UNIVERSITY EXAMINATIONS: 2019/2020

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS IN

INFORMATION TECHNOLOGY

BUSS 306: EVALUATION OF BUSINESS INVESTMENT

FULL TIME/ PART TIME/ DISTANCE LEARNING

DATE: MAY, 2020 TIME: 6 HOURS

INSTRUCTIONS: Answer ALL Questions

SECTION TWO: (20 MARKS)

QUESTION ONE

a) Discuss THREE forms of efficient market hypothesis. (6 Marks)

b) Explain TWO differences between the Capital Market Line (CML) and the Security Market

Line (SML)

(2 Marks)

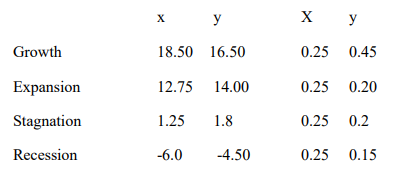

c) The table below shows the performance of two shares x and y under four different economic

conditions and their associated probabilities of occurrence

Economic condition Rate of return (%) Probabilities

Required;

i. The expected rate of return for shares x and y. (4 Marks)

ii. The standard deviation of returns for shares x and y. (4 Marks)

iii. The coefficient of variation of returns for shares x and y. (2 Marks)

iv. Advice an investor on the preferred share. (2 Marks)

SECTION THREE: (20 MARKS)

QUESTION ONE

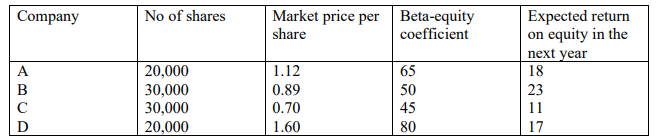

a) Mr.Wanjama is currently holding a portfolio consisting of shares of four companies quoted

on the Naxx securities exchange as follows;

Company No of shares Market price per

share

Beta-equity

coefficient

Expected return

on equity in the

next year

The current market return is 14% per annum and the treasury bills yield is 9% p.a.

Required;

i. calculate the risk of Wanjama’s portfolio relative to that of the market. (8 Marks)

ii. Explain whether or not Wanjama should change the position of his portfolio. (8 Marks)

b) Discuss any two factors that affected the efficiency of a portfolio. (4 Marks)