UNIVERSITY EXAMINATIONS: 2018/2019

EXAMINATION FOR THE DEGREE OF BACHELOR OF SCIENCE IN

INFORMATION TECHNOLOGY/ BACHELOR OF SCIENCE IN

APPLIED COMPUTING

BIT 1309: FINANCIAL MANAGEMENT FOR IT

FULL TIME/PART TIME/DISTANCE LEARNING

DATE: AUGUST, 2019 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One & ANY OTHER TWO questions.

QUESTION ONE

a) Briefly explain six Users of Accounting Information and their need for such information

(6 Marks)

b) Explain the nature of Accounting Equation (5 Marks)

c) Phillips, a sole trader specialising in material for Asian clothing, has the following purchases

and sales for March 2017:

Mar 1 Bought from Smith Stores: silk shs4000, cotton shs8000.

8 Sold to A. Grantley; lycra goods shs2800, woollen items shs4400

15 Sold to A. Henry: silk shs3600, lycra shs14400, cotton goods shs12000.

23 Bought from C. Kelly: cotton shs8800, lycra shs5200.

24 Sold to D. Sangster: lycra goods shs4200, cotton shs4800.

31 Bought from J. Hamilton: lycra goods shs27000

d) Required:

i. Prepare the purchases and sales day books of C. Phillips from the above, (5 Marks)

ii. Post the items to the personal accounts. (5 Marks)

iii. Post the totals of the day books to the sales and purchases accounts. (5 Marks)

iv. d) Prepare a trial balance as at 31st March 2017 (4 Marks)

QUESTION TWO

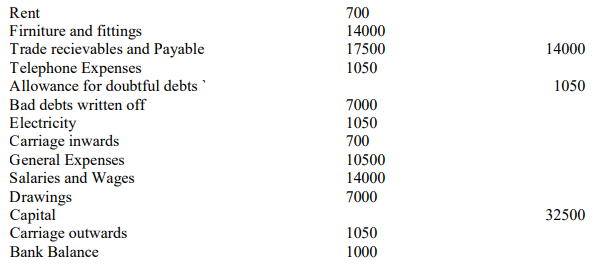

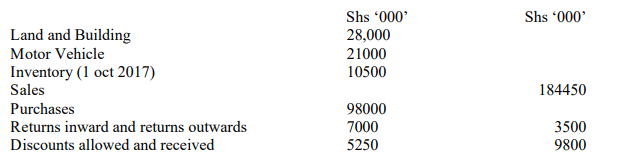

Jamboree Katambi runs Wholesale business selling children clothing her trial balance for the

year ended 30th September 2018 was as follows

Additional information

i. Inventories as at 30th September 2018 was valued at Sh 7000,000

ii. Allowance for doubtful debts is to be increased by 10%

iii. Rent accrued as at 30th September 2018 amounts to Sh 525,000

iv. Electricity and Telephone bills prepaid as at September 2016 amount to Sh 175,000 and

525,000 respectively

v. General Expenses accrued as at 30th September 2018 amounts to Sh 700,000

vi. Depreciation is provided on motorvehicle and furniture anf fittinfs at 15% per annum

on cost

REQUIRED

a) Income Statement for the year ended 30th September 2018 (12 Marks)

b) Statement of Financial Position as at 30 September 2018 (8 Marks)

QUESTION THREE

The following details are from the books of James Bogonko for the month of March 2018

“1 Balances brought forward: Cash Sh .230; Bank Sh .4,756.

“2 The following paid their accounts by cheque, in each case deducting 5 percent

“3 Discounts: R Burton Sh 140; E Taylor Sh. 220; R Harris Sh 800.

“ 4 Paid rent by cheque Sh.120.

“ 6 J Cotton lent us Sh 1,000 paying by cheque.

“ 8 We paid the following accounts by cheque in each case deducting a 21⁄2 per

cent cash discount: N Black Sh 360; P Towers Sh 480; C Rowse Sh 300.

“ 10 Paid motor expenses in cash Sh 44.

“ 12 H Hankins pays his account of Sh. 77, by cheque Sh 74, deducting Sh 3

cash discount.

“ 15 Paid wages in cash Sh. 160.

“ 18 The following paid their accounts by cheque, in each case deducting 5 per cent

cash discount: C Winston Sh 260; R Wilson & Son Sh 340; H Winter Sh 460.

“ 21 Cash withdrawn from the bank Sh 350 for business use.

“ 24 Cash Drawings Sh 120.

“ 25 Paid T Briers his account of Sh 140, by cash Sh 133, having deducted

Sh 7 cash discount.

“ 29 Bought fixtures paying by cheque Sh 650.

“ 31 Received commission by cheque Sh 88.

REQUIRED

a) Prepare a three column cashbook (12 Marks)

b) Balanced off, and the relevant discount accounts in general ledger ( 8 Marks )

QUESTION FOUR

a) Juja farm limited owns the following items of non-current assets on 1st January 2016

Machinery shs 500,000

Motor vehicles shs 780,000

Machinery were disposed on 1st October 2018

Machinery are depreciated at 20% on cost (straight line method) while the motor

vehicles are depreciated at 25 % reducing balance method

Required

i) Calculations for depreciation for each of the assets for the years 2016, 2017 and

2018 (4 Marks)

ii) Open the provision for depreciation accounts for each of the following;

Machinery

Motor Vehicles (4 Marks)

b)Explain the factors that cause depreciation on Plant, Property and Equipment’s (2Marks)

c) Giving Examples briefly explain the following concepts

i. Going Concern (2Marks)

ii. Materiality (2Marks)

iii. Accrual concept (2Marks)

d) Describe the need for use of computers in Accounting (4Marks)

QUESTION FIVE

a) The trial balance test does not detect the some kinds of errors. State and explain five such

errors (5 Marks)

b) Explain the qualitative characteristics of financial information (5 Marks)

c) Explain the role of audit in financial management of an organization resource (5 Marks)

d) Explain the relationship duality of accounting transaction and the principle of double entry

(5 Marks)