These are the methods developed to assist in estimating the amount of depreciation to be charged in the profit and loss account as an expense. The methods chosen by a firm should be in accordance with the agreed accounting practice, accounting standards and

suit the firm’s non-current assets. There are two main methods of estimating depreciation and five others that will apply in a firm’s situation.

The main methods are: Straight-line method and Reducing Balance method. The other 5 methods include:

- Sum of the digits methods – uses a formular.

- Revaluation method – applies to a non-current asset of low value.

- Machine-Hour method – depreciation is based on number of hours a machine is expected to operate (manufacturing process).

- Unit of output method – depreciation is based on the number of units a machine is expected to produce

- Depletion of units – depreciation is based on number of units extracted from the asset.

The Straight-Line Method

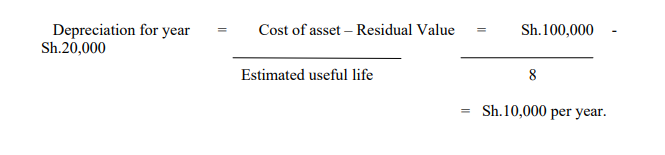

This method ensures that a uniform amount of depreciation is charged in the P&L a/c for a particular asset and is based on the following formular:

Cost of Asset – Residual Value

Estimated useful life of asset.

Residual Value

The amount the firm expects to sell the asset after the period of use in the firm, also called Sales Value / Scrap Value.

Estimated Useful Life

The period the asset is expected to be used in the firm.

Example

A firm buys a machine for Sh.100, 000 which it expects to use in the firm for eight years. After the eight years the machine will be sold for Sh.20, 000. Under the straight-line method, the depreciation amount will be computed as follows:

This means for this asset Sh.10, 000 will be charged in the profit and loss account as depreciation expense on the machine.

The straight line method assumes that benefits accruing on use of a non-current asset are spread out evenly over the life of the asset e.g. buildings use straight-line method. Percentage rate based on cost as opposed to number of years can also be used to calculate

the depreciation.

Reducing Balance Method

The firm determines a fixed percentage rate that is applied on the cost of the asset during the first period of use. The same rate is applied in the subsequent financial periods but the rate is applied on the reduced value of the asset. (Cost of asset – total depreciation

provided to date).