Capital of a firm is a mix (or proportion) of a firm permanent long term financing representing by debt, preferred stock and common stock Given that is firm has a certain structure of assets, which offers net operating earnings of given size and quality, and given a certain structure of rates in the capital markets in there some specific degree financing leverage at which the market value of firm’s securities will higher (or the cost of capital will be lower) than at other degrees of leverage? This question has been the basis of extensive work on capital structure and has resulted in a number of theories which we shall now focus on.

5.2 Assumptions and Definitions

In order to grasp the elements of the capital structure and the values of the firm or the cost capital properly we make the following assumptions.

• Firms employ only two types of capital debt and equity

• The total assets of the firm are given and the degree of leverage can be changed by selling debts to repurchase shares or selling shares to retire debt.

• Investors have the same probability distribution of expected future operating earnings for a given firm.

• The firm has policy of paying 100 per cent dividends.

• The operating earnings of the firm are not expected to grow.

• The business risk is assumed to be constant and independent of capital structure and financial risk.

• The corporate and personal income taxes do not exist this assumption is relaxed later on.

In our analysis of capital structure theories we shall use the following basic definitions:

S= market value for ordinary shares

D= market value of debt

V= total market value of the firm (S+D)

= XNOI = expected net operating income i.e. earning before interest an taxes (EBIT)

INT= interest charges DKei ).,.( d

= YNI = net income or shareholders earnings (EBIT-INT) when corporate taxes do not

exist.

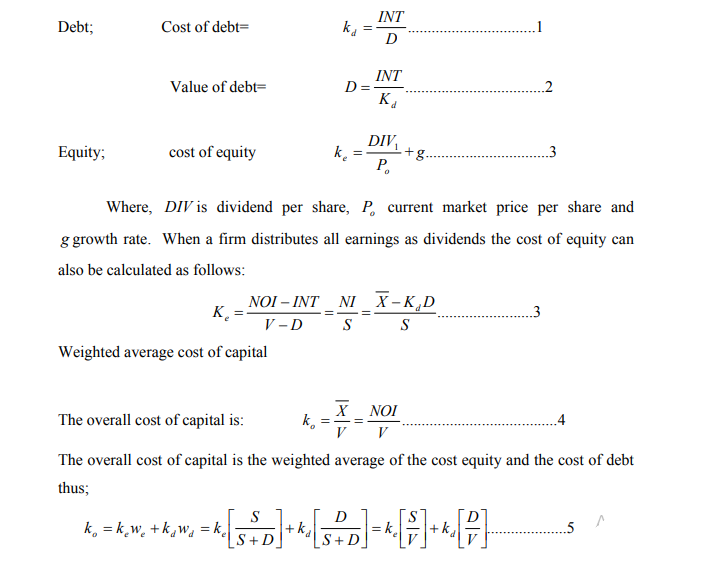

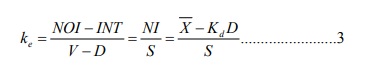

The capitalization rates or costs associated with the different earnings stream and the value of different securities can be defined as follows:

The equation and definition described above are valid under any the capital structure theories. The controversy is with behavior of the variables like o k , e k and V etc.

5.3 Capital Structure Theories

5.3.1 Net Income Approach ……………. Capital Structure Matters

The essence of the net income (NI) approach is that the firm can increase its or lower the overall cost capital by increasing the debt in the capital structure the crucial assumptions of the approach are:

• The use of debt does not change the risk perception of investors as result the equity capitalization rate and the debt capitalization rate , remain constant with changes in leverage.

• The debt capitalization rate is less than the equity capitalization rate (i.e. < ) d k e k

• The corporate income taxes do not exist.

The first assumption implies that if and are constant increased use of debt by magnifying the shareholders earnings will result in higher value of the firm via higher values of equity consequently the overall or the weighted average cost of capital will decrease. The overall cost of capital is measured by equation

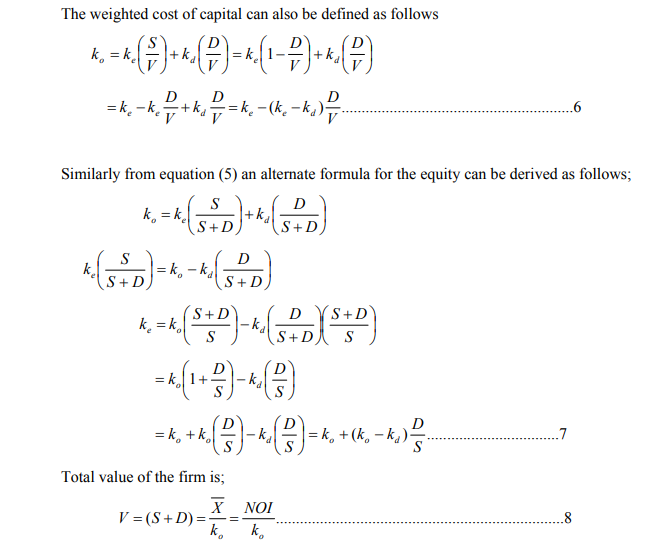

It is obvious from equation (4) that with constant annual net operating income (NOI), the overall cost of capital would decrease as the value of the firm V increases. The overall cost of capital can also be measured by equation;

![]()

In equation (6) as per the assumption of the NI approach, and are constant and is less than therefore will be equal to if the firm is fully equity financed. V increases as the overall cost of capital decreases or as D/V increases. Equation (6) also implies that the overall cost of capital will be equal to if the firm does not use any debt i.e. D/V = 0 and that will approach as D/V approach one.

5.3.2 The Net Operating Income Approach ………………. Capital Structure Does Not Matter

According to the net operating income (NOI) approach the market value of the firm is not affected by the capital structure changes. The market value of the firm is found not by capitalized the net operating income at the overall or the weighted average cost of capital

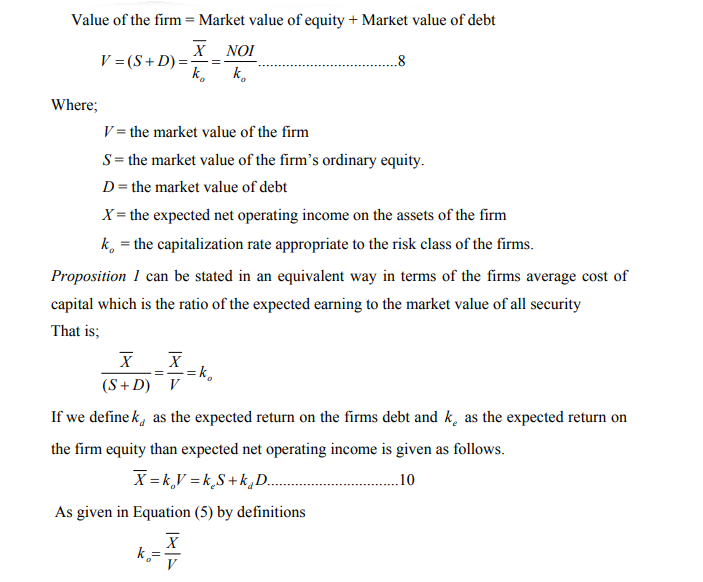

which is a constant. The value of the firm V is determined by equation (8).

Where is the overall capitalization rate, which depends on the business risk of the firm. It is independent of financial mix. If NOI and are independent of capital structure changes, the critical assumptions of the NOI approach are:

• The market capitalizes the value of the firm as a whole. Thus the split between debt and equity is not important.

• The market uses an overall capitalization rate to capitalize the net operating income and depends on the business risk. If the business risk is assumed to remain unchanged is a constant.

• The use of less costly debt funds increases the risk of shareholders. This causes the equity capitalization rate to increase. Thus the advantage of debt is offset exactly by the increase in the equity – capitalization rate . e k

• The debt – capitalization rate is a constant. d k

• The corporate income taxes do not exist.

As stated above under NOI approach the total value of the firm is found out by out by dividing the net operating income by the overall cost of capital . The market value of equity, S, can be determined by subtracting the value of debt D, from total market value

of the firm V, (i.e. S = V – D). The cost of equity will be the measured as follows:

Where, INT is the interest charges. Alternative the cost of equity can be defined as follows.

Equation (7) indicates that if and are constant would increase linearly with debt equity ratio D/S.

5.3.3 The Traditional View …………… The Existence of an Optimal Capital Structure

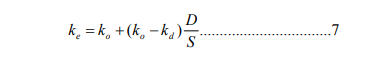

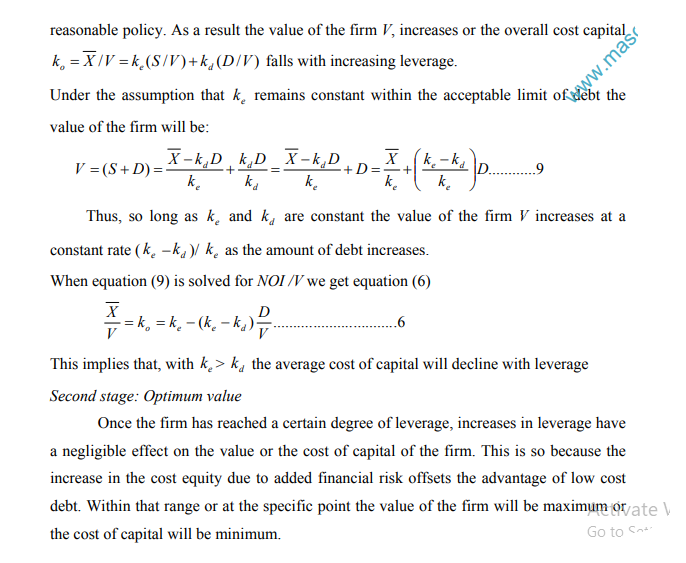

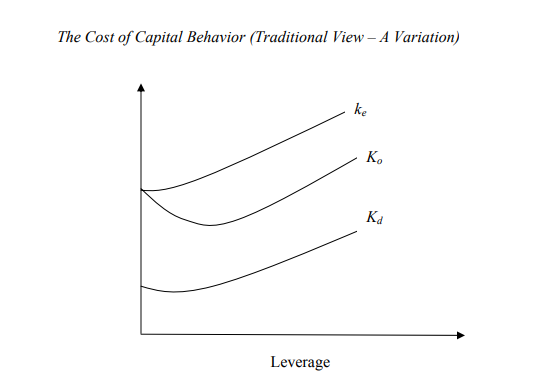

The traditional view which is also known as an intermediate approach is a compromise between the net income approach and the net operating approach and the net operating approach. According to this view the value of the firm can be increased or he cost of capital can be reduced by a judicious mix of debt and equity capital. This approach very clearly implies that the cost of capital decrease within the reasonable limit of debt and then the cost of capital increases with leverage. Thus, an optimum capital structure exists and it occurs when the cost of capital is minimum or the value of the firm is maximum. The cost of capital declines with leverage because debt capital is cheaper than equity capital within reasonable or acceptable limit of debt. The statement that debt funds are cheaper than equity implies the weighted average cost of capital will decrease with the use of debt.

According to the traditional position, the manner in which the overall cost of capital reacts to changes in capital structure can be divided in to three stages.

First stage: increasing value

In the first stage this rate at which the shareholders capitalization their net income i.e. the cost of equity remains constant or rises slightly with increase debt but it does not increase fast enough to offset the advantage of low cost debt. During this stage the cost debt remains constant of rises negligibly since market views the use of debt as a

Third stage: Declining value

Beyond the acceptable limit of leverage the value of this firm decreases with leverage or the cost of the capital increases with leverage. This happens because investors perceive a high degree of financial risk and demand a higher equity capitalization rate which offset the advantage of low cost debt. The overall effect of these three stages is to suggest that the cost of capital is a function of leverage. In declines with leverage and after reaching a minimum point or range starts rising. The relation between costs of capital and leverage is graphically shown in the figure below wherein the overall cost of capital curve is saucer shaped with a horizontal range. This implies that there is a range of capital structure in which the cost of capital is minimized. is assumed to increase slightly in the beginning and then at a faster rate. In figure below the cost of capital curve is shown to be U – shaped under such a situation there is a precise point at which the cost of capital would be minimum. This precise point defines the optimum capital structure.

Criticism of the traditional view

The validity of the traditional position has been questioned on the ground that the market value of the firm depends upon its net operating income and risk attached to it. The form of financing can neither change the net operating income nor the risk attached

to it. It simply changes the way in which the income is distributed between equity holders and debt- holders. Therefore, firms with identical net operating income and risk, but differing in their modes of financing should have same total value. The traditional view is

criticized for implying that the totally of risk incurred by all security – holders of a firm can be altered by changing the way in which this totality of risks are distributed among the various classes of securities. Modigliani and Miller also do not agree with the traditional view. They criticized the assumption that the cost of equity remains unaffected by leverage up to some reasonable limit. They assert that sufficient justification does not exist for such an assumption. They do not accept the contention that moderate amounts of debt in “sound firms” do not really add very much to the “riskiness” of the shares. However the argument of the traditional theories that an optimum capital structure exists, can be supported on the two counts; the tax deductibility of interest changes and market imperfections.

5.3.4 The Modigliani and Miller Hypothesis With Out Taxes …. Capital Structure is Irrelevant

The Modigliani-Miller (M-M) posits that in the absence of taxes a firm’s market value and the cost of capital remain invariant to the structures changes.

Assumptions

The M-M hypothesis can be explained in terms of their propositions I and II whose assumption as described below.

• Prefect capital markets: securities (share and debt instruments) are traded in the perfect capital market situation. This specifically means that (a) investors are free to buy or sell securities (b) they can borrow without same term as the firm do; and (c) they behave rationally. It is also implied that the transaction costs i.e. the cost of buying and selling securities do not exist

• Homogeneous risk classes: firm can be grouped in to homogenous risk classes. Firms would be considered to belong to a homogenous risk class if their expected earnings have identical risk characteristics. It is generally implied under the M-M hypothesis that firms within same industry constitute a homogenous class.

• Risk: The risk of investors is defined it terms of the variability of the net operating income (NOI), the probability that the actual value of the firm may turn out to be different than their best estimate.

• No taxes: In the original formulation of their hypothesis M-M assume that no corporate income taxes exist.

• Full payout: Firms distribute all net earning to the shareholders which means a 100 per cent payout.

5.3.4.1 Proposition 1: M-M (1)

Given the above stated assumptions M-M (1) argue that, for firms in the same risk class the total market value is independent of debt equity mix and is given by capitalization the expected net operating income by the rate appropriate to that risk class. This is their

proposition 1 and can be expressed as follows:

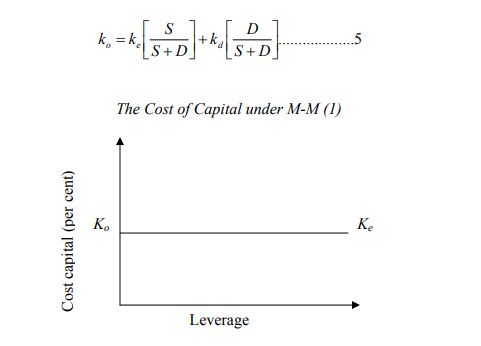

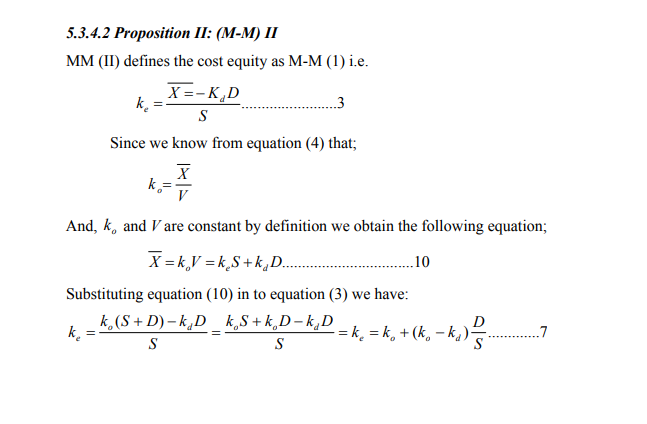

Equation (5) expresses as the weighted average of the expected rate of return of equity and debt capital of the firm. Since the cost of capital is defined as the expected net operating income divided by the total market value of the firm, M-M (1) conclude that the total the market value of the firm is unaffected by the financing mix. It follows that the cost of capital is independent of the capital structure and is equal to the capitalization rate of a pure equity stream of its class. The cost of capital function as hypothesized by M-M (1) shown in the figure above is a constant and is not affected by leverage.

Arbitrage process

The simple principle of M-M (1) is that firms identical in all respects except for capital structure can not command different market values or have different cost of capital. M-M

(1) do not accept the NI approach as valid

Their opinion is that if two identical firms except for the degree of leverage have different markets values arbitrage (or switching) will take place to enables investors to engage in personal or home made leverage as against the corporate leverage to restore equilibrium in the market.

Equation (7) states that for firm in a given risk in a given risk class. The cost of equity is equal to the constant average cost of capital plus premium for the financial risk which is equal to debt – equity ratio times the spread between the constant average cost of capital and the cost of debt ( – ) D/S. The cost of equity is a linear function of a leverage measured by the market value of debt to equity D/S. Thus leverage will result not only in more earnings per share to shareholders but also increased cost of equity. The benefit of leverage is exactly taken off by increased cost of equity and consequently the firm’s market value will remains unaffected.

It should however be noticed that the functional relationship = ( – ) D/S is valid irrespective of any particular valuation theory. For example M-M (1) assume to be constant, while according to the more popular traditional view is a function of leverage. The crucial part of the M-M thesis that will not rise even if very excessive sure of leverage is made. This conclusion could be valid of the cost of borrowing remains constant for any degree of leverage.

But in practice, increases with leverage beyond a certain acceptable or reasonable level of debt. However M-M maintains that even if the cost of debt increase will increase at a decreasing rate and may even turn down eventually. This is illustrated in the figure above. M-M insists that the arbitrage process will work and that as increases with debt, will become less sensitive to further borrowing. The reason for this that debt holders in the extreme situations, own the firms assets and bear some of the firm’s business risk. Since the risk of shareholders is transferred to debt holders declines.

Criticism of the M-M hypothesis

The arbitrage process is the behavioral foundation for the M-M thesis. The shortcoming of this thesis lie in the assumption of perfect capital market in which arbitrage may fail to work and may give rise to discrepancy between the market values of levered and unleveled firms. The arbitrage process may fail to bring equilibrium in the capital market for the following reasons.

Leading and borrowing rates discrepancy: The assumption that firms and individual can borrow and lend at the same rate of interest does not hold well in practice. Because of the substantial holding of fixed assets firms have a higher credit standing. As a result they are able to borrow at lower rates of interest that individual. Non- substitutability of personal and corporate leverage: it is incorrect in assume that personal (home made) leverage is a perfect substitute for “corporate leverage”. The existence of limited liability of firms in contrast with unlimited liability of individuals clearly places individuals and firms on a different footing in the capital markets. If a levered firm goes bankrupt all investors stand to lose to the extent of the amount of the purchase price of their shares. But if an investors creates personal leverage then in the event of the firm’s insolvency, he would lose not only his principle in the shares of the unleveled company, but will also be liable to return the amounts of his personal loan

Transaction costs: The existence of transaction costs also interferes with the working of arbitrage.

Institutional restrictions: institutional also impede the working of arbitrage because “home made” leverage is not particularly feasible as a number of institutional investors would not be able to substitute personal leverage for corporate leverage simple because they are not allowed to engage in the “home made” leverage.

Existence of corporate tax: The incorporation of the corporate income taxes will also frustrate M-M a conclusions interest charges are tax deductible. This is fact, means. The very existence of interest chares gives the firm a tax advantages. Which allows it to return to its equity and debt holders a larger stream of income than it other wise could have.

5.3.5 The M-M Hypothesis under Corporate Taxes ……. Relevance of Capital Structure

M-M’s hypothesis that the value of the firms is independent its debt policy is based on the critical assumption that corporate income taxes do not exist in really, corporate income taxes exist and interest paid to debt holders is treated as a deductible expense. Dividends paid to shareholders on the other hand are not tax deductible. Thus unlike dividends the return to debt holders is not subject to the taxation at the corporate level. This makes debt financing advantages. In their 1963 article M-M show that the value of the firm will increase with debt due to the deductibility of interest charges for tax computation and the value of the levered firm will be higher that of the unleveled firm.

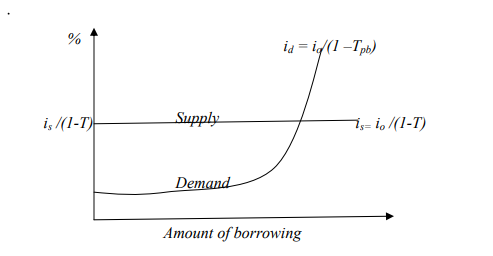

5.3.6 Miller Hypothesis with Corporate and Personnel Taxes ……. Economy Wide

Optimum Capital Structure

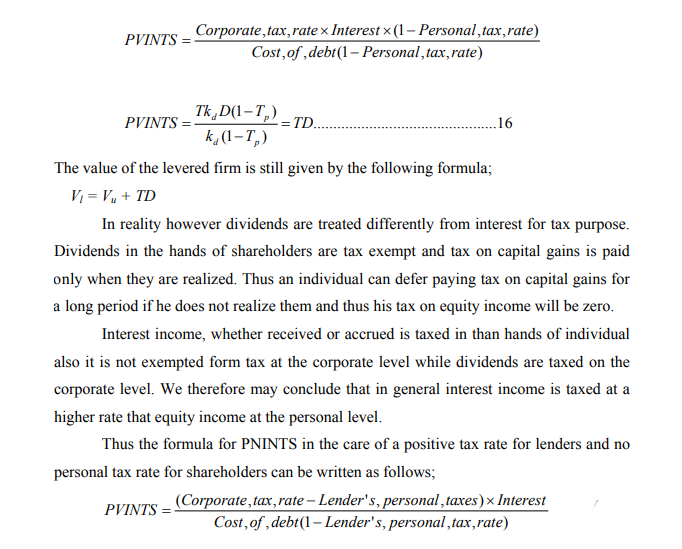

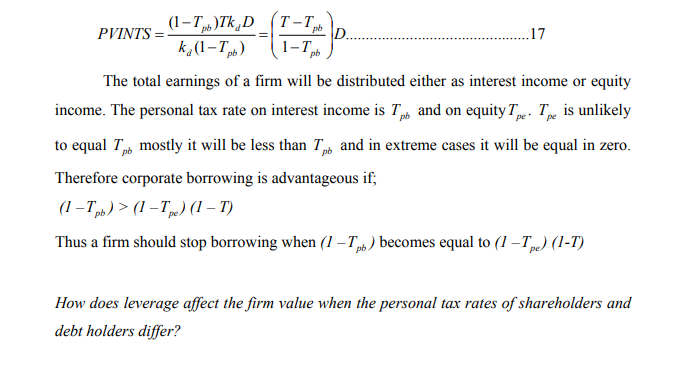

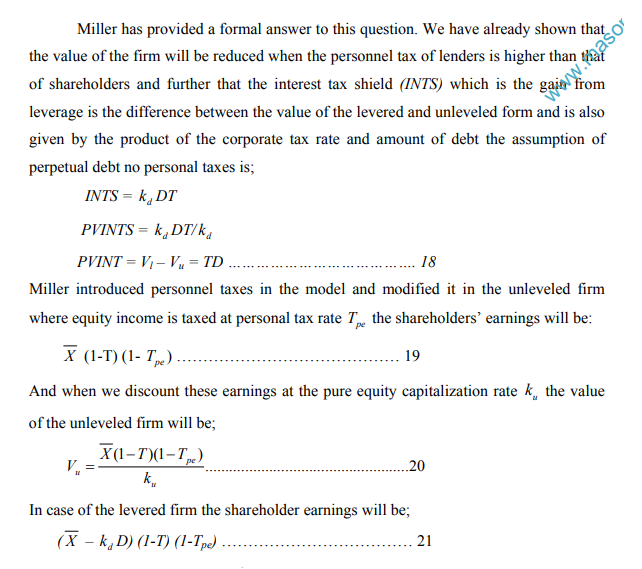

Investors are required to pay personal taxes on the income earned by them. Therefore, form investors point of view taxes will include both corporate and personal taxes. A firm should thus aim at minimizing the total taxes (both corporate and personal) while deciding about borrowing. Note that the after tax income available to both shareholders and debt holders is less by the tax rate on account of personal taxes. This present value is same as obtained earlier when the personal taxes were ignored. It is because both cash flows and discount rate have been reduced by the personal tax rate of 40 per cent. Thus;

We can generalize the following from equation (24):

• If Tpe = Tpb = 0 then the present value of the interest tax shield is equal to: TD (corporate tax rate T times the amount of debt D)

• If > then the present value of the interest tax shield will be less than TD:

PVINTS<TD.

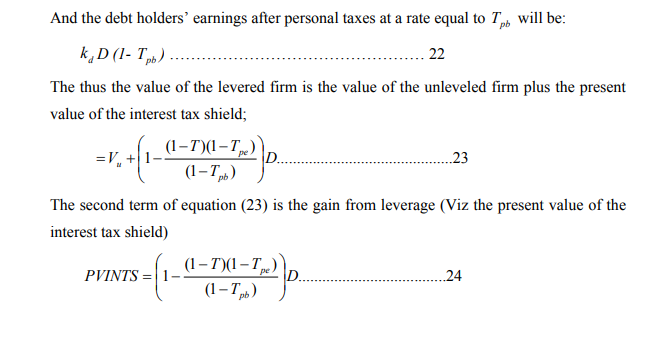

• If (1- ) = (1-T (1- ) then the advantage of leverage will be completely lost. Tpb Tpe In terms of the corporate borrowing Miller model (equation (24) indicates the following if the personal tax rate on equity income is zero except the tax exempt debt holders nobody would be interested in lending to the firm. Therefore to induce debt holders to lend, the firm will have to offer a higher before tax interest rate. This implies that if this rate on the firm of tax exempt investors is say io then debt holders with a personal tax rate of will have to be at least offered a rate of interest equal to i Tpb o/(1 – ) otherwise they will not lend. Therefore, firms have to keep raising interest to attract investors in high tax brackets. Firms will be motivated to keep the interest rate rising if the corporate tax saving is greater than the personal tax loss. Tpb They will stop borrowing once the corporate tax rate T. equals the personnel tax rate . Thus in the equilibrium the interest rate should be equal to i Tpb o / (1-T) to verify this point. Assume that the personal tax rate on equity income is zero, = 0 then equation (24) can be written as follows:

Miller’s model had two important implications

• There is an optimum amount of debt in the economy which is determined by the corporate and personal tax rates. In others words. There is an optimum debt equity ratio for all firms in the economy.

• There is no optimum debt equity ratio for a single firm. There are hundreds of firms which have already induced tax except and low tax brackets investors. Therefore a single firm can not gain or lose by borrowing more or less.

Miller’s model has the following limitations

• It implies that tax exempt persons or institutions will invest only in debt securities and high tax bracket investors in equities. In practice investors hold portfolio of debt and equity securities.

• The personal tax rate on equity income is not zero. Firms do pay dividends if is positive more investors can be induced to invest in debt securities Tpe

• Investors in high tax brackets can be induced to invest in debt securities indirectly, they can invest in the corporate bonds.

M-M and Miller’s model can be summarized as follow

Under M-M’s model the existence of the corporate taxes provides a strong incentive to borrow. In fact it is ideal for a firm to have 100 per cent debt in its capital structure. They ignore personal taxes. Miller’s model considers both the corporate both the corporate as well as the personal taxes. It concludes that the advantage of corporate borrowing is reduced by the personal tax loss. The crucial implication of model is that there is no optimum capital structure for a single form a single but for the economy as a whole there exists an equilibrium amount of aggregate debt.

From a single firm’s point of view therefore, the capital structure does not matter Miller’s model is based on some controversial assumptions and therefore most people still believe that in balance, there is a tax advantages to corporate borrowing.

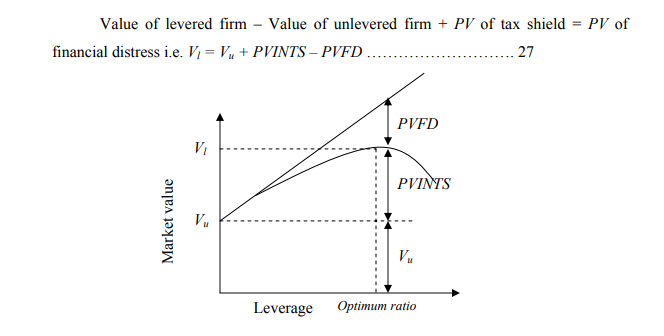

5.4 Financing Distress

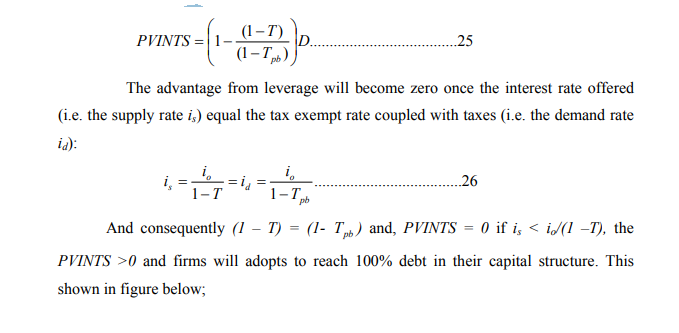

It is difficult believe that a firm should have 100% debt because of tax advantage. Why don’t firm in practice borrow 100% or what is the offsetting disadvantage of debt? The offsetting disadvantage is grouped under the term financial distress. Financial distress occurs when the firm finds it difficult to honor the obligation of creditors. The extreme form of financial distress is insolvency. Insolvency could be very expensive. It involves legal costs. The firm may have to sell its needed assets at distress prices. More important the consideration is the inflexibility of raising funds if the firm has already used heavy amount of debt. Non availability of funds on acceptable terms could adversely affect the operating performance of the firm. Creditors lose patience when a firm is financially distressed they force the firm in to liquidation to realize their claims. They the value of levered firms is given as follows:

The figure above shows how the capital structure of the firm is determined as a result of the tax benefits and the costs of financial distress. The present value of the interest tax shield increase with borrowing but so does the present value of the cost of financial distress. However, the cost of financial distress are quite insignificant with moderate level of debt and therefore the value of eh firm increase with debt. With more and more debt and the cost of financial distress increases and therefore the tax benefit shrinks. The optimum point reached when the present value of the tax benefits equal to the present value of the costs of financial distress. The value of the firm is maximum at this point.

5.5 Agency Theory

The theory posts that equity holders and debt holders incur costs associated with monitoring management to ensure that it behaves in ways consistent with the firm’s contractual agreement. Regardless of who makes the monitoring express the cost is ultimately borne by the shareholders. Debt holders anticipating high monitoring costs charges higher interest rates which lower the value of the firm to its shareholders. The presence monitoring cost acts as a disincentive to the insurance of debt monitoring costs like insolvency costs tend to increase at an increasing with leverage.

5.6 Signaling Theory

The theory contends that signal provided by capital structure changes are credible in providing the trend of future cash flows. Actions that increase have been associated with positive equity returns while actions that decrease leverage have been assonated with negative equity reruns, therefore when a firm makes any capital changes it must be mindful of the signal that the proposed transaction will transmit to the market place regarding the firm’s present and future earnings prospects and the intentions of its managers. The theory is based on the assumption of information asymmetry between the management and shareholders.

5.7 The Pecking Order Theory

The pecking order theory implies that firms prefer to finance internally and if external financing is required, they will tend to use the safest securities first. Debt tends to be the first security issued and external equity the last resort. The preference of internal financing is based on the desire to avoid the discipline and monitoring that occurs when new securities are sold publicly.