UNIVERSITY EXAMINATIONS: 2013/2014

UNIVERSITY EXAMINATIONS: 2013/2014

ORDINARY EXAMINATION FOR THE BACHELOR OF SCIENCE

IN INFORMATION TECHNOLOGY

BIT 1309 FINANCIAL MANAGEMENT FOR IT

DATE: AUGUST, 2014 TIME: 2 HOURS

INSTRUCTIONS: Answer Question ONE and any other TWO

QUESTION ONE

a) Describe any Six users of financial statements. Within your description, comment on

the needs of each user. (12 marks)

b) Discuss the limitations of financial accounting (6 marks)

c) Computer technology has greatly improved the way financial information is prepared

and saved. This has also improved the internal control systems all the same,

information technology can potentially weaken the control systems. Explore the

positive and negative impacts of computers on the internal control systems of an

organization. (8 Marks)

d) Central machine tools purchased an industrial lathe to be used in its manufacturing

process. The purchase price was Kshs 6,200,000. The company incurred kshs

1,000,000 to transport the machine to its plant location plus Kshs. 300,000 shipping

insurance. In addition the machine had to be installed and mounted on a special

platform at a cost of Kshs. 1,200,000. After installation, several trial runs were made

to ensure proper operation. The cost of these trials including waste materials was

Kshs 600,000. At what amount should the Company capitalize the lathe machine?

(4 marks)

QUESTION TWO

(a) Mama Gatimu opened a general grocers shop on 1 January 2014. She had shs.112,000

cash out of which she deposited shs.100,800 into her bank account. She completed the

following transactions during the month of January.

January 3: Purchased goods from Kirika for shs.16,800 on credit

4: Paid half-year’s rent by cheque shs.67,200

5: Cash sales for week amounted to shs.82,200

Paid cash into bank shs.56,000

8: Purchased goods from P. Pundo on credit for shs.12,880

Purchased goods on credit from K. Kiige for shs.8,456

10: paid Kirika’s account by cheque in full settlement shs.15,120

12: Cash sales for the week amounted to shs.81,984

Paid cash into bank shs.67,200

Cash drawings by Mama Gatimu amounted to shs.11,200

18: Paid K. Kiige by cheque shs.8,456. Paid P. Pundo by cheque on account

shs.5,600

19: Made sales to Mukaria on credit shs.3,360

Cash sales for the week amounted to sshs.54,175

Paid cash into bank shs.56,000

22: Purchased goods from P. Pundo for shs.19,745 on credit

23: Bought a cash register from BuruBuru Printers on credit for shs.19,265

24: Mukaria settled his credit balance by cheque less 10% discount

30: Cash sales for the week amounted to shs.64,100

Drawings by Mama Garimu by cheque amounted to shs.2,240

Paid cash into bank shs.78,000

Required:

(i) A three-column cash book to record the above transactions. (13 marks)

b) The balancing of the trial balance is not an absolute proof of accuracy in the books of

accounts. Give examples of accounting errors that the trial balance may not help to

disclose. (7 marks)

QUESTION THREE

The following trial balance is extracted from the books of Earnest Mutembei, a sole

trader, at the close of business on 31 December 2013:

Shs Shs

Capital 16,700,000

Purchases 4,500,000

Sales 9,850,000

Purchase returns 27,000

Sales returns 80,000

Discount allowed 90,000

Discount received 68,000

Wages and salaries 3,051,000

Rates 240,000

Insurance 175,000

General expenses 405,000

Trade debtors 1,840,000

Trade creditors 1,605,000

Bank balance 381,500

Cash in hand 35,000

Stock in trade 1 January 2013 605,000

Land and building (cost) 8,500,000

Plant and equipment (cost) 6,100,000

Motor vehicle (cost) 3,000,000

Drawings 835,000

Loan from Small- Finance Co. 1,000,000

Loan interest 150,000

Bad debts ___25,500 _________

29,631,500 29,631,500

The following additional information is provided:

1. Stock at 31 December 2013 amounted to Shs 741,800.

2. Rates paid in advance on 31 December 2013 amounted to Shs 30,000.

3. Wages and salaries owing on 31 December 2013 were as 150,000.

4. Earnest Mutembei took goods worth Shs 200,000 for personal use.

5. The loan from small – Business Finance Co. attracted interest at 20% per annum.

The interest for the last three months of the year was not paid by 31 December 2013

6. Depreciation is to be provided on straight line basis as follows:

Plant and equipment – 25%

Motor vehicles – 20%

Assume that the above assets were acquired at the beginning of the financial year.

Required

a) Income Statement for the year ended 31 December 2013. (10 Marks)

b) Statement of Financial Position as at 31 December 2013. (10 Marks)

QUESTION FOUR

(a) (i) Define the term “depreciation” (2 marks)

(ii) Explain any two factors considered in allocation of depreciation (4 marks)

Jabali established his Hardware business and started trading on 1 January 2011. His

purchases and disposal of fixed assets over a period of three years Subsequent to

establishing his business were as follows:

Asset Date of purchase Cost (Sh) Date of Disposal Proceeds of Disposal

(Sh)

MSIE 1 1 January 2011 2,800,000

MSIE 2 1 January 2011 1,400,000 1 January 2013 504,000

MSIE 3 1 January 2013 3,920,000

Required:

Prepare the following as they would appear in the books of Jabali for the years ended 31

December 2011, 2012 and 2013 assuming that the firm charges depreciation at 20% per

annum calculated on the straight line basis:

a) Fixed assets account. (at cost) (4 Marks)

b) Provision for depreciation account (5 Marks)

c) Disposal of fixed assets account. (5 Marks)

QUESTION FIVE

a) Discuss the main differences between income and expenditure account and receipts

and payments accounts. (8 Marks)

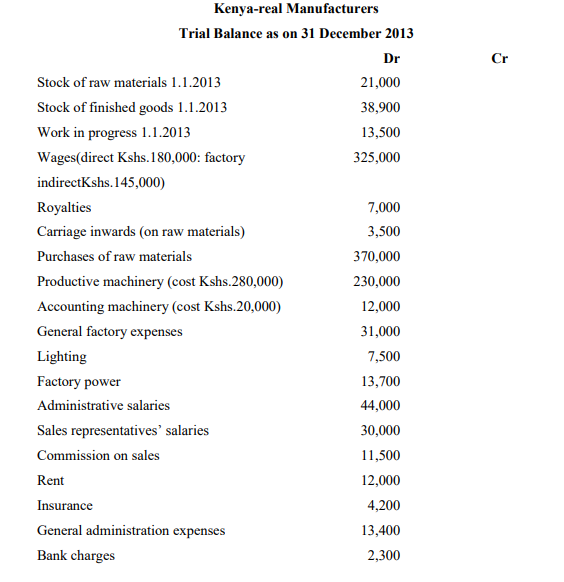

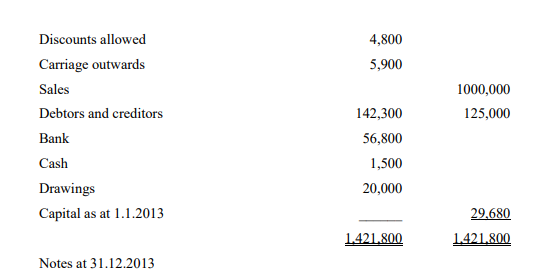

b) Kenya-real wine manufacturers presented the trial balance below

1. Stock of raw materials Kshs.24,000, stock of finished goods Kshs.40,000, work in

progress Kshs.15,000.

2. Lighting, and rent and insurance are to be apportioned: factory 5/6ths, administration

1/6th

.

3. Depreciation on productive and accounting machinery at 10 per cent per annum on

cost.

Required:

Prepare a manufacturing account and income statements for the year ended 31

December 2013. (12 Marks)