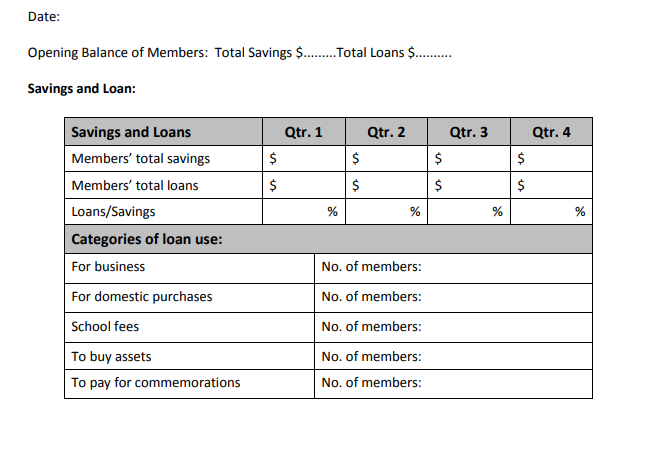

Co-operatives should analyse the recorded data and comments on the poster at regular intervals. Some information is recorded for quarterly periods and the results of this should be analysed and be presented to the Management Committee at their regular meetings. This should help them understand how the co-operative is performing, during the year, and place them in a position to make good decisions on current and future actions.

At the end of each year the Accounting and Audit team should analyse all the findings from the poster and use that information to help review actual progress against the plans. Over time the poster will show three year trends and will provide critical evidence of how successful the co-operative has been and what can be expected from future plans. This should help the cooperative develop or amend their plans for the next year.

A National Registrar of Co-operatives

A National Registrar of Co-operatives may have a national database; if so the findings from the poster results will be able to feed into the database.

Aggregated results provide useful information about what co-operatives are doing and how good their management planning systems are and their ability to implement plans. Financial analysis can be strengthened by aggregating the results of financial ratios. The SWOT comments and ideas can be analysed to see how the membership views the co-operatives and what ideas they have on

improving performance, and on new products and services. To deepen the analysis the information can be categorised for geographical areas, sectors and co-operative size.

4.1 Methods for Analysing Data

The Co-op Accounting and Audit method uses three categories for identifying and recording data; under the headings of: Strong Co-operatives; Strong People; and Strong Communities. This provides three difference data sources and methods of data collection: this can be used to triangulate data.

Triangulation of data means that the results from the analysis will be most reliable. If only one method is used results may be accepted without question; if two methods are used, the results may clash; by using three methods it is likely that consistent and verifiable results can be obtained. Using the results from the Co-op Accounting and Audit poster, under the different headings, you can undertake different types of analysis, as outlined below.

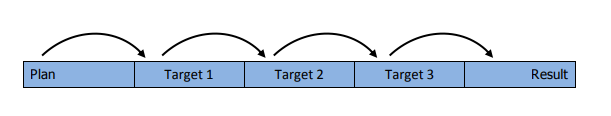

Planned and Actual Analysis

This type of analysis focuses on examining the step by step approach from the plan to the result. It does mean that co-operatives have got to have plans and these plans have got to be clear enough for management to schedule the activities and state the targets to achieve the plans. If achievement of targets begin to lag behind then action needs to be taken early to get the plan back on track to achieve the result on time and within budget. Alternatively, the final result can be put back to accommodate the delays.

Quantitative Analysis

Quantitative Analysis is used for a direct comparison usually against numerical indicators or benchmarks. Often this is done by calculating a ‘before and after’ number or percentage in relation to a benchmark and/or baseline figure. Planned and actual targets are quantitatively analysed to measure achievement of the commercial, social environmental plans.

Ratio Analysis

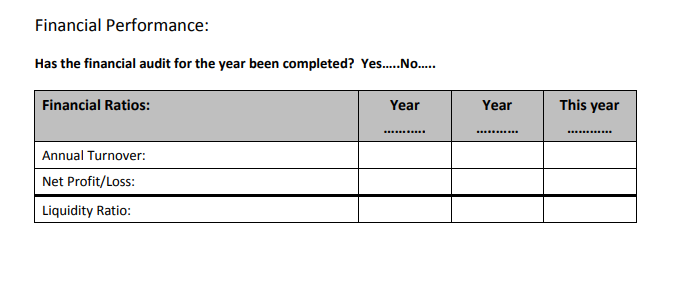

Ratio Analysis is used to compare relationship between two figures to arrive at a percentage which can be used to compare, say net profit this year with net profit last year irrespective of the actual income and expenditure for the period. Different types of ratio analysis can be used to assess liquidity of current assets/current liabilities or profit margin for a sector average against an individual co-operative.

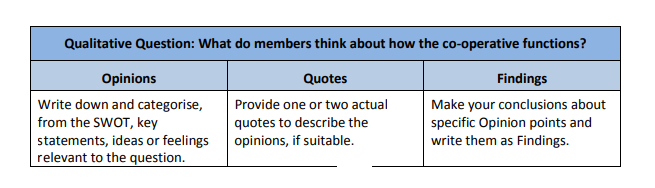

Qualitative Analysis

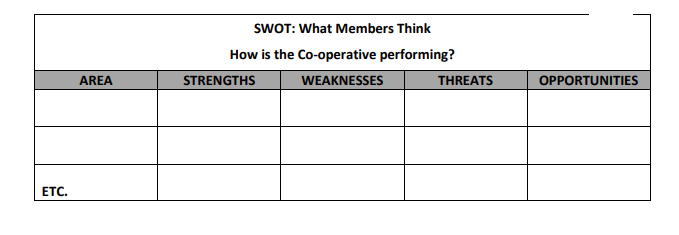

Qualitative Analysis is used when the finer details of experience need to be described. Questions are used to obtain comments, ideas and attitudes on set topics. Responses are then categorised in relation to the topic so that comparisons can be made. The SWOT provides qualitative analysis. A Qualitative Question Grid (as below) can be used to capture the information from the SWOT statements members have written on the poster. Categorise and list the responses, and use quotes to illustrate the points made; then make conclusions about each category out of the many statements and how these categories compare with each other.

This should be done for comments that have been made a number of times, not necessarily for every comment. So decide which are the most common statements and opinions and use these to report on the SWOT findings.

Reporting

Reporting results from the poster will take place both on the poster and in separate short reports. The key to good reporting is to keep reports short, focused and relevant. The poster itself will act as a report when filling in the planned and actual, quarterly reviews will can provide reports and annual audit will also report on achievements. How a co-operative decides which ones to use will depend on the how involved the membership is in trading with the co-operative and how the AGMs are managed.

- Members will be able to see the planned and actual results as they are recorded on the poster in the quarterly target boxes. This will include information on planned targets, savings and loans deposits, comments and ideas from the SWOT, the commercial, social and environmental plans.

- The Accounting and Audit team should discuss the findings from the poster on a quarterly basis.

- The manager should report the information to the Management Committee.

- The Management Committee should discuss the interim quarterly findings and if necessary take action to deal with any identified problems. The responses from the SWOT might identify problems or solutions that the committee can immediately act upon and put into action using the ‘Plans from the SWOT’ planning grid in the poster, otherwise they will need to be included in

next year’s annual plans. - Once the accounts have been audited officers from the National Registrar of Co-operatives should write the final figures, plus the financial ratios, for the current year on the poster. They may also assist the co-operative in reviewing and drawing up next years’ business plans.

- The poster should stay with the co-operative as they will use it for their own purposes, a new blank poster should be given to each co-operative in time for them to prepare the plans for the next year.

- The Management Committee should report the information to members at the AGM. Members should be allocated an agenda item to discuss the findings and how they should deal with them.

The AGM should be held soon after the audited accounts and the poster has been completed. It is important that the plans for the next year are discussed at the AGM and agreed by members before they are written up on the poster for the next year. The report will be the finial entries on the Co-op Accounting and Audit poster; it will comprise the final quarters’ actual statement against the planned statement, financial information from the financial audit and the ratio calculations, and the comments made by members in the SWOT framework.

This will all be written on the poster that can be left on the wall for a set period of time, say one month, and or the information can be copied to a short document and written up as a report for wider circulation. See Annex 2. However the annual audit is finalised it is essential that a copy of it is kept at the co-operative office for at least three years.

Annex 1. The Triple Bottom Line

The triple bottom line describes the three dimensions against which organisations with social objectives, such as social enterprises, community enterprises, community interest companies (CICs) and co-operatives are measured and which frame the way their results are reported. Traditionally, organisations have been measured in terms of financial performance; did they generate sufficient income to cover all costs and make a profit? This is purely a measure of the amount of money invested and the amount of return generated by that investment. This is described as financial return on investment.

In co-operatives the investment is described more widely: by the financial, social and environmental inputs and they are consequently measured in terms of their financial, social and environmental returns on those investments; the triple bottom line. The achievement of the triple bottom line is predicated on ‘sustainability’: economic performance is used to measure financial viability (making an annual trading profit); the level of social wellbeing created through the co-operatives operations is used to measure social wealth; and the support to the natural and built environment and community is used to measure the responsible behaviour of a co-operative in relation to local environment.

There are no common units of cost and benefit for measuring the three dimensions of sustainability, the easiest way is to measure against plans. This is realistic in co-operatives because the plans are developed by members who are the people who work and trade with the co-operative and live in the local communities around where the co-operative is located. They are the people most affected

by the operations of the co-operative and therefore have the most interest in its good behaviour and governance.

Using plans developed democratically by the membership means that all three dimensions of the triple bottom line are likely to be designed in the best interests of the co-operative, local people and their communities.

The reporting on the triple bottom line is undertaken by measuring the activities carried out by the co-operative in order to achieve their plans, the outputs generated from the completion of the plans, and the benefit experienced by people of the impact of the plans’ achievements.

Financial Viability

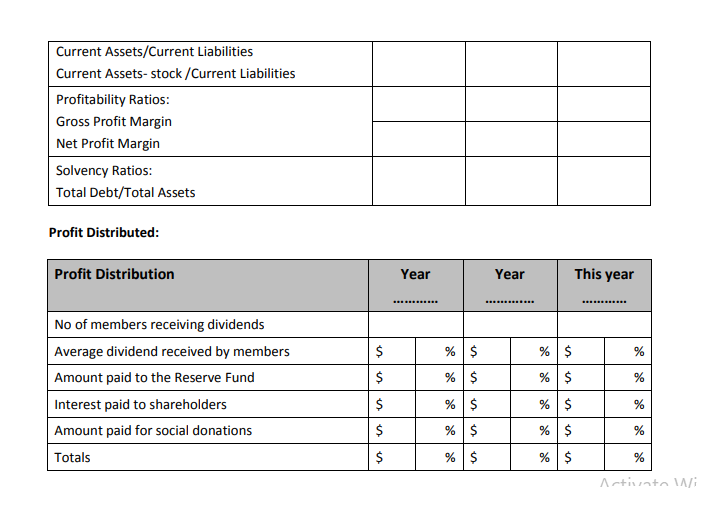

Financial viability creates independence and membership control, provides employment and generates profit which is distribution to members who in turn spend the money locally and enhance the multiplier effect and consequently the local economy.

Financial investment may include cash, financial credit, assets, liabilities and other definable resources. The return on these investments can be measured using normal financial accounting and audit methods which then will report on income and expenditure, net profit and profit distribution, and determine the net worth of a co-operative.

Accounting will inform on the administrative accounts, the monthly balances of income and expenditure, and how well the cashflow is being managed. Audit will inform on the financial strength of the co-operative, it profitability, its willingness to invest in maintenance and expansion, the amount of dividend received by members, its ability to pay invoices on time, and the risk of raising finance, if required.

Knowing about the financial viability of a co-operative will enable management to plan and control the co-operative operations and if necessary raise finance to provide investment. Members and employees will also benefit from knowing and understanding their financial security and how they as individuals can plan for their families’ futures.

Social Wealth

Social wealth creates the foundation for people to have access to resources and knowledge, organise together for mutual aid, learn new skills, and have the connections to work with other groups of people and communities. This may also include access to education and training for members to learn about environmental and community improvements. Social wealth is a measure of how people work and connect together, their standard of living and security, their access to opportunities for personal advancement, and people and families living in the community affected by the operations of the co-operative. Social wealth is also generated by not being exploited or endangered by the operations of the co-operative.

Accounting will show how social benefits are planned and progress is recorded and through the use of the SWOT offer members and customers the opportunity to express their personal views on a cooperative’s’ performance. Audit will report on the achievement of planned benefits, and if the benefits have been received and utilised, and what positive impact was made.

Community and Environmental Responsibility

Community and environmental responsibility is when the co-operative provides resources and or puts in place actions to improve the physical and natural environment in their local operations and communities. It is the responsibility of all people and all organisations to take positive action to reduce their negative environmental impact.

Community and environmental responsibility means that the co-operative takes measures to reduce waste, recycle materials and invest in non-polluting transport, energy, and water use. Financial investment in renewable energy, low impact packaging, etc. is also a measure of community and environmental responsibility.

The provision of financial donations such as grants to schools, local health facilities, etc. and support to community initiatives in pursuit of environmental improvements is also an indicator of the level of community and environmental benefit derived from the co-operative.

A co-operative may also design in support for communities through its strategic planning and use its own resources and operational actions to generate environmental good practice. Accounting will measure progress against the plans, for both internal reduction of waste and use of renewable resources as well as support for external projects and local actions.

Audit determines the annual results of the actions taken by the co-operative: this may, depending on the actions, show a (reduction) in waste, costs, and use of natural resources, or an (increase) in the amount of funds used to support communities and in investment in less polluting ways of operating.

Annex 2. Co-op Accounting and Audit Document

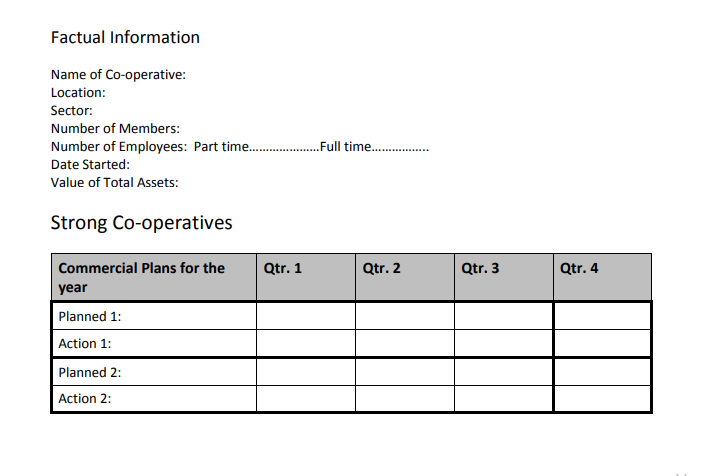

If it is not feasible to use the poster for recording and analysing the results of the Co-op Accounting and Audit method then using the same information in the same layout can be used as a short working document instead. Alternatively, if a co-operative and its members have the means the poster information can be displayed on an interactive monitor either physically attached to a wall

like a poster or using online computing so members can view and be interactive with the poster from their own computers or smartphones. Below the information described in the poster is set out in a document format, this can be copied to a computer or hand written. Where we have, for example, put in two planned and actual rows in the Commercial Plans the cooperative can put in as many rows as they have plans.

SWOT Analysis:

If the poster is not used then the exercise of members writing their comments and ideas in a SWOT will have to be undertaken either as a workshop exercise or as a questionnaire that members are asked to fill in once a year. It is recommended, however, that this exercise is undertaken at least once a year as a way of getting feedback from members and to engage with members for them to feel more involved in the cooperative.