THURSDAY: 16 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question.

QUESTION ONE

1. Lending is considered a good and acceptable practice in the world of business, but debt collection could be the difference between business success or failure.

With reference to the above statement, analyse four factors to consider before hiring a debt collection agency. (8 marks)

2. Explain the term “trade credit insurance policy”. (2 marks)

List four benefits of taking trade credit insurance in a business. (4 marks)

3. Propose three options that a bank could pursue to minimise the impact of non-performing loans (NPLs). (6 marks)

(Total: 20 marks)

QUESTION TWO

1. Discuss three factors to consider before proceeding with debt recovery through the legal system. (6 marks)

2. Explain three ways that the management of a company could make use of the ageing debtors analysis. (6 marks)

3. Analyse four approaches a credit collector could use to encourage his debtors to pay their bills and invoices faster. (8 marks)

(Total: 20 marks)

QUESTION THREE

1. In the context of customer visits, analyse five types of customer visits used by debt collectors. (5 marks)

2. Discuss four categories of debtor personalities. (8 marks)

3. Describe seven characteristics of a plaint. (7 marks)

(Total: 20 marks)

QUESTION FOUR

1. Analyse six instances when a loan is deemed to be Non-Performing. (6 marks)

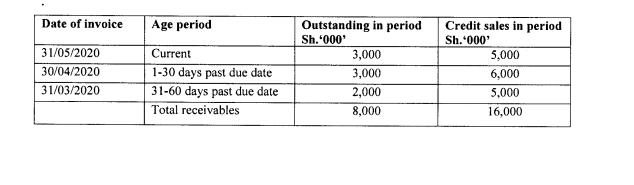

2. The following account receivables data was extracted from the books of Terox Ltd.

Number of days:

A year = 365

Six months = 182

Quarter of a year = 91

A month = Actual

Required:

Calculate:

Standard DSO. (3 marks)

Best possible DSO. (3 marks)

Delinquent DSO. (3 marks)

3. Summarise five measures that can be taken by collections staff to suspend credit terms to customers who do not meet credit standards. (5 marks)

(Total: 20 marks)

QUESTION FIVE

1. Mokolo Bilanga has just graduated as a Credit Professional and started a Credit Management Consultancy majoring in credit services. His client Komeko Enterprises has experienced tremendous growth in debtors’ portfolio and have approached Mokolo to assist them in hiring a collection manager.

Required:

Advise Mokolo on six responsibilities that he should consider when interviewing applicants for the Collection Manager’s position. (6 marks)

2. Many creditors refer debts they are unable to collect to third-party commercial collection agencies. The creditors always wonder how collection agencies are able to collect debts after their in-house collection efforts failed.

Required:

With reference to the above statement, evaluate four reasons why third party collection agencies succeed after in-house collection efforts fail. (8 marks)

3. Explain the following classifications of non-performing assets:

Doubtful (3 marks)

Sub-standard (3 marks)

(Total: 20 marks)