MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATIONS 2013/2014 ACADEMIC YEAR

FOURTH YEAR SECOND SEMESTER

SCHOOL OF BUSINESS AND ECONOMICS

BACHELOR OF BUSINESS MANAGEMENT

COURSE CODE: BBM 415

COURSE TITLE: : INTERNATIONAL FINANCE

DATE:15TH APRIL 2014 TIME:2.00PM – 5.00PM

INSTRUCTIONS TO CANDIDATES

Question ONE is compulsory

Answer any other TWO questions

This paper consists of 3 printed pages. Please turn over.

QUESTION ONE

a) Why is it important to study International Finance? [5marks]

b) Describe the following terms used in International Finance;

i. Currency swap [3marks]

ii. Forward market hedge [3marks]

iii. Balance of Payment [3marks]

iv. Hedge fund [3marks]

c) What is a foreign financial intermediary? Give three examples [4marks]

d) State and briefly describe the three types of foreign exchange exposure. [9marks]

QUESTION TWO

a) International Monetary Fund and World Bank were established by Bretton Woods for divergent purposes. State and explain the functions of each of these organizations. [14marks]

b) Enumerate and briefly describe participants in foreign exchange market. [6marks]

QUESTION THREE

a) What are some of the factors that led to formation of Multinational Corporations? [10marks]

b) Clarify on some of the problems facing Multinational Corporations .

[10marks]

QUESTION FOUR

a) Explain the meaning and purposes of derivatives. [8marks]

b) State and explain any four types of options. [8marks]

c) What is interest rate parity? [4marks]

QUESTION FIVE

a) Discuss the role of financial management in an international setting with particular reference to;

i. Currency exchange rates [3marks]

ii. Sources of finance [2marks]

iii. Investing in oversees countries [3marks]

b) A Kenyan import-export merchant was contracted on 1st January 2014 to buy 1,500 tonnes of a certain product from a supplier in Uganda at a price of Ush. 118,200 per ton. Shipment was to be made direct to a customer in Tanzania to whom the merchant had sold the product at Tsh. 462,000 per ton. Of the total quantity, 500 tonnes were to be shipped during the month of January 2014 and the balance by the end of the month of February 2014. Payment to the suppliers was to be made immediately on shipment, whilst one month’s credit from the date of shipment was allowed to the Tanzanian customer.

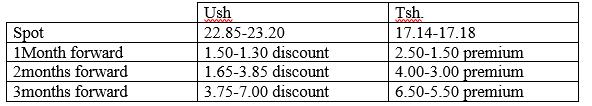

The merchant arranged with his bank to convert those transactions in Kenyan shilling (Ksh.) on the forward exchange market. The exchange rates at on 1st January 2014 were as given below;

The exchange commission is Ksh. 10 per Ksh. 1,000 (maximum sh. 1,000,000) on each transaction.

Required

Calculate the profit that the merchant made during the transaction (to nearest Ksh.)

[12marks]