9.1 Phases of the Business Cycle

Four phases of the business cycle are identified as follows

- A peak is when business activity reaches a temporary maximum with full employment and near-capacity output.

- A recession is a decline in total output, income, employment, and trade lasting six months or more.

- The trough is the bottom of the recession period.

- Recovery is when output and employment are expanding toward full employment level.

9.2 Unemployment:

Unemployment generally refers to a state/situation where factors of production (resources) are readily available and capable of being utilized at the ruling market returns/rewards but they are either underemployed or completely unengaged. When referring to labour, unemployment is considered to be a situation where there are people ready, willing and able to work at the going market wage rate but they cannot get jobs. This definition focuses only on those who are involuntarily not employed. It is noteworthy to mention here that all countries suffer unemployment but most developing countries experience it at relatively higher degree, and the following can be some of the causes.

9.2.1 Types and Causes of Unemployment

1. Transitional unemployment: Transitional unemployment is that situation which prevails due to some temporary reasons. The main reason for this type of unemployment are:

Turnover unemployment: Some individuals leave their present jobs and make efforts to secure better ones and in this way, they remain unemployed for some time.

Casual unemployment: Casual workers are employed for a specific job and when the job is competed, such workers become eventually unemployed. E.g. shipping or building construction workers.

Seasonal unemployment: Some industries, for instance have seasonal demand and their produce is manufactured for a specific period of time (a specific period of the year). The workers of such industries remain unemployed for that time e.g. ice factories may remain closed during winter.

2. Structural unemployment: Caused by structural changes such that there exist:

Cyclical unemployment: During depression, prices are too low and profit margins remain distinctively low. In this case, investment decreases and unemployment increases.

Technological unemployment: Due to inappropriate technology. Technology is not inappropriate per se but in relation to the environment in which it is applied. In most developing countries, most production structures tend to be labour saving (capitalintensive), which is not appropriate as these countries experience high labour supply. Capital – labour ratios tend to be high in these countries implying that less labour is absorbed compared to capital in production undertakings causing unemployment.

Industrial change: The establishment of new industries decreases the demand for the products of existing industries e.g. the rapid increase in the demand for Japanese industrial products is one reason for greater unemployment in some European countries.

Keynesian unemployment: According to Keynesian theory of income and employment, unemployment occurs due to lack of effective demand. If effective demand is less, production of goods and services will fall which will further result in the unemployment of labour. Another feature of Keynesian unemployment is that unemployment of labour is associated with unemployed capital such as plant and

machinery which tend to be idle during depression.

Urban unemployment: Due to availability of more facilities in urban areas, more and more people tend to move to these areas. The employment opportunities are not sufficient to absorb all those people who settled in the urban areas. This kind of unemployment is therefore due to rural-urban migration.

Disguised unemployment: Situation where some people are employed apparently, but if they are withdrawn form this job, total production remains the same. In most developing countries this type of unemployment is estimated at 20 to 30% and measures should be taken to employ such people in other sectors of the economy.

3. Insufficient Capital: Shortage of capital is a hindrance in the establishment of more industries and other productive installations, and due to this reason, more employment opportunities are not created.

4. Nature of education system: Education systems for most developing countries are whitecollar oriented, yet the nature of productive capacities of these economies are not sufficiently supportive. Moreover, inadequate education and training facilities render(s)

most people unable to secure those job opportunities that require high skills and specialized training.

5. Rapidly increasing population: The rate of growth in population exceeds the amount of job opportunities that the economy can generate.

Thus in summary, of the causes of unemployment in developing countries can be said to include:

- Rapidly increasing population

- Inappropriate technology

- Insufficient capital base

- Demand deficiency/structural changes

- Presence of expatriates

- Education Systems – white-collar orientation

- Rural-urban migration

- One person for more than one job

- Corruption and general mismanagement

- Inadequate knowledge on market opportunities

Cost of Unemployment

Unemployment is a problem because it imposes costs on society and the individual. The cost of unemployment to a nation can be categorized under three headings: the social costs, the cost to the exchequer and the economic cost.

The Social Cost of Unemployment

- For the individual, there is the demoralizing effect which can be devastating particularly when they are old. This is because as some job seekers become more and more pessimistic about their chances of finding a job, so their motivation is reduced and their changes of succeeding in finding jobs become even more remote.

- Many of the longer-term unemployed become bored, idle, lose their friends and suffer from depression

- There is also evidence of increased family tension leading in some cases to violence, infidelity, divorce and family breakups.

- Unemployment may also lead to homelessness, as in some circumstances building societies may foreclose on a mortgage if the repayments are not kept up.

- Long-term unemployment may also lead to vandalism, football, hooliganism and increases in the crime rate and insecurity in general.

The cost to the exchequer (Ministry of Finance)

- There is increasing dependency ratio on the few who are employed in the form of:

- The loss of tax revenues which would otherwise have been received: This consists mostly of lost income tax but also includes lost indirect taxes because of the reduction in spending.

- The loss of national insurance contributions which would otherwise have been received

The economic cost

Unemployment represents a terrible waste of resources and means that the economy is producing a lower rate of output than it could do if there were full employment. This leads to an output gap or the loss of the output of goods and services as a result of unemployment.

REMEDIES FOR UNEMPLOYMENT

The measures appropriate as remedies for unemployment will clearly depend on the type and cause of unemployment. Broadly they can be divided into:

- Demand management or demand side policies

- Supply side policies.

Demand management policies

These policies are intended to increase aggregate demand and, therefore the equilibrium level of national income. They are sometimes called fiscal and monetary policies. The principal policy instruments are:

- Supporting declining industries with public funds

- Instituting proper demand management policies that increase aggregate demand including

exploiting foreign and regional export markets. This can be done by increasing government expenditure, cutting taxation or expanding the money supply. - Promoting the location of new industries in rural areas which will require an improvement of rural infrastructure.

Supply-side policies

Supply-side policies are intended to increase the economy‘s potential rate of output by increasing the supply of factor inputs, such as labour inputs and capital inputs, and by increasing productivity. They include:

- Increasing information dissemination on market opportunities.

- Reversing rural-urban migration by making rural areas more attractive and capable of providing jobs. This particularly is the case in developing countries where rural-non-farm opportunities offer the longest employment opportunities.

- Changing attitude towards work i.e. eliminating the white-collar mentality and creating positive attitudes towards agriculture and other technical vocational jobs.

- Provision of retraining schemes to keep workers who want to acquire new skills to improve their mobility.

- Assistance with family relocation to reduce structural unemployment. This is done by giving recreational facilities, schools, and the quality of life in general in other parts of the country even the provision of financial help to cover moving costs and assist with home purchase.

- Special employment assistance for teenagers many of them leave school without having studied work-related subjects and with little or no work experience.

- Subsidies to firms which reduce working hours rather than the size of the workforce.

- Reducing welfare payments to the unemployed. There are many economists who believe that welfare payments have artificially increased the level of unemployment.

- Reduction of employee and trade union rights.

9.3 Inflation

Definition: Inflation is a rising general level of prices (not all prices rise at the same rate, and some may fall).

Causes and theories of inflation:

1. Demand-pull inflation: Spending increases faster than production. It is often described as ―too much spending chasing too few goods.‖

2. Cost-push or supply-side inflation: Prices rise because of rise in per-unit production costs (Unit cost = total input cost/units of output).

- Output and employment decline while the price level is rising.

- Supply shocks have been the major source of cost-push inflation. These typically occur with dramatic increases in the price of raw materials or energy.

Complexities: It is difficult to distinguish between demand-pull and cost-push causes of inflation, although cost-push will die out in a recession if spending does not also rise.

Redistributive effects of inflation:

The price index is used to deflate nominal income into real income. Inflation may reduce the real income of individuals in the economy, but won‘t necessarily reduce real income for the economy as a whole (someone receives the higher prices that people are paying). Unanticipated inflation has stronger impacts; those expecting inflation may be able to adjust their work or spending activities to avoid or lessen the effects. Fixed-income groups will be hurt because their real income suffers. Their nominal income does

not rise with prices. Savers will be hurt by unanticipated inflation, because interest rate returns may not cover the cost of inflation. Their savings will lose purchasing power. Debtors (borrowers) can be helped and lenders hurt by unanticipated inflation. Interest payments may be less than the inflation rate, so borrowers receive ―dear‖ money and are paying back ―cheap‖ dollars that have less purchasing power for the lender.

If inflation is anticipated, the effects of inflation may be less severe, since wage and pension contracts may have inflation clauses built in, and interest rates will be high enough to cover the cost of inflation to savers and lenders. ―Inflation premium‖ is amount that interest rate is raised to cover effects of anticipated inflation. ―Real interest rate‖ is defined as nominal rate minus inflation premium. (See Figure 26.5)

Output Effects of Inflation

- Cost-push inflation, where resource prices rise unexpectedly, could cause both output and employment to decline. Real income falls.

- Mild inflation (<3%) has uncertain effects. It may be a healthy by-product of a prosperous economy, or it may have an undesirable impact on real income.

- Danger of creeping inflation turning into hyperinflation, which can cause speculation, reckless spending, and more inflation (see examples in text of Japan following World War II, and Germany following World War I).

9.4 Inflation and Unemployment

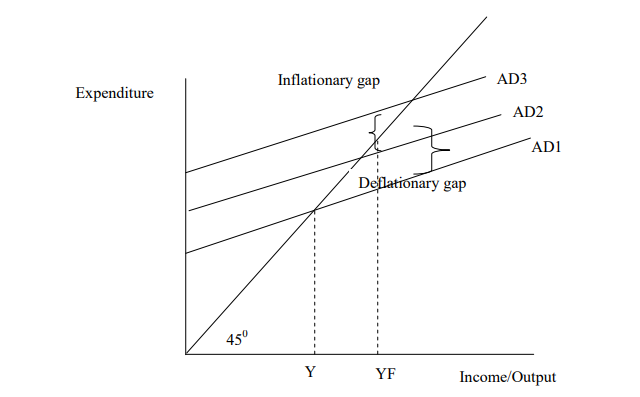

For many years it was believed that there was a trade-off between inflation and unemployment i.e. reducing inflation would cause more unemployment and vice versa. This relationship was explained using a simple Keynesian model using a diagram as follows:

The model was developed in the 1930s when there was large-scale unemployment which led Keynes to focus on the problem of the ―deflationary gap‖. This situation in which aggregate spending is less than that required to employ all those who wish to work at the prevailing wage level. This is illustrated in the figure above by the aggregate demand function AD1. Here the equilibrium level of national income is Y. If aggregate demand is increased by an additional injection or reduced by fewer withdrawals the aggregate demand function can be shifted upwards. This extra demand encourages investment and via the multiplier additional demand

and hence employment until aggregate demand reaches AD2 and helps to produce full employment YF.

Beyond the point of full employment where all resources are committed, any increase in aggregate demand to say AD3 cannot increase real output and thus an inflationary gap occurs which can only be filled by using prices. If there are unemployed resources in the economy and aggregate demand increases then unemployment will be reduced and prices will remain steady. If whenever the economy is already at the full employment level, any additional increase in aggregate demand will force up prices but have little effect on the level of real output and employment. In the 1950s the nature of the relationship between inflation and unemployment

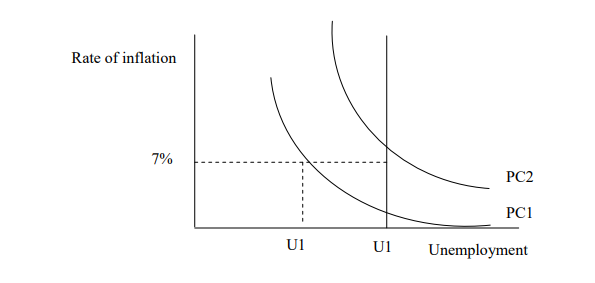

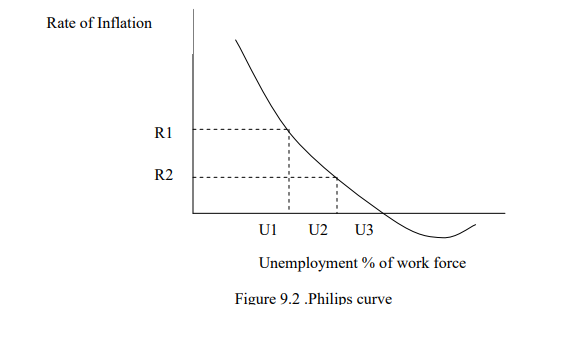

was stated in more precise form by Prof. A. W. Philips. He studied the relationships between the variables over the period 1862 and 1958 for the UK. The statistical relationship he found can be represented in diagrammatic form as in the figures below.

The negatively sloped curve indicates that the lower the rate of unemployment, the higher the rate of inflation. At a lower rate of unemployment like U1, when aggregate demand is high and there are inflationary pressures, the Philips curve suggests there will be a high rate of inflation R1. When unemployment rise to U2 the inflation falls to R2. Finally when unemployment falls to U3 the rate of inflation has fallen to zero and any further increase in unemployment is predicted by this model to give negative inflation/falling prices.

Because of the empirical evidence in support of this relationship over a long period, in most countries, politicians and their economic advisors felt confident during the 1950s and 1960s thatthey could by appropriate demand management exercise a degree of control over unemployment. They could then trade off lower unemployment for a little more inflation. The behaviour of inflation and unemployment in the 1970s however, casts doubts on what had seemed to be a well established relationship. In contrast with previous experience both inflations and unemployment increased during the 1970s giving rise to the phenomena labeled ―stagflation‖. Though inflation came down in many countries in the 1980s and 1990s, the level of unemployment remains alarmingly high. In brief, the relationship predicted by the Philips model no longer held. A new theory, or at least a significant amendment to the existing theory

was required to explain the relationship between the variables. This was supplied by monetarists and the neo-classical. This amended theory attributes a major role to expectations which various key groups within the economy have about future levels of inflation and redefines the concept of full employment from the Keynesian one of demand deficient or involuntary unemployment to the rate at which there exists no inflationary pressure on wages. This ‗natural rate of unemployment‘ exists where the demand and supply of labour are in rough overall balance in the labour market. The magnitude of this natural rate of unemployment depends, it is claimed, on such factors as the effectiveness of the labour market, the strength of trade unions, the level of social security benefits and the extent of competition or monopoly. The amended model of the relationships between inflation and unemployment can be elaborated upon more easily by the use of a diagram similar to that below and widely referred to as the ‗expectations-augmented Philips

curve‘.