UNIVERSITY EXAMINATIONS: 2017/2018

UNIVERSITY EXAMINATIONS: 2017/2018

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS

INFORMATION TECHNOLOGY

BUSS203 BUSINESS FINANCE

FULL TIME/ PART TIME

DATE: APRIL, 2018 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One & ANY OTHER TWO questions.

QUESTION ONE

a) Discuss advantages and disadvantages of the profit maximization goal. (5 Marks)

b) Explain why individuals prefer current income as opposed to future income (3 Marks)

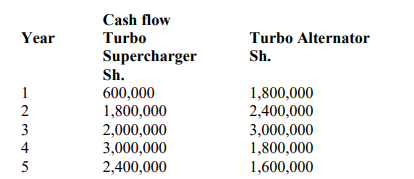

c) Ujezi Limited is considering the purchase of a new machine. Two alternative machines,

Turbo Supercharger and Turbo Alternator, which will cost Sh.6,000,000 and Sh.7,000,000

respectively are available in the market. The cash flow after taxation of each machine are as

follows:

Required

(i) Compute the net present value of each machine. The cost of Capital is 12% p.a.

(8 Marks)

(ii) Assuming that each machine represents a project:

a. Compute the Internal Rate of Return Ujezi Limited expects to earn from each of

the two projects. (10 Marks)

b. Comment on the use of the results obtained in (i) and (ii)(a) above in selecting

between the two projects.

(4 Marks)

(Total: 30 Marks)

QUESTION TWO

a) Distinguish between debt and equity capital. (5 Marks)

b) Describe the scope of a Financial Manager in a Corporate Environment. (5 Marks)

c) What are the advantages of leasing an asset as compared to borrowing to buy an asset?

(5 Marks)

d) Within a business finance context, discuss the problems that might exist in the relationship

between Shareholders and managers (5 Marks)

(Total: 20 Marks)

QUESTION THREE

a) Define the term weighted average cost of capital. (3 Marks)

b) What is meant by the marginal weighted average cost of capital? (3 Marks)

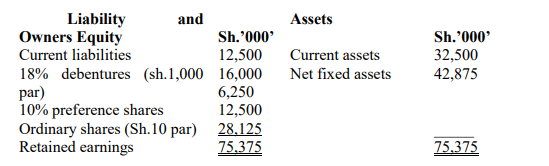

c) Tik tak Company Ltd. is in the Telecommunications Industry. The company’s statement of

financial position as at 31 March 2018 is as below:

Additional information

The debentures are now selling at Sh.950 in the market and will be redeemed 10 years from

now.

By the end of last financial period, the company had declared and paid Sh.5.00 as dividend

per share. The dividends are expected to grow at an annual rate of 10% in the foreseeable

future. Currently, the company’s shares are trading at Sh.38 per share at the local stock

exchange.

The preference shares were floated in 2013 and their prices have remained constant.

Most banks are lending money at an interest of 22% per annum.

The Corporation tax rate is 40% per annum.

Required

i) Calculate the market weighted cost of capital for this firm. (12 Marks)

ii) “The book-value weights should be used discreetly when computing weighted cost of

capital”. Why” (2 Marks)

(Total: 20 Marks)

QUESTION FOUR

a) In relation to capital markets, differentiate between the terms stock and financial markets.

(4 Marks)

b) The Nairobi Securities Exchange has undergone major changes in terms of services since the

Central Depository System (CDS) was put in place.

i) What is the Central Depository System (CDS)? (4 Marks)

ii) How has it benefited the parties involved? (4 Marks)

c) The shares of Kasuku Airways Company Ltd. have been trading at Sh.8.00 per share for the

last several months. The existing shareholders argue that such shares are undervalued. They

say that, the shares should normally be trading at around Sh.15 per share.

i) When would a share price said to be unfair? (4 Marks)

ii) If the price earnings ratio for Kasuku Airways Company Ltd. ordinary shares is 2.5 times

while the price earnings ratio of the shares of Ambiria Company Ltd. is 10 times, which

share is more attractive to a potential investor? Give reasons. (4 Marks)

(Total: 20 Marks)

QUESTION FIVE

i) Explains the assumptions of Economic Order Quantity (EOQ) Model (5 Marks)

ii) Wapenzi Ltd requires 2,000 units of conveyor belts in its manufacturing process in the

coming year which costs Sh.50 each. The conveyor belts are available locally and the

leadtime is one week. Each order costs Sh.50 to prepare and process while the holding

cost is Shs.15 per unit per year for storage plus 10% opportunity cost of capital.

Required

a) How many conveyor belts should be ordered each time an order is placed

to minimize inventory costs? (5 Marks)

b) What is the reorder level? (3 Marks)

c) How many orders will be placed per year? (3 Marks)

d) Determine the total relevant costs. (4 Marks)

(Total: 20 Marks)