UNIVERSITY EXAMINATIONS: 2016/2017

ORDINARY EXAMINATION FOR THE DEGREES OF BACHELOR OF

SCIENCE IN INFORMATION TECHNOLOGY

BIT1309 FINANCIAL MANAGEMENT FOR IT

DISTANCE LEARNING

DATE: AUGUST, 2017 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One & ANY OTHER TWO questions.

QUESTION ONE [30 MARKS]

(i) Give a brief overview of the accounting cycle (4 Marks)

(ii) Relate the above cycle with the input- processing- output model of information systems

(6 Marks)

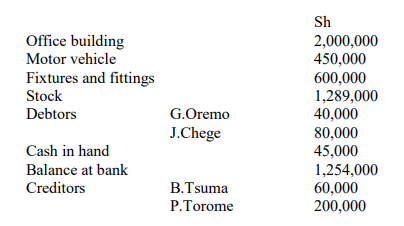

(iii) The following balances were extracted from the books of Sabila Ketani as at 1 October

2016.

Required: determine His capital as at 1 October 2016 (4 Marks)

(iv.) On 1 October 2016, Macklick had Sh.750,000 in the bank and Sh. 126,000 in hand.

During the month he had the following receipts and payments:

1 October Cash sale – receipt Sh.80,000

4 October Payment to supplier Mondo Sh.120,000

Payment of rent Sh.300,000

6 October Payment from credit customer Kapondi Sh.450,000

Payment from credit customer Bokelo Sh.250,000

10 October Cash sale – receipt Sh. 100,000

Payment to supplier Waswa Sh.500,000

15 October Payment of hire-purchase installment Sh.150,000

17 October Purchase of new machine Sh.1,200,000

19 October Cash sale – receipt Sh.370,000

21 Cash withdrawn from bank for office use 75,000

22 October Payment from credit customer Moseti Sh.600,000

24 October Payment of fuel bill Sh.175,000

26 October Interest received Sh. 25,000

29 Cash taken from cash till to pay fees for daughter Sh. 25,000

Required:

Prepare a two column cashbook and determine bank and cash balances at the end of the month

(10 Marks)

(v) The balancing of the trial balance is not an absolute proof of accuracy in the books of

accounts. Give examples of accounting errors that the trial balance may not help to disclose.

(6 Marks)

QUESTION TWO [20 MARKS]

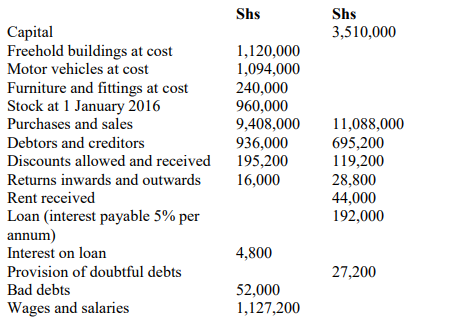

The following trial balance was extracted from the books of Wellington a sole trader, on 31

December 2016:

Notes:

1. Stock at 31 December 2016 was valued at Shs 1,360,000

2. Included in general expenses is sum of Shs 26,400 being expenses on electricity for domestic

use.

3. As at 31 December 2016, wages and salaries outstanding amounted to Shs 66,400.

4. Prepaid rates and insurance as at 31 December 2016 stood at Shs 12,000

5. Interest paid is only a half of the amount due for the year ended 31 December 2016.

6. Provision for doubtful debts is to be adjusted to 5% of the debtors.

7. Rent owing from a tenant who occupies a part of the building was Shs 40,000 as at December

2016.

Required:

a) Income statement ended 31 December 2016

b) Statement of financial position as at 31 December 2016 (20 Marks)

QUESTION THREE [20 MARKS]

Simon odunga runs a general groceries shop in Siakago. The following transactions relate to the

shop for the month of September 2015:

1 September: Cash in hand shs.31,400; Bank balance shs.50,800; Capital accounts shs.82,200.

3 “ Bought goods is cash for shs.8,200.

4 “ Purchased goods on credit from Muirurui Enterprises for shs.11,600

7 “ Sold goods on credit to Odero and Sons at shs.17,800.

10 “ Withdrew cash from the bank amounting to shs.1,000 for private use.

12 “ Sold goods on credit to Eric Gikomo at shs.12,800.

14 “ Paid shs.10,000 to Muiruri Enterprises in full settlement of their account.

15 “ Received shs.8,000 in cash from Eric Gikomo in part settlement of his account.

17 “ Goods worth shs.800 were returned by Eric Gikomo.

21 “ Purchased goods on credit at shs.17,400 from Chitala and Co.

24 “ Paid shs.12,000 to Chitala and Co. by cheque, discount allowed shs.600.

25 “ Purchased furniture on credit from Majiki Furniture Mart for shs.16,000.

26 “ Transferred shs.4,400 from the cash till to the bank account.

28 “ Goods worth shs. 1,200 were returned to Chitala and Co.

29 “ Goods worth shs.800 were taken by Simon Odunga for his personal use.

29 “ Paid shs.1,000 b7 cheque for advertising.

29 “ Paid wages to shop assistant in cash amounting to shs.3,600.

29 “ Made cash sales of shs.43,600.

29 “ Banked shs.40,000.

29 “ Received shs.11,800 in cash from Odero and Sons in part payment of their account after

allowing a discount of shs.200.

Required:

(a) Record the above transactions in the appropriate ledger accounts (15 Marks)

(b) Extract a trial balance as at 30 September 2015 (5 Marks)

QUESTION FOUR [20 MARKS]

(i) The following details were obtained for the records of Waumini for the month of May 2016.

May 1 Sold goods on credit to L. Long Shs800, S. Short Shs1250 and

B. Stone Shs1 620

May 3 Bought goods on credit from S. Lewis Shs730, J. Makoy Shs950

May 4 S. Short returned goods to us Shs370

May 8 Bought goods on credit from A. Ladi Shs840, B. Ready Shs1750

May 9 Returned faulty goods to B. Ready Shs500

May 10 Sold goods on credit to Tovadis Limited Shs1 290 less 10% trade discount

May 15 Credit purchases from S. Lewis Shs510, J. Makoy Shs 450

May 18 Returned goods to J. Makoy Shs190

May 24 Credit sales to L. Long Shs2 700, B. Stone Shs970

May 28 B. Stone returns some of the goods purchased on May 24, Shs180

May 30 Tovadis Limited returned goods with a list price of Shs200

Record the above transactions in the appropriate daybooks and determine the amount to be

transferred to the Sales a/c, Purchases a/c, Return Inwards and Return Outwards a/cs.

(10 Marks)

(ii) A company’s statement of profit or loss for the year ended 31 December 2016 showed a net

profit of Shs83, 600,000. It was later found that Shs18, 000,000 paid for the purchase of a motor

van had been debited to the motor expenses account. It is the company’s policy to depreciate

motor vans at 25% per year on the straight line basis, with a full year’s charge in the year of

acquisition. (6 Marks)

(iii) Discuss the main branches of accounting (4 Marks)

QUESTION FIVE [20 MARKS]

i. Define the term internal controls (2 Marks)

ii. Explain how information technology may be used to strengthen the system of internal

controls within an organization (6 Marks)

iii. Explain the benefits of computerized accounting system over a manual accounting

system (6 Marks)

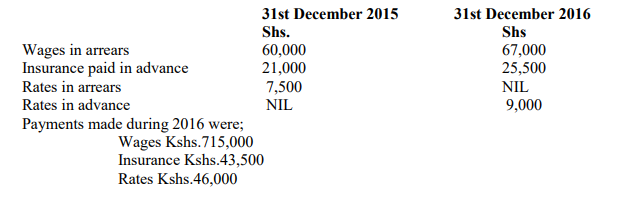

iv. The following information is provided to you by Salome Kim ;

31st December 2015 31st December 2016

Calculate the amounts he should transfer to the income statement for wages, insurance and rates

for the year 2016. (6 Marks)