UNIVERSITY EXAMINATIONS: 2013/2014

UNIVERSITY EXAMINATIONS: 2013/2014

ORDINARY EXAMINATION FOR THE BACHELOR OF SCIENCE

IN INFORMATION TECHNOLOGY

BIT 1309 FINANCIAL MANAGEMENT FOR IT DISTANCE

LEARNING

DATE: AUGUST, 2014 TIME: 2 HOURS

INSTRUCTIONS: Answer Question ONE and any other TWO

QUESTION ONE

(a)

i). Discuss the main branches of accounting (4 Marks)

ii). Identify the input (data) – processing- output (information) components in the

financial accounting cycle. (6 Marks)

iii).Explain how information technology may be used to strengthen the system of internal

accounting controls. (6 Marks)

iv).Identify and describe four desirable characteristics of accounting information.

(4 marks)

v). Explain the benefits of computerized accounting environment over a manual

accounting environment. (4 Marks)

vi). The following information is provided to you by Wacu Wanderi ;

31st December 2011 31st December 2012

Shs. Shs

Wages in arrears 60,000 67,000

Insurance paid in advance 21,000 25,500

Rates in arrears 7,500 NIL

Rates in advance NIL 9,000

Payments made during 2012 were;

Wages Kshs.715,000

Insurance Kshs.43,500

Rates Kshs.46,000

Calculate the amounts he should transfer to the income statement for wages, insurance

and rates for the year 2012. (6 Marks)

QUESTION TWO

On 1 July 2014, Jacob Mapito started a groceries shop with a starting capital of Sh. 82

200 comprising Sh. 31 400 cash in hand and Sh. 50 800. The following transactions took

place in the month of July 2014:

2 July Bought goods for cash Sh. 8 200

6 July Purchased goods on credit from Jakaya Enterprises for Sh. 11 600 less

10% trade discount

7 July sold goods on credit to Odero and sons at Sh. 17 800 less 20% trade

discount

10 July Withdrew Sh. 1 000 in cash for private use

13 July Paid Sh. 10 000 in cash to Jakaya Enterprises in full settlement of their

account.

14 July Sold goods on credit to Eric at Sh. 12 800

15 July Received Sh. 8 000 in cash from Eric in part settlement of his account.

17 July Goods worth Sh. 800 were returned by Eric

21 July Purchased goods on credit at credit Sh. 17 400 from Mavoko Ltd.

24 July Paid Sh. 12 000 to Mavoko Ltd. By cheque. Discount allowed was Sh. 600

25 July Purchased furniture on credit from Majani furniture Mart for Sh. 16 000

27 July Eric was declared bankrupt and only paid Sh. 2 000 of the remaining debt.

28 July Goods worth Sh.1 200 were turned to Mavoko Ltd.

29 July Goods worth Sh. 800 were taken by Jacob Mapato for his personal use.

29 July Paid Sh. 1 000 by cheque as deposit for placing an advertisement.

30 July Made cash sales of Sh. 43 600 and banked Sh. 40 000

31 July Received in cash Sh. 11 800 from Odero and Sons in part settlement for

their account after allowing a discount of Sh. 200.

Required:

(a) Ledger accounts to record the above transactions (16 marks)

(b) Trial balance as at 31 July 2014 (4 marks)

QUESTION THREE

(a) Distinguish between a receipts and payments account and an income and expenditure

account. (6 marks)

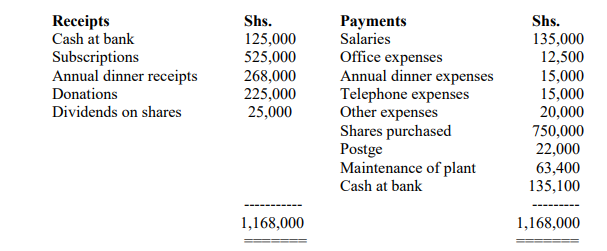

(b) The following is the receipts and payments account for Wazito youth Club as at 31

December 2013:

The following additional information is available:

1) The value of the building owned by the club stood at shs.5,000,000 as at 1 January 2013

with depreciation being provided at the rate of 2% per annum on cost.

2) The club had 200 members paying subscriptions at the rate of shs.2,500 per member per

annum.

3) As at 1 January 2013, no subscriptions had been received in advance, but subscriptions

were outstanding to the extent of shs.10,000 as at 31 December 2001 and shs.15,000 as at

31 December 2013.

4) Postage stamps in the custody of the secretary as at 1 January 2013 and 31 December

2013 were valued at shs.2,500 and shs.1,500 respectively.

5) The investment in shares as at 1 January 2013 stood at shs.50,000.

6) An amount of shs.2,500 in respect of annual dinner receipts was yet to be received as

at 31 December 2013.

7) Shs.25,000 for hire of the hall where the dinner was hosted is still outstanding.

8) Telephone service are paid for in advance to the extent of shs.3,000.

Required:

(i) Income and expenditure account for the year ended 31 December 2013. (7 marks)

(ii) Balance Sheet at 31 December 2013. (7 marks)

(Total: 20 marks)

QUESTION FOUR

i). Discuss the factors that cause assets to depreciate (4 Marks)

ii). Why is land not depreciated unlike other noncurrent assets? (2 marks)

iii).Discuss the main difference(s) between the two main methods of providing for

depreciation. You may use an illustration (4 marks)

The following information was extacted from the balance sheet Walibora farm

contractors as at 31 December 2013

Cost Accumulated depre’ NBV

Sh “000” Sh “000” Sh “000”

Tractors 2550 1350 1200

The following transactions took place during the year to 31 December 2013:

1. Disposals:

30 June 2013: Tractor A, which had originally been purchased for Shs 350,000 on

1 January 2008 was sold for Shs 100,000.

31 January 2013: Tractor B, which had originally been purchased for Shs

750,000 on 25 March 2011 was sold for Shs 250,000.

2. Additions

1 July 2013: The Company decided to acquire an additional Tractor C for Shs

750,000.

1 February 2013: Tractor D was purchased for 1,250,000.

3. The company uses straight line method of depreciation at 20% per annum on

original costs.

4. The company policy is to charge a full year’s depreciation in the year of

acquisition but no depreciation is charged in the year of disposal.

Required:

Draw up the tractors account, the provision for depreciation account and the tractor

disposal account for the year to 31 March 2013. (10 marks)

QUESTION FIVE

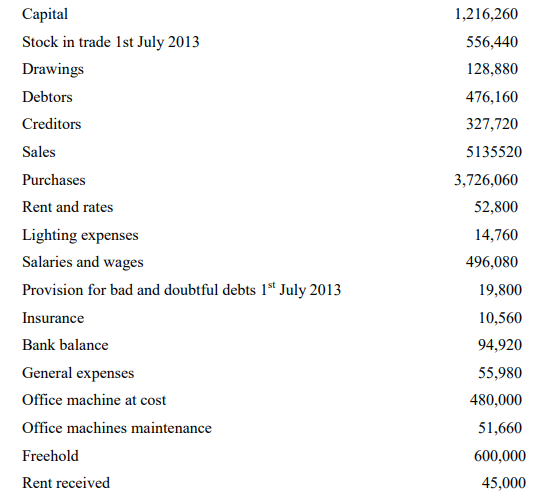

The following balances were extracted from the books of Derllamere a sole trader on

30th June 2014.

Required;

(a) Income Statement for the year ended 30th June 2014 (12marks)

(b) Statement of financial position as at 30th June 2014 (8 marks)