MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATION

2018/2019 ACADEMIC YEAR

FIRST YEAR SECOND SEMESTER

SCHOOL OF BUSINESS AND ECONOMICS

BACHELORS OF COMMERCE, ECONOMICS, ECO0MICS AND

STASTICS, FINANCIAL ECONOMICS, SCIENCE IN AGRICULTURAL

ECONOMIS AND RESOURCE MANAGEMENT, HUMAN RESOURCE

MANAGEMENT AND EDUCATION.

COURSE CODE: BCM 1206

COURSE TITLE: FOUNDATIONS OF ACCOUNTINGN 2

DATE :23RD APRIL,2019 TIME:2.00 P.M- 4.00 P.M

INSTRUCTIONS TO CANDIDATES:

Answers question ONE and any other three.

QUESTION ONE.

a) Explain any three reasons why some businesses do not maintain a

complete set of accounting records. ( 3 marks)

b) On 31.12.2017, subscriptions paid in advance to Amani sports Club

amounted sh. 1,101,200 while those arrears amounted to sh. 1,600,000. As at

31.12.2018, subscriptions in arrears were sh. 2,100,000 and subscriptions

paid in advance amounted sh840,000. The receipts and payments account of

the club showed total subscriptions received in 2018 as sh. 3,220,000. Prepare

a subscriptions account to show the amount of subscriptions earned during

the year ended 31.12.2018 which is to be reflected in the income and

expenditure account. [4 MARKS]

c) Explain five differences between a partnership deed and a partnership Act.

[5MARKS]

d) Name two types of goodwill and explain how each is treated in the books

of accounts of partnerships. (4 marks)

e) Explain any six factors that influence the value of goodwill. (6 marks)

f) Explain the difference between prime costs and manufacturing overheads,

and highlight why they are charged to the manufacturing account and not the

trading profit and loss account. (3 marks)

QUESTION TWO.

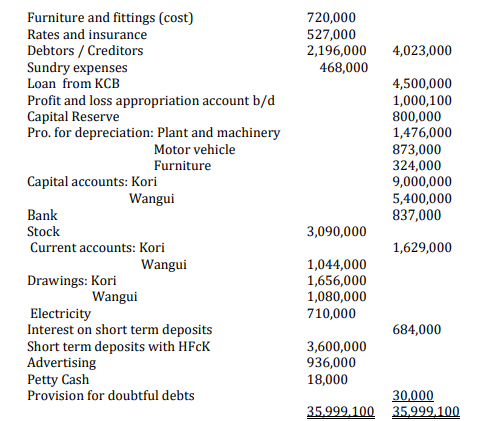

The following trial balance was extracted from the books of accounts of KOWA

partnership operated by Kori and Wangui partners for the period ended

31/12/2018 after preparing a trading account.

KOWA partnership Trial balance as at 31/12/2018

Trading gross profit

Additional information:

1. Debtors include an irrecoverable debt of 36,000

2. There was prepaid advertising prepaid expense of 60,000 as at

31.12.2018.

3. Provision for bad and doubtful was to be 5% of the outstanding debts.

4. On 2nd Jan. 2019 a bill of 480,000for water was received for the year

ended 31st Dec. 2018.

5. On 3rd Jan 2019 a credit note of 64,000 from a correction of an error in

meter reading for the month of December 2018 was received from

KPLC.

6. Kori had drawn a monthly salary of 45,000 as an active partner and the

total amount drawn had been included in salaries and wages account.

7. The loan from KCB had been raised on 1st July 2018 and was attracting

an interest rate of 20% p.a.

8. Partners were to be credited with interest on fixed capital account

balance at 12% p.a.

9. Kori and Wangui share profits and losses in the ratio of 2:1 respectively.

10. Depreciation was to be allowed as follows: Plant and machinery at

10% on reducing balance; Furniture at 15% on reducing balance and

motor vehicle at 25% on straight line method.

Required:

a) Prepare a profit and loss appropriation account for the period ended

31st Dec. 2018. ( 9 marks)

b) The partnership balance sheet as at 31st Dec. 2018. ( 6 marks)

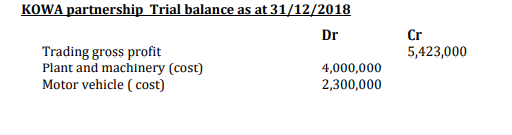

QUESTION THREE.

Men Conference Ltd has an authorized share capital of 60,000,000 ordinary

shares of Sh. 10 each and 500,000 shares of Sh. 50 each. The following trial

balance of the company was extracted as at 31.12 2018.

Issued and fully Paid share Capital:

Additional information.:

1. Closing Stock was valued at 41,000,000

2. Directors proposed to transfer 8,000,000 to general reserve and pay

dividends at 3%on ordinary shares.

3. Provide for depreciation of motor vehicles at 10% of cost and on

furniture and fittings at 10% on book value.

a) Prepare the company’s comprehensive income statement for the year

ended 31st Dec. 2018. (8 marks)

b) Statement of the financial position as at 31 December 2018. (7 marks)

QUESTION FOUR.

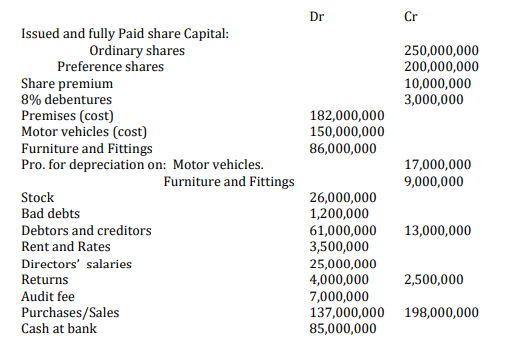

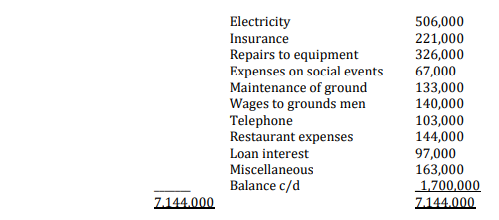

Kericho Sports Club has been operating for some time now. The treasurer

analysed the cash book and produced the following Receipts and Payments

account for the year ended 31st Dec. 2018.

Additional information:

1. Loan interest outstanding and miscellaneous expenses accrued as at 31st

Dec. 2018 were 33,000 and 75,000 respectively.

2. Depreciation on pavilion for the year was 498,000.

3. Rent prepaid and accrued restaurant expenses as at 31.12.2018 were

16,000 and 65,000 respectively.

Required:

a) Restaurant Trading profit and loss account for the year ended 31.12.2018.

(3 marks)

b) Prepare the sport’s club Income and expenditure account for the year

ended 31 December 2018. (7 marks)

c) The club’s Balance sheet as at 31 December 2018. (5 marks)

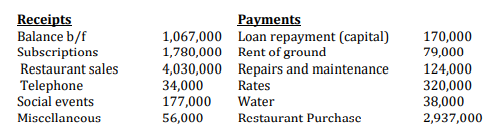

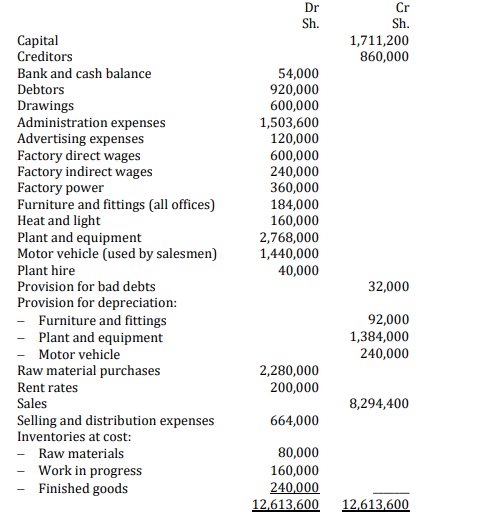

QUESTION FIVE.

Handshake owns and manages a small manufacturing business in Narok town.

The following balances have been extracted from his books of account at 31

December 2018:

Additional information:

1. Accruals at 31 Dec. 2018 were:

Factory power – Sh.1, 6000

Rent and rates – Sh. 4, 0000

2. There was prepayment of Sh. 8,000 for salesmen’s motor vehicle

insurance.

3. Inventories at 31 December 2018, were valued at cost as follows:

Raw materials – Sh. 152,000

Work in progress – Sh. 304,000

Finished goods – Sh. 456,000

4. Depreciation is to be charged on plant and equipment, motor vehicle,

furniture and fittings at the rates of 20%, 25% and 10% per annum

respectively on cost.

5. Expenditure on heat and light, and rent and rates is to be apportioned

between the factory and office in the ratio of 9 to 1 and 3 to 2

respectively.

6. Provision for doubtful debts is to be made equal to 5% of outstanding

debtors at 31 December 2018.

Required:

a) Prepare Handshake’s manufacturing, trading and profit and loss account for

the year ended 31 December 2018. (8 marks)

b) Balance sheet as at 31st December 2018. (7marks)