UNIVERSITY EXAMINATIONS: 2018/2019

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS

INFORMATION TECHNOLOGY

BUSS200 INTRODUCTION TO ACCOUNTING II

FULL TIME / PART TIME

DATE: APRIL, 2019 TIME: 2 HOURS

INSTRUCTIONS: Answer ALL questions.

QUESTION ONE

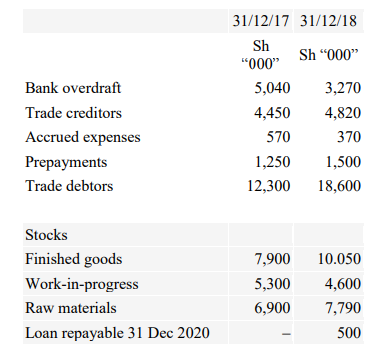

McCarthy did not keep a Ledger. He began trading on 1 January Year 2018 with business premises costing

Shs.25,000,000 and machines costing Shs.20,000,000. At 31st December Year 2017 and 2018 his other

assets and liabilities were summarized as follows:

assets and liabilities were summarized as follows:

The machines are depreciated at 10% per annum using the straight line method. No Depreciation on

premises.

McCarthy introduced further capital of Shs.10, 000,000 into the business on 1 January 2018.

His drawings for 2018 were Shs.12,000,000

Required:

Prepare

(a) Statement of Affairs at 31 December 2017 and 31 December 2018, in columnar form, showing

clearly the figure for closing capital for each year (8 Marks)

(b) Calculation of McCarthy’s net profit for 2018 using the capitals found in (a) above (7 Marks)

QUESTION TWO

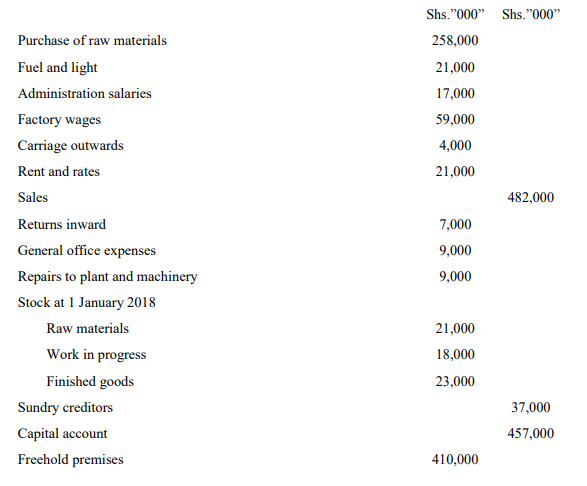

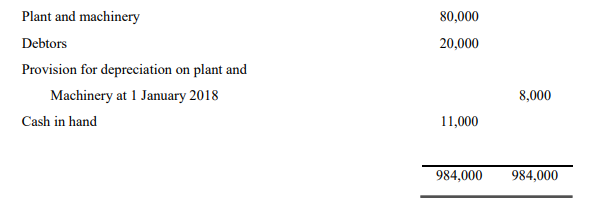

J Mpiana a manufacturer has prepared the following trial for the year ended 31 December 2018

(b) Depreciation of 10% on plant and machinery – straight line method

(c) 80% of fuel and light and 75% of rent and rates to be charged to manufacturing

(d) Doubtful debts provision – 5% of sundry debtors

(e) Shs.4,000,000 outstanding for fuel and light

(f) Rent and rates paid in advance – Shs.5,000,000

Required:

Prepare

i. Manufacturing account for the year ended 31 December 2018 (7 Marks)

ii. Income statement for the year ended 31 December 2018 (7 Marks)

iii. Statement of financial position as at 31 December 2018 (6 Marks)

QUESTION THREE

Outline two major weaknesses of ratio analysis as a tool of analyzing financial statements

(2 Marks)

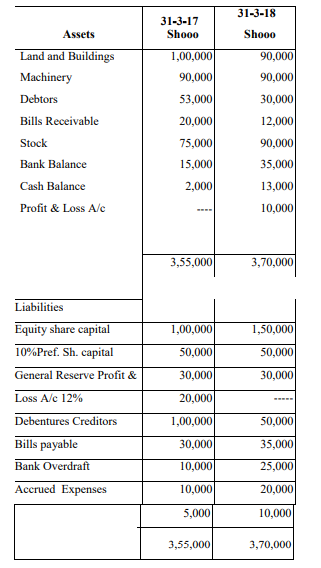

Two years’ Financial Statements of Aibuma Company Ltd. are as follows

Information:

Calculate following ratios and give your opinion about company position in 2017‐’18 in

comparison with 2016‐’17.

i. Current ratio

ii. Liquid ratio

iii. Debtors ratio (Take 365 days for calculations)

iv. Gross profit ratio

v. Stock Turnover ratio

vi. Rate of return on equity share‐holders’ funds. (18 Marks)

QUESTION FOUR

Emerald Ltd. arrived at a net income of Shs.5,00,000 for the year ended March 31, 2019.

Depreciation for the year was Shs.2,00,000. There was a profit of Shs.50,000 on assets sold which

was transferred to statement of profit and loss account. Trade Receivables increased during the

year Shs.40,000 and Trade Payables also increased by Shs.60,000.

Required

Compute the cash flow operating activities (4 Marks)

In the context of accounting for nonprofit organizations differentiate between receipts and

payments account and income and expenditure account (6 Marks)

Michael, Charles and Renardt set up a partnership firm on January 1, 2018. They contributed Shs.

500,000, Shs. 400,000 and Shs. 300,000 respectively as their capitals and decided to share profits

in the ratio of 3:2:1. The partnership deed provided that Michael is to be paid a salary of Shs.

10,000 p.m. and Charles a commission of Shs. 50,000. It also provided that interest on capital be

allowed @ 6% p.a. The drawings for the year were: Michael Shs. 60,000, Charles Shs. 40,000 and

Renardt Shs. 20,000. Interest on drawings Shs. 2700 on Michael’s drawings, Shs. 1800 on Charles

‘s drawings and Shs. 900 on Renardt’s drawings. The net amount of profit as per the profit and loss

account for the year ended 2018 was Shs. 356,600

Required

Prepare partners current accounts for the year (5 Marks)