UNIVERSITY EXAMINATIONS: 2019/2020

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS IN

INFORMATION TECHNOLOGY

BUSS 305: STATISTICAL DECISION MAKING

FULL TIME/ PART TIME/ DISTANCE LEARNING

DATE: MAY, 2020 TIME: 6 HOURS

INSTRUCTIONS: Answer ALL Questions

SECTION B

QUESTION ONE (20 MARKS)

(a) A researcher wished to estimate the difference between the proportion of users of two

shampoos who are satisfied with the product. In a sample of 400 users of Shampoo A

taken by this researcher, 78 said they are satisfied. In another sample of 500 users of

Shampoo B taken by the same researcher, 92 said they were satisfied.

i) Construct a 90% confidence interval for the true difference between the two population

proportions. (8Marks)

ii) Based on your answer in (a), what would be your response at

=0.1 to the claim that

there is no difference in customer satisfaction between the two shampoos. (2 Marks)

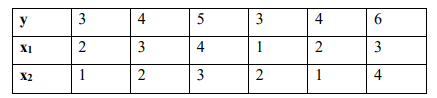

(b) Studies in finance have shown that the price of a share of stock (y) is directly related to the

issuing company’s level of debt (x1) and the dividend rate (x2).

Develop a regression model that relates the share of stock, level of debt and dividend rate

and hence estimate the share of stock when level when debt is 3 and the dividend rate is

5. (10 Marks)

SECTION C

QUESTION TWO (20 MARKS)

(a) A survey recently reported that the mean national annual expenditure for inpatient and

outpatient services of all persons over 64 years of age was $5,423 with a standard

deviation of $979. A random sample of 352 persons over age 64 living in Nairobi had an

average expense of $5,516.

Can we conclude that the mean inpatient and outpatient expense of all Nairobi?

residents over age 64 is higher than the national average of $5,423? Use the .01

level of significance. (9Marks)

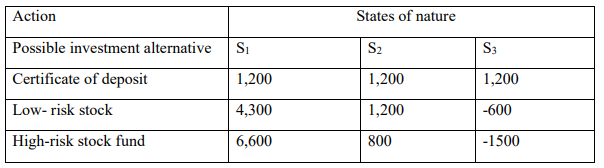

(b) An investor is considering three alternatives-a certificate of deposit, a low risk stock fund,

and a high risk stock fund- for a $20,000 investment. The investor considers three possible states

of nature

(i) Which action is selected by the investor if he is a risk seeker? [2Marks]

(ii) Which action is selected by the investor if he is a risk averter? [2Marks]

(iii) Which criteria is selected by the minim ax regret criterion? [4Marks]

(iv) Draw the decision tree for the investor’s problem. [3Marks]