UNIVERSITY EXAMINATIONS: 2014/2015

SPECIAL/SUPPLIMENTARY EXAMINATION FOR THE

BACHELOR OF SCIENCE IN INFORMATION TECHNOLOGY

BIT 1309 FINANCIAL MANAGEMENT FOR IT

DATE: DECEMBER, 2014 TIME: 2 HOURS

INSTRUCTIONS: Answer Question ONE and Any Other TWO Questions

QUESTION ONE [30 MARKS]

(i) Define the term accounting and discuss the main branches of accounting.

(4 Marks)

(ii) If annual financial statements are to satisfy the information needs of their users,

the information that they contain must have characteristics related to the needs of

these users.

Identify and describe four desirable characteristics of accounting information.

(8 marks)

(iii) List four basic types of errors that the trial balance fails to disclose and provide an

example of each. (8 marks)

iv) On 1 October 2010, Nduundune had Sh.750,000 in the bank and Sh. 126,000

in hand.

During the month he had the following receipts and payments:

1 October Cash sale – receipt Sh.80,000

4 October Payment to supplier Mondo Sh.120,000

Payment of rent Sh.300,000

6 October Payment from credit customer Kapondi Sh.450,000

Payment from credit customer Bokelo Sh.250,000

10 October Cash sale – receipt Sh. 100,000

Payment to supplier Waswa Sh.500,000

15 October Payment of hire-purchase installment Sh.150,000

17 October Purchase of new machine Sh.1,200,000

19 October Cash sale – receipt Sh.370,000

21 Cash withdrawn from bank for office use 75,000

22 October Payment from credit customer Moseti Sh.600,000

24 October Payment of fuel bill Sh.175,000

26 October Interest received Sh. 25,000

29 Cash taken from cash till to pay fees for daughter Sh. 25,000

Required:

Prepare a two column cashbook and determine bank and cash balances at the end of the

month (10 marks)

QUESTION TWO

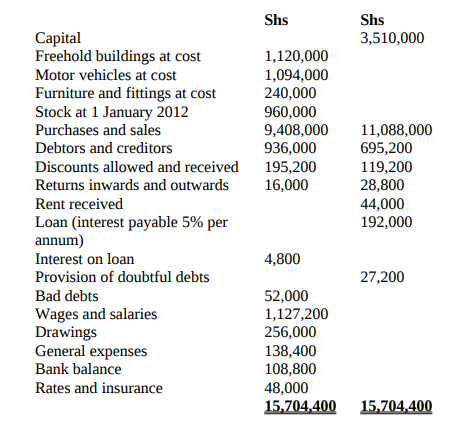

The following trial balance was extracted from the books of Maxwell a sole trader, on 31

December 2012:

Notes:

1. Stock at 31 December 2012 was valued at Shs 1,360,000

2. Included in general expenses is sum of Shs 26,400 being expenses on electricity for

domestic use.

3. As at 31 December 2012, wages and salaries outstanding amounted to Shs 66,400.

4. Prepaid rates and insurance as at 31 December 2012 stood at Shs 12,000

5. Interest paid is only a half of the amount due for the year ended 31 December 2012.

6. Provision for doubtful debts is to be adjusted to 5% of the debtors.

7. Rent owing from a tenant who occupies a part of the building was Shs 40,000 as at

December 2012.

Required:

a) Income statement ended 31 December 2012

b) Statement of financial position as at 31 December 2012 (20 Marks)

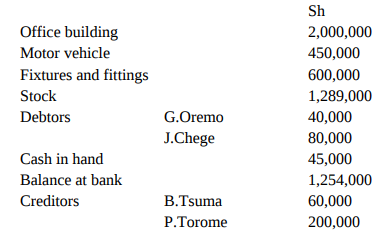

QUESTION THREE

The following balance was extracted from the books of Sibwor Otoyo as at 1 October

2009.

The following transaction took place in the month of October 2009:

October

1. Paid rent 15,000 by cheque.

2. bought goods on credit from B. Tsuma sh. 76,000 J.Terry sh.107,000

5. Sold goods on credit to K. Onyango sh. 134,000, R. Nguma sh.146, 000 and J. Chege.

Sh 158,000

7. Paid motor vehicle expenses in cash sh. 13,000

8. Sold goods on credit to R. Nguma sh. 22,000, J.Chege. sh.67, 000

8. Cash drawings for personal use sh. 20,000

9. Goods were returned by K. Onyango sh. 16,000 R. Nguma sh. 18,000

11. Bought another vehicle on credit from Africa Motors L.t.d. sh. 1,300,000

14. The following debtors settled their accounts as indicated below by cheque.

G. Oremo sh. 40,000

J. Chege sh. 305,000

K. Onyango total amount owing.

R. Nguma total amount owing

Each of the above debtors received a 5% cash discount since they settled the debt on

time.

19 Sibwor returned goods to J. Terry sh. 9,000.

goods are bought on credit from J. Terry sh 89,000 and P. Torome sh 72,000

22. paid the following creditors by cheque:

B. Tsuma total amount owed

P. Torome sh. 200,000

J. Terry initiated amount owed.

J. Matoke was granted 5% cash discount by each of the creditors.

26. Salaries are paid by cheque sh. 56,000

29. Rates are paid by cheque sh. 66,000

31. Africa Motor L.t.d. are paid by cheque sh. 1,300,000

Required.

Opening journal entry. ( 4marks)

Write up all the accounts and balance them as at 31st October 2009. ( 12 marks)

Extract a trial balance as at 31st October 2002. (4 Marks )

QUESTION FOUR

a) Give the accounting definition of the term depreciation (2 Marks)

b) Using a suitable example in each case explain the factors that cause the assets to

depreciate (6 Marks)

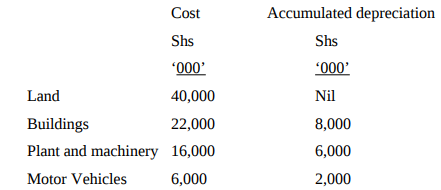

c) Embakasi Limited makes its accounts on 30 June every year. On July 2009, the company’s balance sheet included the following figures for property plant and equipment:

Cost Accumulated depreciation

A full year charge is made in the year of purchase and non in the year of disposal.

During the year ended 30 June 2010, the following transactions took place:

1. On January 2010 a plant which had cost Shs 3 million was sold for Shs 500,000. Accumulated depreciation on this plant on 30 June 2009 amounted to Shs 2.3 million. A

new plant was then purchased at a cost of Shs 4 million.

2. On 1 April 2010 a new motor vehicle was purchased for Shs 3000,000. To facilitate

the purchase one old motor vehicle acquired in april 2007 at Sh 1800,000 was disposed for Sh. 960,000

3. On 1 July 2009 constructed a building a cost of Sh. 15,000,000. This included the

cost of land Sh. 4500,000

Required:

a) The following ledger accounts to record the above transactions:

(i) Buildings account (2Marks)

(ii) Provision for depreciation: Buildings. (2Marks)

(iii) Plant and machinery account (2Marks)

(iv) Provision for depreciation: Plant and Machinery (2Marks)

(v) Motor vehicles account (2Marks)

(vi) Provision for depreciation: Motor vehicles (2Marks)

QUESTION FIVE

(i) Define the term internal controls (2 Marks)

(ii) Explain how information technology may be used to strengthen the system of internal

controls within an organization (6 marks)

(iii) Explain the benefits of computerized accounting system over a manual accounting

system (6 Marks)

(iv) The following information is provided to you by Wacu Wanderi ;

31st December 2011 31st December 2012

Shs. Shs

Wages in arrears 60,000 67,000

Insurance paid in advance 21,000 25,500

Rates in arrears 7,500 NIL

Rates in advance NIL 9,000

Payments made during 2012 were;

Wages Kshs.715,000

Insurance Kshs.43,500

Rates Kshs.46,000

Calculate the amounts he should transfer to the income statement for wages, insurance

and rates for the year 2012. (6 Marks)