UNIVERSITY EXAMINATIONS: 2021/2022

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS

INFORMATION TECHNOLOGY

BUSS 306: EVALUATION OF BUSINESS INVESTMENTS

FULLTIME/ PART TIME/ DISTANCE LERNING

DATE: DECEMBER, 2021 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One and any other Two Questions

QUESTION ONE:

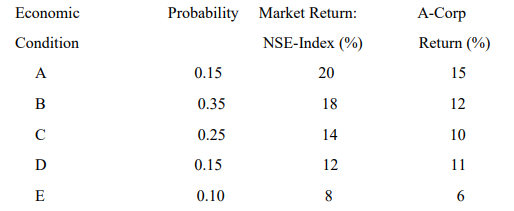

Mr. Penda is very happy with the current aspects of encouraging investments through the security

exchange. He wishes to put some money on A-Corporation shares traded on the securities

exchange. He has approached you for an evaluation. The return on the Nairobi Securities Exchange

(NSE) and A-Corporation shares are shown below for the five possible states of the economy that

might prevail next year.

Economic Probability Market Return: A-Corp

Required:

a) What is the expected return of A-corporation shares (4 Marks)

b) What is the correlation coefficient between the returns on the NSE with the return on A corporation shares (6 Marks)

c) Comment on the results obtained in (b) above (2 Marks)

d) Mr.Kamau is thinking of undertaking an alternative project similar to A-Corporation. If the risk

free rate of return is 6%, what will be the required rate of return of this project? Explain the basis

of your computation (8 Marks)

(Total: 20 Marks)

QUESTION TWO.

a) Highlight any four assumptions of the capital asset pricing model (8 Marks)

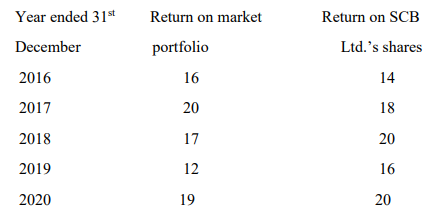

b) A prospective investor is considering buying shares of Equity commercial bank ltd and has

approached you for advice.

You have obtained the following information relating to the returns on the market portfolio and on

the shares of SCB Ltd over the years shown below:

Year ended 31st Return on market Return on SCB

You have also ascertained that the average rate of return on treasury bills has been 10% per annum

and this rate is not expected to change in the foreseeable future.

Required:

1) Expected return for the market portfolio and SCB Ltd.’s shares (2 Marks)

2) Using the capital asset pricing model(CAPM) advise the prospective investor on whether he

should buy the shares of the firm or not (5 Marks)

(Total: 15 Marks)

QUESTION THREE:

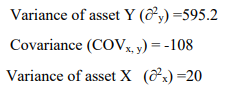

a) A fund is split between two securities X and Y. The following data relate to these securities:

Variance of asset Y (∂2

Required:

The proportions that an extremely risk-averse individual would place in a portfolio comprising of

asset X and Y to obtain a minimum standard deviation (7 Marks)

b) Differentiate between the following terms as applied in finance:

i. Systematic risk and Unsystematic risk (2 Marks )

ii. Asset Allocation and Asset pricing (2 Marks)

iii. Capital Asset pricing model and Arbitrage pricing model (2 Marks)

iv. Efficient Market hypothesis and portfolio theory (2 Marks)

(Total: 15 Marks)

QUESTION FOUR

a) Efficient market hypothesis by Eugene fama is a popular theory in the field of market microstructure’’.

Required:

Explain the proposition of the theory citing how the theory may be applied in pricing of financial

assets (5 Marks)

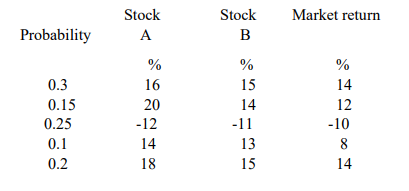

b) You have observed the following returns over time

Stock Stock Market return

The risk free rate of return is 10 %.

Required

i) Compute the Beta coefficient of stock A and B and interpret the results

(6 Marks)

ii) Using the capital asset pricing model (CAPM) determine the required rate of returns

for both stocks A and B (2 Marks)

iii) Would you advise Onyango a prospective investor to invest in stock A and B?

Explain. (2 Marks)

(Total: 15 Marks)

QUESTION FIVE

a) ‘’Trenor was the first scholar to introduce a composite measure of portfolio performance known

as the Trenor’s measure/Trenor’s Alpha. Outline any three limitations of this measure of portfolio

performance (6 Marks)

b) Omega investment unit want to invest in securities x and y of firms in two different industries.

The following information

Required

i) Determine the expected portfolio return (2 Marks)

ii) Determine the Beta factor of the portfolio (2 Marks)

iii) Explain and proof what happens to the portfolio risk if the returns of two securities are

perfect positively correlated. (5 Marks)

(Total: 15 Marks)