UNIVERSITY EXAMINATIONS: 2017/2018

EXAMINATION FOR THE DEGREE OF BACHELOR OF OF BUSINESS

INFORMATION TECHNOLOGY

BUSS200 INTRODUCTION TO ACCOUNTING II

FULL TIME/ PART TIME

DATE: APRIL, 2018 TIME: 2 HOURS

INSTRUCTIONS: Answer all questions.

QUESTION ONE

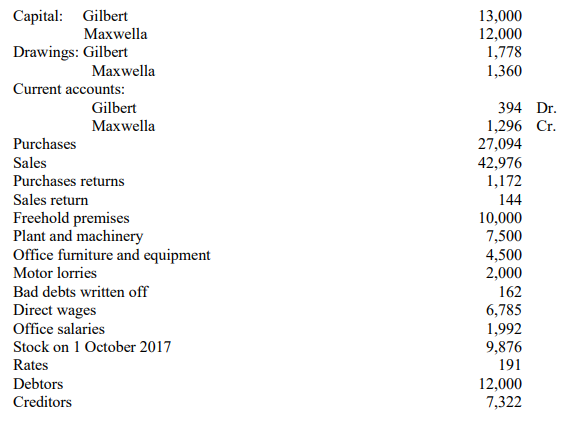

The following list of balances was extracted from the books of Gilbert and Maxwella, partners in

a wholesale business, on 30 September 2017.

Additional information:

(a) Outstanding expenses: Direct wages Kshs.115; rates Kshs.29

(b) Prepaid expenses: Insurance Kshs.39; office expenses Kshs.31

(c) Loan from Ladder is subject to 8% interest.

(d) 6% interest should be allowed on capital but none charged on drawings.

(e) Plant and machinery and motor lorries should be depreciated by 20% and furniture and

equipment by 10%.

(f) Adjust provision for bad debts to 5% of debtors.

(g) Closing stock is valued at Kshs.14,566.

Required:

(a) Income statement and appropriation Account for the year ended 30 September 2017

(8 Marks)

(c) Partners’ Current Accounts. (5 Marks)

(d) Statement of Financial Position as at 30th September 2017 (7 Marks)

QUESTION TWO

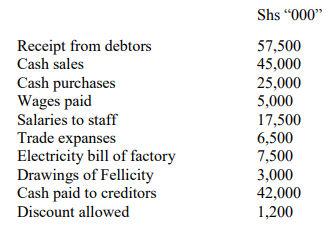

Mrs. Fellicity started business on January 01, 2017 with cash of Sh. 50,000,000 furniture of Shs.

10,000,000 goods of 2,000,000 and machinery worth 20,000,000. During the year she further

introduced Sh. 20,000,000 in her business by opening a bank account. The following additional

information is provided

Mrs. Fellicity used goods worth 2,500,000 for private purposes, which is not recorded in the

books. Charge depreciation on furniture 10% and machinery 20% p.a. on December 31, 2017 her

debtors were worth 70,000,000 and creditors Shs. 35,000,000 stock in trade was valued on that

date at Sh. 25,000,000

Required:

Income statement for the year ended 31 December 2017 (9 Marks)

Statement of Financial Position as at 31 December 2017 (6 Marks)

QUESTION THREE

(a) In the context of manufacturing accounts differentiate between direct costs and indirect costs

(4 Marks)

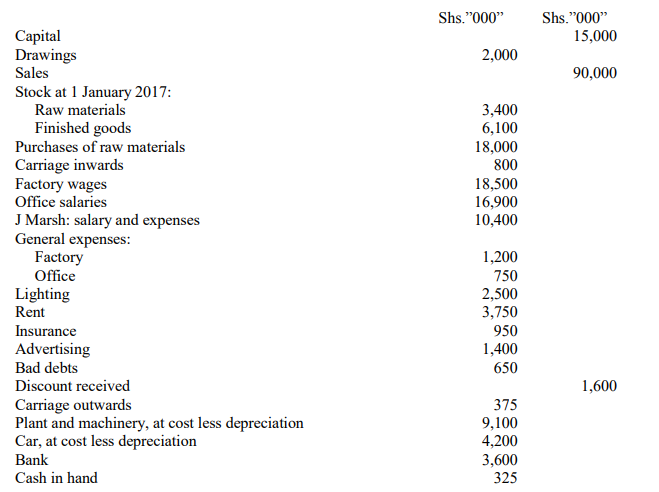

(b) Billy Jean owns a small business making and selling children’s toys. The following trial

balance was extracted from her books on 31 December 2017:

You are given the following additional information:

1. Stocks at 31 December 2017

Raw materials Shs.2,900,000

Finished goods Shs.8,200,000

There was no work in progress.

2. Depreciation for the year is to be charged as follows:

Plant and machinery Shs.1,500,000

Car Shs. 500,000

3. At 31 December 2017 Insurance paid in advance was Shs.150,000 and office general

expenses unpaid were Shs.75,000.

4. Lighting and rent are to be apportioned: 4/5 factory, 1/5 office. Insurance is to be apportioned:

¾ factory, ¼ office.

5. Jean is the business’s salesperson and her salary and expenses are to be treated as a selling

expense. She has sole use of the firm’s car.

Required:

a) A manufacturing account and Income Statement (10 Marks)

b) Statement of Financial position as at 31 December 2017 (6 Marks)

QUESTION FOUR

a. X Ltd., has a current ratio of 3.5:1 and quick ratio of 2:1. If excess of current assets over

quick assets represented by inventories is Shs. 24,000, calculate current assets and current

liabilities. (4 Marks)

b. Highlight two key differences between accounting for profit making organizations and

accounting for nonprofit making organizations (3 Marks)

c. Explain why a company which has reported a surplus in its income statement may report

a decrease in cash and cash equivalents in its statement of cash flows over the same

period. (4 Marks)

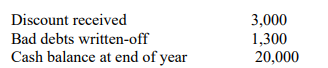

d. For a recent year a corporation’s financial statements reported the following:

Shs. “000”

Net Income 100,000

Depreciation expense 10,000

Increase in accounts receivable 30,000

Gain on sale of Lorry 12,000

Decrease in accounts payable 15,000

Based on the above information, what amount will the corporation report as Cash

Provided by Operating Activities on the cash flow statement? (4 Marks)