At the end of a particular period (mostly one month) the balances of the cash book should be extracted and in many instances, the cash at bank balance in the cash book does not agree with the bank statement over the same period though theoretically it should. This is a normal occurrence and the two needs to be reconciled so that any material errors can be identified as early as possible. The causes of the disagreement may be as a result of:

- Items that appear on the cash book but not on the bank statement.

- Items that appear on the bank statement but not on the cashbook

- Errors when entering amounts in the cash book

- Errors by the bank while posting transactions

Items that appear on the cash and not on the bank statement

1. Un-credited amounts (cheques/deposits)

This item mainly affects the cheques. Due to the nature of the cheque clearing process, a firm may deposit a cheque and thus debit the cashbook, but by the time the bank statement is being prepared, the amounts are not yet available. The cheque could also bounce and before the bank can communicate to the account holder, the balances in the bank statement and in the cash book will not tally.

2. Un-presented or outstanding cheques

These are the cheques issued to the suppliers by the firm and shown as payments in the cash book. The suppliers may hold the cheque for a number of days before presenting it to the bank for payment and thus the bank will not have recorded such a payment in the bank statement hence will reflect a different balance from that in the cash book

3. Items appearing in the bank statement and missing in the cash book

- Direct Credits: when a customer deposits either cash or a cheque directly into the business’ bank account without informing the business.

- Bank Charges: when the bank debits (decreases) the account of the business with charges e.g. cheque book charges, ledger fees, commissions on electronic funds transfer both incoming and outgoing etc.

- Direct Debits or standing orders; when the bank pays/ honors a standing order, deducts loan payment from the account etc

- Dishonored Cheques; when a cheque earlier deposited is dishonored

Errors while entering the amounts in the cashbook would include

- Overstatement/understatement of receipts and payments in the cash book

- Mis-posting of deposits or payments in the cash book

Purpose of bank reconciliation statement

Bank reconciliation is used to bring the two balances into agreement i.e. the back balance in the cash book and the bank balance in the bank statement.

It is prepared for the following reasons;

- To update the cash book with some relevant entries appearing in the bank statement e.g. bank charges, direct debit etc

- To detect or prevent errors or frauds that relate to the cash book

- To prevent or prevent errors or frauds that relate to the bank

Steps of bank and cash book reconciliation

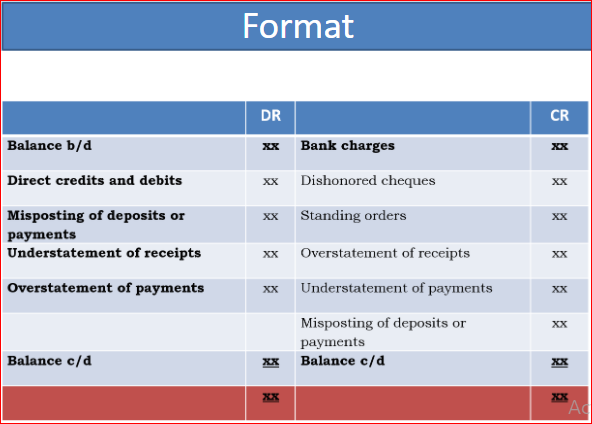

The first thing to do while reconciling a bank statement is to update the cashbook.

This is done by entering all the transactions that ought to be in the cashbook but were missing, as well as correct all errors in the cash book. Such entries would

include

- Bank charges

- Direct credits and debits

- Dishonored cheques

- Overstatement/understatement of receipts in the cashbook

- Over/understatement of payments in the cash book

- Misposting of deposits or payments in the cash book

The second step is to prepare a bank reconciliation statement which expected to make adjustments on the balance in the bank statement to

agree with the new balance obtained from the adjusted cashbook.

The following items will now be shown under the bank reconciliation statement

- Un-presented cheques

- Un-credited deposits

- Errors in the bank statement

- The updated cash book balance

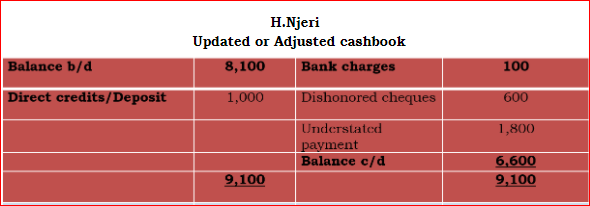

Illustration

On 31st December 2019 the cash book of H. Njeri showed a balance at the bank of Sh Sh8, 100. The bank statement however showed a balance of Sh 6,700. Going

through the bank statement she found out that:

- A cheque received from Taifa Ltd on 1st December for Sh 600 and entered into the cash book did not appear on the bank statement.

- A cheque paid to E. Kamara Sh 700 on 25th December had not been presented.

- A cheque received from N Njiru on 24th December Sh 600 and entered into the cash book was returned dishonored. No entry in this regard was recorded in the cash book.

- Bank charges amounting to Sh 100 had not been entered into the cash book.

- The bank received directly Sh 1000 from E.A.B.L as dividends on 18th December on behalf of H. Njeri.

- A cheque payment of Sh 2000 to Olivia had been entered in error Sh200 in the cashbook.

Required

a) Make the necessary entries to update the cash book

b) Prepare a bank reconciliation statement for H. Njeri for the month of December 2019

SOLUTION