SECTION A (32 marks)

Answer ALL the questions in this section

1. Outline two differences between debentures and retained earnings, as sources of business finance. (4 marks)

2. Highlight two services rendered by commercial bunks to their customers. (4 marks)

3. The following information relates to Wuka Limited for die last quarter of die year 2017.

Ordinary share capital 200,000 al Kshs

Net profit after tax Kshs. 1,000.000

Ordinary share dividend paid Kshs. 400.000

Market price per ordinary share Kshs. 20

Using the information above, calculate each of the following ratios

(i) Dividend per share;

(ii) Earnings per share;

(iii) Dividend yield;

(iv) Earnings yield.

(4 marks)

4 State two types of policies that may be used in lhe management of credit in an organization. (2 marks)

5. The follow ing information shows the net cash inflows ofTamhako Limited.

Year Net Cash Inflows

t 450,000

2 600,000

3 600,000

4 480,000

Initial investment

Target return

Ksh. 2,000,000

30%

(a) Calculate the Accounting Rate of Return (ARR) of Tambako Limited.

(b) Using the result in (i) above, comment on the performance of the company.

6. John intends to buy a car in three years’ time, at a cost of Ksh. 1,000.000. At the beginning of the first year, he deposited Ksh, 300.000 in a hank, which pays compound interest at the rale of 10% per annum. At the beginning of the second year, he deposited Ksh. 400.000 in the same bank

Calculate the amount John should deposit in the bank at the beginning of the third year to enable him buy the car,

(3 marks)

7. Outline the relationship between business finance and each of the following disciplines;

(a) Financial Accounting;

(b) Economics. (4 marks)

8. Sigmo Limited has ordinary share capital of Ksh. 1,000,000 with a par value of Ksh 20 per share. The ordinary shares are currently selling at Ksh 35 each. The company paid ordinary share dividends totalling Ksh. 100,000 during a particular year.

Calculate the cost of equity of the company. (3 marks)

9. ITie following balances were extracted from the books of account of Viewpoint l imited:

Ksh.

Fixed Assets 2,000.000

Current Assets 500,000

Current liabilities 150,000

Capital 2.350,000

(a) Calculate the company’s current ratio.

(b) Compare the ratio in (i) above with the industry‘s ratio of 2:1. (2 marks)

10. Highlight two advantages of internal financing loan organization.

Outline Tour factors which influence the choice of finance for a business.

Outline Tour factors which influence the choice of finance for a business.

Tie following is the capital structure ofNakum Ventures Limited.

190,000 ordinary shares of Ksh. 20 each 2.000,000

Retained earnings 800,000

12% preference shares of Ksh. 10 each 1,000,000

13% debentures 900,000

The company paid ordinary dividend of Ksh. 3 per share. The ordinary shares arc currently selling at Ksh. 25 per share. The preference shares arc selling at Ksh. 16 per share. The corporation lux rate is 30%

(i) Calculate the cost of each component of capital.

(ii) Calculate the Weighted Average Cost of Capital < WACC).

Explain four differences between ordinary shares and preference shares.

The follow ing information relates to material B24 of a tirm,

Maximum consumption

Minimum consumption

Lead time

Economic Order Quantity

(FOQ)

7,500 units

3,400 units

2-4 weeks

10,500′

Calculate each of the following;

(i) Re-order level;

(ii) Minimum stock level;

(in) Maximum stock level;

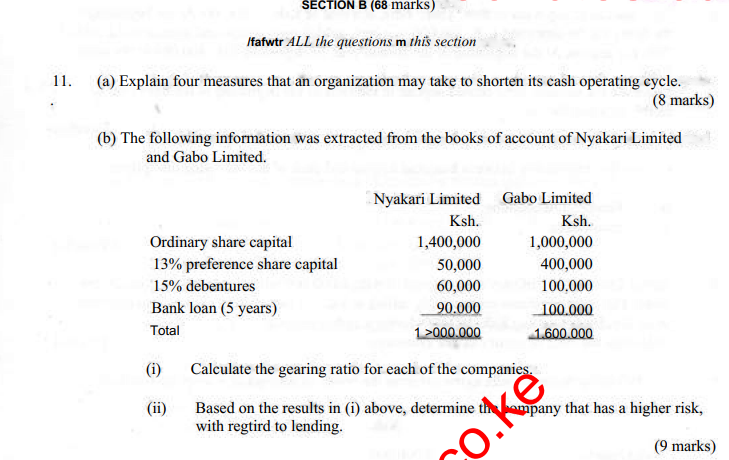

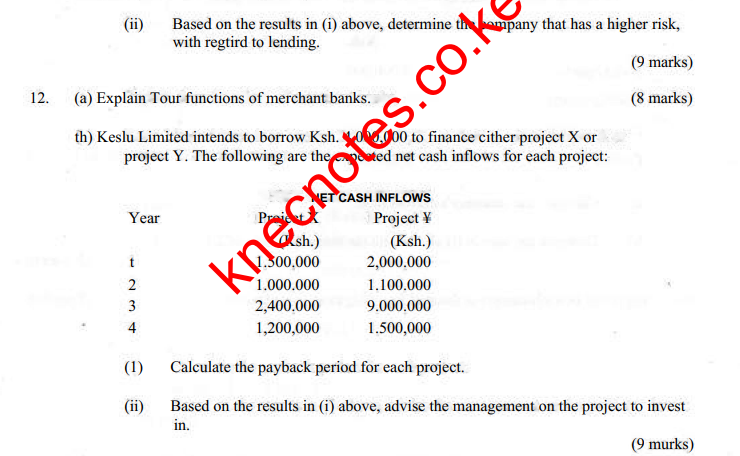

(iv) Average stock level.