UNIVERSITY EXAMINATIONS: 2017/2018

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS IN

INFORMATION TECHNOLOGY

BUSS 106 COST ACCOUNTING

FULL TIME/PART TIME/DISTANCE LEARNING

DATE: DECEMBER, 2017 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One & ANY OTHER TWO questions.

QUESTION ONE

a) Define marginal costing and give its limitations. (6 Marks)

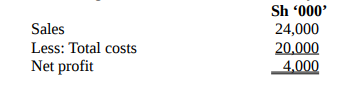

b) The following data relate to Ziwa Ltd for the year ended 31 December 2016.

Fixed costs account for 40% of the total costs.

Required:

i) Margin of safety. (2 Marks)

ii) Break-even point in sales (2 Marks)

iii) Sales required to earn profit of Sh 6,000,000. (2 Marks)

iv) In order to increase sales, the management has the following two options:

1. To increase sales by 25% on incurring a sales promotion cost of Sh 2,500,000.

2. To increase sales by 15% on reducing selling price by 5%.

Advise the management on which option they should take. (8 Marks)

(Total: 20 Marks)

QUESTION TWO

(a) Briefly explain the following cost estimation methods;

i) High-low method (2 Marks)

ii) Simple regression method. (2 Marks)

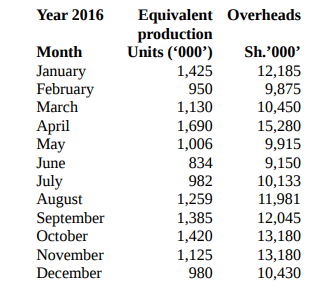

(b) The management of Kenya Processing Company Limited wishes to obtain better cost

estimates to evaluate the company’s operations more effectively.

The following information is provided to you for analysis:

Additional information:

1. In November, the opening work in progress inventory contained 1,000,000 units that were

30% complete with respect to conversion costs.

2. During the same month of November, the manufacturing department transferred 1,500,000

units.

3. The closing inventory for the month of November was 1,200,000 units and the units were

305 incomplete with respect to conversion costs

4. Using the above information, you have obtained the following variables by applying simple

regression analysis.

Sh. ‘000’

Constant 3,709

Slope 6,487

Required:

i) Use the high-low method to estimate the overhead cost function. (3 Marks)

ii) Use the regression method to determine the overhead cost function. (2 Marks)

iii) Compute the equivalent units of production with respect to conversion costs for the month of

November using the FIFO method. (3 Marks)

iv) Use the regression function formulated in (ii) above to estimate the overhead cost for the

month of November. (3 Marks)

(Total: 15 Marks)

QUESTION THREE

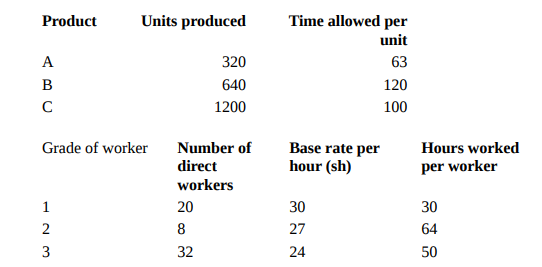

Annex Products Ltd who manufactures and retails products A, B and C employ sixty direct

workers who work under a group of bonus scheme. The company engages three grades of

workers who are paid a bonus of the excess of time allowed over time taken. The bonus paid is

75% of the workers’ base rate and is shared by the workers in proportion to the time spent on the

work. The following production data has been extracted from the company’s records for April

2016.

Required:

a) Percentage of hours saved to hours taken. (5 Marks)

b) Bonus due to the group. (5 Marks)

c) Gross earnings due to the group. (5 Marks)

(Total: 15 Marks)

QUESTION FOUR

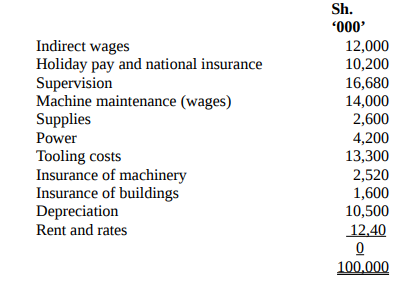

Nuso Manufacturing Company Ltd. is located at the industrial area in Nairobi. The company

uses four different machine groups, A, B, C and D in its manufacturing process.

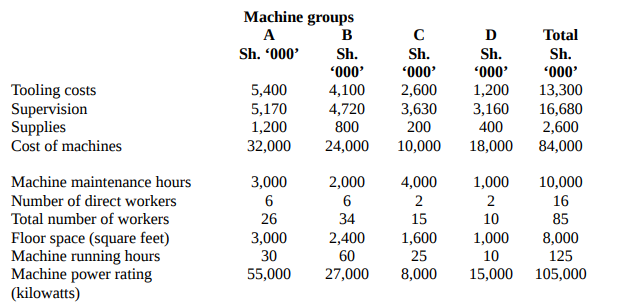

The overhead costs budget for the year ending 31 December 2016 is as follows:

At present, overheads are absorbed into the cost of the company’s products by means of a single

direct wages percentage of 70 percent. The company wishes to change to machine hour

overhead absorption rate for each of its four different machine groups.

The following data is available for each of the four machine groups:

Machine groups

Required:

(a) Machine hour overhead absorption rate for each of the four groups of machines.

(9 Marks)

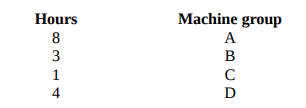

(b) The overhead cost to be absorbed by product XY123 if:

(i) It utilizes the following time resources of the indicated machine groups:

(3 Marks)

(ii) Direct labour cost is Sh. 22,000,000 and the direct wages percentage method is

used. (3 Marks)

(c) Briefly discuss the argument in favour of changing the overhead absorption rate from

direct wages percentage in machine hour rate. (5 Marks)

(Total: 20 Marks)