2.1 Introduction

A bridging loan is an advance given to a borrower for the purpose of completing a particular purchase with the source of repayment coming from the sale of another property in the near future.

There are two types of bringing loan facilities:

- Open ended bridge loan

- Closed ended bridge loan

2.2 Closed Ended Bridge Loan

This means that the borrower has already identified buyer a buyer for the existing property which is the main source of repayment of the advance. Its one where contracts have been exchanged with a clear completion date on the sale of an existing property which represents the key source of repayment. Since such contracts are legally binding the lending risks are lower now provided a lawyers oath / undertaking is obtained to ensure sale proceeds are received by the bank. Exchange of contracts does not however guarantee that a sale will take place and problems can still arise in the full circumstances.

- The buyer may not have the finance to complete the purchase. However, a reputable lawyer cannot allow contacts to be exchanged if the necessary resources to complete the contract are not available but it can happen. Close liaison with the lawyer / advocate is essential indirectly through buyer’s lawyers. It’s also becoming common for buyer to deposit 10% of the value of property to be purchased as a show of commitment to purchase the property.

- Completion of the contract maybe conditional. For example the buyer might have an option to withdraw from a purchase of property being built / improved if works are not finished on time. Alternatively completion maybe dependent the buyer

having a mortgage. - Although fixtures and fittings maybe forming a significant part of the purchase price, they may not form part of lenders security if things go wrong. A full valuation of the property should be taken and if significant be included as part of security. However such valuation is not always taken in a bridging situation particularly if bridging appears to be closed.

- Collision between buyer and seller, they might mutually agree not to go ahead with the transaction in such a situation there is nothing a lender can do to ensure the transaction go ahead in such circumstances and care should be taken when its

known that the buyer and seller are related. - Fees and finance costs.

NB: The safest course of action when in doubt completion will take place is to treat the facility as an open ended bridge loan.

2.3 Open Ended Bridge Loan

This occurs especially where contacts regarding the sale of an existing property which represent source of repayment have not been signed for the loan to be advanced to purchase a new property. A lender should not consider an open ended bridge loan unless:-

- The property market in question is a buoyant and it looks like staying that way in immediate future.

- An early sale of the existing property is in prospect i.e. a definite buyer has been found although contact have not been signed.

- There is a substantial margin to cover all contingencies. The expected net sale proceed should be able to pay the loan plus twelve month accrued interest and at the same time allow for 20% reduction in the asking price.

2.4 General Considerations

- The advance for property purchase must be made on a loan account in order for any tax benefits to be claimed.

- Where the deposits only is being advanced its still necessary to access the complete transaction incase problems arise.

- Written confirmation must be obtained from the borrower’s lawyer that contract for both sale and purchase have been obtained.

- Lawyer undertaking or oath should be obtained in respects of monies due or deeds to come. Consideration to be given to take formal charges over the property especially if the bridge is open ended.

- Where the source of repayment is a mortgage from another lender confirmation are required of the amount and when it’s due together with an undertaking to send money to the bank. If part of borrower’s contribution is to come from other sources similar considerations may apply.

- If the loan is being provided to be to build properly ensure:-

Builders are reliable

The contract is either fixed price or reasonable terms.

Advances are only made against architect’s certificates at pre-determined stages of development.

7. Realistic valuation should place in property

8. Full insurance cover is essential as soon as contracts are exchanged.

9. Status enquiry is necessary for lawyers unknown to the bank.

Example 2.1

Mr. and Mrs. Smith have been customers of your branch for 15 years. A house they have always liked has come on the market and they wish to buy it. The vendor is looking for a quick sale and will sell to the first people who can exchange contracts. The Smiths wish to offer the asking price of Kshs 8.5m. A local estate agent has suggested that their present house is worth Kshs. 5m, there is a mortgage of Kshs 2.5m outstanding. Smith is 40 years old and currently earns Kshs.2.3m per year. His wife is 38years old and earns Kshs.500, 000 per year. Smith has approached his building society which has agreed to lend him Kshs.5.5m to acquire the new property. You are aware that Smith has just over Kshs 1m invested in the building society.

The estate agent will charge 2% of the sale value and the Smith lawyer has indicated that he will charge Kshs 50,000 on the sale and Kshs 75,000 on the purchase.

Assume stamp duty is 1% and base rate is expected to be 10% for foreseeable future. The Smith wish to exchange contract for the purchase as soon as possible. They call to see you and ask for a bringing loan.

Required:-

- Identify the type of bringing loan

- Set out advice will give to the Smiths and your decision giving reason for each. Show in full calculations how you illustrate your reasoning.

- Indicate what further steps you might take to help the Smiths achieve their dream.

- List the conditions you wish to fulfilled to protect both Smiths and the bank position if the loan was granted.

- Ignore all costs except those mentioned above.

Solution

1. This is an open ended bridge loan

Reasons – buyers not identified

– The contracts have not been exchanged.

2. Apply CAMPARI

Initial reaction: character, connection and capital.

The bank has no adverse information concerning them. Someone earning 2.3m per year is not a kind of customer can any lending institutions can wish away. There is evidence that they have saved Kshs1m from their personal earnings. As far as connections are

concerned no information has been given. Because the Smith has banked with you for 15 years without problem, the bank should assist if at all possible. However this being an open ended bridge the bank requires substantial margins between the anticipated

outgoings and the anticipated income to cover the following:-

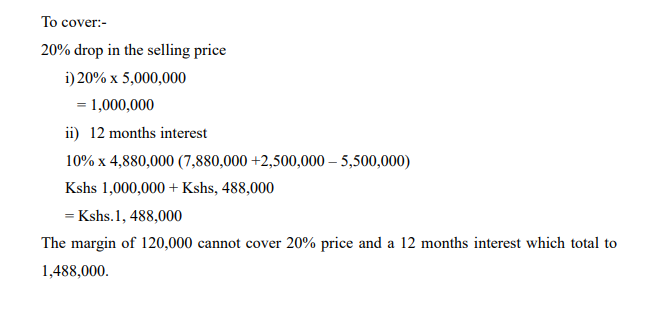

- 20% drop in the selling price of the existing house should a quick sale become essential if the house stays for one year before being sold.

- Interest for 12 months in the bridging loan.

- If there are outside assets available or if there is sufficient income then the bank required regarding margin can be relaxed

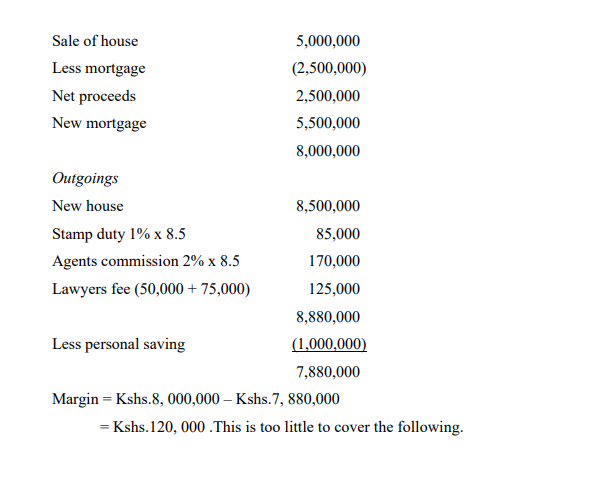

The margin is calculated as below:

Income Kshs

Decision

On the facts presented the bank must decline.

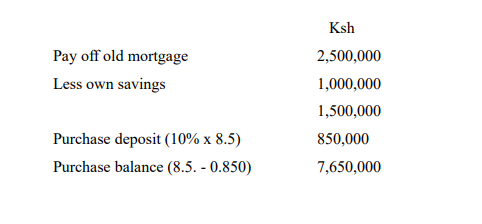

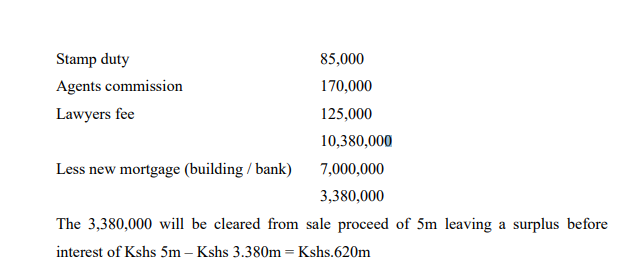

Remoulding the proposition

- If the Smith were granted a mortgage of Kshs.7,000,000 this will cover both the reduction of 1m and ones year interest of Kshs.488,000

- The Smiths have saved Kshs.1m therefore showing ability to save from income. They have already financed Kshs.2.5m without problems.

- The Kshs. 7m new mortgage should come with banks house purchase criteria as regard salary and equity in the house.

Conditions

- Ensure that the Smiths can meet the bank criteria for Kshs.7m mortgage.

- Ensure other commitments can be met e.g. food, clothing, entertainments etc.

- If the bank is satisfied on the above bank mortgage but give the Smith opportunity to apply for larger mortgage from building society.

- Value existing house to ensure it can sell within a reasonable time for Kshs.5m. Confirm amount outstanding on the present mortgage by sight of the building society statements.

- Professional relation of new property should be undertaken to meet mortgage criteria

- Pay off the Kshs.2.5m mortgage taking a legal charge over the deeds / land certificates.

- Release the documents to Smith lawyer against his/her understanding in a standard bank form to remit the net sale proceeds to the bank. Take a status report on the lawyer if he/she is known by the bank.

- Lend the purchase balance of new property against the standard undertaking so that the bank will obtain a mortgage assuming the bank has provided a

- Insurance cover is required on new property from the date of exchange of contract. The bank should facilitate insurance

- Lend as follows:-

The bank will lend on a separate loan account for ease of control and to enable customer obtain tax relief.

Other appropriate services offer insurance and other contents and appropriate insurance to cover mortgage e.g. mortgage protection policy or endowment policy.

Additional Risks in Open-ended Bridging loans

Consider

- Delay in the sale; leading to

- Excessive interest accruing; leading to

- Seller reducing the selling price, thereby eroding the surplus needed to repay the loan.

Generally, if you are assisting a customer with an open –ended bridge, allow a margin in your calculations to cover a 20% drop in the sale price and 12 months’ interest at least. In times of falling or static house prices or rising interest rates these figures should be

increased. Typically the security taken would consist of a first charge over the house being purchased and a second charge over the house being sold, if it is not already charged to the bank.

Before lending you must satisfy yourself that:

- There are readily realizable assets to repay the advance quickly.

- The solicitors handling the estate are reliable and trustworthy

- The executors or administrators are of good integrity and financial standing as bank is effectively lending to them.

2.5 Lending to Executors and Administrators

This is usually needed by the personal representatives of a deceased to:

- Settle estate debts prior to grant of probate or letters of administration.

- Pay inheritance tax to enable a grant of probate or letters of administration to be obtained.

- Lend after receipt of grant of probate or administration to wind up the estate.

You will be lending entirely on the personal liability of the personal representatives who must b e asked to sign the standard bank mandate, thereby accepting joint and several liability on the account. Property previously charged by the deceased is not available for

new borrowing unless recharged by the personal representatives.

Banks normally agree to assist if they are satisfied that the:

- Personal representatives and the solicitor are of the highest integrity.

- Amount to be borrowed is justified and reasonable; and the

- Advance can be repaid quickly from the realization of liquid asses.

Probate / inheritance tax advances

If a customer dies and his estate is large enough (over £200,000 in the year 1996 / 7, but this figure tends to increase with each Finance Act), then his executors may have to pay any inheritance tax, currently at 40%, on the value of the estate, before probate or

authority to realize the estate assets is granted. Banks are often asked by the executors or administration to assist a ‘catch 22’ situation exists. Without probate the executors cannot sell estate assets to pay the inheritance tax, but they cannot usually afford to pay the

inheritance tax without realizing such assets.

In these circumstances good status replies from bankers are necessary. Furthermore you will clearly wish to see the deceased‘s death certificate and will, if available. If there are credit monies held by the bank in the name of the deceased, this is some comfort. If

he/she was in debit, the borrowing as well as the inheritance tax liability must be covered by the liquid assets in the estate.

Banks will be very conservative in their valuation of the estate assets, particularly where property has to be sold on a weak market. If borrowing is requested to carry on a business, you must check the will to ensure that the executors have the authority to do

this. Inheritance tax advances are taken on separate loan account in the joint names of the executors / administrators. As security a ‘first proceeds form’ is signed by the executors giving the bank right to repayment from the first proceeds realized.

2.6 Lending to Trustees

Trustees are similar to executors and administrators and they must be persons of high integrity. A bank mandate specifying joint and several liability must be taken, otherwise they are only jointly liable. You should lend on overdraft against personal liability of the

trustees or on loan account if the trustees are able to charge trust assets (as they have no implied power to do this, so specific authority must be requested and checked).

2.7 Lending to Clubs and Associations

If these are not registered companies, thy do not have contractual powers and cannot be sued for their debts. Their members are not personally liable and it seems that committee members may not be either. If lending, follow he normal canons of lending and ensure that personal liability is held, usually by lending on a separate account to responsible officers or by taking their guarantees if lending to the club itself. In the latter case, check that the club rules permit it to borrow. Club property is held in names of trustees and if taken as security, specific powers for the trustees to charge security and to borrow must be held and adequately verified.