Candidates have been facing major challenges when it comes to attempting questions in this paper to the satisfaction of the examiner. It is recommended that the candidates invest time in researching into and grasping the theory underpinning the various topics in the discipline of finance. Once the theory has been grasped, it becomes easier to apply it to practical scenarios.

Some candidates did not perform well in the following questions:

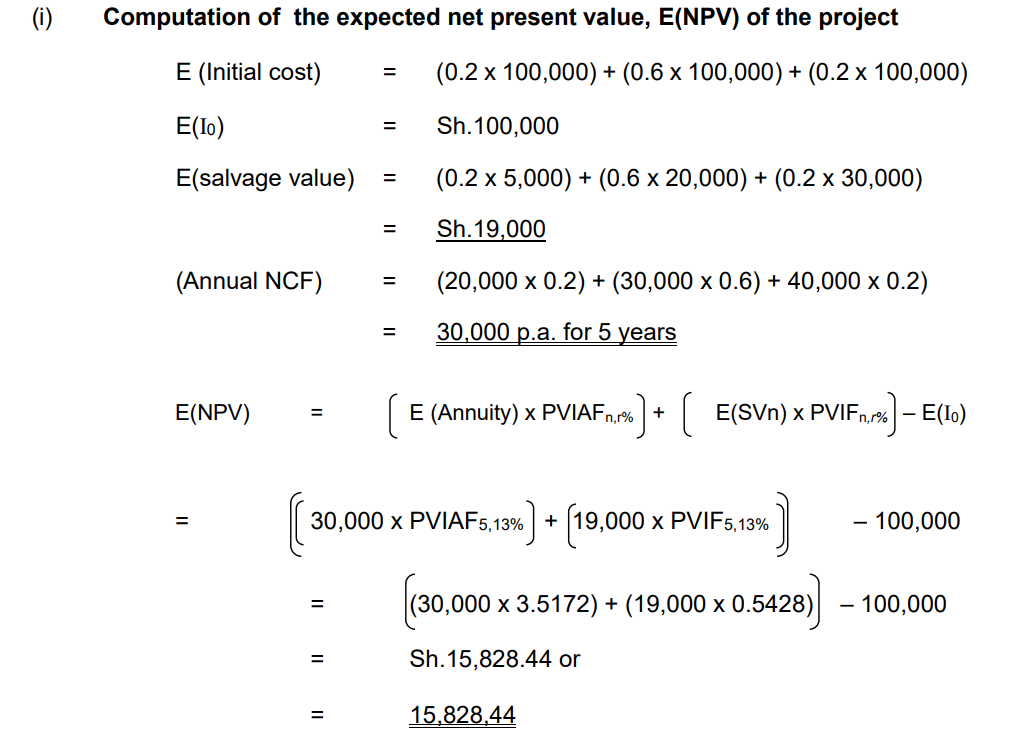

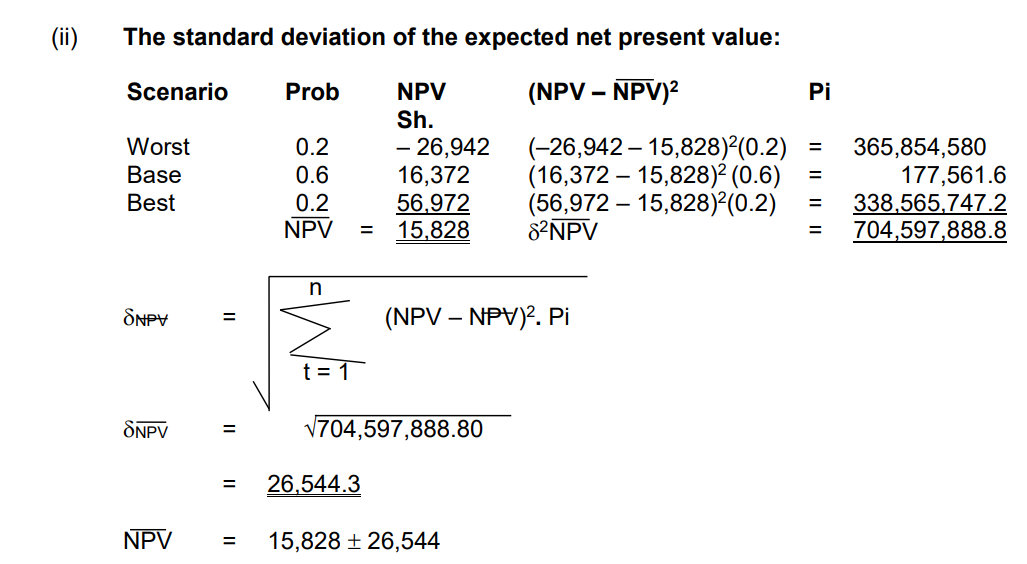

Question No. 1 (b)

In which candidates had challenges in evaluating a capital project given three scenarios namely worst case, most probable case and best case. Candidates had difficulties in computing the expected net present value E(NPV) of the project. In

addition, candidates encountered problems when determining the standard deviation of the expected net present value of the E(NPV) of the project.

The following were among the expected responses:

There are very high variations around the expected NPV. Hence, risk interest in this project is quite high.

Question No.3 (b)

In which candidates had a challenge in undertaking computations related to foreign currency risk management using forward exchange contracts, money markets hedge as well as making leading payments and thereafter advising a company

on the cheapest method to use.

The examiner expected the following responses.

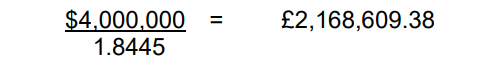

(i) The forward exchange market

Rema Limited must buy dollars in order to pay the US supplier. The exchange rate in a forward exchange contract to buy $4,000,000 in three months’ time (bank sells) is 1.8445. The cost of the $4,000,000 to Rema Limited in three months’ time will be;

This is the cost in three months. To work out the cost now, we could say that by deferring payments for three months, the company is:

- Saving having to borrow money now at 13.25% a year to make the payment now, or

- Avoiding the loss of interest on cash deposits earning 10% a year.

NB: The choice between (a) and (b) depends on whether Rema Limited needs to borrow to make any current payment (a) or is cash rich, (b).

Here, assumption (a) is selected, but (b) might in fact apply.

At an annual interest rate of 13.25% the rate for three months is 13.25 = 3.3125%

The present cost of £2,168,609.38 in three months’ time is

£2,168,609.38 / 1.033125 = £2,099,077.44

(ii) The money markets

Using the money markets involves:

- Borrowing in the foreign currency – if the company will eventually receive the currency.

- Lending in the foreign currency – if the company will eventually pay the currency, here, Rema Limited will pay $4,000,000 and so it will lend US dollars.

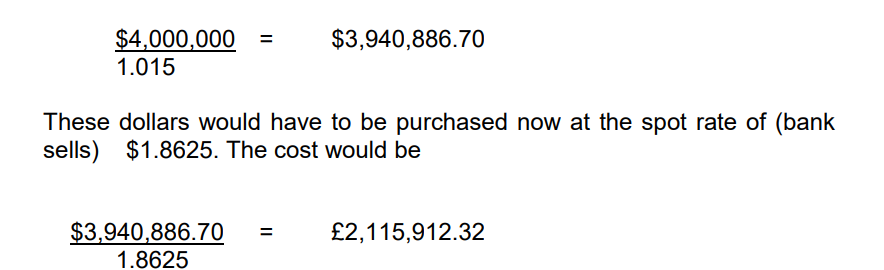

It will lend enough US dollars for three months so that the principal repaid in three months’ time plus interest will amount to the payment due of $4,000,000.

- Since the US dollar deposit rate is 6% p.a., the monthly rate for three months = 6/4 = 1.5%.

- To earn $4,000,000 in three months time at 1.5%, Rema Limited would have to lend now.

NB: By lending US dollars for three months, Rema Limited is matching eventual receipts and payments in US dollars and so has hedged against foreign exchange risk.

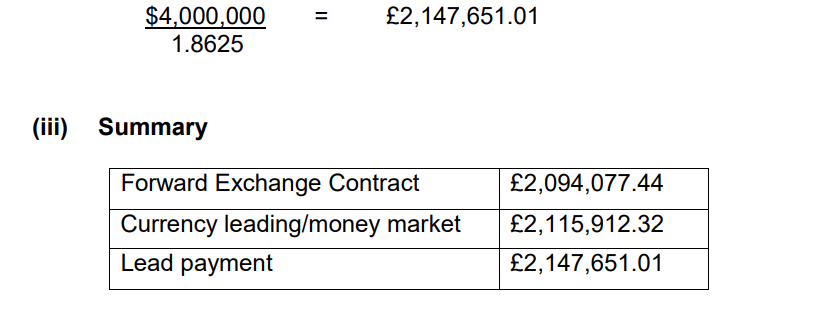

(iii) Lead payment

Lead payments should be considered when the currency payment is expected to strengthen over time and is quoted forward at a premium on the foreign exchange market.

Here the cost of lead payment (paying $4,000,000 now) would be:

Advice

The cheapest method is the forward exchange contract as per the summary above.

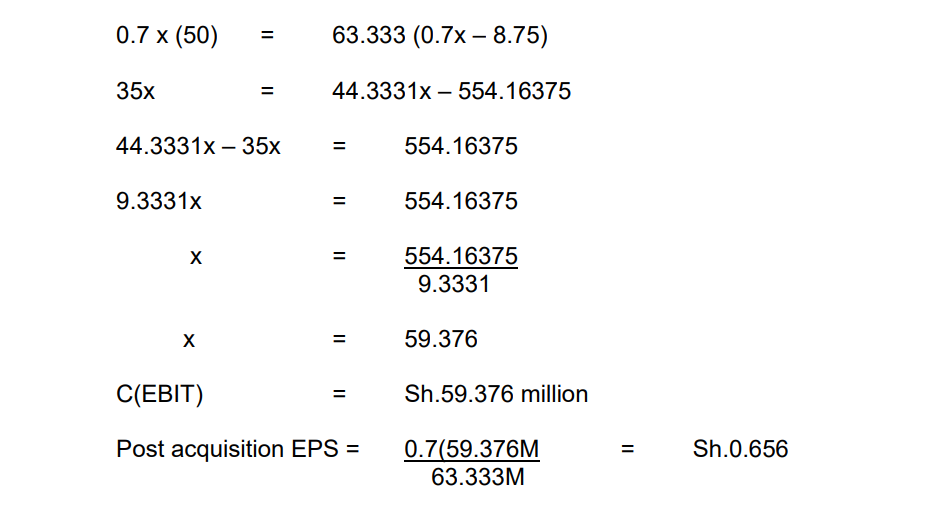

Question no.5 (c)

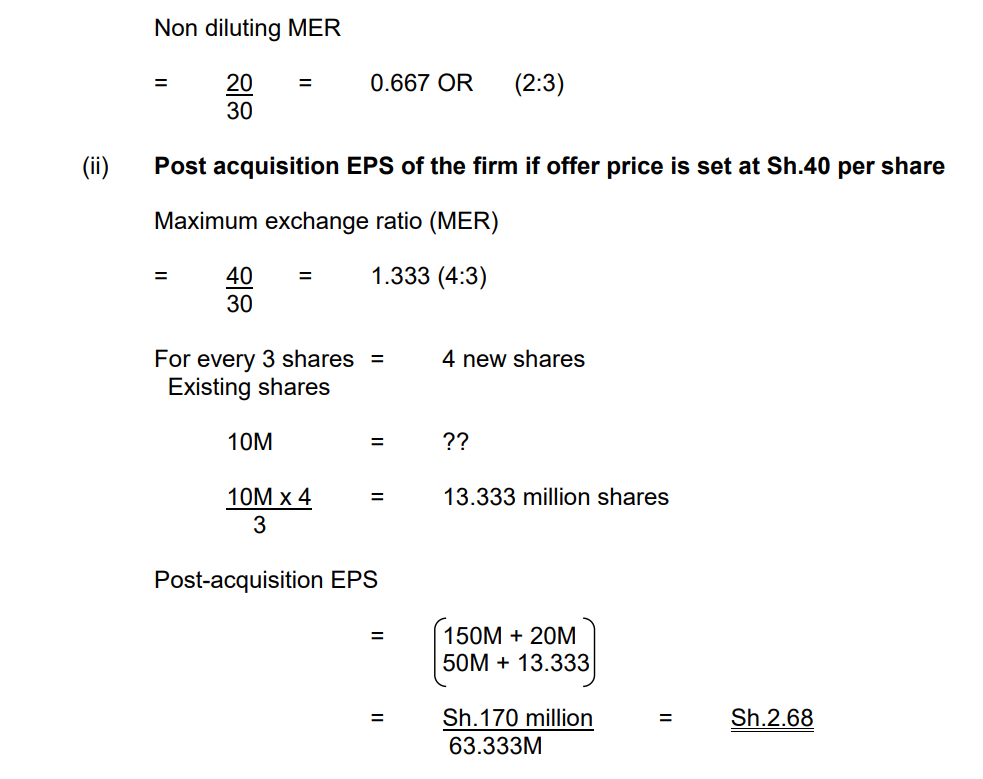

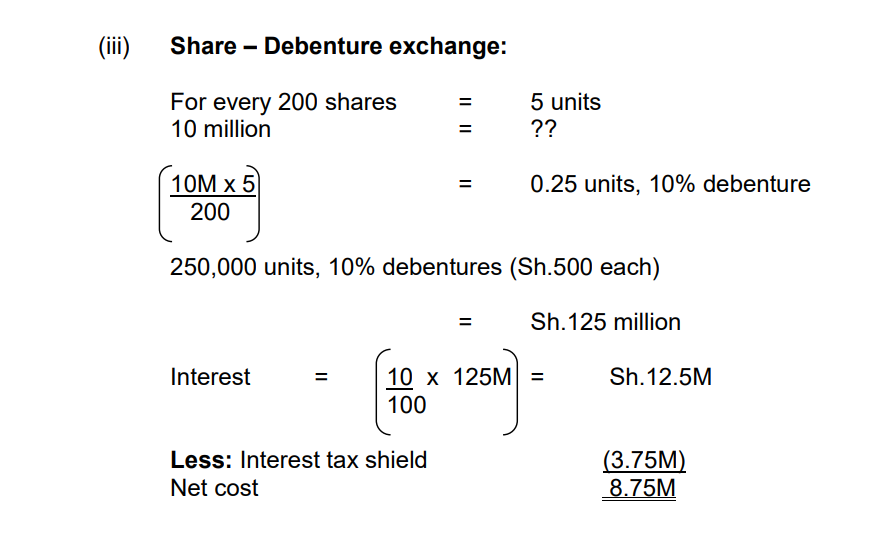

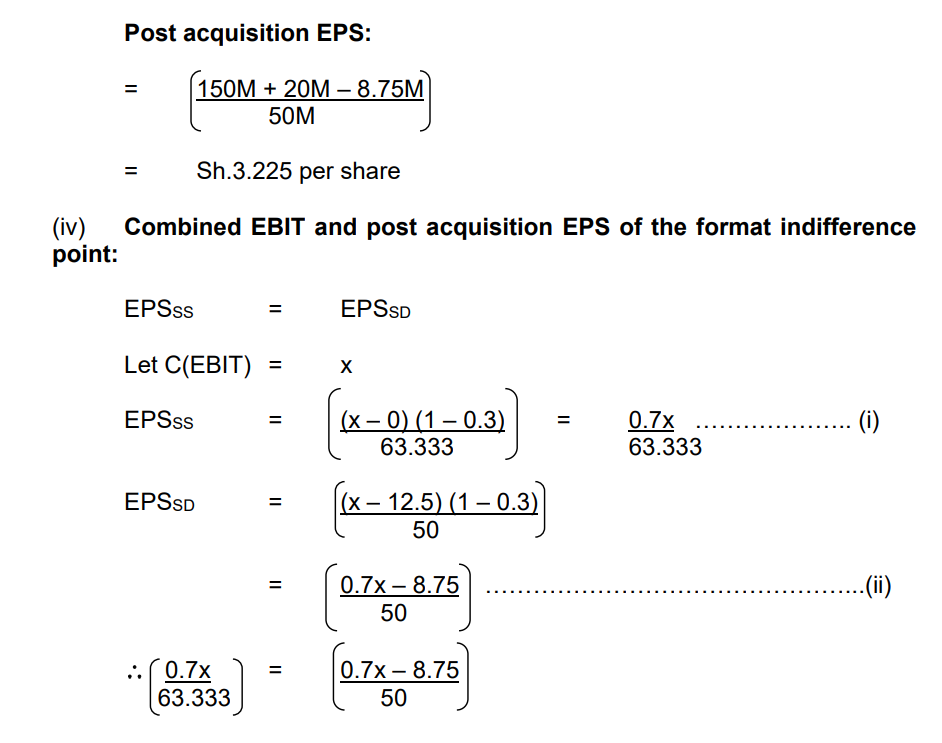

In which candidates were unable to apply their knowledge in the context of one company considering acquiring another. Majority of the candidates were unable to compute the maximum exchange ratio to avoid dilution of post-acquisition earnings per share (EPS) of the acquirer. In addition, candidates were unable to compute the combined operating profit (EBIT) and the post-acquisition EPS at the point of indifference between the earnings of the firm under two different financing plans as given in the question.

Examiners expected the following responses:

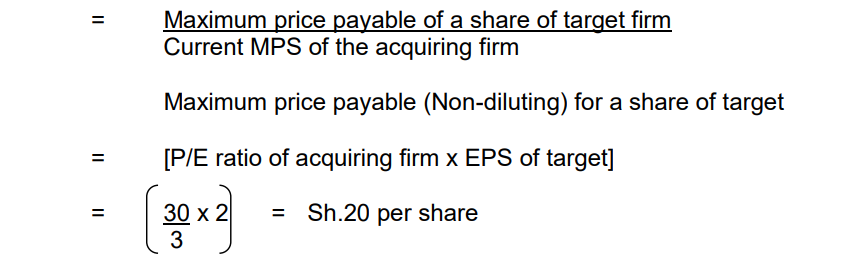

(i) Non-diluting maximum exchange ratio: