 150 |

| ––––– | |

| The tax due on the profit on disposal is: | |

| ($150,000 × 30%) | 45 |

The profit on disposal will be disclosed as an exceptional item in the statement of profit or loss.

The tax on the gain will be charged to the statement of profit or loss as part of the year’s current tax charge.

| (b) Consolidated accounts | ||

| $000 | $000 | |

| Sales proceeds | 250 | |

| Net assets at disposal date | 88.0 | |

| Goodwill at disposal date (W1) | 23.0 | |

| Less: NCI at disposal date (W2) | (14.2) | |

| ––––– | (96.8) | |

| ––––– | ||

| Profit on disposal | 153.2 | |

| ––––– |

The tax of $45,000 that arose on the disposal in the parent’s financial statements will be consolidated into the group financial statements.

| (W1) Goodwill | $000 | |||

| Consideration | 100.0 | |||

| NCI at acquisition | 15.0 | |||

| –––– | ||||

| 115.0 | ||||

| FV of net assets at acquisition | (69.0) | |||

| –––– | ||||

| Goodwill at acquisition | 46.0 | |||

| Impairment ($46 × 50%) | (23.0) | |||

| –––– | ||||

| Goodwill at disposal date | 23.0 | |||

| –––– | ||||

| (W2) NCI at disposal date | ||||

| $000 | ||||

| NCI at acquisition | 15.0 | |||

| NCI % of post-acq’n net assets movement | 3.8 | |||

| (20% × ($88.0 – $69.0)) | ||||

| NCI % of impairment (20% × $23.0 (W1)) | (4.6) | |||

| –––– | ||||

| 14.2 | ||||

| –––– | ||||

Test your understanding 3 – Hague

- Full disposal

- Profit in Hague’s individual financial statements

| $000 | ||

| Sale proceeds | 10,000 | |

| Cost of shares | (6,000) | |

| –––––– | ||

| Profit on disposal | 4,000 | |

| Tax charge on disposal: | –––––– | |

| (25% × $4,000) | (1,000) |

- Profit in consolidated financial statements

| $000 | $000 | ||

| Sale proceeds | 10,000 | ||

| FV of retained interest | nil | ||

| CV of subsidiary at disposal: | |||

| Net assets at disposal: | 3,000 | ||

| Goodwill at disposal (W1) | 2,500 | ||

| Less: NCI at disposal date (W2) | (400) | (5,100) | |

| ––––– | |||

| ––––– | |||

| Profit on disposal | 4,900 | ||

| (W1) Goodwill | ––––– | ||

| $000 | |||

| Consideration | 6,000 | ||

| NCI at acquisition | 1,000 | ||

| –––––– | |||

| 7,000 | |||

| FV of NA at acquisition (given) | (2,000) | ||

| –––––– | |||

| Goodwill at acquisition | 5,000 | ||

| Impaired (50%) | (2,500) | ||

| –––––– | |||

| Goodwill at disposal | 2,500 | ||

| –––––– | |||

| (W2) NCI at disposal date | |||

| $000 | |||

| NCI at acquisition | 1,000 | ||

| NCI share of post-acquisition net assets | 400 | ||

| (40% × ($3,000 – $2,000)) | |||

| Less: NCI share of goodwill impairment | (1,000) | ||

| (40% × $2,500) (W1) | |||

| –––––– | |||

| 400 | |||

| –––––– |

- Disposal of a 35% shareholding

- Profit in consolidated financial statements

| $000 | $000 | ||

| Disposal proceeds | 5,000 | ||

| FV of retained interest | 3,500 | ||

| ––––– | |||

| CV of subsidiary at disposal date: | 8,500 | ||

| Net assets at disposal | 3,000 | ||

| Goodwill at disposal (W1) | 2,500 | ||

| Less: NCI at disposal date (W2) | (400) | (5,100) | |

| ––––– | |||

| ––––– | |||

| Profit on disposal | 3,400 | ||

| ––––– |

- After the date of disposal, the residual holding will be accounted for using the equity method in the consolidated financial statements:

– The statement of profit or loss will show the group’s share of the current year profit earned by the associate from the date significant influence was obtained.

– The statement of financial position will show the carrying value of the investment in the associate. This will be the fair value of the retained shareholding at the disposal date plus the group’s share of the increase in reserves from this date.

Test your understanding 4 – Kathmandu

- Consolidated statement of profit or loss – full disposal

| $ | ||

| Revenue ($553,000 + (6/12 × $450,000)) | 778,000 | |

| Operating costs ($450,000 + (6/12 × $400,000)) | (650,000) | |

| ––––––– | ||

| Operating profit | 128,000 | |

| Investment income ($8,000 – ($10,000 × 70%)) | 1,000 | |

| Profit on disposal (W1) | 80,400 | |

| ––––––– | ||

| Profit before tax | 209,400 | |

| Tax ($40,000 + (6/12 × $14,000)) | (47,000) | |

| ––––––– | ||

| Profit for the period | 162,400 | |

| Attributable to: | ––––––– | |

| Equity holders of Kathmandu (bal. fig) | 157,000 | |

| Non-controlling interest (W5) | 5,400 | |

| ––––––– | ||

| 162,400 | ||

| ––––––– |

There were no items of other comprehensive income during the year.

- Group statement of profit or loss – discontinued operations presentation

| $ | ||

| Revenue | 553,000 | |

| Operating costs | (450,000) | |

| –––––––– | ||

| Operating profit | 103,000 | |

| Investment income | 1,000 | |

| ($8,000 – (70% × $10,000)) | –––––––– | |

| Profit before tax | 104,000 | |

| Tax | (40,000) | |

| –––––––– | ||

| Profit for the period from continuing | 64,000 | |

| operations | ||

| Profit from discontinued operations | 98,400 | |

| (($36,000 × 6/12)+ $80,400 (W1)) | –––––––– | |

| 162,400 | ||

| Attributable to: | –––––––– | |

| Equity holders of Kathmandu (bal. fig) | 157,000 | |

| Non-controlling interest (W5) | 5,400 | |

| –––––––– | ||

| 162,400 | ||

| –––––––– |

There were no items of other comprehensive income during the year.

Notice that the post-tax results of the subsidiary up to the date of disposal are presented as a one-line entry in the group statement of profit or loss. There is no line-by-line consolidation of results when this method of presentation is adopted.

- Consolidated statement of profit or loss – partial disposal

| $ | |

| Revenue ($553,000 + (6/12 × $450,000) | 778,000 |

| Operating costs ($450,000 + (6/12 × $400,000)) | (650,000) |

| ––––––– | |

| Operating profit | 128,000 |

| Investment income ($8,000 – (70% × $10,000) | 1,000 |

| Income from associate (35% × $36,000 × 6/12) | 6,300 |

| Profit on disposal (W6) | 80,400 |

| ––––––– | |

| Profit before tax | 215,700 |

| Tax ($40,000 + (6/12 × $14,000)) | (47,000) |

| ––––––– | |

| Profit for the period | 168,700 |

| ––––––– |

There were no items of other comprehensive income during the year.

| Attributable to: | |||

| Equity holders of Kathmandu (bal. fig) | 163,300 | ||

| Non-controlling interest (W5) | 5,400 | ||

| ––––––– | |||

| 168,700 | |||

| ––––––– | |||

| (W1) Profit on full disposal (part a) | |||

| $ | $ | ||

| Proceeds | 200,000 | ||

| Interest in subsidiary disposed of: | |||

| Net assets at disposal (W2) | 138,000 | ||

| Goodwill at disposal (W3) | 30,000 | ||

| NCI at date of disposal (W4) | (48,400) | ||

| –––––– | (119,600) | ||

| ––––––– | |||

| Profit on disposal | 80,400 | ||

| ––––––– |

| (W2) Net assets of Nepal at disposal | |||||

| $ | |||||

| Share capital | 50,000 | ||||

| Retained earnings b/f | 80,000 | ||||

| Profit up to disposal date (6/12 × $36,000) | 18,000 | ||||

| Dividend paid prior to disposal | (10,000) | ||||

| ––––––– | |||||

| Net assets at disposal | 138,000 | ||||

| ––––––– | |||||

| (W3) Goodwill | $ | ||||

| Consideration | 100,000 | ||||

| FV of NCI at date of acquisition | 40,000 | ||||

| ––––––– | |||||

| 140,000 | |||||

| FV of net assets at date of acquisition | (110,000) | ||||

| ––––––– | |||||

| Goodwill | 30,000 | ||||

| ––––––– | |||||

| (W4) NCI at disposal date | |||||

| FV of NCI at date of acquisition | 40,000 | ||||

| NCI share of post-acquisition net assets | 8,400 | ||||

| (30% × ($138,000 (W2) – $110,000) | ––––––– | ||||

| 48,400 | |||||

| ––––––– | |||||

| (W5) Profit attributable to NCI | |||||

| $ | $ | ||||

| Profit of Nepal (6/12 × $36,000) | 18,000 | ||||

| –––––– | |||||

| × 30% | 18,000 | –––––– | |||

| Profit attributable to NCI | 5,400 | ||||

| –––––– |

| (W6) Profit on part disposal (part c) | |||||

| $ | $ | ||||

| Proceeds | 100,000 | ||||

| FV of retained interest (per question) | 100,000 | ||||

| ––––––– | |||||

| 200,000 | |||||

| Net assets at disposal (W2) | 138,000 | ||||

| Unimpaired goodwill at disposal date (W3) | 30,000 | ||||

| ––––––– | |||||

| 168,000 | |||||

| NCI at date of disposal (W4) | (48,400) | ||||

| ––––––– | (119,600) | ||||

| ––––––– | |||||

| Profit on disposal | 80,400 | ||||

| ––––––– | |||||

Test your understanding 5 – Gordon and Mandy

| (i) Purchase of 20% of Mandy shares | |||

| $ | |||

| Cash paid | 25,000 Cr | ||

| Decrease in NCI ((20%/20%) × 20,000) | (20,000) Dr | ||

| –––––– | |||

| Decrease in other components of equity | 5.000 Dr | ||

| –––––– | |||

| (ii) Purchase of 5% of Mandy shares | |||

| $ | |||

| Cash paid | 4,000 | Cr | |

| Decrease in NCI ((5%/20%) × 20,000) | (5,000) | Dr | |

| –––––– | |||

| Increase in other components of equity | (1,000) | Cr | |

| –––––– | |||

Test your understanding 6 – David and Goliath

| (i) Sale of 5% of Goliath shares | |||

| $ | |||

| Cash proceeds | 5,000 | Dr | |

| Increase in NCI | (4,500) | Cr | |

| (5% × ($70,000 + $20,000) | ––––– | ||

| Increase in other components of equity | 500 | Cr | |

| ––––– | |||

| (ii) Sale of 25% of Goliath shares | |||

| $ | |||

| Cash proceeds | 20,000 | Dr | |

| Increase in NCI | (22,500) | Cr | |

| (25% × ($70,000 + $20,000) | |||

| –––––– | |||

| Decrease in other components of | (2,500) | Dr | |

| equity | –––––– | ||

Note that in both situations, Goliath remains a subsidiary of David after the sale of shares. There is no gain or loss to the group – the difference arising is taken to equity. Goliath would continue to be consolidated within the David Group like any other subsidiary. There is no change to the carrying value of goodwill. The only impact will be the calculation of NCI share of retained earnings for the year – this would need to be time-apportioned based upon the NCI percentage pre- and post-disposal during the year.

Test your understanding 7 – Pepsi

| Consolidated statement of financial position | ||

| $000 | ||

| Assets ($1,000 + $800 + $500) | 2,300 | |

| Goodwill ($140 + $90) (W3) | 230 | |

| ––––– | ||

| Total assets | 2,530 | |

| Equity | ––––– | |

| Ordinary share capital ($1) | 500 | |

| Retained earnings (W5) | 556 | |

| Other components of equity ($6 – $4) (W6, W7) | 2 | |

| ––––– | ||

| 1,058 | ||

| Non-controlling interests ($48 + $124) (W4) | 172 | |

| ––––– | ||

| 1,230 | ||

| Liabilities ($600 + $500 + $200) | 1,300 | |

| ––––– | ||

| Total equity and liabilities | 2,530 | |

| ––––– |

Workings

(W1) Group structure

Pepsi

| Sprite | Tango | ||

| Initial holding: | 80% | Initial holding | 75% |

| Acquisition: | 8% | Disposal | (10%) |

| –––– | –––– | ||

| Reporting date | 88% | Reporting date | 65% |

| –––– | –––– |

| (W2) Net Assets of subsidiaries | ||

| Sprite | Acquisition date | Reporting date |

| $000 | $000 | |

| Share capital | 200 | 200 |

| Retained earnings | 25 | 100 |

| –––– | –––– | |

| 225 | 300 | |

| –––– | –––– |

| Tango | Acquisition date | Reporting date | |

| $000 | $000 | ||

| Share capital | 100 | 100 | |

| Retained earnings | 60 | 200 | |

| –––– | –––– | ||

| 160 | 300 | ||

| –––– | –––– | ||

| (W3) Goodwill | |||

| Sprite | $000 | ||

| Consideration | 300 | ||

| FV of NCI at acquisition | 65 | ||

| Fair value of net assets at acquisition (W2) | (225) | ||

| –––– | |||

| 140 | |||

| Tango | –––– | ||

| $000 | |||

| Consideration | 200 | ||

| FV of NCI at acquisition | 50 | ||

| Fair value of net assets at acquisition (W2) | (160) | ||

| –––– | |||

| 90 | |||

| –––– | |||

| (W4) Non-controlling interest | ||||

| Sprite | $000 | |||

| NCI at acquisition (W3) | 65 | |||

| NCI% × post acquisition net assets | 15 | |||

| (20% × $75 (W2)) | –––– | |||

| NCI before control to control adjustment | 80 | |||

| Decrease in NCI (W6) | (32) | |||

| –––– | ||||

| 48 | ||||

| Tango | –––– | |||

| $000 | ||||

| NCI at acquisition (W3) | 50 | |||

| NCI% × post acquisition net assets | 35 | |||

| (25% × $140 (W2)) | –––– | |||

| NCI before control to control adjustment | 85 | |||

| Increase in NCI (W7) | 39 | |||

| –––– | ||||

| 124 | ||||

| –––– | ||||

| (W5) Retained earnings | ||||

| $000 | ||||

| Pepsi’s retained earnings | 391 | |||

| Pepsi’s % of Sprite’s post acquisition retained earnings | 60 | |||

| (80% × $75 (W2)) | ||||

| Pepsi’s % of Tango’s post acquisition retained earnings | 105 | |||

| (75% × $140 (W2)) | –––– | |||

| 556 | ||||

| –––– |

| (W6) Control to control adjustment – Sprite | ||||

| $000 | ||||

| Cash paid | 26 | Cr | ||

| Decrease in NCI (8/20 × $80 (W4)) | (32) | Dr | ||

| –––– | ||||

| Increase to other components of equity | (6) | Cr | ||

| –––– | ||||

| (W7) Control to control adjustment – Tango | ||||

| $000 | ||||

| Cash received | 35 | Dr | ||

| Increase in NCI (10% × ($300 (W2) + $90 (W3)) | (39) | Cr | ||

| –––– | ||||

| Decrease to other components of equity | (4) | Dr | ||

| –––– |