The candidates did not perform well in the following questions:

Question 3 (a) and (b)

IMPORTANT TUTORIAL NOTES RELATING TO THIS QUESTION

This question tests on consolidated financial statements (both SPLOCI and SOFP).

Before proceeding to the detailed suggested solution, the candidate should read through the following important notes.

Permissible Accounting Events

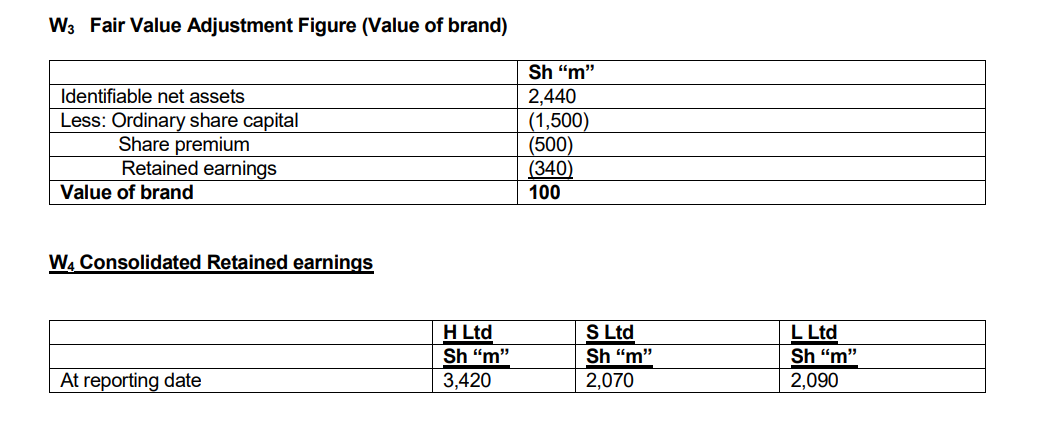

IFRS 3 (Business Combinations) outlines the accounting treatment for the acquisition of a company. The standard permits a number of accounting events at the acquisition date which would not typically be permitted under other IFRSs. For example, the acquirer recognises the identifiable assets, liabilities and non-controlling interests of the subsidiary

at the acquisition date. This principle allows the recognition of assets and liabilities that would usually not be permitted under other IFRSs. For example, internally generated intangible assets of the subsidiary, such as a brand name (like is the case in this question), may be recognised in the financial statements. This accounting treatment would not be permitted under IAS 38 (Intangible Assets) outside of a business combination context.

Control

IFRS 10 (Consolidated Financial Statements) and IFRS 3 (Business Combinations) provide guidance to determine whether an entity has obtained control. In most cases, control of an investee is obtained through holding the majority of voting rights. Therefore, control is normally obtained through ownership of a majority of the shares that confer

voting rights (or through obtaining additional voting rights resulting in majority ownership if some were already held).

Control requires:

• power over the investee

• exposure, or rights, to variable returns

• ability to use power to affect returns.

Examples of ways an entity may obtain control

- The entity transfers cash, cash equivalents or other assets (including net assets that constitute a business).

- The entity incurs liabilities.

- The entity issues shares.

- The entity transfers more than one type of consideration.

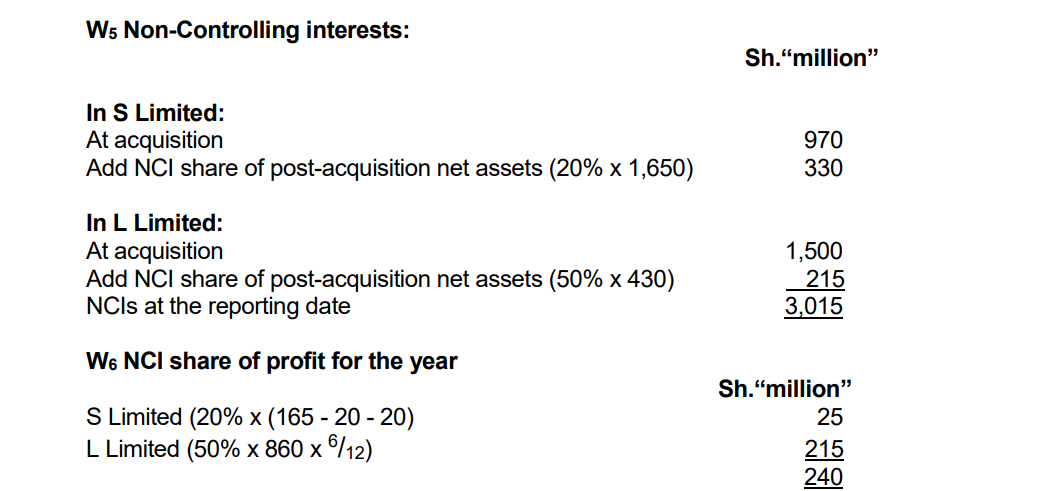

From the above, it can easily be determined that despite the fact that H Ltd. and M Ltd. has each obtained 50% of the ordinary shares in L Ltd, it is H Ltd that has control over L Ltd.

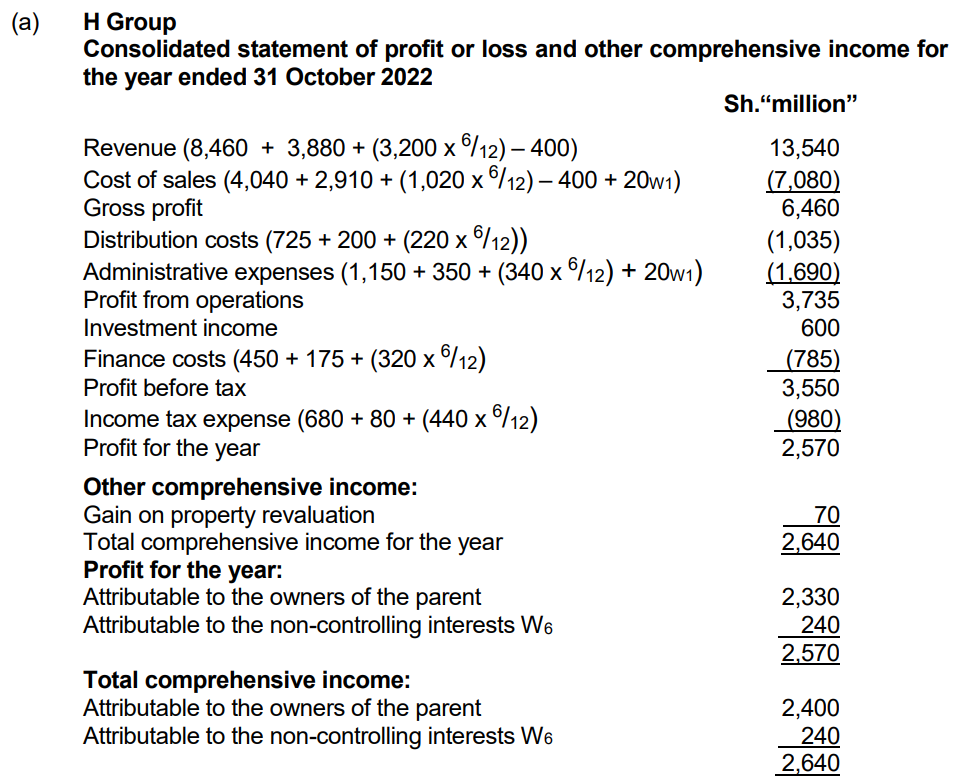

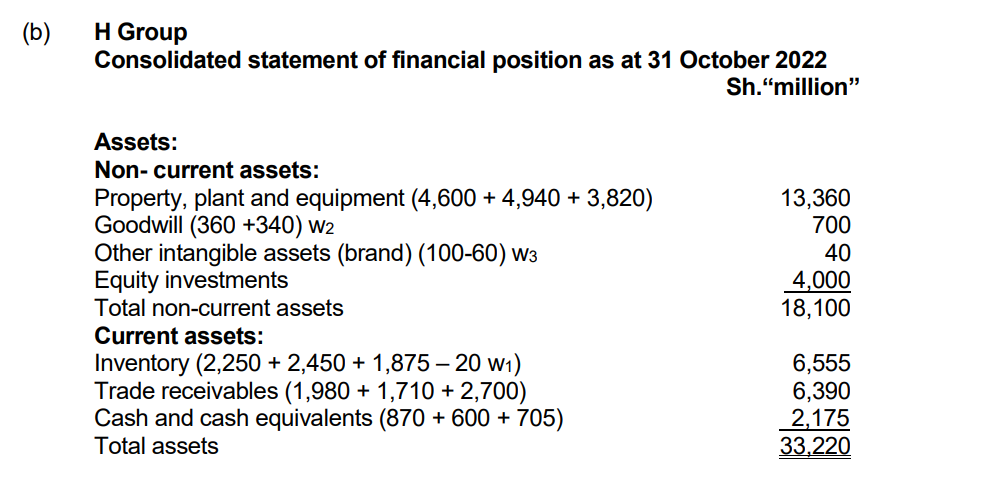

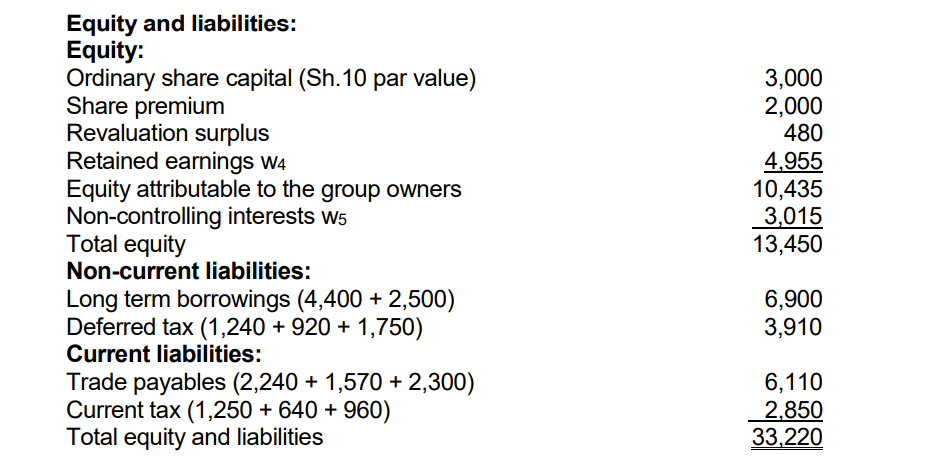

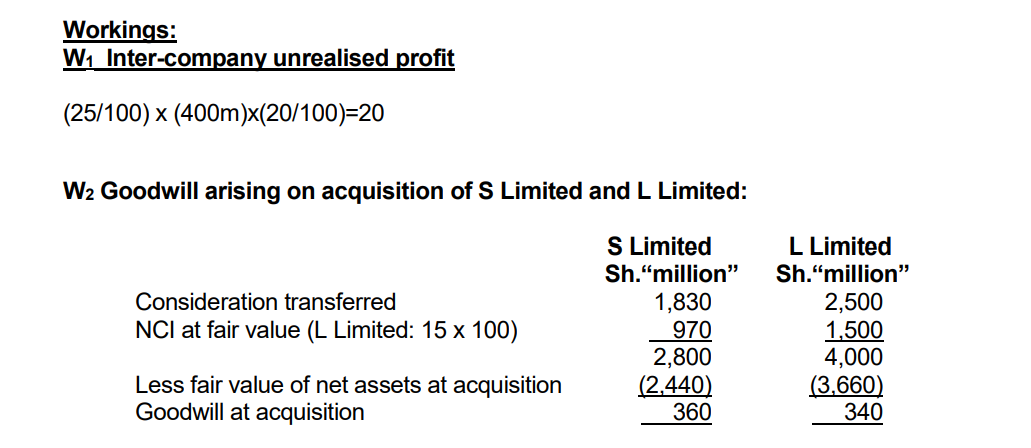

The expected solutions as follows:

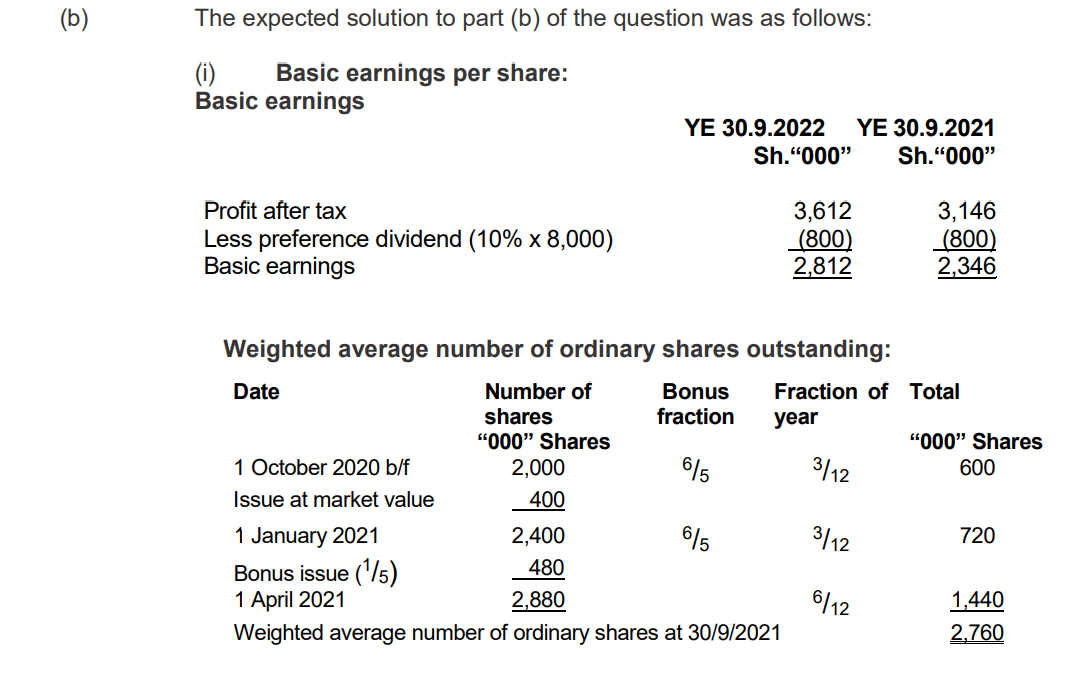

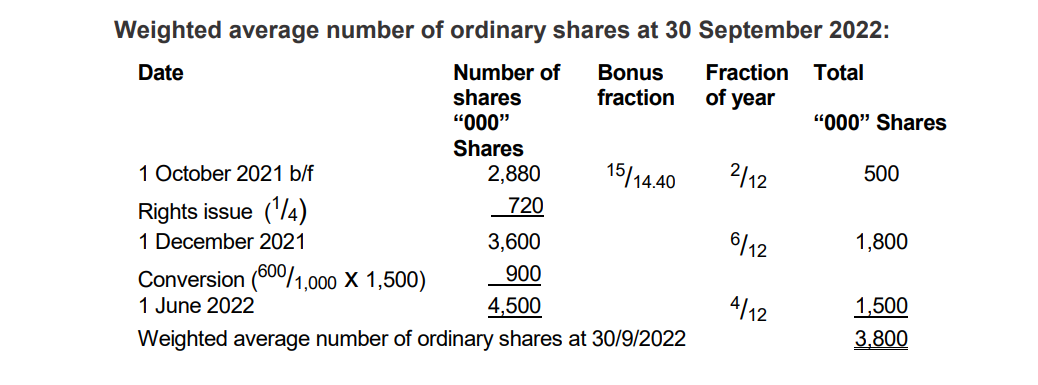

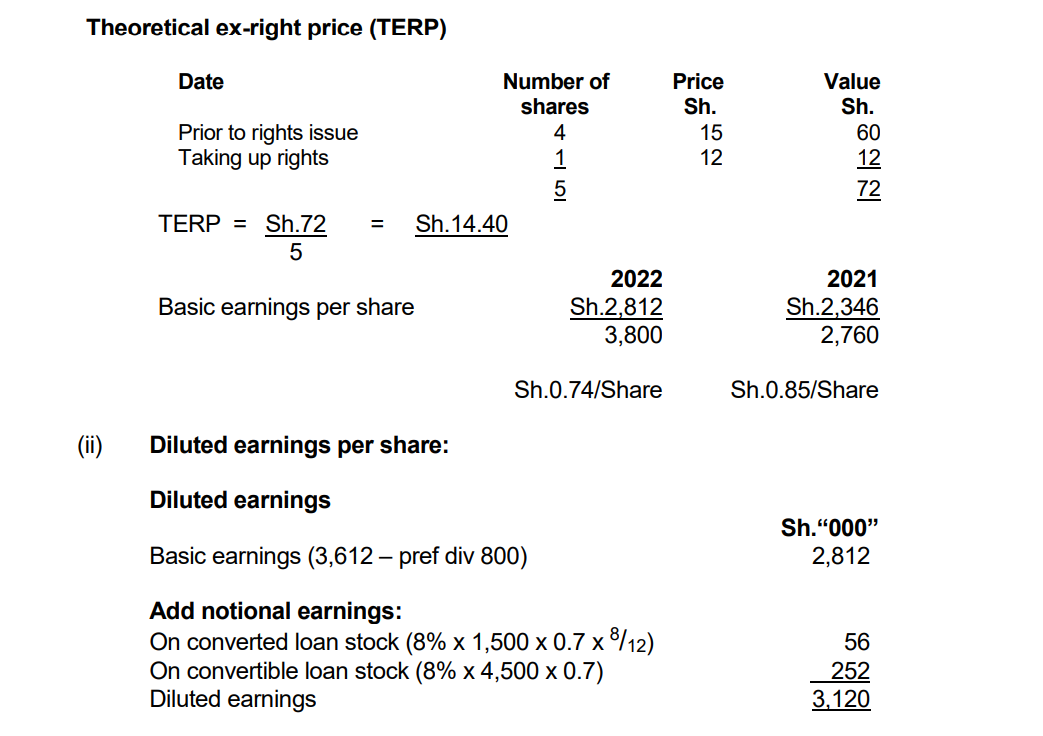

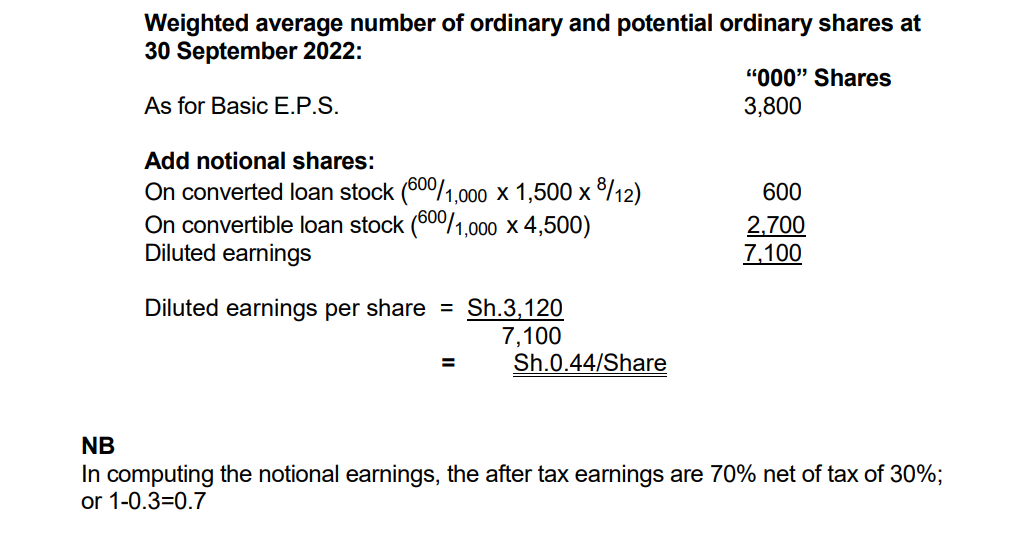

Question 4. (a) and (b)

NOTE

This question tested on IAS 33 (Earnings per Share). EPS is a common key performance indicator (KPI). However, although the basic calculation appears quite simple, some aspects of it are not straight forward. Applying IAS 33 to more complex arrangements can be quite a challenge.

To begin with, the question required candidates to explain the following two terms in part (a).

Most candidates did not convincingly explain these two terms. Here are the answers the examiner expected:

(a) (i) Contingently issuable ordinary shares

These are ordinary shares issuable for little or no cash or other consideration upon the satisfaction of specified conditions in a contingent share agreement. A common example of contingently issuable shares is sharebased payment arrangements that are subject to performance conditions and have little or no exercise price.

(ii) Potential ordinary shares (POS)

A potential ordinary share is a financial instrument or other contract that may entitle its holder to ordinary shares. Examples of POSs include convertible debt, convertible preference shares, share options and warrants, share rights,

employee share purchase plans and contingent share issuance contracts or agreements arising in a business combination. A POS is dilutive if its conversion to ordinary shares would decrease EPS or increase loss per share from continuing operations.