MAASAI MARA UNIVERSITY

SCHOOL OF BUSINESS AND ECONOMICS

DEPARTMENT OF BUSINESS MANAGEMENT

CERTIFICATE IN BUSINESS MANAGEMENT

END OF SEMESTER EXAMINATION APRIL 2014

CBM 05: BOOK KEEPING

Instructions answer Question one and any other three questions

QUESTION ONE

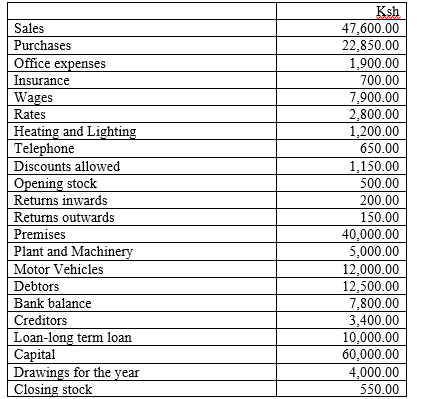

a) Brian is a sole trader. At 30 June 2012 the following balances have been extracted from his books:

Required:

a) Prepare a trial balance, from the above list of balances [ 15 marks]

b) Explain any five documents used in recording of accounting transactions [ 10 marks]

QUESTION 2

Write short notes on the following terms;

i) Assets and liabilities [3 marks ]

ii) Transactions [ 3 marks]

iii) The Going concern concept. [ 3 marks ]

iv) Business entity concept. [ 3 marks ]

v) Materiality. [ 3 marks ]

QUESTION 3

a) Briefly discuss any five functions of accounting [ 10 marks ]

b) Accounting has various branches, explain any five of these branches. [ 5 marks ]

QUESTION 4

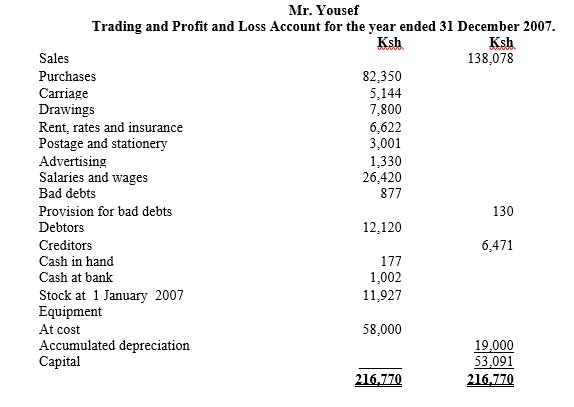

The following trial balance has been extracted from the ledger of Mr. You, a sole trader.

Mr. Yousef

Trading and Profit and Loss Account for the year ended 31 December 2007.

The following additional information as at 31 December 2007 is available:

(a) Rent is accrued by Ksh210.

(b) Rates have been prepaid by Ksh880.

(c) Ksh2, 211 of carriage represents carriage inwards on purchases.

(d) Equipment is to be depreciated at 15% per annum using the straight line method.

(e) The provision for bad debts to be increased byKsh40.

(f) Stock at the close of business has been valued at Ksh13, 551.

Required:

i) Prepare a trading and profit and loss account for the year ended 31 December 2007 [ 9 marks ]

ii) A balance sheet as at that date. [ 6 marks]

QUESTION 5

Briefly explain why the following parties may be interested in the financial statements of an organization:

(i) Employees (3 marks)

(ii) Financial institutions (3 marks

(iii) The Government. (3 marks)

(iv) The public. (3 marks)

(v) Investors (3 marks)

QUESTION 6

a) Explain the purpose of preparing a petty cash book in the organization. [ 5 marks]

b) A cashier in a firm starts with ksh 2,000 in the month of March (that is the cash float). I n the following week, the following payments are made:

Ksh

1st March – bought stamps for 80

2nd March – paid bus fare for 120

2nd March – cleaning materials 240

3rd March – bought fuel 150

3rd March – cleaning wages 300

4th March – bought stamps 200

4th March – paid L. Thompson (creditor) 400

5th March – fuel costs 150

On the 5th of March the cashier requested for a refund of the cash spent and this amount was reimbursed back.

Required:

Prepare a detailed petty cash book showing the balance to be carried forward to the next period and the relevant expense accounts, as they would appear on the General Ledger. [10 marks]