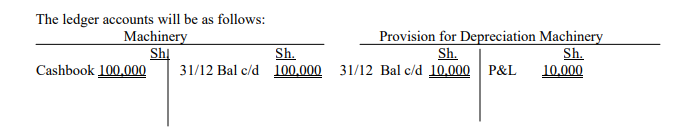

When non-current assets are depreciated, a new account for each type of asset is opened; this account is called a provision for depreciation whereby the following entries will be made:

Debit – P&L a/c

Credit – Provision for depreciation a/c

With the amount of depreciation charged for the period.

Example on straight-line method

The entries will be as follows:

Debit – P&L a/c with Sh.10, 000

Credit – Provision for depreciation. Machines a/c with Sh.10, 000 being depreciation provided for the machine.

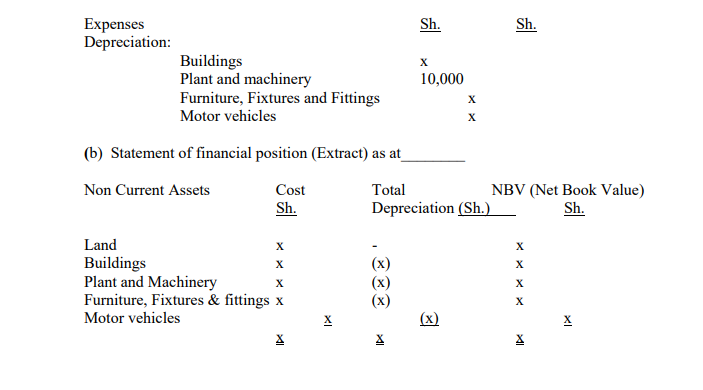

The final accounts extracts will be shown as follows:

- Profit And Loss Account (Extract) for the year ended